VANCOUVER, British Columbia--(BUSINESS WIRE)--Chip Wilson, founder and largest shareholder of lululemon athletica inc. (NASDAQ:LULU), today issued the following open letter to lululemon shareholders:

Dear Fellow lululemon Shareholders:

As many of you know, I founded lululemon and remain its largest shareholder with almost 14.2% of the company’s shares. I asked the Board to allow me 10 minutes to address my fellow shareholders at this year’s annual general meeting. They denied me that opportunity. Had I been given the opportunity, this is what I would have said:

I love lululemon and its employees and remain its biggest believer and supporter. No one is more aligned and focused on shareholder value creation. I am confident that with the right management, Board stewardship and capable execution, lululemon can return to greatness and all shareholders will see exponential returns.

Unfortunately, lululemon has lost its way and I believe a call to action is needed. I feel strongly that our current Board and management team must clearly articulate and execute a strategy with urgency towards regaining lululemon’s competitive advantage and profitable growth and they must take responsibility.

Lululemon created the global athleisure market (which I refer to as “streetnic” --stretch, technical, street -- market) and seeded a revolution in the way we all dress. But we are just at the beginning. We cannot continue to cede the market opportunity we created to Under Armour and Nike. The Company’s greatest opportunities are ahead.

LULULEMON’S STOCK PERFORMANCE

While like all shareholders, I am pleased the company has shown incremental improvement lately, its performance has to be put into perspective. Three years ago our stock was double the value of Under Armour’s. Now it is worth less than half.

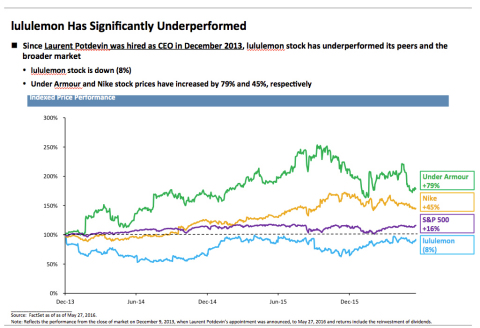

Since December 2013 when the current management team was appointed by this Board, lululemon stock has dramatically under-performed the market and its peers:

- Under Armour has increased 79%

- Nike is up 45%

- Even the general stock market, as measured by the S&P 500, is up 16%

- Yet lululemon stock has dropped 8% in the midst of the greatest change in the way people have dressed in the history of the world

Under Armour has taken our leadership role, and the market recognizes this with a premium valuation. Under Armour trades at double our EBITDA and P/E multiples. If lululemon were rewarded with the same multiple as Under Armour’s, our stock would be almost 90% or approximately $8 billion higher today, or another $60 higher per share.

LULULEMON’s FINANCIAL PERFORMANCE

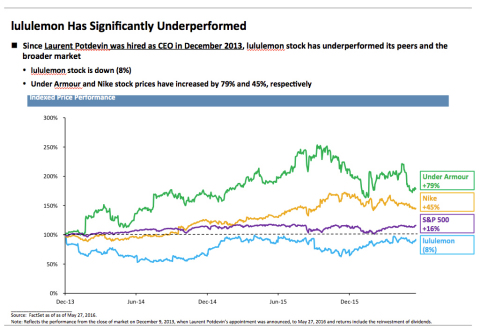

Sadly, the market is correct in not rewarding lululemon’s performance. The most frustrating thing to me as a shareholder is the current management team’s dismal financial performance.

Since this management has been at the helm, lululemon has grown revenues by half a billion dollars. Yet net income has declined!

Not one incremental dollar of earnings has flowed to the bottom line.

Management competence is uninspiring at best. I am not convinced we have the right leadership in place to catalyze the change necessary to win in the current global, multi-channel and dynamic environment. We have witnessed a dramatic erosion of the Company’s unique culture and capability that empowered and embraced innovation, technology, and product development. This culture and what it accomplished fueled our brand positioning, margins and growth.

DECLASSIFY THE BOARD

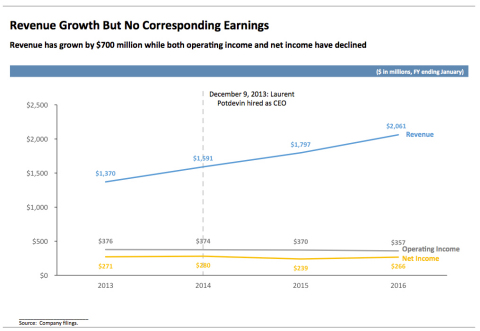

This Board and management have not created shareholder value in three years. Boards are responsible for choosing the right CEO. This Board needs to be responsive to its shareholders. In that regard, I am asking the Board to act in accordance with 90% of companies in the S&P 500 and declassify the Board.

Why? Because staggered boards result in entrenched directors and management. If the Board that is currently in place cannot implement the changes that are required to increase shareholder value, then shareholders deserve the right to vote on all of the Board members and, if they so choose, make a change. But this is something prevented by our current staggered Board which only allows us to vote on three directors at a time.

QUESTIONS FOR THE BOARD

I have two questions for the lululemon Board of directors:

- Do you plan to get back to our original leadership position compared to our competitors, in a market we invented and built? If yes, by when, and what are the exact signs, metrics and signals we should be looking for to indicate your plan is working?

- Shareholders are entitled to judge performance and hold Board members accountable, deserve the right to vote on all of the Board members and, if they so choose, make a change. Will you, act in accordance with 90% of companies in the S&P and voluntarily move to declassify the Board so shareholders can vote for a full slate in 2017?

IN CLOSING

In closing, as a long-term investor in lululemon, I am uncomfortable with the lack of urgency, stewardship and performance of our great company. I have not heard a strategy nor seen actions that lead me to believe we will regain our competitive position and secure long-term returns. This is unacceptable and the Board needs to understand that I – indeed all shareholders – will be watching closely.

For more information please visit www.elevatelululemon.com.