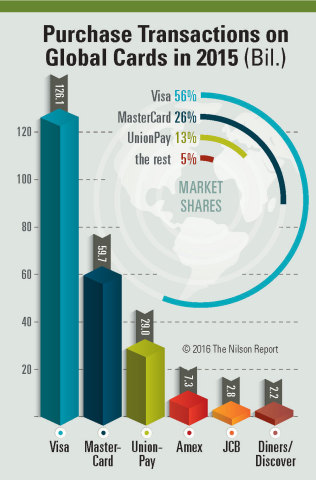

CARPINTERIA, Calif.--(BUSINESS WIRE)--Global general purpose cards carrying Visa, UnionPay, MasterCard, JCB, Diners Club/Discover, and American Express brands generated 227.08 billion purchase transactions at merchants in 2015, an increase of 16.1% over 2014, according to The Nilson Report, the top trade newsletter covering the card and mobile payment industries. Purchase transactions included all commercial and consumer credit, debit, and prepaid cards.

Visa cards, which include both Visa Inc. and Visa Europe, accounted for 55.52% of all purchase transactions worldwide. Debit cards with the Visa brand continued to account for the most purchase transactions with a share of 35.50%, followed by Visa credit cards with 20.02%, MasterCard credit cards with 13.14%, MasterCard debit cards with 13.13%, UnionPay credit cards with 6.79%, UnionPay debit cards with 6.00%, and American Express cards with 3.21%. JCB cards with 1.23% overtook Diners Club/Discover cards with 0.98%. Commenting on the results, David Robertson, Publisher of The Nilson Report said, "When consumers worldwide reach into their wallets for a payment card, more than half of the time, they use a Visa card."

UnionPay continued to have the highest percentage increase in purchase transactions. Last year UnionPay credit and debit card purchase transactions at merchants grew by 47.0%. Its year-over-year growth of 9.28 billion transactions topped the 8.09 billion increase for MasterCard but trailed an increase of 13.16 billion for Visa.

Debit and prepaid cards accounted for 54.63% of purchase transactions, up from 54.05% in 2014. Visa purchase transactions were 63.95% debit, up from 63.71%. MasterCard purchase transactions were 49.98% debit, up from 47.86%. UnionPay purchase transactions were 46.90% debit, up from 46.00%.

Purchase volume for goods and services, which excludes cash advances on credit cards and cash withdrawals on debit cards, grew by 18.0% or $3.110 trillion in 2015. UnionPay debit cards were the most popular payment product based on purchase volume, followed by Visa credit cards, which overtook Visa debit cards. The fourth largest was UnionPay credit cards, followed by MasterCard credit cards, MasterCard debit cards, and American Express credit cards.

Credit, debit, and prepaid cards in circulation totaled 10.25 billion at the end of 2015, up 8.2% over year-end 2014. UnionPay accounted for 53.07% of global brand cards in circulation, up from 52.09%, followed by Visa with 28.95%, down from 30.23%, MasterCard with 15.35%, up from 14.96%, American Express with 1.15%, down from 1.18%, JCB with 0.91%, down from 0.93%, and Diners Club/Discover with 0.56%, down from 0.60%.

Of the total cards in circulation, 75.94% were debit, up from 74.61%. Debit cards in circulation grew by 716.3 million compared to a 61.4 million increase for credit cards.

About The Nilson Report

The Nilson Report is the most respected source of news and analysis of the global card and mobile payment industries. The by-subscription-only newsletter provides brand, issuer, acquirer, and vendor statistics not found in any other trade journal, as well as concise vendor, personnel, and product updates. The Nilson Report does not accept paid advertising of any kind. There are no advertisements, no articles written by vendors, no sponsored content. Contact Lori Fulmer at lfulmer@nilsonreport.com for a complete copy of Global Cards 2015, or download it now. The report mentioned here appears in the April 29, 2016 issue of the newsletter.