STAMFORD, Conn.--(BUSINESS WIRE)--Even with the increasing influence of digital technology on retail habits, the in-store experience is important in all major purchase decisions, with an overwhelming majority of shoppers buying in person. At the same time, shoppers continue to carefully research major purchases of $500 or more, including financing options.

Synchrony Financial (NYSE:SYF), a premier consumer financial services company with 80 years of retail heritage, today released findings from its Fourth Annual Major Purchase Consumer Study, confirming that while 80% of major purchase shoppers start with online research, most tend to finish the deal inside of a store.

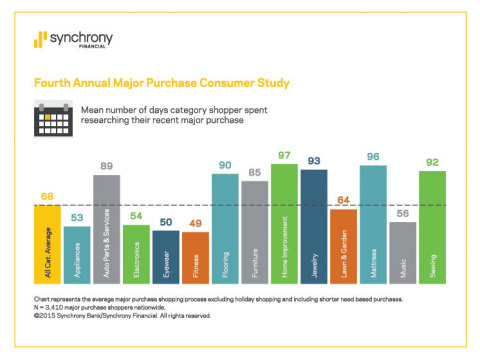

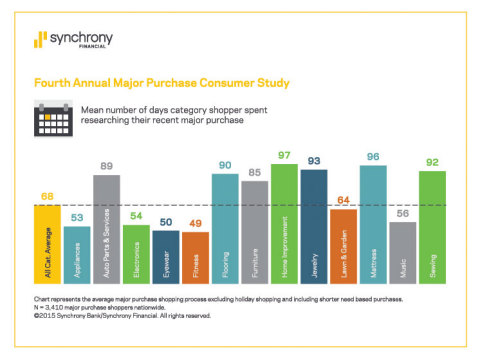

The latest study explored attitudes about shopping and spending habits, financing, and the path to making major purchases across 13 categories: appliances; automotive service, tires and products; electronics; eyewear; fine jewelry; flooring; home improvement; furnishings; bedding and mattresses; lawn and garden; musical instruments; sewing; and sports and fitness equipment.

More than 3,400 Synchrony Bank cardholders and random shoppers who had made a purchase of $500 or more in the past six months, or planned to make such a purchase, participated in the survey conducted in May 2015 by global market research company Rothstein Tauber, Inc.

Key findings of the Fourth Annual Major Purchase Consumer Study include:

- The major purchase journey is getting shorter, with shoppers spending an average of 68 days researching a product (down from 80 in 2014).

- Digital tools continue to be an important part of the research process, empowering shoppers to navigate information and narrow options. Online purchasing of larger ticket items remained stable at 13% year-over-year, with the exception of consumer electronics.

- The in-store experience matters more than ever, with 73% conducting research during their visit and 87% of respondents purchasing in person. Sixty-four percent of all shoppers surveyed said in-store visits had a greater influence on their purchasing decision than online research.

- Financing continues to play a critical role in the major purchase process, with 75% of Synchrony cardholders surveyed saying they “always” seek promotional financing when making a purchase, and 89% indicating promotional financing makes larger purchases more affordable.

Results show that shoppers enjoy the immediacy and interaction of in-store purchases. Shopping in-store allows them to take the product home on the same day, see and feel the product, and interact with a store associate. Some respondents noted they simply like to shop at the retailer.

“These insights are a valuable reminder for retailers of the importance of the in-store experience as part of a true omni-channel strategy,” said Toni White, chief marketing officer, Synchrony Financial. “Providing an integrated and consistent experience across all channels bridges shoppers from online sources of information to visit a physical store, validate their choices, and ultimately purchase.”

Shoppers continue to carefully conduct research via a number of channels prior to making their major purchase. Steps in their path-to-purchase include product research online and off such as store visits, consulting friends and family, exploring offers and financing, and checking online reviews. Consumers who purchase online are driven by value and availability and said they liked the ease and convenience, found better deals on the web, or bought items not stocked in the store.

The Synchrony Financial Market Research team provides insights into consumer attitudes and perceptions toward the retail brand, products and platforms to improve customer satisfaction. Through the Synchrony Connect program, Synchrony Financial partners can connect with subject matter experts to gain knowledge and expertise in non-credit areas that help them grow, lead and operate their business. More information can be found at www.SynchronyFinancial.com.

About Synchrony Financial

Synchrony Financial (NYSE: SYF) is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables.* We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 300,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Synchrony Financial (formerly GE Capital Retail Finance) offers private label and co-branded Dual Card credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com and twitter.com/SYFNews.

*Source: The Nilson Report (April, 2015, Issue # 1062) - based on 2014 data.

Topics: Retail, credit cards, merchants, mid-size businesses, consumer shopping

Editor Note: Graphic data representations are available.

©2015 Synchrony Bank/Synchrony Financial, All rights reserved.