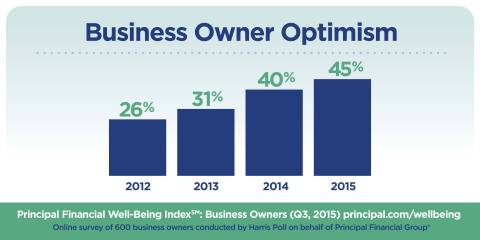

DES MOINES, Iowa--(BUSINESS WIRE)--As election season fast approaches, American business owners with 10 to 500 employees are feeling more confident about the current and future state of the economy, according to new research from The Principal Financial Well-Being IndexSM: Business Owners. This year, 45 percent of small business owners are optimistic about the economy, up from 26 percent in 2012.

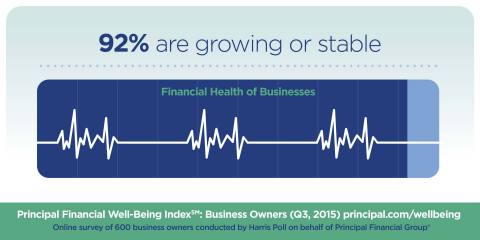

A staggering 92 percent of business owners rate the financial health of their business as growing or stable. Two-thirds added staff and roughly as many feel their financials have improved in the past year.

Small businesses are often regarded as the backbone of the U.S. economy, and are drivers of America’s well-being. They employ half of U.S. workers, represent 99.7 percent of all employers, and have generated 63 percent of new private-sector jobs (net) between 1993 and mid-2013. They also produce 16 times more patents per employee than large patenting firms1.

Small business owners not only believe in the current success of their businesses, but believe the economic climate will hold and allow for prosperity in the next year. Sixty-six percent believe their business financials will improve in the next 12 months, up from 55 percent in 2014. Forty-two percent plan to add staff in the next 12 months, 32 percent plan to add benefits and another one-third plan to increase wages.

However, of the 74 percent of business owners that report having surplus capital, more than three-quarters (77 percent) are not spending it. They most commonly cite saving for future growth, economic uncertainty and lessons from the economic crisis as their primary reason for not spending surplus capital.

“We are seeing a clear rise in financial confidence from small business owners,” said Amy Friedrich, senior vice president at the Principal Financial Group®. “When business owners are adding jobs, increasing wages and adding benefits, we know they’re feeling good about their business, which bodes well for economic growth.”

Business owners and the election

Of the financial issues

that will have the greatest impact on business owners’ voting decisions,

the state of the economy, Affordable Care Act, economic growth, health

care costs and minimum wage ranked the highest.

As the percentage of Millennial business owners continues to grow faster than Baby Boomers and Gen X, there may be a shift in political party affiliation, and how they view economic policy issues overall. Currently, the split among Republican, Democrat and Independent business owners is relatively even at 34 percent, 26 percent and 36 percent, respectively. Though 34 percent of business owners consider themselves Republican, Baby Boomers are significantly more likely (48 percent) to identify as a Republican than Millennials (28 percent) or Gen Xers (23 percent).

The Principal Financial Well-Being Index: Business Owners surveyed 600 business owners nationwide who own at least 5 percent of a company in the United States with 10 to 500 employees, and are actively involved in company management. The Index is part of a series of quarterly studies commissioned by The Principal Knowledge Center examining the financial well-being of American workers and business owners, as well as advisor opinions and practice management. The survey was conducted online by Harris Poll® from July 29 – August 26, 2015.

For more research, analysis and insights from The Principal, visit The Principal Knowledge Center and connect with us on Twitter.

About the Principal Financial Group

The Principal Financial

Group® (The Principal®)2 is a global

investment management leader offering retirement services, insurance

solutions and asset management. The Principal offers businesses,

individuals and institutional clients a wide range of financial products

and services, including retirement, asset management and insurance

through its diverse family of financial services companies. Founded in

1879 and a member of the FORTUNE 500®, the Principal

Financial Group has $539.9 billion in assets under management3 and

serves some 20.1 million customers worldwide from offices in Asia,

Australia, Europe, Latin America and the United States. Principal

Financial Group, Inc. is traded on the New York Stock Exchange under the

ticker symbol PFG. For more information, visit www.principal.com.

1 U.S.

Small Business Administration March 2014 FAQs

2 “The

Principal Financial Group” and “The Principal” are registered service

marks of Principal Financial Services, Inc., a member of the Principal

Financial Group.

3 As of June 30, 2015.