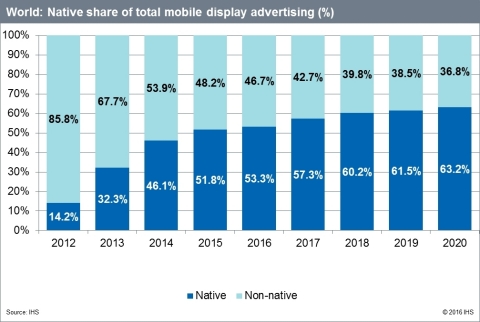

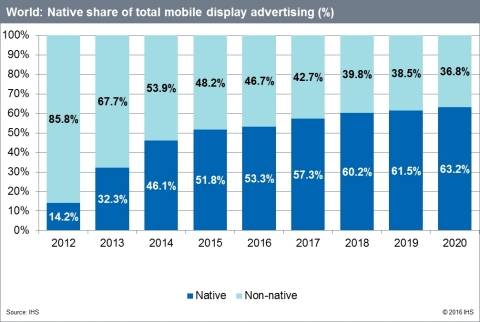

LONDON--(BUSINESS WIRE)--A new study released today by IHS Inc. (NYSE: IHS), the leading global source of critical information and insight, and Facebook’s Audience Network found that by 2020 in-app native advertising revenue will generate almost two-thirds (63.2 percent) of mobile display advertising revenue and will amount to $53.4 billion.

Mobile advertising has grown faster than any other medium in the last four years and is now a significant proportion of online advertising revenue.

“Initially, we saw mobile advertising struggling to match the success of mobile app usage and consumer spending,” said Eleni Marouli, principle analyst at IHS Technology and co-author of the study. “Now, native advertising is booming and today’s most successful mobile marketers have already made the switch. The future of mobile advertising is native.”

The IHS study is the first to provide market sizing and future projections of the in-app native advertising market across regions. Since native advertising is becoming a buzzword used inconsistently across the industry, IHS is using the following definition throughout the report: ‘native advertising’ - a format of advertising that takes advantage of the form and function of the surrounding user experiences, all of which are indigenous to the wide variety of mobile devices.

Five billion smartphones by 2018

Since Apple launched its App Store in mid-2008, global smartphone and tablet application stores have served more than 500 billion app downloads. By the end of 2015 there were 3.3 billion smartphones in use globally, and in the most advanced markets in Western Europe, North America, and mature Asian markets there were more than 85 smartphones in use per 100 people. There is still room for growth; the global smartphone installed base will pass 5 billion in 2018. “This growth presents opportunities for both app store revenues from in-app purchases and also in-app mobile advertising,” said Jack Kent, director at IHS Technology. “Many of these markets will be mobile first in consumer adoption of online services and so mobile advertising will be the dominant online advertising channel."

Mobile is key driver

Third party in-app native advertising (native advertising that is operated and served by a third party onto a publisher’s inventory) will be the fastest growing format and a key driver of mobile advertising. IHS research shows that it will increase an average of 70.7 percent a year in terms of revenues to reach $8.9 billion in 2020.

North America is the leading region in third party in-app advertising both in absolute and relative terms; however, Asia Pacific will record the largest increase in the next five years at 177 percent compound annual growth rate between 2015 and 2020.

Patterns

“When analysing mobile advertising revenue by company, two patterns can be observed,” Marouli said. “Companies which focus on mobile in-app advertising command the majority of the mobile advertising market, and companies which focus on native advertising as a primary revenue stream are the most successful at monetizing through mobile.” This does not suggest that non-native, mobile web advertising is not growing, but rather that native in-app advertising is outpacing all other mobile advertising formats.

Champions of in-app native advertising

IHS research found that adoption of native varies by publisher type with utilities as the most advanced and games most reluctant at adopting native ad formats.

Method

As part of this study IHS conducted in-depth interviews with industry stakeholders in 25 countries. Responses were given by a broad range of companies in three categories including publishers, app and game developers; agencies and advertisers; trade associations, ad networks and technology vendors.

Based on qualitative and quantitative insights gained from interviews, company and industry reports, and IHS in-house data and models, native advertising was estimated and forecasted separately for North America, Europe and Asia Pacific. The global total was calculated by adding up the three regions included in this study.

All advertising revenue numbers in this report are the net advertising revenues made by publishers and platforms. The regional splits are accounted for in the region in which the advertising revenue was booked. For example, if company A is a North American company, but it generated revenue in Europe, APAC and North America, its total revenue is split regionally according to where it was sold.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of insight, analytics and expertise in critical areas that shape today’s business landscape. Businesses and governments in more than 150 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners. © 2016 IHS Inc. All rights reserved.