JACKSONVILLE, Fla.--(BUSINESS WIRE)--Regency Centers Corporation (“Regency” or the “Company”) (NYSE:REG) today reported financial and operating results for the period ended December 31, 2015.

Financial Results

Regency reported Core Funds From Operations (“Core FFO”) for the fourth quarter of $76.0 million, or $0.79 per diluted share, compared to $66.0 million, or $0.71 per diluted share, for the same period in 2014. For the twelve months ended December 31, 2015 Core FFO was $288.9 million, or $3.04 per diluted share, compared to $261.5 million, or $2.82 per diluted share for the same period in 2014.

NAREIT Funds From Operations (“NAREIT FFO”) for the fourth quarter was $64.2 million, or $0.67 per diluted share, compared to $73.0 million, or $0.78 per diluted share, for the same period in 2014. For the twelve months ended December 31, 2015 NAREIT FFO was $276.5 million, or $2.91 per diluted share, compared to $269.1 million or $2.90 per diluted share for the same period in 2014.

The Company reported net income attributable to common stockholders (“Net Income”) for the fourth quarter of $17.6 million, or $0.18 per diluted share, compared to Net Income of $73.5 million, or $0.79 per diluted share, for the same period in 2014. For the twelve months ended December 31, 2015 Net Income was $129.0 million, or $1.36 per diluted share, compared to $166.3 million, or $1.80 per diluted share for the same period in 2014.

Operating Results

For the period ended December 31, 2015, Regency’s results for wholly-owned properties plus its pro-rata share of co-investment partnerships were as follows:

|

Q4 2015 |

YTD |

||||||||

| Percent leased, same properties | 95.8% (flat YoY) | ||||||||

| Percent leased, all properties | 95.6% (+20 bps YoY) | ||||||||

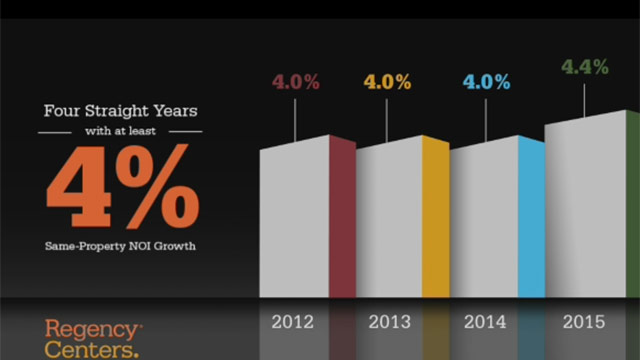

| Same property NOI growth without termination fees | 4.2% | 4.4% | |||||||

| Same property NOI growth without termination fees or redevelopments | 2.4% | 3.2% | |||||||

| Rental rate growth(1) | |||||||||

| New leases | 13.1% | 14.4% | |||||||

| Renewal leases | 11.5% | 8.5% | |||||||

| Blended average | 11.9% | 9.6% | |||||||

| Leasing transactions | |||||||||

| Number of new and renewal leasing transactions | 386 | 1,458 | |||||||

| Total square feet leased (000s)(2) | 1,398 | 4,799 | |||||||

(1) Operating properties only. Rent growth is calculated on a comparable-space, cash basis.

(2) Co-investment partnerships at 100%

Portfolio Activity

Property Transactions

During the quarter, Regency sold one wholly-owned property and one co-investment property for a combined gross sales price of $17.4 million. Regency’s share of these dispositions was $10.0 million. During 2015, the Company sold seven properties for a combined gross sales price of $146.1 million. Regency’s share of these dispositions was $120.0 million.

Developments and Redevelopments

During the quarter, Regency started the development of two projects totaling $45.9 million in net development costs. The first, CityLine Market Phase II, will increase the footprint of the center by 22,000 square feet and will feature a CVS with 9,000 square feet of retail shop space. Phase I of this project, although still under construction, is already 98% leased including Whole Foods Market and a mix of best-in-class national and regional retailers. The second development start, Northgate Marketplace Phase II, will complement the 100% leased Northgate Marketplace, which was originally developed by Regency. The new phase will add 180,000 square feet of retail space anchored by HomeGoods and Dick’s Sporting Goods. Phase I of Northgate Marketplace, which stabilized in 2013, is anchored by Trader Joe’s, Ulta, and REI.

At year end, the Company had twenty projects in development or redevelopment with combined, estimated costs of $245.7 million. In-process developments were a combined 65% funded and 83% leased and committed, including retailer-owned square footage.

Balance Sheet

During the fourth quarter, Regency settled its forward sale agreements, dated January 14, 2015 and January 15, 2015, in connection with its common stock offering that closed on January 21, 2015. Upon settlement of the forward sale agreements Regency received approximately $186.0 million of net proceeds after adjustments for interest, dividends and the underwriters’ discount but before deducting offering expenses. Also during the quarter, the Company accessed its at-the-market common equity program, generating net proceeds of $24.0 million (together the “Proceeds”).

The Company used a portion of the Proceeds to fund investment activities, including the previously disclosed acquisition of University Commons, as well as to fund ongoing development and redevelopment costs. Regency also used a portion of the Proceeds to redeem $100 million of the $400 million outstanding 5.875% Senior Unsecured Notes due 2017. The redemption price, determined by the applicable indenture, was $110.7 million including accrued and unpaid interest. Excluding accrued and unpaid interest, the redemption price was approximately 108.1% of the principal amount redeemed, which resulted in a make-whole premium of approximately $8.1 million.

Dividend

On February 8, 2016, Regency’s Board of Directors declared a quarterly cash dividend on the Company’s common stock of $0.50 per share, which represents an increase of 3.1%. The dividend is payable on March 3, 2016 to shareholders of record as of February 22, 2016.

Conference Call Information

In conjunction with Regency’s fourth quarter results, the Company will host a conference call on Thursday, February 11, 2016 at 10:00 a.m. ET. Dial-in and webcast information is listed below.

|

Fourth Quarter Conference Call |

|||||

| Date: | Thursday, February 11, 2016 | ||||

| Time: | 10:00 a.m. ET | ||||

| Dial#: | 877-407-0789 or 201-689-8562 | ||||

| Webcast: | |||||

Replay

Webcast Archive: Investor Relations page under Webcasts & Presentations

Non-GAAP Disclosure

NAREIT FFO is a commonly used measure of REIT performance, which the National Association of Real Estate Investment Trusts (“NAREIT”) defines as net income, computed in accordance with GAAP, excluding gains and losses from dispositions of depreciable property, net of tax, excluding operating real estate impairments, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Regency computes NAREIT FFO for all periods presented in accordance with NAREIT's definition. Many companies use different depreciable lives and methods, and real estate values historically fluctuate with market conditions. Since NAREIT FFO excludes depreciation and amortization and gains and losses from depreciable property dispositions, and impairments, it can provide a performance measure that, when compared year over year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, acquisition and development activities, and financing costs. This provides a perspective of the Company’s financial performance not immediately apparent from net income determined in accordance with GAAP. Thus, NAREIT FFO is a supplemental non-GAAP financial measure of the Company's operating performance, which does not represent cash generated from operating activities in accordance with GAAP and therefore, should not be considered an alternative for net income or as a measure of liquidity. Core FFO is an additional performance measure used by Regency as the computation of NAREIT FFO includes certain non-cash and non-comparable items that affect the Company's period-over-period performance. Core FFO excludes from NAREIT FFO, but is not limited to: (a) transaction related gains, income or expense; (b) impairments on land; (c) gains or losses from the early extinguishment of debt; and (d) other non-core amounts as they occur. The Company provides a reconciliation of NAREIT FFO to Core FFO.

Reconciliation of Net Income Attributable to Common Stockholders to NAREIT FFO and Core FFO — Actual (in thousands)

| For the Periods Ended December 31, 2015 and 2014 |

Three Months Ended |

Year to Date |

|||||||||||||

|

2015 |

2014 |

2015 |

2014 |

||||||||||||

| Net Income Attributable to Common Stockholders | $ | 17,608 | $ | 73,514 | $ | 128,994 | 166,328 | ||||||||

| Adjustments to reconcile to Funds From Operations: | |||||||||||||||

| Depreciation and amortization (1) | 46,115 | 46,123 | 182,103 | 184,750 | |||||||||||

| Provision for impairment (2) | 1,820 | 557 | 1,820 | 983 | |||||||||||

| Gain on sale of operating properties (2) | (1,361 | ) | (29,053 | ) | (36,642 | ) | (64,960 | ) | |||||||

| Gain on remeasurement of investment in real estate partnership | - | (18,271 | ) | - | (18,271 | ) | |||||||||

| Exchangeable operating partnership units | 36 | 134 | 240 | 319 | |||||||||||

| NAREIT Funds From Operations | $ | 64,218 | 73,004 | $ | 276,515 | 269,149 | |||||||||

| NAREIT Funds From Operations | $ | 64,218 | 73,004 | $ | 276,515 | 269,149 | |||||||||

| Adjustments to reconcile to Core Funds From Operations: | |||||||||||||||

| Development and acquisition pursuit costs (2) | 1,305 | 486 | 2,409 | 2,598 | |||||||||||

| Income tax benefit | - | (996 | ) | - | (996 | ) | |||||||||

| Gain on sale of land (2) | (40 | ) | (385 | ) | (73 | ) | (3,731 | ) | |||||||

| Provision for impairment to land | - | 474 | - | 699 | |||||||||||

| Hedge ineffectiveness (2) | (1 | ) | 30 | 5 | 30 | ||||||||||

| Early extinguishment of debt (2) | 8,298 | 10 | 8,239 | 51 | |||||||||||

| Change in executive management included in gross G&A | 2,193 | - | 2,193 | - | |||||||||||

| Gain on sale of AmREIT stock, net of costs | - | (6,610 | ) | - | (5,960 | ) | |||||||||

| Gain on sale of investments | - | - | (416 | ) | (334 | ) | |||||||||

| Core Funds From Operations | 75,973 | 66,013 | 288,872 | 261,506 | |||||||||||

| Weighted Average Shares For Diluted FFO per Share | 96,013 | 93,456 | 95,011 | 92,562 | |||||||||||

| (1) Includes pro-rata share of unconsolidated co-investment partnerships, net of pro-rata share attributable to noncontrolling interests | |||||||||||||||

| (2) Includes pro-rata share of unconsolidated co-investment partnerships | |||||||||||||||

Same property NOI is a key measure used by management in evaluating the operating performance of Regency’s properties. The Company provides a reconciliation of income from operations to pro-rata same property NOI in its supplemental information package.

Reported results are preliminary and not final until the filing of the Company’s Form 10-K with the SEC and, therefore, remain subject to adjustment.

Reconciliation of Net Income Attributable to Common Stockholders to NAREIT FFO and Core FFO — Guidance

| Full Year | ||||||||

| NAREIT FFO and Core FFO Guidance: | 2016 | |||||||

| Net income attributable to common stockholders | $ | 1.25 | 1.31 | |||||

| Adjustments to reconcile net income to NAREIT FFO: | ||||||||

| Depreciation and amortization | 1.93 | 1.93 | ||||||

| NAREIT Funds From Operations | $ | 3.18 | 3.24 | |||||

| Adjustments to reconcile NAREIT FFO to Core FFO: | ||||||||

| Development and acquisition pursuit costs | 0.02 | 0.02 | ||||||

| Core Funds From Operations | $ | 3.20 | 3.26 | |||||

The Company has published forward-looking statements and additional financial information in its fourth quarter 2015 supplemental information package that may help investors estimate earnings for 2015. A copy of the Company’s fourth quarter 2015 supplemental information will be available on the Company's website at www.RegencyCenters.com or by written request to: Investor Relations, Regency Centers Corporation, One Independent Drive, Suite 114, Jacksonville, Florida, 32202. The supplemental information package contains more detailed financial and property results including financial statements, an outstanding debt summary, acquisition and development activity, investments in partnerships, information pertaining to securities issued other than common stock, property details, a significant tenant rent report and a lease expiration table in addition to earnings and valuation guidance assumptions. The information provided in the supplemental package is unaudited and there can be no assurance that the information will not vary from the final information in the Company’s Form 10-K for the year ended December 31, 2015. Regency may, but assumes no obligation to, update information in the supplemental package from time to time.

About Regency Centers Corporation (NYSE: REG)

With more than 50 years of experience, Regency is the preeminent national owner, operator and developer of high-quality, grocery-anchored neighborhood and community shopping centers. The Company’s portfolio of 318 retail properties encompasses over 42.8 million square feet located in top markets throughout the United States, including co-investment partnerships. Regency has developed 221 shopping centers since 2000, representing an investment at completion of more than $3 billion. Operating as a fully integrated real estate company, Regency is a qualified real estate investment trust that is self-administered and self-managed.

Forward-looking statements involve risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements. Please refer to the documents filed by Regency Centers Corporation with the SEC, specifically the most recent reports on Forms 10-K and 10-Q, which identify important risk factors which could cause actual results to differ from those contained in the forward-looking statements.