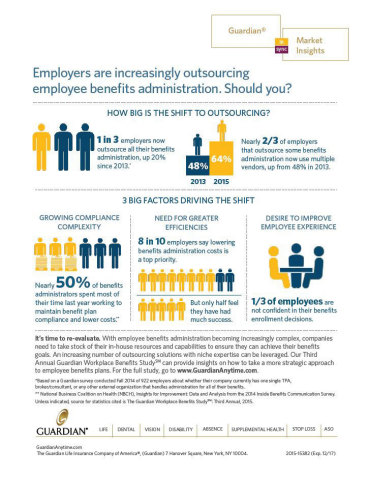

NEW YORK--(BUSINESS WIRE)--The Guardian Life Insurance Company of America® (Guardian), one of the nation’s largest mutual life insurers and a leading provider of employee benefits, today announced new findings from the third annual Guardian Workplace Benefits StudySM that outlines how one in three employers now outsource all of their benefits administration, up 20 percent since 2013. Employers are also using more vendors for support: nearly two-thirds that outsource at least some benefits administration are using multiple vendors, up from 48 percent in 2013. As employers of all sizes realize the need to improve efficiency; keep compliant with requirements of the ACA, FMLA and ADA; and improve employees’ benefits enrollment experience, they will need to rely more heavily on external expertise to meet their goals.

The study signals future growth in outsourcing management of employee absences as employers emphasize the need to increase employee productivity, adhere to FMLA, ADA, and ADAA requirements, expand wellness initiatives, and provide more assistance for employees returning to work following a disability. As of now, only half believe their company is very effective in tracking and managing employee leave, including FMLA, disability and other paid-time off. Companies with 100 or more employees who more commonly outsource leave management are also more likely to report they are effectively tracking leaves compared to smaller companies.

Nearly two-thirds of employers report outsourcing aspects of their enrollment process, with the most popular activities related to tasks including preparing enrollment materials (49 percent) and presenting at enrollment meetings (48 percent). Unfortunately, less are inclined (31 percent) to outsource the development of their overall enrollment strategy. Having a decentralized approach lessens the effectiveness around enrollment activities. It will best suit employers to outsource enrollment strategies to integrate services which support employee decision-making.

“As emerging technology and specialized expertise increasingly become available in the market, employers and HR decision makers should embrace these offerings for advantages that go beyond addressing administration complexities,” says Ray Marra, Senior Vice President, Group Products at Guardian. “Our study shows utilizing outside expertise can offer opportunities for companies to transform their benefits package and offer a broader range of employee benefits and related services.”

For more information about Guardian’s Workplace Benefits or to obtain a copy of The Guardian Workplace Benefits Study SM: Third Annual, please visit https://www.guardiananytime.com/2015-workplace-benefits-study or Guardian Anytime. An infographic outlining why employers are increasingly outsourcing employee benefits administration can be found here: https://www.guardiananytime.com/gafd/wps/portal/fdhome/employers/ideas-and-insights/workplace-benefits-studies/outsourcing-employee-benefits-administration

About the Survey

The Guardian Life Insurance Company of America® (Guardian) conducted the Guardian Workplace Benefits Study to showcase how the workplace remains a foundation of financial security for many American households, and how employees rely on benefits for overall feelings of financial preparedness.

This study presents findings from two online surveys conducted in the fall of 2014 among benefits decision-makers (“Employers”) and another among 1,706 benefits plan participants (“Employees”), age 22 or older, who work full time for a U.S. company with at least five employees.

About Guardian

The Guardian Life Insurance Company of America® (Guardian) is one of the largest mutual life insurers, with $6.8 billion in capital and $1.3 billion in operating income in 2014. Founded in 1860, the company has paid dividends to policyholders every year since 1868. Its offerings range from life insurance, disability income insurance, annuities, and investments for individuals to workplace benefits, such as dental, vision, and 401(k) plans. The company has approximately 6,000 employees and a network of over 3,000 financial representatives in more than 70 agencies nationwide. For more information about Guardian, please visit www.GuardianLife.com.

Financial information concerning The Guardian Life Insurance Company of America, as of December 31, 2014, on a statutory basis: Admitted Assets = $45.3 Billion; Liabilities = $39.6 Billion (including $34.9 Billion of Reserves); and Surplus =$5.7 Billion. Dividends are not guaranteed. They are declared annually by Guardian’s Board of Directors.

2016-16639