NEW YORK--(BUSINESS WIRE)--Viacom Inc. (NASDAQ:VIAB, VIA) today reported financial results for the second quarter of fiscal 2016 ended March 31, 2016.

|

Fiscal Year 2016 Results |

||||||||||||||||||

|

|

||||||||||||||||||

| (in millions, except per share amounts) |

Quarter Ended |

B/(W) |

Six Months Ended |

B/(W) | ||||||||||||||

| 2016 | 2015 |

2016 vs. |

2016 | 2015 |

2016 vs. |

|||||||||||||

| Revenues | $ | 3,001 | $ | 3,078 |

(3) |

% |

$ | 6,155 | $ | 6,422 |

(4) |

% |

||||||

| Operating income | 586 | 38 | NM | 1,425 | 973 | 46 | ||||||||||||

| Net earnings/(loss) attributable to Viacom | 303 | (53) | NM | 752 | 447 | 68 | ||||||||||||

| Diluted earnings/(loss) per share | 0.76 | (0.13) | NM | 1.89 | 1.09 | 73 | ||||||||||||

|

Non-GAAP* |

||||||||||||||||||

| Adjusted operating income | 586 | 822 | (29) | 1,425 | 1,781 | (20) | ||||||||||||

| Adjusted net earnings attributable to Viacom | 303 | 467 | (35) | 773 | 1,005 | (23) | ||||||||||||

| Adjusted diluted earnings per share | $ | 0.76 | $ | 1.16 |

(34) |

% |

$ | 1.94 | $ | 2.44 |

(20) |

% |

||||||

NM - Not Meaningful

* Non-GAAP measures referenced in this release

are detailed in the Supplemental Disclosures at the end of this release.

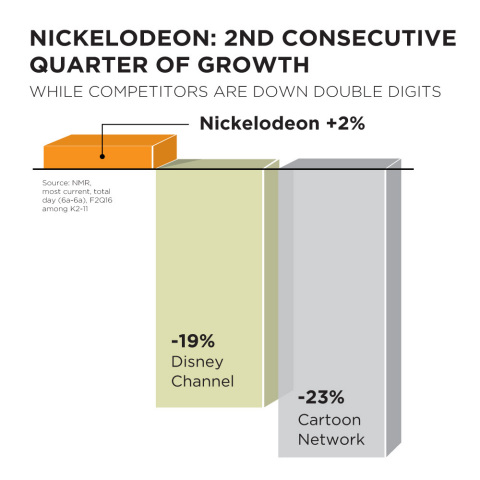

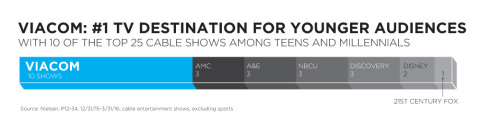

Philippe Dauman, Executive Chairman, President and Chief Executive Officer of Viacom, said, “Viacom’s brands are among the most popular and culturally connected in the world. Nickelodeon remains the number one network for kids and many of our other networks have shown sequential improvements in ratings and consumption across platforms. The continuing strength of our brands was validated by our recent renewals with DISH and Frontier on attractive terms. In the past year, we have successfully closed long-term carriage agreements with domestic distributors representing more than 44 million subscribers. Around the world we continue to expand the global reach of our networks, launching several new channels in the quarter. At Paramount, we are looking forward to upcoming blockbusters Teenage Mutant Ninja Turtles: Out of the Shadows and Star Trek Beyond this summer.

"We are responding to industry consumption shifts with innovative, thoughtful, and long-term strategic solutions and are generating meaningful results in many important areas, including content creation, data-based audience measurement and distribution innovation. There is much more work to be done, but we see the path to growth ahead and are very optimistic about our future."

|

Revenues |

||||||||||||||||||

|

|

||||||||||||||||||

| (in millions) |

Quarter Ended |

B/(W) |

Six Months Ended |

B/(W) | ||||||||||||||

| 2016 | 2015 |

2016 vs. |

2016 | 2015 |

2016 vs. |

|||||||||||||

| Media Networks | $ | 2,381 | $ | 2,452 |

(3) |

% |

$ | 4,946 | $ | 5,106 |

(3) |

% |

||||||

| Filmed Entertainment | 655 | 659 | (1) | 1,267 | 1,379 | (8) | ||||||||||||

| Eliminations | (35) | (33) | NM | (58) | (63) | NM | ||||||||||||

| Total Revenues | $ | 3,001 | $ | 3,078 |

(3) |

% |

$ | 6,155 | $ | 6,422 |

|

(4) |

% |

|||||

NM - Not Meaningful

Quarterly revenues declined 3% to $3.00 billion. Absent an unfavorable 1% impact of foreign exchange, quarterly revenues decreased 2%. Media Networks revenues were $2.38 billion, a decline of 3%. Domestic advertising revenues decreased 5%, as pricing increases were more than offset by softer ratings at some of our networks. International advertising revenues declined 1%, driven by a 7% adverse effect of foreign exchange. Absent the impact of foreign exchange, international advertising revenues increased 6%, driven principally by growth in Europe. Domestic affiliate revenues decreased 2%, reflecting a modest decline in subscribers and a previously disclosed rate adjustment with a major distributor partially offset by rate increases across the remaining subscriber base. International affiliate revenues increased 4%, driven by new channel launches, increased subscribers, and rate increases. Absent a 7% adverse impact of foreign exchange, international affiliate revenues increased 11%.

Filmed Entertainment revenues decreased by 1% to $655 million, as an increase in license fees and theatrical revenues was more than offset by declines in home entertainment and ancillary revenues. Excluding foreign exchange, which had a 2% unfavorable impact, worldwide revenues increased 1%. Worldwide theatrical revenues increased 6% to $217 million in the quarter, reflecting revenues from Daddy’s Home and The Big Short, both released late in the first fiscal quarter. License fees increased 17% to $240 million in the quarter, driven by the licensing of certain titles for subscription video-on-demand services. Worldwide home entertainment revenues decreased $41 million in the quarter, primarily reflecting lower revenues associated with catalog and third-party distribution titles.

|

Operating Income/(Loss) |

||||||||||||||||||||||

|

|

||||||||||||||||||||||

| (in millions) |

Quarter Ended |

B/(W) |

Six Months Ended |

B/(W) | ||||||||||||||||||

| 2016 | 2015 |

2016 vs. |

2016 | 2015 |

2016 vs. |

|||||||||||||||||

| Media Networks | $ | 805 | $ | 903 |

(11) |

% |

$ | 1,862 | $ | 2,007 |

(7) |

% |

||||||||||

| Filmed Entertainment | (136 | ) | 1 | NM | (282 | ) | (59 | ) | (378) | |||||||||||||

| Corporate expenses | (53 | ) | (57 | ) | 7 | (103 | ) | (118 | ) |

13 |

||||||||||||

| Eliminations | (4 | ) | — | NM | — | 2 | NM | |||||||||||||||

| Equity-based compensation | (26 | ) | (25 | ) | (4) | (52 | ) | (51 | ) | (2) | ||||||||||||

| Adjusted operating income | 586 | 822 | (29) | 1,425 | 1,781 | (20) | ||||||||||||||||

| Loss on pension settlement | — | — | — | — | (24 | ) | NM | |||||||||||||||

| Restructuring and programming charges | — | (784 | ) | NM | — | (784 | ) | NM | ||||||||||||||

| Operating income | $ | 586 | $ | 38 | NM | $ | 1,425 | $ | 973 |

46 |

% |

|||||||||||

NM - Not Meaningful

Quarterly adjusted operating income declined 29% to $586 million. Media Networks adjusted operating income decreased 11% to $805 million, reflecting revenue declines as well as an increase in programming expenses. Filmed Entertainment adjusted operating loss was $136 million, driven by the performance of certain films released in the quarter.

Quarterly adjusted net earnings attributable to Viacom decreased to $303 million. Adjusted diluted earnings per share for the quarter were $0.76.

Debt

At March 31, 2016, total debt outstanding was $12.53 billion, compared with $12.29 billion at September 30, 2015. The Company’s cash balances were $480 million at March 31, 2016, a decrease from $506 million at September 30, 2015.

About Viacom

Viacom is home to premier global media brands that create compelling television programs, motion pictures, short-form content, apps, games, consumer products, social media experiences, and other entertainment content for audiences in 180 countries. Viacom's media networks, including Nickelodeon, Comedy Central, MTV, VH1, Spike, BET, CMT, TV Land, Nick at Nite, Nick Jr., Channel 5 (UK), Logo, Nicktoons, TeenNick and Paramount Channel, reach over 3.5 billion cumulative television subscribers worldwide. Paramount Pictures is a major global producer and distributor of filmed entertainment.

For more information about Viacom and its businesses, visit www.viacom.com. Viacom may also use social media channels to communicate with its investors and the public about the company, its brands and other matters, and those communications could be deemed to be material information. Investors and others are encouraged to review posts on Viacom’s company blog (blog.viacom.com), Twitter feed (twitter.com/viacom) and Facebook page (facebook.com/viacom).

Cautionary Statement Concerning Forward-Looking Statements

This news release contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: the public acceptance of our brands, programs, motion pictures and other entertainment content on the various platforms on which they are distributed; the impact of inadequate audience measurement on our program ratings, advertising revenues and affiliate fees; technological developments and their effect in our markets and on consumer behavior; competition for content, audiences, advertising and distribution; the impact of piracy; economic fluctuations in advertising and retail markets, and economic conditions generally; fluctuations in our results due to the timing, mix, number and availability of our motion pictures and other programming; the potential for loss of carriage or other reduction in the distribution of our content; changes in the Federal communications or other laws and regulations; evolving cybersecurity and similar risks; other domestic and global economic, business, competitive and/or regulatory factors affecting our businesses generally; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our 2015 Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The forward-looking statements included in this document are made only as of the date of this document, and we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. If applicable, reconciliations for any non-GAAP financial information contained in this news release are included in this news release or available on our website at http://www.viacom.com.

|

VIACOM INC. |

|||||||||||||||||

|

Quarter Ended |

Six Months Ended |

||||||||||||||||

| (in millions, except per share amounts) | 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Revenues | $ | 3,001 | $ | 3,078 | $ | 6,155 | $ | 6,422 | |||||||||

| Expenses: | |||||||||||||||||

| Operating | 1,654 | 2,056 | 3,247 | 3,679 | |||||||||||||

| Selling, general and administrative | 705 | 721 | 1,372 | 1,452 | |||||||||||||

| Depreciation and amortization | 56 | 57 | 111 | 112 | |||||||||||||

| Restructuring | — | 206 | — | 206 | |||||||||||||

| Total expenses | 2,415 | 3,040 | 4,730 | 5,449 | |||||||||||||

| Operating income | 586 | 38 | 1,425 | 973 | |||||||||||||

| Interest expense, net | (155 | ) | (166 | ) | (310 | ) | (326 | ) | |||||||||

| Equity in net earnings of investee companies | 35 | 42 | 66 | 75 | |||||||||||||

| Other items, net | (6 | ) | (12 | ) | (4 | ) | (30 | ) | |||||||||

| Earnings/(loss) before provision for income taxes | 460 | (98 | ) | 1,177 | 692 | ||||||||||||

| Provision for income taxes | (151 | ) | 50 | (407 | ) | (227 | ) | ||||||||||

| Net earnings/(loss) (Viacom and noncontrolling interests) | 309 | (48 | ) | 770 | 465 | ||||||||||||

| Net earnings attributable to noncontrolling interests | (6 | ) | (5 | ) | (18 | ) | (18 | ) | |||||||||

| Net earnings/(loss) attributable to Viacom | $ | 303 | $ | (53 | ) | $ | 752 | $ | 447 | ||||||||

| Basic earnings/(loss) per share attributable to Viacom | $ | 0.76 | $ | (0.13 | ) | $ | 1.90 | $ | 1.10 | ||||||||

| Diluted earnings/(loss) per share attributable to Viacom | $ | 0.76 | $ | (0.13 | ) | $ | 1.89 | $ | 1.09 | ||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||

| Basic | 396.1 | 402.5 | 396.4 | 406.6 | |||||||||||||

| Diluted | 397.4 | 402.5 | 397.9 | 411.4 | |||||||||||||

| Dividends declared per share of Class A and Class B common stock | $ | 0.40 | $ | 0.33 | $ | 0.80 | $ | 0.66 | |||||||||

|

VIACOM INC. |

||||||||

| (in millions, except par value) |

March 31, |

September 30, |

||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 480 | $ | 506 | ||||

| Receivables, net | 2,784 | 2,807 | ||||||

| Inventory, net | 806 | 786 | ||||||

| Prepaid and other assets | 664 | 479 | ||||||

| Total current assets | 4,734 | 4,578 | ||||||

| Property and equipment, net | 879 | 947 | ||||||

| Inventory, net | 3,876 | 3,616 | ||||||

| Goodwill | 11,436 | 11,456 | ||||||

| Intangibles, net | 333 | 340 | ||||||

| Other assets | 1,307 | 1,206 | ||||||

| Total assets | $ | 22,565 | $ | 22,143 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 343 | $ | 506 | ||||

| Accrued expenses | 679 | 748 | ||||||

| Participants' share and residuals | 848 | 860 | ||||||

| Program obligations | 692 | 703 | ||||||

| Deferred revenue | 413 | 481 | ||||||

| Current portion of debt | 1,033 | 18 | ||||||

| Other liabilities | 462 | 537 | ||||||

| Total current liabilities | 4,470 | 3,853 | ||||||

| Noncurrent portion of debt | 11,496 | 12,267 | ||||||

| Participants' share and residuals | 322 | 351 | ||||||

| Program obligations | 288 | 356 | ||||||

| Deferred tax liabilities, net | 531 | 150 | ||||||

| Other liabilities | 1,290 | 1,348 | ||||||

| Redeemable noncontrolling interest | 221 | 219 | ||||||

| Commitments and contingencies | ||||||||

| Viacom stockholders' equity: | ||||||||

|

Class A common stock, par value $0.001, 375.0 authorized; 49.4 and

50.1 |

— | — | ||||||

|

Class B common stock, par value $0.001, 5,000.0 authorized; 346.8

and 348.0 |

— | — | ||||||

| Additional paid-in capital | 10,073 | 10,017 | ||||||

| Treasury stock, 400.1 and 398.0 common shares held in treasury, respectively | (20,825 | ) | (20,725 | ) | ||||

| Retained earnings | 15,192 | 14,780 | ||||||

| Accumulated other comprehensive loss | (551 | ) | (534 | ) | ||||

| Total Viacom stockholders' equity | 3,889 | 3,538 | ||||||

| Noncontrolling interests | 58 | 61 | ||||||

| Total equity | 3,947 | 3,599 | ||||||

| Total liabilities and equity | $ | 22,565 | $ | 22,143 | ||||

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION

The following tables reconcile our results for the six months ended March 31, 2016 and the quarter and six months ended March 31, 2015 to adjusted results that exclude the impact of certain items identified as affecting comparability. The tax impacts included in these tables have been calculated using the rates applicable to the adjustments presented. We use consolidated adjusted operating income, adjusted net earnings attributable to Viacom and adjusted diluted earnings per share ("EPS"), as applicable, among other measures, to evaluate our actual operating performance and for planning and forecasting of future periods. We believe that the adjusted results provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare Viacom’s results with those of other companies and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with accounting principles generally accepted in the United States of America, they should not be considered in isolation of, or as a substitute for, operating income, net earnings attributable to Viacom and diluted EPS as indicators of operating performance, and they may not be comparable to similarly titled measures employed by other companies. There were no adjustments to our results for the quarter ended March 31, 2016.

| (in millions, except per share amounts) | ||||||||||||

|

Six Months Ended |

||||||||||||

| Operating Income |

Net Earnings |

Diluted EPS | ||||||||||

| Reported results (GAAP) | $ | 1,425 | $ | 752 | $ | 1.89 | ||||||

| Factors Affecting Comparability: | ||||||||||||

| Discrete tax expense (1) | — | 21 | 0.05 | |||||||||

| Adjusted results (Non-GAAP) | $ | 1,425 | $ | 773 | $ | 1.94 | ||||||

|

Quarter Ended |

||||||||||||

| Operating Income |

Net Earnings/(Loss) |

Diluted EPS | ||||||||||

| Reported results (GAAP) | $ | 38 | $ | (53 | ) | $ | (0.13 | ) | ||||

| Factors Affecting Comparability: | ||||||||||||

| Restructuring and programming charges (2) | 784 | 520 | 1.29 | |||||||||

| Adjusted results (Non-GAAP) | $ | 822 | $ | 467 | $ | 1.16 | ||||||

|

Six Months Ended |

||||||||||||

| Operating Income |

Net Earnings |

Diluted EPS | ||||||||||

| Reported results (GAAP) | $ | 973 | $ | 447 | $ | 1.09 | ||||||

| Factors Affecting Comparability: | ||||||||||||

| Restructuring and programming charges (2) | 784 | 520 | 1.26 | |||||||||

| Loss on pension settlement (3) | 24 | 15 | 0.04 | |||||||||

| Discrete tax expense (1) | — | 23 | 0.05 | |||||||||

| Adjusted results (Non-GAAP) | $ | 1,781 | $ | 1,005 | $ | 2.44 | ||||||

(1) The net discrete tax expense is principally related to a reduction in qualified production activity tax benefits as a result of retroactively reenacted legislation.

(2) The pre-tax charge of $784 million reflects $578 million of programming charges and a $206 million restructuring charge associated with workforce reductions.

(3) The pre-tax non-cash charge of $24 million was driven by the settlement of pension benefits of certain participants of our funded pension plan.