NEWARK, N.J.--(BUSINESS WIRE)--Growing numbers of plan sponsors and intermediaries may be open to embracing stable value in the coming years, according to a new white paper released today by Prudential Retirement, a business unit of Prudential Financial, Inc. (NYSE: PRU). Favorable perceptions of stable value among plan sponsors and intermediaries coupled with the changing regulatory environment for money market funds could boost demand for stable value funds.

The white paper, “Expanding the Case for Stable Value,” is based on the survey of 400 plan sponsors and 300 intermediaries, which identified the factors that motivated them to adopt stable value and recommend the asset class to others. Plan sponsors and intermediaries that had not yet embraced stable value were also asked to identify the barriers to adoption. The survey revealed a number of key findings:

- the top two reasons for stable value adoption were capital preservation and steady returns

- 54 percent of plan sponsors and 75 percent of intermediaries cited capital preservation as their main reason for adoption

- 54 percent of plan sponsors and 70 percent of intermediaries cited steady returns as a deciding factor in adoption

- stable value recommendations were primarily based on three factors: 1) the returns the asset class delivered versus other fixed-income investments 2) their role in boosting plan participation and deferral rates, and, 3) for the intermediaries, their liquidity for participants.

- non-adoption of stable value stemmed mainly from three factors: 1) perceptions about cost 2) their performance relative to equities and other non-fixed income asset classes, and 3) the notion that they may be difficult for plan participants to understand

- 53 percent of plan sponsors and 69 percent of intermediaries saw the cost of stable value funds as a challenge.

The white paper also points out that another reason for non-adoption might be that stable value is less well known than other investment options, including money market funds and mutual funds---and familiarity is a key driver of acceptance for most investment products in the marketplace.

“Over the past 40 years, stable value funds have performed remarkably well, even through economic downturns, like the financial crisis in 2008,” says Gary Ward, head of Stable Value at Prudential. “Yet, the number of DC plans offering stable value funds remains at less than 50 percent, leaving significant numbers of plan participants without access to the asset class. Through this new research, we were able to uncover what motivates decision-makers to adopt and recommend stable value and why some aren’t taking advantage of it. By educating plan sponsors and intermediaries about the advantages of stable value and better understanding the preconceived notions that exist about the asset class, the industry can help propel greater adoption in the future.”

Greater use of stable value in the future is inevitable due to a number of factors, according to the white paper. First, plan sponsor and intermediary attitudes toward broader use of the asset class are favorable. Among plan sponsors, 55 percent of non-adopters plan to offer stable value in the future, while only 9 percent of adopters are at risk of getting rid of it. For intermediaries, 30 percent of those who recommend stable value to clients are doing so more often today than they did a year ago, and 35 percent expect this trend to accelerate over the next three years.

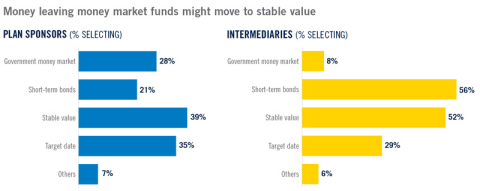

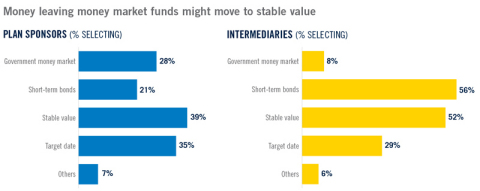

Another factor is the changing regulatory environment for money market funds. Beginning in October 2016, the U.S. Securities and Exchange Commission will allow money market funds to impose redemption fees, or temporarily halt redemptions, when the funds fall below certain liquidity thresholds, which could spur more interest in stable value funds as an alternative. Sixty-three percent of sponsors that currently offer money market funds and 49 percent of intermediaries who currently recommend them say the SEC ruling is likely to drive changes in their allocation to money market funds.

In addition, 39 percent of plan sponsors who moved money out of a money market fund in the past year or plan to do so in the next three years, switched some of it to stable value funds or plan to do so. Other factors that will drive demand for stable value in the future include its potential to be added to target-date funds, which 74 percent of plan sponsors who offer TDFs said they would do.

“There are tremendous growth opportunities for stable value in defined contribution plans, especially if incorporated more broadly into target date funds, which could not only provide a positive absolute return component to the fund, but also improve participant engagement,” Ward explains. “In the coming years, there is also potential for the stable value market to expand internationally. Overall, our research proves that expanding the use of stable value isn’t just desirable, it’s also doable.”

Prudential Retirement delivers retirement plan solutions for public, private, and nonprofit organizations. Services include defined contribution, defined benefit and non-qualified deferred compensation record keeping, administrative services, investment management, comprehensive employee education and communications, and trustee services, as well as a variety of products and strategies, including institutional investment and income products, pension risk transfer solutions and structured settlement services.

With over 85 years of retirement experience, Prudential Retirement helps meet the needs of 4.0 million participants and annuitants. Prudential Retirement has $366.2 billion in retirement account values as of Sept. 30, 2015.

Retirement products and services are provided by Prudential Retirement Insurance and Annuity Company (PRIAC), Hartford, CT, or its affiliates. PRIAC is a Prudential Financial company.

Prudential Financial, Inc. (NYSE:PRU), a financial services leader, has operations in the United States, Asia, Europe, and Latin America.

0286898-00001-00