PRINCETON, N.J.--(BUSINESS WIRE)--Industry-wide losses from natural catastrophes in 2015 were lower than the previous year, due in part to El Niño climate conditions in the Pacific ocean which reduced hurricane activity in the North Atlantic. The costliest global natural catastrophe for the insurance industry was the series of winter storms that struck the northeast United States and Canada.

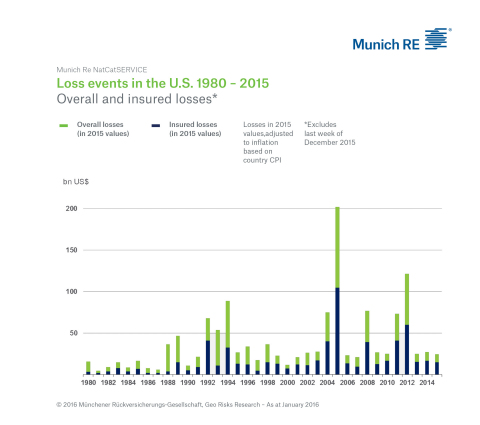

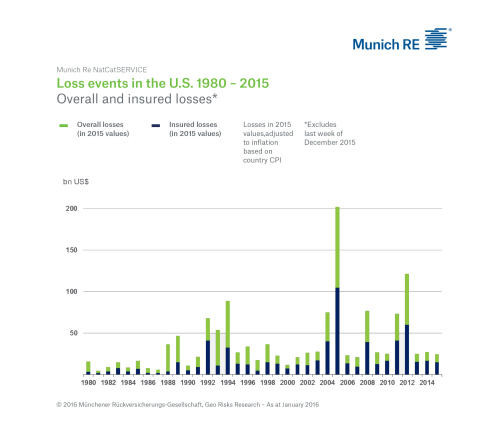

In the US, 2015 estimated natural catastrophe losses totalled US$ 25bn (previous year US$ 28bn), of which roughly US$ 15bn (previous year US$ 17bn) was insured. 2015 estimates exclude loss events that occurred during the last week of December (which are still being assessed).

“In terms of financial losses, the industry was somewhat fortunate in 2015,” said Tony Kuczinski, President and CEO, Munich Reinsurance America, Inc. “However, the comparatively low losses are no reason for complacency. Near misses and time between significant events tend to decrease perception of risk. We must continue to focus on creating resiliency and saving lives through stronger building codes, better land use and protective infrastructure.”

Natural catastrophes claimed 280 lives in the US in 2015 (previous year 270), below the annual average for the last 30 years (580).

Peter Hoeppe, Head of Munich Re's Geo Risks Research Unit said, “In 2015, strong tropical cyclones primarily hit sparsely populated areas or did not make landfall at all. In the North Atlantic, wind shear from the El Niño event helped to curtail the development of tropical cyclones, while measures to reduce loss susceptibility may have also had a positive effect. However, scientists believe that in the coming year the strong El Niño phase might be followed by a La Niña event. Both versions of the climate oscillation ENSO (El Niño Southern Oscillation) in the Pacific, influence weather extremes throughout the world. A La Niña phase would promote the development of hurricanes in the North Atlantic, for example.”

The costliest natural catastrophe for the insurance industry in 2015 was a series of winter storms that struck the northeast United States and Canada. Insured losses came to US$ 2.1bn; overall losses were US$ 2.8bn. As in 2014, the winter of 2015 was unusually cold and snowy in the northeast US. In Boston, a record 90-inches of snow fell over a three week period, resulting in extraordinary snow loads that damaged thousands of buildings.

“North America is hit by dozens of winter storms annually, which cause a variety of hazards such as snow and sleet,” said Mark Bove, Senior Research Meteorologist, Munich Reinsurance America, Inc. “But despite the frequency and size of winter storms, they do not usually have the same loss potential as tropical cyclones or earthquakes. Nevertheless, a large number of winter storms in rapid succession can lead to significant aggregate losses.”

There were direct overall losses of US$ 4.6bn in the US from the harsh winter of 2014/15, of which US$ 3.4bn was insured. Losses were even higher than in the frigid winter of 2013/14 (US$ 4.4bn, insured losses US$ 2.5bn).

Two tornado outbreaks in late December 2015 across the southern US brought an unfortunately destructive and deadly end to what had been a relatively quiet year for severe thunderstorms in the US. The December outbreaks included two EF4 tornadoes with wind speeds up to 200 mph. The first devastated several small towns in northern Mississippi and southern Tennessee, while the second carved a path through a densely populated suburb of Dallas, Texas. Both tornadoes took the lives of at least 10 people each; only ten tornado fatalities had been recorded nationally in 2015 before these events.

Earlier in 2015, two severe thunderstorm outbreaks each produced billion-dollar insured losses, though overall, the spring thunderstorm season in the US was quieter than usual. Less than 1,200 tornadoes were recorded in the US in 2015; the average figure is 1,360. The relatively inactive storm season still produced insured losses in excess of US$ 9.4bn (excluding industry-wide loss estimates from the late December storms which are not yet available). The current El Niño likely impacted conditions that led to a quieter overall thunderstorm season, as well as the late December storms that occurred close to the Gulf of Mexico coastline.

Drought conditions in California deteriorated further in 2015, following yet another winter without significant rainfall. Forests and brush land turned into tinder boxes, which fuelled numerous wildfires across the state, including two that caused significant property losses in northern California. The Valley Fire ignited near the Napa Valley winemaking region and the Butte Fire in the foothills of the Sierra Nevada destroyed thousands of structures. These two fires together caused losses totalling US$ 1.6bn, US$ 1.2bn of which was insured. They were the costliest wildfires in California since the 2007 Witch Creek Fire in San Diego, and the costliest in northern California since the 1991 Oakland firestorm.

2015 Global Natural Catastrophes

Worldwide, 94% of loss-relevant natural catastrophes in 2015 were weather-related events. Particularly evident was the influence of ENSO in the equatorial Pacific. Due to the strong El Niño phase, the number of 11 tropical cyclones in the North Atlantic was below the basin average since 1995 (14.8). Of these cyclones, only four reached hurricane strength (average 7.6). Overall losses and insured losses came to just a fraction of the averages for previous years.

On the other hand, El Niño promoted the development of intense tropical cyclones in the northeast Pacific, partly due to the higher water temperatures it brings. A total of 26 cyclones (long-term average 15.6) developed there, 16 of which reached hurricane strength. Eleven (long-term average 4.1) grew to major hurricanes.

Although most storms in the northeast Pacific do not make landfall, one storm in 2015 did, and was particularly noteworthy: Hurricane Patricia became one of the strongest tropical cyclones on record globally and the most powerful in the northeast Pacific to make landfall. With sustained wind speeds of up to 200 mph, Patricia came ashore in late October close to Cuixmala in the Mexican state of Jalisco. Fortunately, this region contains the Chamela-Cuixmala Biosphere Reserve and is therefore sparsely populated. The storm was also relatively small in size and did not cause the level of damage that many less powerful but larger storms usually do.

Overall losses from Hurricane Patricia are estimated at US$ 500m, of which only a fraction was insured. Had the storm reached the nearby holiday resort of Puerto Vallarta, the damage and losses would have been much greater. “Besides this fortuitous set of circumstances, timely precautions and early warnings helped bring people to safety and prevented losses. One such measure was the prompt evacuation of affected areas ordered by the government,” explained Hoeppe.

The El Niño phase had a considerable effect on droughts and heatwaves, especially in South America, Africa and Southeast Asia. Overall losses worldwide from such events last year came to US$ 12bn, of which US$ 880m was insured. However, the highest losses from heatwave and drought – albeit not influenced by El Niño – were caused by the hot, dry summer in Europe. The overall loss totalled some US$ 2bn (€1.9bn); only about a tenth of this was insured.

2015 global natural catastrophes at a glance

- 2015 saw the lowest losses of any year since 2009. Overall losses totalled US$ 90bn (previous year US$ 110bn), of which roughly US$ 27bn (previous year US$ 31bn) was insured.

- 2015 natural catastrophes claimed 23,000 lives, substantially more than the previous year’s figure of 7,700, but below the annual average for the last 30 years (54,000).

- For the first time, more than a thousand loss events were recorded in a single year. However, this is likely due to improved communication of such events. In particularly benign years, many minor events are also recorded.

- The year’s most devastating natural catastrophe was the earthquake in Nepal, which occurred on April 25, northwest of the capital Kathmandu, and reached a magnitude of 7.8. As is often the case in developing countries, only a fraction of the US$ 4.8bn in overall losses caused by the earthquake and the aftershocks was insured (US$ 210m).

Please click here for more information.

Munich Re stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. This is how Munich Re creates value for clients, shareholders and staff. In the financial year 2014, the Group – which combines primary insurance and reinsurance under one roof – achieved a profit of €3.2bn on premium income of over €48bn. It operates in all lines of insurance, with over 43,000 employees throughout the world. With premium income of around €27bn from reinsurance alone, it is one of the world’s leading reinsurers. Especially when clients require solutions for complex risks, Munich Re is a much sought-after risk carrier. Its primary insurance operations are concentrated mainly in the ERGO Insurance Group, one of the leading insurance groups in Germany and Europe. ERGO is represented in over 30 countries worldwide and offers a comprehensive range of insurances, provision products and services. In 2014, ERGO posted premium income of €18bn. In international healthcare business, Munich Re pools its insurance and reinsurance operations, as well as related services, under the Munich Health brand. Munich Re’s global investments amounting to €227bn are managed by MEAG, which also makes its competence available to private and institutional investors outside the Group.

Disclaimer

This press release contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of our Company. The Company assumes no liability to update these forward-looking statements or to conform them to future events or developments.