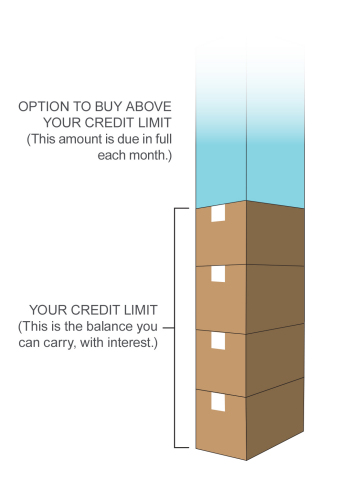

NEW YORK--(BUSINESS WIRE)--American Express OPEN today announced the launch of the no annual feei SimplyCash® Plus Business Credit Card, which for the first time offers small businesses greater buying power traditionally found on a charge cardii, while also providing more opportunities to earn cash back from a larger list of business expense categories. Leveraging expanded buying power, SimplyCash Plus Card Members can spend beyond their credit limit in order to help pay for larger purchases, like inventory and equipment, all while continuing to earn valuable cash back. The amount spent above the credit limit is due in full each month as part of the minimum payment due. Card Members can continue to carry a balance with interest on the amount spent within their credit limit.

The SimplyCash Plus Card helps solve a critical issue for small businesses who sometimes need greater buying power in order to quickly pursue opportunities for growth, while continuing to earn cash back on all of their business expenses, big and small. According to an American Express OPEN survey of 1,001 small business ownersiii, while 71% of respondents said a credit/charge card is an important tool to help fund and grow their business, 76% of those who use them for business expenses said it would be beneficial for their business to receive an increase in their credit cards’ spending limit at least once a year. Small businesses can quickly and easily use the expanded buying power on the SimplyCash Plus Card without any additional applications or over limit fees. While the amount the small business can spend beyond their credit limit varies based on a number of factors unique to each Card Member, if a Card Member is ever unsure whether they can use their expanded buying power to pay for a particular purchase, they can consult the Check Spend Ability feature in their online account or call the number on the back of their Card.

The same American Express OPEN survey also found that 78% of small business owners see credit card rewards as important to their business. Within different types of rewards, 74% say that cash back would benefit their business the most. In addition to offering 5% cash back on purchases made from U.S. office supply stores and U.S. wireless service providers, the SimplyCash Plus Business Credit Card offers an enhanced cash back program that lets small businesses choose their 3% bonus reward category from an expanded list of business expense categories and enables them to get valuable cash back as they spend, even from purchases made above the credit limit.iv

“We consistently hear that one of small businesses’ largest challenges is managing cash flow. The SimplyCash Plus Card combines our charge and lending capabilities to provide a product that offers greater buying power to help with the ebb and flow of a small business, as well as more opportunities to earn valuable cash back even on larger business expenses,” said Audrey Hendley, Senior Vice President and General Manager of American Express OPEN Products. “This Card empowers small businesses to quickly and seamlessly seize and fund opportunities for growth.”

The SimplyCash Plus Card offers an enhanced cash back rewards program that includes:

- 5% cash back on purchases made in the following categories combined: U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers (on up to $50,000 in purchases per year, then 1% on purchases made thereafter)

-

3% cash back on a category of choice from a list of eight categories

including:

- U.S. gas stations

- U.S. restaurants

- U.S. purchases for advertising in select media

- U.S. purchases for shipping

- Airfare purchased directly from airlines

- Hotel rooms purchased directly from hotels

- Car rentals purchased from select car rental companies

- *New: U.S. computer hardware, software, and cloud computing purchases made directly from select providers

- (on up to $50,000 in purchases per year, then 1% on purchases made thereafter)

- 1% cash back on other purchases. There is no limit to the cash back that can be earned at 1%.

The SimplyCash Plus Business Credit Card is currently being offered to select small business owners and will be available for all eligible small businesses in Spring 2016.

About American Express OPEN

American Express OPEN is a leading payment card issuer for small businesses in the United States and supports business owners and entrepreneurs with products and services to help them run and grow their businesses. This includes business charge and credit cards that deliver purchasing power, flexibility, rewards, savings on business services from an expanded lineup of partners and online tools and services designed to help improve profitability. Learn more at www.OPEN.com and connect with us at openforum.com and twitter.com/openforum.

About American Express

American Express (NYSE:AXP) is a global services company, providing customers with access to products, insights and experiences that enrich lives and build business success. Learn more at americanexpress.com and connect with us on facebook.com/americanexpress, foursquare.com/americanexpress, linkedin.com/company/american-express, twitter.com/americanexpress, and youtube.com/americanexpress.

Key links to products, services and corporate responsibility information: charge and credit cards, business credit cards, Plenti rewards program, travel services, gift cards, prepaid cards, merchant services, corporate card, business travel and corporate responsibility.

i Annual Fee: There is no annual fee for the

SimplyCash® Plus Business Credit Card APRs: 0% intro APR on

purchases for the first 9 months of Card Membership. After that, the APR

will be a variable rate, currently 12.49%, 17.49%, or 19.49%, based on

your creditworthiness as determined at the time of account opening. The

Penalty APR is also a variable rate based on the Prime Rate, currently

29.49%. Variable rates are accurate as of 1/15/2016. Foreign

Transaction Fee: 2.7% of each transaction after conversion to US

dollars.

ii The amount you can spend above your

credit limit is not unlimited. It adjusts with your use of the Card,

your payment history, credit record, financial resources known to us,

and other factors.

iii Survey based on a random

online sample of 1,001 U.S. small business owners/managers of companies

with $250,000 or more in revenues and fewer than 100 employees. The

anonymous survey was conducted by Ebiquity on behalf of American Express

OPEN from December 9-18, 2015. The poll has a margin of error of +/-

3.1% at the 95% level of confidence.

iv There is no

limit to the cash back that can be earned at 1%. Cash back is received

in the form of an automatic statement credit.