DALLAS--(BUSINESS WIRE)--To the shareholders of The Howard Hughes Corporation, from the Chief Executive Officer David R. Weinreb:

Five short years ago, The Howard Hughes Corporation (NYSE:HHC) was reborn as a public company. Hughes himself, this company’s successful and pioneering namesake, built a legacy that places him among the greatest entrepreneurs of the 20th century. In the 21st century, we remain inspired by his spirit, and focused on the challenging work ahead: to unlock value across a broad and increasingly diverse portfolio. I am proud to be associated with a talented group of professionals who share this vision, as well as privileged to work side by side with a senior leadership team and board of directors that share my passion for building a transformational company. With this milestone anniversary upon us, I want to look back at our accomplishments since inception, provide an update on our core assets, and define our thinking on the future strategic direction of HHC.

Five Years and Building

We emerged publicly in 2010 as a collection of 34 disparate assets that were under-appreciated by the market. Over the last five years, we have transformed that initial collection of assets into a market-leading enterprise with three complementary businesses that are operated within a culture of entrepreneurship, imaginative thinking and passion for excellence.

Our core competencies range from planning and developing suburban cities in our master planned community (MPC) segment and developing complex, large-scale mixed-use projects in our strategic developments segment to actively managing these developments once completed in our operating assets segment. We benefit from the range of our assets, which include large-scale communities with dominant market positions. Moreover, we allocate our capital and expertise across geographically diverse properties and asset classes to maximize returns throughout the real estate cycle. This diversity mitigates our exposure to the health of any one local economy or business segment, thus providing the foundation for growth, sustainability and opportunity in the company that you own today. As a result of our asset class and geographic diversification, no other company was like us at inception and that still holds true today.

Aligned Incentives

“Be as you wish to seem” - Socrates

For HHC that understated advice speaks of an approach to investing that, we believe, inspires confidence. Throughout my career in real estate, I have invested my own capital in ventures I support. This commitment to having “skin in the game” is at the core of my investment philosophy and has been critical to my past success. Grant Herlitz, our President, and Andrew Richardson, our CFO, share this philosophy. To that end, upon joining HHC, I invested $15 million in the company, with Grant and Andy investing $2 million each, all in the form of warrants. The value of the company has increased significantly since that time and our investment represents a meaningful equity stake. Furthermore, the warrants are restricted for six years and have a short one year window in which they can be exercised. As I stated in my 2011 letter, “It was clear that the only way we could properly lead this company was to make meaningful, long-term personal investments. In doing so, we affirmed our belief in the business and our commitment to creating long-term shareholder value. You can be certain that we will treat your money as if it is our own.” This culture of ownership is further strengthened by investment from our board of directors. Pershing Square Capital Management and its affiliates, led by our Chairman Bill Ackman, has an approximately 24%1 economic interest in HHC. In total, our directors and senior management cumulatively own approximately 30% of the company. The significant level of capital commitment outlined is unequivocal evidence that the leadership of the company aligns itself with our shareholders. When you do well, we all reap rewards.

2015 Financial Results

Our financial results demonstrate the progress we have made in significantly increasing the intrinsic value of our asset base. We increased Net Operating Income (NOI)2 from our income-producing Operating Assets from $43 million in 2010 to $120 million based on our annualized fourth quarter 2015 NOI. Furthermore, when stabilized, the commercial property assets under construction or completed and placed into service through 2015 are projected to achieve approximately $219 million of NOI by 2019. Excluding the legacy assets inherited via the spinoff, at stabilization, we expect to achieve a 9.0% yield on approximately $2.0 billion of costs. These assets if sold should trade at a meaningful premium to their construction cost. Because our portfolio is geographically diverse, its attractiveness to multiple investors may vary. For example in states such as New York and Hawaii, cap rates will be lower than other markets such as The Woodlands and Las Vegas.

Our ability to navigate volatile environments and stay the course through development cycles comes, in large part, from maintaining a strong balance sheet and ample liquidity. We seek to limit capital market conditions from influencing or disrupting our ability to create long-term value. In order to mitigate this risk, we finance our projects conservatively and maintain substantial corporate cash balances.

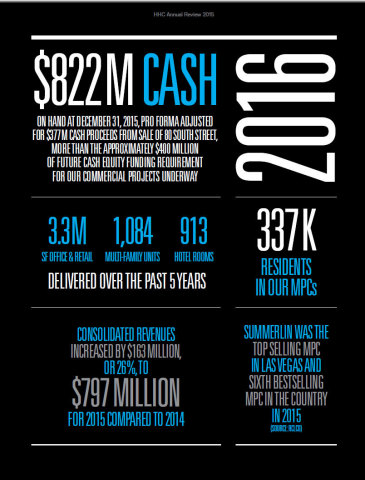

As of December 31, 2015, we had $445 million cash on hand. This has been significantly bolstered by $377 million in net cash proceeds from the sale of the Seaport District Assemblage, which closed on March 16th. Including the sale of the Seaport District Assemblage, our pro forma adjusted cash on hand as of December 31, 2015 is $822 million. Our aggregate future cash needs for the developments underway are expected to be funded over several years, during which time our MPCs and operating assets will also generate significant cash flow. The vast majority of this cash flow will be allocated to our strategic assets segment and, as appropriate, to new opportunities. Each of our active developments has committed financing from leading institutions with the exception of the Seaport District, developed without project financing to date, which has allowed us more flexibility with development and leasing decisions. Our net debt to enterprise value (defined as the market value of equity plus net debt) was just 31% as of December 31, 2015. We have sufficient liquidity for all our cash needs for developments currently under construction. Over the next two years, we expect to incur an additional $781 million of debt for developments currently underway, $541 million of which is short term construction debt for Waiea and Anaha at Ward Village expected to be repaid in full by the end of 2017. Additionally, we expect to invest approximately $400 million of equity in these projects.

Our consolidated revenue increased by $163 million, or 26%, to $797 million for 2015 compared to 2014. Net operating income from our income-producing Operating Assets increased by $44 million, or 59%, to $118 million for 2015. Our NOI does not yet reflect the full impact of a number of projects placed into service in 2014 and 2015 that have not yet stabilized. Revenue from our MPC segment during 2015 totaled $230 million, including $76 million generated in Houston, a region that has proven more robust and resilient than news headlines would suggest.

During 2015 we completed several major developments totaling over one million square feet, the majority of which are located in The Woodlands north of Houston, TX:

- Two office buildings constructed for ExxonMobil, a “AAA” rated credit tenant, totaling 649,000 square feet

- 126,000 square feet of retail and restaurant space anchored by Whole Foods Market at Hughes Landing

- Creekside Village Green, a 75,000 square foot mixed use project also located in The Woodlands

- A 205-key Embassy Suites at Hughes Landing that opened at the end of 2015

- The Westin at The Woodlands, a 302-key hotel located in the Town Center that opened this month

- Two multifamily projects in our MPCs totaling 770 units, The Metropolitan in Downtown Columbia, MD and One Lakes Edge at Hughes Landing in The Woodlands

These projects will contribute to our NOI through 2016 and into 2017 as they achieve stabilized operating and occupancy levels.

In addition, the following projects commenced construction in 2015:

- One Merriweather, a 199,000 square foot office building approximately 49% pre-leased to MedStar, one of the region’s largest healthcare service providers located in Downtown Columbia, MD

- The Summit, a 555 acre luxury residential golf course community in the Summerlin MPC outside of Las Vegas, NV being developed in a joint venture with Discovery Land Company, first lot sale closings to take place in 2016

- The Constellation, a 124 unit luxury apartment development in Downtown Summerlin being developed as a joint venture to be completed in 2016

- Lakeland Village Center, an 83,600 square foot CVS-anchored mixed use neighborhood development that has become the first commercial development in the Bridgeland MPC in Houston, TX, to be completed this year

- Alden Bridge Self-Storage Facilities in The Woodlands, totaling 1,320 units to be completed in 2016 and 2017

In 2015, we sold The Club at Carlton Woods, a 36-hole Nicklaus-Fazio designed country club located in The Woodlands, for $25 million in cash and the assumption by the purchaser of $54 million of membership deposit liabilities. This asset no longer had strategic value to us because the lots surrounding it were substantially sold, and it saddled HHC with approximately $4 million of annual NOI losses.

Over the past five years, we have completed (on schedule and under budget) the construction of over 3.3 million square feet of office and retail properties as well as 1,084 multifamily units and 913 hotel rooms, with a combined cost of $1.4 billion. Upon stabilization, these projects are projected to generate $126 million of NOI, an approximate 9.0% yield on cost as reflected in the NOI table below.

Our operating asset segment based on developed, under construction, acquired and legacy commercial properties at stabilization will consist of 4 million square feet of retail, 3.8 million square feet of office, 2,059 multifamily units, 913 hotel rooms and 1,320 units of self-storage. In addition, we have three market rate condominium towers in Honolulu that are under construction which are projected to generate $1.7 billion of gross sales proceeds.

| Square | |||||||

| Feet/Number | Projected Annual | ||||||

| ($ in millions) | of Units | Stabilized NOI | |||||

| Commercial Properties - Completed Development | |||||||

| Retail - Completed Development | 1,690,067 | $ | 47.1 | ||||

| Office - Completed Development | 1,578,048 | 32.6 | |||||

| Multifamily, Hospitality & Other - Completed Development | 1,997 | 46.3 | |||||

| Total Commercial Properties - Completed Development | 126.0 | ||||||

| Commercial Properties - Under Development | |||||||

| Retail - Under Development | 196,600 | 5.7 | |||||

| Office - Under Development | 520,000 | 12.7 | |||||

| Multifamily - Under Development | 561 | 5.1 | |||||

|

Self-Storage - Under Development |

1,320 | 1.6 | |||||

| Total Commercial Properties - Under Development | 25.1 | ||||||

| Commercial Properties - Acquired | |||||||

| Retail - Acquired | 83,951 | 2.8 | |||||

| Office - Acquired | 1,282,510 | 20.9 | |||||

| Multifamily, Hospitality & Other - Acquired | 414 | 5.1 | |||||

| Total Commercial Properties - Acquired | 28.8 | ||||||

| Commercial Properties - Legacy | |||||||

| Retail - Legacy | 2,040,226 | 27.8 | |||||

| Office - Legacy | 446,471 | 6.6 | |||||

| Multifamily, Hospitality & Other - Legacy | N/A | 4.5 | |||||

| Total Commercial Properties - Legacy | 38.9 | ||||||

| Total Commercial Properties | |||||||

| Total Retail | 4,010,844 | 83.4 | |||||

| Total Office | 3,827,029 | 72.8 | |||||

| Total Multifamily, Hospitality | 2,972 | 61.0 | |||||

|

Total Self-Storage |

1,320 | 1.6 | |||||

| Total Commercial Properties | $ | 218.8 | |||||

| Notes: |

| Includes the following commercial properties that were not included in our full year 2015 earnings release: One Merriweather, m.flats at 50% share (included within Parcel C), The Woodlands self-storage facilities, Constellation and retail at the base of condominiums under construction at Ward Village. Excludes the Seaport. |

Master Planned Communities

In our MPC segment, we plan, develop and manage suburban cities in dynamic markets, including The Woodlands and Bridgeland in Houston, TX; Summerlin in Las Vegas, NV; and Columbia, MD. Combined, they represent over 80,000 acres (of which 12,000 acres of land remain to be sold) with a population of over 337,000 residents and 135,000 jobs. Our core business is selling residential land to homebuilders and commercial development. Because of their integrated lifestyle and strong amenity base, our communities attract a wide range of home buyers and obtain a significant premium over comparable homes outside of our master planned environment. With more than 12,000 acres of land remaining to be sold or developed, we have substantial untapped value in our portfolio. This large-scale business is a significant generator of net cash flow for the company. Unlike many businesses in which inventory depreciates in value over time, land has been an appreciating asset over the long term for HHC.

The table below outlines the estimated uninflated and undiscounted gross sales value of our land holdings. However, a more precise way to value our MPC segment would be to sum (i) the net present value of our unsold residential land, (ii) the value of our unsold commercial land holdings and (iii) the imputed value of the potential development opportunities within this segment. As an investor one might value our MPC assets by taking what the land can be sold for today and applying a market inflation rate on each parcel of land. Each MPC must be sold in an orderly fashion over its intended life cycle with an appropriate sellout date net of land development costs incurred to improve the property. One must then apply an appropriate discount rate to arrive at what would be the net present value of the MPC. Most land buyers would target levered discount rates for raw unentitled land at 15%-20%. In the case of HHC, the substantial majority of our vacant land is located in MPCs which are established with long-term track records in their communities and deserve a much lower discount rate. In the case of The Woodlands, where the sellout date is almost certain and quickly approaching, we believe a discount rate in the single digits is appropriate. Lastly, a value should be given for the vertical component of the potential development opportunities available within the MPC.

| MPC Gross Sales Value | |||||||||||||||||||||||||||||||||

| Remaining Saleable and |

Average Price per Acre1,2 |

Projected | Average Cash | Undiscounted/Uninflated Value | |||||||||||||||||||||||||||||

| Developable Acres | ($ in thousands) | Community |

Margin3 |

($ in millions)4 |

|||||||||||||||||||||||||||||

| Community | Residential | Commercial | Residential | Commercial |

Sell-Out Date |

Residential | Residential | Commercial | Total | ||||||||||||||||||||||||

| Bridgeland | 3,293 | 1,010 | $ | 382 | $ | 448 | 2036 | 70 | % | $ | 881 | $ | 452 | $ | 1,333 | ||||||||||||||||||

| Maryland5 | - | 108 | - | 316 | 2022 | - | - | 34 | 34 | ||||||||||||||||||||||||

| Summerlin | 4,591 | 830 | 535 | 651 | 2039 | 65 | % | 1,595 | 540 | 2,136 | |||||||||||||||||||||||

| The Woodlands | 395 | 785 | 666 | 939 | 2025 | 90 | % | 237 | 737 | 974 | |||||||||||||||||||||||

| The Woodlands Hills | 1,493 | 171 | 253 | 48 | 2028 | 70 | % | 264 | 8 | 272 | |||||||||||||||||||||||

| Total | 9,772 | 2,904 | $ | 445 | $ | 610 | $ | 2,977 | $ | 1,772 | $ | 4,749 | |||||||||||||||||||||

|

Notes: |

| 1) Residential pricing: average 2015 acreage pricing for Bridgeland, Summerlin and The Woodlands. Summerlin includes 555 acres contributed to the Summit joint venture at an agreed upon value of $225,000/acre. Pro forma acreage pricing for The Woodlands Hills. |

| 2) Commercial pricing: estimate of current value based upon recent sales, third party appraisals and third party MPC experts. The Woodlands Hills commercial is valued at cost. |

| 3) Bridgeland assumes the average of the 65%-75% range provided. Bridgeland margins are applied to The Woodlands Hills. |

| 4) Pre-tax cash flow estimates. |

| 5) Maryland commercial acres exclude land in Downtown Columbia that is held within our Strategic Developments segment. |

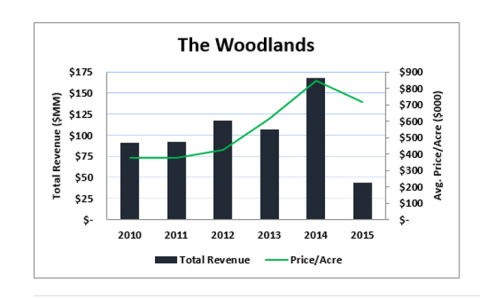

The Woodlands

In my 2014 shareholder letter, I noted our expectation that the rapid decline in oil prices would result in a slowdown in economic growth in the Houston area, consequently slowing absorption of vacant commercial space and the velocity of land sales. The price of oil has greatly decreased over the past twelve months, and we have therefore taken a cautious approach to making new development commitments in response to an anticipated reduced demand. Nonetheless, we remain focused on creating shareholder value in The Woodlands and Bridgeland in this more challenging environment.

As the owner and developer of virtually all of the remaining commercial land in The Woodlands, we do not have the competitive pressures to quickly lease or monetize properties that other, one-off and less well-capitalized developers encounter. A positive aspect of the slowdown, then, is that many of our competitors have retreated while we continue to strengthen our dominant position in the market.

We are patient and focused on long-term value creation, only selling residential land when homebuilder pricing meets or exceeds our return expectations, and only developing commercial product when an appropriate level of demand exists. We have continued to achieve record pricing with average commercial land values increasing from $10 per square foot in 2010 to $22 per square foot in 2015. Using these average selling prices, our undiscounted remaining commercial land would have an estimated value of $737 million.

In 2015, The Woodlands sold 225 residential lots and generated over $32 million in revenue. Although the pace and price of our residential land sales decreased relative to 2014, we were able to maintain a higher price per acre relative to the past. Average price per acre for detached residential product decreased by 14.1% for 2015 compared to 2014. However, the $633,000 average price per acre in 2015 is 76% higher than per acre pricing in 2010, which demonstrates the value inherent in our remaining supply of residential lots. The reduced pace is partly attributable to the economic slowdown in the Houston area but also due to the fewer standard-sized lots remaining for sale. Furthermore, as the majority of the infrastructure work is completed, future net cash margins (which is the percentage cash profit realized net of development costs) equate to over 90% of our sale price. Based on a remaining inventory of 1,192 lots, we estimate an undiscounted residential land value of $237 million.

Our retail and office developments are leased to some of the country’s most credit worthy companies, including JP Morgan Chase, ExxonMobil, Wells Fargo, Whole Foods Market and American Financial Services. 32% of our tenants are publicly traded with a median market capitalization of $5.0 billion3, and 48% of our occupied office space is leased to investment grade companies. Including the developments that were completed in 2015, our retail portfolio in The Woodlands has an average remaining lease term of 8.5 years, while our office portfolio has an average remaining lease term of 7.8 years. Credit performance of our Houston commercial properties has been outstanding, with no tenants carrying significant balances more than 30 days past due.

Despite the economic slowdown in Houston, the metropolitan area posted growth in 2015, adding approximately 23,000 jobs. Much of that growth came from professional services, construction and healthcare. With a population 11% larger than 2010, the Houston area sold 73,000 homes in 2015, a 2% decrease from 2014 while housing starts decreased by 10% to approximately 27,000 in 2015. However, inventory of single family homes in the area is 3.2 months compared to a national average of five months. The Houston economy is much more diversified than in the past, and we believe that our communities, due to their commanding market positions and reputations, are better positioned than the general Houston market to continue generating demand for housing and commercial space.

The Woodlands continues to be one of the most sought-after master planned communities in the country. We are proud to carry on the vision and ideals of this exceptional, renowned community. Since 2004, the population has grown by 46% to approximately 113,000 residents with more than 2,100 businesses. Heading into 2016, we are working to ensure that The Woodlands remains not only a great place to live, work and play, but also a great place to visit. This commitment is most evident in our growing hospitality segment, which includes the recently opened Embassy Suites at Hughes Landing, The Westin at The Woodlands, and our recently expanded and redeveloped Woodlands Resort & Conference Center.

To learn more about The Woodlands, click here.

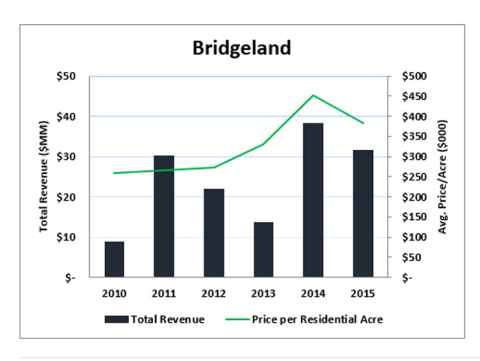

Bridgeland

In 2015, Bridgeland generated $32 million in revenue, which includes the sale of 130 residential lots at an average price of $84,000. Because almost all of Bridgeland’s infrastructure work is reimbursable through MUDs (Municipal Utility District Receivables), our cash margin is expected to be between 65% and 75% over the life of the MPC depending on our success in obtaining the maximum amount available for reimbursement. Since 2010, when HHC assumed Bridgeland’s operations, we have increased the average price per acre for detached residential lots by 47% from $259,000 to $382,000 and increased land sales revenue from $15 million per year to over $32 million per year.

Despite the slowdown in sales relative to 2014, Bridgeland took another important step towards becoming a world-class master planned community by advancing construction of its first neighborhood retail and office center, Lakeland Village Center, and selling two land parcels for three schools and a new church. The Grand Parkway, bisecting Bridgeland’s future downtown, is now open for traffic between US 59 South and I-45 North. For Bridgeland residents, the newest segment between US 290 and I-45 drastically reduces commute time to Houston, The Woodlands and major employment nodes such as the new ExxonMobil campus.

Lakeland Village Center is scheduled to open in 2016 and will incorporate 83,600 square feet of retail, restaurant and office space anchored by a CVS. The parcel designated for education is approximately 127 acres for a to-be built one million square foot elementary, middle and high school combined on the same site. Local school district officials have indicated that students will greatly benefit from its design, and we are confident this project will be an asset for current and future residents as well as a catalyst for the development and sale of new homes in Bridgeland.

Bridgeland has strong long-term prospects as the top MPC in the Northwest region of Houston, especially considering that only 21% of the total saleable acreage has been developed. As the Houston economy recovers and other master planned communities sell out, Bridgeland will benefit from our ability to deliver lots and fuel the future growth of the region. Similar to our strategy in The Woodlands, as Bridgeland grows, we will develop new commercial assets that meet the community’s needs.

To learn more about Bridgeland, click here.

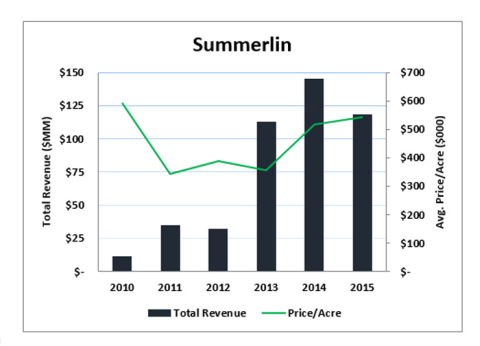

Summerlin

2015 was another year of economic expansion in Las Vegas. Tourism, consumer spending and construction all experienced strong growth. Visitor traffic surpassed 42 million people (an all-time high), gaming revenues reached $9.6 billion, unemployment is 6.2% (80 basis points below where it was a year ago) and the pipeline of new investment in commercial development remains robust.

There is approximately $13 billion of commercial real estate development planned or underway in the Las Vegas Valley as developers and institutional capital align to meet market demand. The Las Vegas Valley has experienced more than 50% population growth since 2000, adding approximately 700,000 new residents. The area is projected by Experian to grow another 12% over the next five years or almost three times as fast as the overall U.S. population. At the same time, the Las Vegas market is also becoming more diverse as the city attracts a broader range of employment sectors. Over the past ten years, education, healthcare, government services, retail trade and professional services have all grown to be bigger drivers of the area’s economy.

According to the Nevada Gaming Control Board, over half of Clark County casino revenue (58%) now comes from non-gaming sources (rooms, food and beverage, entertainment and other ancillary revenue). As the economy continues to expand, more people will move to Summerlin.

In 2015, new home sales in Las Vegas increased 13%, and median new home prices were up 6.5%, with the resale market having a three month supply of homes at the end of the year. Analysts predict that the Las Vegas market can absorb approximately 15,000 units, and we are not even 50% of the way there, which leaves solid room for growth.

Increasing economic diversity coupled with sustainable growth creates tremendous opportunity for us in all areas of our business. As the market continues to strengthen, we will leverage our position as the largest private land owner in Las Vegas, and continue to sell land to homebuilders and develop new commercial assets throughout Summerlin.

The Summerlin MPC had another strong year in 2015. New home sales increased 37.8%, and the median new home prices increased 3.8%. Summerlin was ranked sixth in the U.S. for new home sales by Robert Charles Lesser’s annual poll of Top Selling Master Planned Communities in 2015. We generated $118 million of revenue from land sales and received over $21 million in participation revenue due to better-than-expected home price appreciation. This year, we sold 75 finished lots, seven superpads (totaling 178 acres) and 14 custom lots. As of December 31, 2015, we had 18 active subdivisions, an increase from 14 at the end of 2014. In 2015, the average price per superpad acre sold increased by 8.6% to $519,000. This is the highest pricing we have seen in our community since the recession which reflects the strength of the Las Vegas economy and our dominant market position. Our expected cash margins for residential and commercial land sales are estimated to be approximately 65% over the remaining life of the MPC.

We are proud to partner with some of the nation’s largest and healthiest homebuilders, including Lennar Corporation, PulteGroup and Toll Brothers. Each actively builds and sells homes in our community and has been instrumental in delivering a high quality housing mix to Summerlin. We estimate that Summerlin captures 8% of the overall Las Vegas housing market and 24% of the housing market over $400,000. We expect our market share to continue to grow as Summerlin further distinguishes itself as the premier place to live in the Las Vegas Valley by developing new commercial offerings and exceptional amenities that are unmatched by other communities in the region.

Our joint venture with Discovery Land Company to develop an exclusive luxury golf course community with low density residential housing is another significant differentiating element of Summerlin. Discovery, led by Chairman and CEO Michael Meldman, is the premium developer of these communities and a great example of how we partner when appropriate with the most successful companies to accelerate our initiatives.

The project, known as “The Summit,” is developing and selling lots in the $2 million to $8 million range in addition to various luxury attached and detached homes. This product does not compete with our current offerings and accelerates the monetization of our land holdings, increasing the value of our MPC. The 555 acre Summit will further distinguish Summerlin as the top place to live in the Las Vegas Valley. We plan to bring approximately 270 residences to the market by the end of 2023. As of December 31, 2015, Discovery sales were well ahead of schedule. The project has contracted 39 lots for $119 million of sales revenue and collected $45 million in deposits relating to these contracts. Our land contribution to the venture was valued at $125.4 million and had a $13.4 million gross book value. We will receive a 5% annual return on our $125.4 million land contribution and a return of all of our capital before our partner receives any distributions. Based on the contracted sales to date, we anticipate receiving initial distributions in 2016.

In opening the long awaited Downtown Summerlin in the fourth quarter of 2014, we created a vibrant shopping, dining and entertainment destination and further strengthened Summerlin’s position as the premier community in the region. The initial phase consists of 1.4 million square feet of mixed use development on 106 of the approximate 300 developable acres in the heart of Summerlin. To date, we have welcomed an estimated 17 million visitors, opened 115 retailers and steadily increased occupancy to 90% leased. ONE Summerlin, our first Class A office building that is located within Downtown Summerlin, is currently 70% leased. We are confident in the catalytic effect Downtown Summerlin will continue to have on both residential land sales as well as on future commercial development in our community.

Last year, I mentioned that the ultimate build out of our downtown will be similar to the development of The Woodlands Town Center. Since then, our commitment has only strengthened. We have begun the process of master planning the remaining 184 acres where we envision over five million square feet of density in order to expand our commercial offerings and provide new amenities for our residents. The first multifamily development in Downtown Summerlin is located on this remaining land that is part of Phase Two. Developed in a joint venture with the Calida Group, the Constellation will deliver 124 luxury rental units that will be completed in the second quarter of 2016 for which we have received strong demand. We will continue to deliver new residential and commercial offerings in the Summerlin market.

To learn more about Summerlin and Downtown Summerlin, click here.

Columbia

Columbia is our most mature MPC and is among the first master planned communities in the country. Jim Rouse, the father of the MPC business, originally assembled the land which was ultimately developed into Columbia, strategically seeking to position it between Baltimore, MD, and Washington, DC. It is now home to over 112,000 residents.

The Merriweather Post Pavilion amphitheater, identified by Rolling Stone magazine as one of the most significant outdoor performance venues in the country, sits in the center of the community. Columbia also thrives on its close proximity to the Baltimore/Washington International Airport and Fort Meade, home to the National Security Agency, and is home to some of the nation’s top public schools. These factors contributed to Money magazine ranking Columbia as one of the Best Places to Live in 2014.

The Rouse Company sold out the community’s inventory of single-family residential lots long ago, but Downtown Columbia was reserved for the last stages of development so that it would become an urban-oriented business and cultural hub. This strategy is consistent with The Woodlands, which created enormous value by reserving strategically located “town center” land for commercial development later in the lifecycle of the MPC. The adoption of the Downtown Columbia Plan in 2010 by Howard County allows for up to 13 million square feet of new commercial entitlements which provides us with a unique development opportunity.

Our focus over the past five years has been planning the commercial development of Downtown Columbia when we were designated lead Community Developer with fully legislated development rights subject only to administrative approvals for specific projects. Under the plan, we can develop up to 5,500 residential units, 4.3 million square feet of office, 1.3 million square feet of retail and 640 hotel rooms.

For our first project, we successfully repurposed the former Rouse Company headquarters building, one of the first works of architectural giant Frank Gehry, into a Whole Foods Market-anchored mixed-use asset. Next, in a joint venture with Kettler, we completed a 380-unit multifamily development named The Metropolitan. In December 2014, we acquired a portfolio of existing office buildings totaling over 717,000 square feet of rentable space. Known as 10-60 Columbia Corporate Center, the buildings are strategically located adjacent to our other office and mixed use holdings. With this acquisition, we became the largest office landlord in Downtown Columbia, controlling approximately 1.1 million square feet of the 2.4 million square feet of office in the submarket.

This purchase is consistent with our strategy of controlling supply across business segments and product types in our MPCs as we have done in The Woodlands. In early 2016, we began construction on our next 437-unit multifamily project now known as m.flats. When stabilized, our operating assets and the assets that are currently under development are estimated to generate approximately $27.7 million of NOI as shown in the table below:

| Square Feet / | Projected Annual | |||||||||

| ($ in millions) | Asset Type | Number of Units | Stabilized NOI | |||||||

| Operating Assets | ||||||||||

| 10-70 Columbia Corporate Center | Office | 870,739 | $ | 12.4 | ||||||

| The Metropolitan | Multifamily | 380 | 3.5 | |||||||

| Columbia Regional Building | Retail/Office | 88,556 | 2.2 | |||||||

| Columbia Operating Properties | Various | 220,471 | 0.5 | |||||||

| Total - Operating Assets | 18.6 | |||||||||

| Under Development | ||||||||||

| One Merriweather | Office | 199,000 | 5.1 | |||||||

| m.flats | Multifamily | 437 | 4.0 | |||||||

| Total - Under Development | 9.1 | |||||||||

| Total - Operating Assets & Under Development | $ | 27.7 | ||||||||

|

Notes: |

||||||||||

|

Joint venture projected annual stabilized NOI is shown at share. |

||||||||||

Early in 2015, the Howard County Planning Board approved 4.9 million square feet of density to be built on the 35 acres of land in Downtown Columbia surrounding the Merriweather Post Pavilion. We branded this area the Merriweather District with planned density to include 1.5 million square feet of office space, 2,300 residential units, 314,000 square feet of retail and 250 hotel rooms accompanied by conference center space. We envision the Merriweather District one day as its own small community, much like Hughes Landing in The Woodlands.

Late in 2015, following the signing of MedStar, one of the largest healthcare providers in the region, to anchor the building, we began construction in the Merriweather District on the first new Class A office building to be constructed in Downtown Columbia in decades. Named One Merriweather, the building will contain approximately 199,000 square feet with structured parking containing 1,129 spaces, enough parking for another similar-sized office building. It will be completed at the end of 2016 for an estimated cost of $78 million, excluding land value, and is forecasted to generate $5.1 million in NOI when stabilized.

We continue to generate interest from a variety of businesses in Downtown Columbia including healthcare, cyber security and other technological and research-oriented companies. By developing a corporate employment center, more people will want to live and play in Downtown Columbia, specifically in the Merriweather District itself. We are confident that in the near future, Downtown Columbia will attract a critical mass of like-minded companies in addition to the vibrant industry that is already in place.

Our plans for this urban core continue to reflect Rouse’s fifty-year old vision, and they are on their way to becoming reality. We are proud to be honoring his legacy in creating Downtown Columbia and reinventing the community for a new generation of residents and office workers. We are excited about the early momentum we have achieved and expect meaningful progress with this development in the coming year.

To learn more about Downtown Columbia, click here.

Strategic Developments

The Seaport District

With its storied past as New York City’s original commercial hub, the South Street Seaport was an important gathering place for Lower Manhattan residents and a destination for visitors interested in experiencing the authenticity of yesterday’s New York and unmatched views of the Brooklyn Bridge.

Our unique Seaport District encompasses an area comprised of historic buildings to the west of the FDR Drive and the adjacent Pier 17 on the East River. It was redeveloped into a shopping destination in the 1980s, yet over the years lost its relevance to New Yorkers while remaining a high volume tourist destination, with approximately 15 million visitors per year prior to our redevelopment. In the 15 years following the tragic events of September 11, 2001, Lower Manhattan has transformed into an ever-evolving destination for companies in the creative, media, technology and financial services sectors. Lower Manhattan has over 500,000 office workers, with those in the private sector earning close to $150,000 annually on average – approximately 25% higher than workers in the rest of Manhattan. Over 800 companies in the creative and media sectors call Lower Manhattan home, including Conde Nast, Time Inc., Harper Collins and Gucci. This does not account for the more than five million square feet of Class A office space that is projected to be delivered by 2020 as part of the World Trade Center redevelopment in addition to the approximately five million square feet of space that was recently completed over the last few years.

Lower Manhattan has also become one of the fastest growing neighborhoods in New York City, attracting affluent, well-educated New Yorkers with average household incomes exceeding $200,000. This growth is only the beginning as many new residents will be relocating to the area with 31 residential buildings totaling 5,227 units scheduled for completion by 2018. An increase in visitors will also follow with 23 hotels scheduled for completion by 2018 adding a total of more than 3,900 new rooms. Lower Manhattan is poised for continued growth with the Seaport District well positioned to benefit from the transformation of Lower Manhattan.

When HHC obtained control of the South Street Seaport in 2010, we quickly recognized the opportunity to transform it into a district that would become one of the ultimate destinations for New Yorkers and visitors while embracing the waterfront and historic cultural fabric of the locale. Today, that vision is well underway to becoming a reality. The initial development encompasses seven buildings spanning several city blocks and includes the new Pier 17 building (under construction) along with the buildings west of the FDR known as the Historic District. This space will be home to more than 50 retailers in nearly 365,000 square feet - excluding the Tin Building - that will be filled with fashion, culinary, entertainment and cultural offerings. The culinary experiences at the Seaport District will feature world-renowned chef Jean-Georges Vongerichten, and include a flagship restaurant on the pier along with an approximately 40,000 square foot food market in the to-be reconstructed Tin Building between Pier 17 and the FDR Drive. Recently we executed a lease with acclaimed chef, David Chang, founder of the Momofoku Group, who will also be opening a dynamic new restaurant concept in the Pier 17 building. This dining experience will further cement the extraordinary culinary offerings at the Seaport District.

Jean-Georges and David Chang are the first to be announced in what will become a range of dining choices by the most notable restaurateurs designed to captivate locals and visitors alike. With 40% more public space than before, Pier 17 will be highlighted by a 1.5-acre roof that will include a restaurant, outdoor bars and a venue for concerts and special events that we believe will become one of the world’s most recognized entertainment venues. The rooftop will be programmed as a year-round destination, home to a seasonal summer concert series as well as a winter village and a cultural and entertainment gathering place for all New Yorkers and visitors.

Renovation of the Historic District should be substantially complete by late 2016. iPic Theaters will open their first Manhattan location in the Fulton Market Building by the end of the year. Its distinct theater offering will attract locals from all over the city to enjoy a premier cinematic experience. If you have visited the area in the past two years while our renovations have been underway, you likely noticed that we have been attracting local residents with unique seasonal programming and offerings, such as the Smorgasburg food outpost, summer movie nights, our curated pop up concept store – Seaport Studios – in collaboration with WWD, the Culture District and our ice skating rink in the winter. In a few short years, we have re-energized the Seaport. As the city’s birthplace of innovation, it is particularly fitting that the Seaport District is reemerging as a hub for cutting edge cultural, fashion, culinary and entertainment experiences.

We currently estimate that the initial development will cost approximately $514 million, excluding the Tin Building, but this estimate could change as we advance the development process. The development will ultimately generate revenue from rents paid by our tenants, participation income generated from businesses that are tenants and in which we are also a partner and event and concert revenue from programming the rooftop entertainment space. We have not yet provided estimates of the future cash flow potential at the Seaport District due to the significant complexity and the dynamic nature of the plans and designs associated with a development of this scale. We believe it has the potential to be an enormously valuable long-term hold for the company.

We expect the dynamic offerings provided in the Seaport District to deliver attractive returns not only for us but also for our tenants and partners. As a result, we are structuring our business relationships with many of our tenants so that we may share in the benefits and upside of this performance, rather than having to wait ten or more years when the first generation of leases renew, as we would have to do with more traditional fixed-rent structures.

We are under a letter of intent with the New York City Economic Development Corporation for another potential project in the Seaport District adjacent to our Pier 17 redevelopment currently underway. Our proposed project is expected to include approximately 700,000 square feet of new development within the Seaport District, create a permanent solution for the South Street Seaport Museum and provide critical infrastructure replacements and additional community benefits. There was resistance to our originally proposed tower on the site, and we have subsequently agreed to reduce the size and eliminate all residential square footage from that proposed building, provided that we are able to transfer our development rights to another site. We are searching for suitable sites to receive the remaining available development rights that we intend to transfer from the city parcel to help pay for the museum redevelopment and additional community benefits. We will continue to work with the elected officials and other community stakeholders to come up with a resolution.

While there is no specific timeline for a resolution, discussions are ongoing, and we believe we are making meaningful progress toward a mutually satisfactory resolution that strengthens the Seaport District as a leading destination for New Yorkers.

In 2014, we began to pursue a unique opportunity to assemble a development site capable of holding one of the tallest residential and commercial towers in Lower Manhattan. This included the complex acquisition of a number of independently owned parcels and development rights. Only by entering into a Zoning Lot Development Agreement (Zelda) could a development of this magnitude be possible. As a result of our desire to accelerate the build out of the Seaport District while we focus on the Seaport’s core, we marketed the site and recently announced its sale to China Oceanwide for $390 million and expect to recognize a gain of approximately $140 million before tax. China Oceanwide will develop an iconic residential tower with unmatched views that we expect will complement and enhance our plans for the Seaport District. We wish them tremendous success with the development. This transaction is another indication that the Seaport is gaining recognition as one of the city’s hot spots and is a good example of the creative ingenuity of our acquisitions team, especially its main architect Chris Curry, Senior EVP Development.

To learn more about the Seaport District, click here.

Ward Village

Ward Village, our 60-acre master planned community located on the south shore of Oahu between downtown Honolulu and Waikiki, made significant progress in 2015. The property is currently comprised of 1.3 million square feet of retail, industrial and office space and generated $26 million in net operating income in 2015. Our master plan entitlements allow for up to 9.3 million square feet of mixed use development. As the largest urban development site in Honolulu, Ward Village represents a once-in-a-lifetime opportunity to transform an urban core and create a much needed and sought-after gathering place for all of Oahu. At full build out, we will deliver over 4,000 homes to a market where supply continues to fall short of demand for new housing. We also plan to deliver over one million square feet of retail space, making Ward Village the premier outdoor shopping district in Hawaii and a truly exceptional destination for locals and visitors. As the largest LEED-ND Platinum certified development in the country, Ward Village is at the forefront of sustainable community development and will contain public amenities at a scale that no other development in Hawaii offers. These public amenities include a planned four-acre park in the heart of the community, new tree-lined sidewalks and bike lanes and access to the adjacent Kewalo Harbor, which we control and operate under a 35-year ground lease with the Hawaii Community Development Authority.

Our mission is to create a neighborhood that enriches the lives of everyone who experiences Ward Village. The carefully curated mix of leading design, retail experiences, public spaces and cultural programming will create a place unlike any other in Hawaii. Our approach of partnering with the world’s most admired architects, from Peter Bohlin and James Cheng to Richard Meier, is resulting in an environment that clearly places Ward Village above its competition. We are creating a community that is unique not just in Hawaii but also exceptional when benchmarked against other great urban master plans around the globe, including Hudson Yards in Manhattan and Battersea Power Station in London.

Leading retailers have taken notice. Last year Chef Nobu Matsuhisa announced that he will relocate his only Oahu restaurant from Waikiki to Ward Village at the base of Waiea. Local favorite Chef Peter Merriman selected Ward Village as the home for his first Oahu Merriman’s at the base of Anaha. Additionally, we recently began construction on the long awaited flagship Whole Foods Market that will be located at the base of Ae‘o.

We are proud of the many accomplishments we have made in moving this community forward from a vision on paper to one of the largest mixed use developments underway in Hawaii. Over the past five years, we have attracted top talent in building a formidable operations, development, construction and in-house sales team. To showcase our vision of this small city we are building, we designed and developed a sales experience that is unmatched. To date, we have contracted to sell over 650 homes totaling more than $1.1 billion of revenue of the $1.7 billion currently under construction.

During 2015, our first two residential condominium towers, Waiea and Anaha, moved closer to full sellout with nearly 90% of the 491 residences already under contract. Waiea will be completed in the fourth quarter of this year and Anaha in the second quarter of 2017. Construction of these towers began in 2014. We are on schedule and on budget and will be welcoming our first home owners to Ward Village later this year.

In July 2015, we also began pre-sales on two new towers, Ae‘o, containing 466 residences, and the Gateway Cylinder tower, containing 125 residences. Ae‘o will be developed above the 50,000 square foot flagship Whole Foods Market, which we believe will become the premier grocery destination on Oahu. Ae‘o currently has 46% of its homes contracted for sale. We began construction on the Ae‘o tower in February 2016, and completion is scheduled for 2018.

The Gateway Towers are an important element in communicating to the market our vision for a fully-developed Ward Village. Designed by internationally acclaimed architect, Richard Meier & Partners, these towers frame the connection of our four-acre park to the Pacific Ocean. Gateway Towers represents a level of product quality and overall experience never before seen in the market with pricing that sets a new high for Ward Village. As a result, we expect a more measured absorption period for the Gateway Towers than at our other Ward Village projects. Given the diversity of product we have at Ward Village and land holdings that are under our sole control, we have the patience and ability to stay the course in executing the best overall result for the broader Ward Village community.

In December, we announced Ke Kilohana, a 424-residence condominium tower with 375 of these homes reserved for Hawaii residents who meet certain income and asset requirements. This tower provides a more affordable option for local residents to live in Ward Village. Our entitlements require that 20% of all homes in Ward Village are available exclusively to local residents who meet certain income levels and other qualifying criteria. These 375 homes will satisfy our requirement for the sale of 1,500 market rate units. We expect to begin pre-sales for Ke Kilohana this year.

If you are interested in learning more about purchasing a home at Ward Village, please visit www.wardvillage.com or call one of our sales team members at 808-369-9600.

We have learned a lot from analyzing the extensive customer data obtained through the sales process to identify unmet demand and to design future projects to satisfy that demand. In response to our data and market analysis, we designed Ae‘o with homes having a smaller average size – approximately 836 square feet compared with 1,687 for Waiea, Anaha and the Gateway Cylinder together. This results in homes with lower overall gross prices that appeal to a much broader market segment yet with similar profitability compared to our other products. Our sales and marketing process coupled with constant study of the larger market, helps to identify unmet demand and to inform design and programming decisions for future projects.

While we are proud of another strong year, we recognize that the market is not the same as it was two years ago when we launched our first phase. The sales success of Waiea and Anaha demonstrated significant pent-up demand for new condominiums in Honolulu, particularly at the high end of the market. As this demand was absorbed by Ward Village and other competing projects, the depth of the luxury residential market has shown signs of moderating. The recent announcement that a competing tower was cancelled despite signing over 100 contracts, shows that demand for luxury condominiums in Honolulu, like any market, has limits. We believe that market disruptions create opportunities for Ward Village to take a long-term approach and continue delivering the right mix of product to the market. Unlike most competitors, Ward Village has more than one million square feet of income producing property that does not need to be taken out of operation until we have reached sufficient pre-sales for condominium construction. Moreover, we have an approved master plan to guide us in obtaining project specific approvals, and most importantly, we already own the land. As more homes are completed and we develop public amenities that are unrivaled in the market, we will continue to increase our competitive advantage as Ward Village becomes recognized as one of the most desirable communities in Hawaii and in the world for homeowners and retailers.

Talent

In order to be a successful company, we need both great assets and great people who share common values and a commitment to excellence. At The Howard Hughes Corporation, we have a deep appreciation of the importance of chemistry, work ethic, and character to execute our vision. We continue to add team members who have had success in their prior careers and who have been able to make immediate contributions to the company. 2015 was another successful year in strengthening our human capital.

I have always believed that bringing a function in-house produces a better result over time and can be justified economically when a sufficient scale is reached. Today, we have meaningful capabilities in-house to source talent, procure construction materials, arrange financing, create dynamic branding content, book travel, drive digital strategy and form strategic partnerships that have both saved the company significant amounts of money and created a differentiated advantage for us in completing our initiatives.

We also continue to groom and mentor young talent who will take on future leadership roles as we create a talent base for long term success.

Taxes

Since inception, as a result of the tax benefits we inherited, we have not had to pay any material taxes. We also do not expect to pay significant corporate income taxes for the next few years due to the $255 million of net operating loss carry-forwards and other deductions available to us, after taking into account the sale of the Seaport District Assemblage.

Our operating asset segment benefits from increasing recurring income which would in normal circumstances also result in higher taxes; but, because these assets are newly placed in service and are encumbered by mortgage debt, taxable income from these assets, after depreciation and interest expense deductions, is expected to be near zero for the next several years. We also hold non-core assets that, if sold, we estimate could provide more than an additional $340 million of tax deductions.

Even though we do not expect to be a payer of a material amount of corporate taxes for the next few years, we continually analyze other corporate structures that could be more tax efficient for our shareholders once we have fully utilized our tax attributes. Until that time, we believe that our current structure provides the most flexibility in which to operate the business.

Future Growth

As the company matures in the coming years, our organic growth will naturally transition HHC’s financial profile from cash flow primarily derived from MPC land development and sales, which can vary greatly based on local market conditions, to longer term, more predictable revenue from our developed commercial properties. This growing component of recurring and stable cash flow from our operating assets will, in turn, allow us to acquire or develop other MPCs and commercial properties at a consistent, thoughtful, and sustainable pace through market cycles.

Future opportunities where we can unlock value through our strengths in complex development and master planned communities will likely come from a mix of our existing pipeline and acquisitions. With over 40 million square feet of vertical development opportunities within our existing portfolio, we have the luxury of being patient in our search for the right acquisitions. If we do nothing other than accelerate the development of our existing entitlements into income-producing assets, we will materially grow the value of the company.

We continue to methodically seek out, identify and evaluate acquisition opportunities that we believe will generate additional value for our shareholders. Consistent with acquisitions we made in prior years, we expect that most of our future acquisitions will be sourced by our local management teams in our current markets. We know these markets well, and our leadership has relationships and information advantages in their respective local markets attributable to their long-term presence. Additionally, we are also focusing on other gateway cities in which we do not have a significant presence that exhibit favorable demographics and additional factors conducive to long-term appreciation in real estate values.

From the onset, we acknowledged that this is a complicated business to understand. We are a company that can be valued most easily by a “sum of the parts” analysis. The vast majority of our value lies in six assets, the master planned communities of Columbia, MD, The Woodlands and Bridgeland in Houston, and Summerlin in Nevada; the Seaport District in New York; and Ward Village in Honolulu. We hold many other assets that will generate additional value for the corporation through their sale or development, but to understand the majority of our potential, your time would be best served focusing on the “big six.”

Making Extraordinary

Howard Hughes’ passions as a titan of business spanned a wide range of industries from aviation to the silver screen. We were also fortunate to inherit the legacies of two other great pioneering entrepreneurs – George Mitchell and Jim Rouse. George Mitchell is widely regarded as the father of fracking and had the foresight in the 1960s to acquire tens of thousands of acres of land in Texas that would ultimately become the master planned community known as The Woodlands. Jim Rouse founded Columbia, and he is regarded as one of the visionary leaders of the master planned community business. We have been motivated and inspired by their larger-than-life accomplishments as we work purposefully to execute our plans, leaving our own mark on the next generation.

While uncertainty in the markets is the highest it has been since our emergence, history proves that we will likely look back on this time as one that led to great, new opportunities. During such volatile times, HHC excels. Like any team that welcomes future possibilities, we are prepared for the next stage in the company’s evolution as we further leverage our competitive advantages across our diverse portfolio to create extraordinary experiences for the tens of millions of people that touch our brand and visit our developments along with the hundreds of thousands that live in our communities. Thank you for staying the course and investing your capital with us.

In my first letter to shareholders five years ago, I explained that one of our core principles was to maximize the value of our high quality, irreplaceable real estate. We operate with a long-term mindset and are dedicated to working tirelessly to making extraordinary assets that we would want to own forever and are positioned to stand the test of time. We love real estate, but our brand is about so much more than bricks and mortar. We are about creating something great and transformational that will outlast us. Since our emergence as a public company, we have attracted leading talent and created a strong corporate foundation that has unlocked material value in our core assets, which positions us to create value well into the future on new opportunities. We continue to reinvent the Howard Hughes legacy for the 21st century.

Warm regards,

David

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

FORWARD-LOOKING STATEMENTS

Statements made in this letter that are not historical facts, including statements accompanied by words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” “project,” “realize,” “should,” “transform,” “would,” and other statements of similar expression and other words of similar expression, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. These statements are based on management’s expectations, estimates, assumptions and projections as of the date of this letter and are not guarantees of future performance. Actual results may differ materially from those expressed or implied in these statements. Factors that could cause actual results to differ materially are set forth as risk factors in our filings with the Securities and Exchange Commission, including its Quarterly and Annual Reports. We caution you not to place undue reliance on the forward-looking statements contained in this letter and do not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events, information or circumstances that arise after the date of this letter except as required by law.

NON-GAAP FINANCIAL MEASURES

The Company believes that net operating income, or NOI, a non-GAAP financial measure, is a useful supplemental measure of the performance of our Operating Assets because it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating real estate properties and the impact on operations from trends in occupancy rates, rental rates, and operating costs. We define NOI as revenues (rental income, tenant recoveries and other income) less expenses (real estate taxes, repairs and maintenance, marketing and other property expenses). NOI also excludes straight line rents and tenant incentives amortization, net interest expense, depreciation, ground rent, demolition costs, other amortization expenses, development-related marketing costs and equity in earnings from real estate and other affiliates.

We use NOI to evaluate our operating performance on a property-by-property basis because NOI allows us to evaluate the impact that factors such as lease structure, lease rates and tenant mix, which vary by property, have on our operating results, gross margins and investment returns.

Although we believe that NOI provides useful information to the investors about the performance of our Operating Assets due to the exclusions noted above, NOI should only be used as an alternative measure of the financial performance of such assets and not as an alternative to GAAP net income (loss).

No reconciliation of projected NOI is included in this letter because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts and we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

1 12% ownership through shares and warrants and an additional 12% economic interest through total return swaps.

2 NOI is a non-GAAP measure. For a reconciliation of NOI to the most directly comparable GAAP measure and for a discussion of why we present NOI, see the Supplemental Information section of our press release announcing our financial results for the fiscal year ended December 31, 2015 attached as Exhibit 99.1 to our Current Report on Form 8-K, filed February 29, 2016.

3 Bloomberg. Stock price as of March 15, 2016.