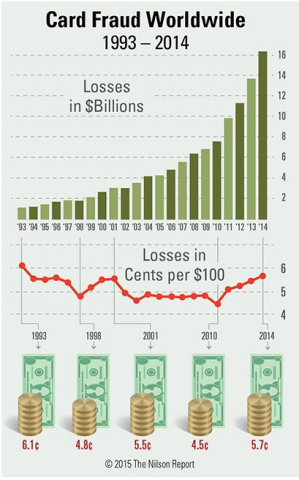

CARPINTERIA, Calif.--(BUSINESS WIRE)--Fraud losses incurred by banks and merchants on all credit, debit, and prepaid general purpose and private label payment cards issued worldwide reached $16.31 billion last year when global card volume totaled $28.844 trillion. This means that for every $100 in volume, 5.65¢ was fraudulent. Fraud, which grew by 19%, outpaced volume, which grew by 15%. Fraud losses occurred from counterfeiting, card not present (CNP), fraudulent application, lost & stolen, card not received, and other much smaller categories according to The Nilson Report, the top trade newsletter covering the card and mobile payment industries.

When measuring only the global general purpose brands — UnionPay, Visa, MasterCard, JCB, Discover/Diners, and American Express, total volume was $23.777 trillion, up 14.8%, and fraud losses were $15.45 billion, up 18.5%.

The U.S. accounted for 48.2% or $7.86 billion of gross card fraud losses worldwide, while generating only 21.4% or $6.187 trillion of total volume. U.S. fraud losses equaled 12.75¢ for every $100 in total volume last year. Fraud in all other regions combined was only 3.73¢ per $100.

“Multiple factors contributed to that gap,” said David Robertson, Publisher of The Nilson Report. “Nothing mattered more than the lack of an EMV-compliant infrastructure.” EMV technology provides the best protection against losses from counterfeit cards, which accounted for 49% of all card fraud losses worldwide last year. U.S. issuers were slammed by losses due to counterfeiting, fueled by data center breaches that made available tens of millions of stolen card account numbers as well as personal cardholder identification information. The combination makes fraud tougher to fight. U.S. issuer losses due to counterfeiting of $3.89 billion last year accounted for 23.9% of all global fraud losses.

Of the total $16.31 billion lost to fraud last year, card issuers worldwide absorbed 62%. Merchants accounted for the other 38%. In the U.S., card issuers lost $4.91 billion and merchants lost $2.95 billion. Those losses do not include related costs issuers and merchants incur.

For 2015 through 2020, card fraud worldwide is expected to total $183.29 billion. In 2020, global card fraud will exceed $35.54 billion. Losses in cents per every $100 in total volume will rise to 5.74¢ in 2015 before falling to 5.26¢ in 2020.

Issuers from all other regions suffered counterfeit losses last year, although not always in their home countries. Europe’s issuers were hit because criminals skimmed the magnetic stripes from the backs of cards to generate fraud on counterfeit cards they created for use at U.S. merchants. Local market counterfeiting continues to plague issuers in Asia-Pacific and Latin America, where criminal gangs are growing in number.

Issuers worldwide were impacted by data breaches in their regions. In EMV-compliant countries, stolen primary account numbers usually result in card-not-present (CNP) fraud. In Asia-Pacific, CNP fraud accounted for more than 70% of all fraud losses last year due to rapid growth in CNP sales. Asia-Pacific saw a higher increase in fraud losses last year than the U.S., even though merchants in the region are far more likely to decline authorizations for fear of fraud compared to U.S. merchants.

The full article “Global Fraud Losses Reach $16.31 Billion” is available by downloading the current issue at www.nilsonreport.com.