CARPINTERIA, Calif.--(BUSINESS WIRE)--American Express, Discover, MasterCard, and Visa brand consumer and commercial credit, debit, and prepaid cards issued in the U.S. generated $4.786 trillion in purchase volume in 2015, up 7.8% versus 2014. These statistics are published in the current issue of The Nilson Report newsletter, a leading publication covering the card and mobile payment industries.

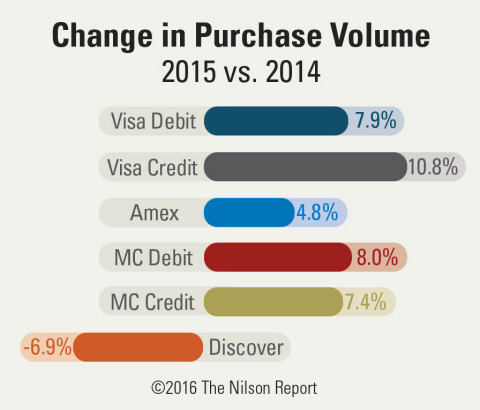

Visa brand debit cards generated $1.374 trillion in purchase volume last year, up 7.9% versus 2014. For the seventh year in a row, no other credit or debit card brand generated more spending at merchants.

Visa credit cards were the second most popular card type at merchants last year. Purchase volume was $1.344 trillion, up 10.8%.

David Robertson, publisher of The Nilson Report, said, “For the third year in a row, the percentage increase for purchase volume on Visa credit cards was better than any other credit or debit card type.”

Credit card purchase volume for American Express at $717.29 billion was up 4.8% in 2015 vs. an 8.1% increase in 2014. This included spending at merchants on cards issued by 10 network partners. American Express remains the second largest credit card brand in the U.S., a position it has held since 2011 when it moved past MasterCard.

Credit card purchase volume at MasterCard grew 7.4% to $652.75 billion in 2015, while purchase volume on its debit cards increased 8.0% to $580.14 billion.

Purchase volume on Discover cards reached $118.49 billion in 2015, a decline of 6.9%. This includes spending at merchants on cards issued by three network partners.

Visa credit cards in circulation increased by 22.3 million in 2015. MasterCard added 11.0 million credit cards. Amex added 2.7 million cards. Discover added 0.6 million cards.

American Express, Discover, MasterCard, and Visa credit card outstandings reached $800.87 billion in 2015, up $35.67 billion or 4.7%. Visa credit card outstandings grew the most, up $15.65 billion, compared to an increase of $14.17 billion for MasterCard, an increase of $4.08 billion for American Express, and an increase of $1.77 billion for Discover cards.

About The Nilson Report

The Nilson Report is the most relevant and respected source of news and analysis of the global card and mobile payment industries. The by-subscription-only newsletter provides issuer, acquirer, and vendor statistics not found in any other trade journal, as well as concise vendor, personnel, and product updates. The Nilson Report does not accept paid advertising of any kind. There are no advertisements, no articles written by vendors, no sponsored content — ever. Paid subscribers in 88 countries value The Nilson Report to track industry trends and provide market information. Contact Lori Fulmer at lfulmer@nilsonreport.com for a complete copy of U.S. General Purpose Cards 2015, which appears in the current issue of the newsletter.