NEW YORK--(BUSINESS WIRE)--Two out of three Americans (66 percent) expect to be stressed about money in retirement based on how they are currently saving, according to a new survey released today by Bank of America and Merrill Edge. The latest Merrill Edge® Report reveals that people with the most time to prepare for retirement – Gen Xers and millennials – are most likely to anticipate a financially rocky retirement, while those who have already retired are less likely to feel anxious about money today.

The survey of more than 1,000 Americans with investable assets of $50,000 to $250,000 finds non-retired Gen Xers (74 percent) and millennials (67 percent) are the most likely to predict financial stress in retirement based on how they’re saving right now, while 59 percent of current retirees say they are not stressed about finances because of how they saved. Additionally, 73 percent of retirees who have saved believe they will have enough money to last through retirement. In comparison, only 57 percent of non-retired respondents think they will have enough money throughout retirement, while the majority (75 percent) of non-retirees are also planning to rely on their own savings and investments for financial help during their golden years.

“Perhaps one cause of this anticipated financial stress is that a large number of non-retired Americans believe they’ll need to rely on their personal savings and investment to live on in retirement,” said Aron Levine, head of Bank of America Preferred Banking and Merrill Edge. “Even though current retirees report they are not as anxious about money, younger Americans can learn from their example – that preparation pays off.” For more report insights from Aron Levine, please watch the “Americans Divided on Retirement Expectations” video.

Pursuing an ideal retirement without financial stress

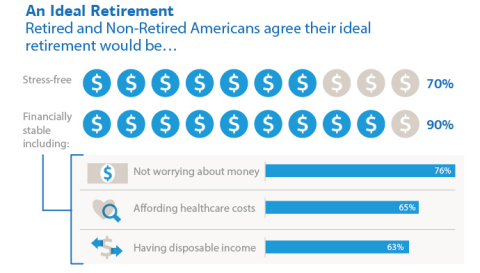

The biannual survey found that most non-retired respondents agree in their ideal retirement, they will not worry about money (77 percent) and will be stress-free (70 percent). Respondents who have yet to reach retirement are taking actions to get there like today’s retirees, but could do more to emulate strategies that retired Americans employed to ensure that their golden years were less worrisome:

- Today, the most popular actions that non-retired Americans are taking to live a stress-free retirement are funding retirement accounts (57 percent) and paying off debt (54 percent). Contributing to a retirement account (63 percent) and paying off debt (68 percent) were also some of the most common measures that retirees took to reduce strain in retirement before reaching that stage.

- However, while more than four in 10 retirees (42 percent) preemptively invested as much as they could outside of a retirement account to be stress-free when they did retire, only 24 percent of non-retired survey respondents are doing this with the same goal in mind.

- Similarly, less than one-quarter (24 percent) of those who have yet to reach retirement are working with a financial advisor to reduce retirement anxiety, while a significantly higher amount of retirees (38 percent) said they worked with an advisor to achieve that same goal before retiring.

Respondents are most likely to feel that stress would be placed on their finances by unexpected health care costs (65 percent), followed by lack of Social Security funds (38 percent) and taking a loan from a 401(k) account (25 percent). Generationally, more seniors (77 percent) and baby boomers (66 percent) agree that unexpected health care costs would put stress on their finances, in comparison to 55 percent of Gen Xers and half (50 percent) of millennials.

Of those who are not yet retired, nearly half (49 percent) plan to work in retirement to get financial help during this time and 28 percent plan to rely on help from the government for the same reason. In comparison, only 20 percent of retired respondents plan to work in their golden years to receive financial assistance, while 41 percent say they currently rely on the government for financial help in their retirement.

Millennials view retirement differently than other generations

More than four in 10 (43 percent) millennials say they are counting on assistance from loved ones if financial help is needed in retirement, which is significantly higher than the 9 percent of all other respondents combined. The reason for the large disparity may come from the fact that 43 percent of millennials say that they feel behind their peers in either financial stability, saving for the future or their income.

According to the survey, millennials also have a different vision of how they plan to spend their retirement: two-thirds (66 percent) say that their ideal retirement includes traveling often, and more than half (54 percent) say the same about living near loved ones. In comparison, fewer older respondents (Gen X, boomers and seniors) say their ideal retirement includes traveling often (62 percent) and living near loved ones (46 percent).

The survey also reveals that millennials are more tech-savvy when it comes to retirement planning than Gen Xers, baby boomers or seniors. In fact, more than one-quarter (27 percent) of millennials say they use websites and apps to manage funds in an attempt to have a more stress-free retirement, compared to 16 percent of Gen Xers, 11 percent of baby boomers and 5 percent of seniors.

Financial emotions lead to positive financial actions

According to the survey, while the overwhelming majority (85 percent) of non-retired Americans are investing for retirement, nearly one-third (29 percent) of all respondents would still be embarrassed if their close friends or family knew intimate details of their finances, specifically their retirement savings, checking account balance, credit score, total wedding cost or monthly discretionary spending. Along similar lines, nearly four in 10 (37 percent) feel that they lag behind their peers in terms of financial stability, saving for the future or current income. However, those shortfalls could also be a catalyst for better financial planning. Nearly one-third (32 percent) of those who aren’t retired report that they have been motivated by financial stress, financial embarrassment or the feeling that they are behind their peers to make positive financial decisions.

Today, respondents are also just as likely to prioritize saving more for the future (61 percent) as living comfortably today (61 percent). In last year’s Spring 2014 Merrill Edge Report, respondents were more likely to prioritize living comfortably today (63 percent) than saving more for the future (48 percent), resulting in a 13 percent increase year over year.

“In comparison to a year ago, we’re seeing a significant jump in positive investment behaviors and intent,” said Levine. “It’s encouraging to see Americans prioritizing the future along with the present and turning financial concerns into positive investment decisions. As demonstrated by the actions of current retirees, the key to success is turning these strong emotions of stress and fear into action.”

For more in-depth information about the financial behaviors and priorities of mass affluent Americans, read the entire Spring 2015 Merrill Edge Report or take our poll here. See the corresponding infographic here.

Merrill Edge Survey Methodology

Braun Research, Inc. conducted a

nationally-representative telephone survey on behalf of Merrill Edge.

The survey was conducted from March 12, 2015, through March 24, 2015,

and consisted of 1,000 mass affluent respondents throughout the U.S.,

defined as individuals with investable assets (value of all cash,

savings, mutual funds, CDs, IRAs, stock, bonds and all other types of

investments excluding primary home and other real estate investments).

Respondents in the study were defined as aged 18 to 34 (millennials)

with investable assets between $50,000 to $250,000 or those aged 18 to

34 who have investable assets of between $20,000 and under $50,000 with

an annual income of at least $50,000; or aged 35-plus with investable

assets between $50,000 to $250,000. We conducted an oversampling of 300

mass affluents in the following markets: San Francisco; Los Angeles;

Orange County, California; Dallas; the State of New Jersey; South

Florida; Chicago; and Phoenix. The markets of Chicago and Phoenix were

newly-surveyed this wave. The margin of error is +/- 3.0 percent for the

national sample; about +/- 5.7 percent for the oversample markets, all

reported at a 95 percent confidence level.

Merrill Edge

Merrill Edge is a streamlined investment service that

provides customers access to the investment insights of Merrill Lynch

and the convenience of Bank of America banking to help simplify their

financial life. With Merrill Edge, customers can see their Merrill Edge

investment and Bank of America bank accounts on one page online, along

with access to tools, research, support and competitive pricing for

online trades. If customers prefer to receive professional advice and

guidance to help simplify pursuing their investment goals, Merrill Edge

Roadmap™ allows them to work one-on-one with a licensed Merrill Edge

Financial Solutions Advisor™. Financial Solutions Advisors work with

customers to design a personalized action plan with specific

recommendations tailored to their investment needs.

Bank of America

Bank of America is one of the world's largest

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range of

banking, investing, asset management and other financial and risk

management products and services. The company provides unmatched

convenience in the United States, serving approximately 48 million

consumer and small business relationships with approximately 4,800

retail financial centers and approximately 15,900 ATMs and award-winning

online banking with 31 million active users and approximately 17 million

mobile users. Bank of America is among the world's leading wealth

management companies and is a global leader in corporate and investment

banking and trading across a broad range of asset classes, serving

corporations, governments, institutions and individuals around the

world. Bank of America offers industry-leading support to approximately

3 million small business owners through a suite of innovative,

easy-to-use online products and services. The company serves clients

through operations in all 50 states, the District of Columbia, the U.S.

Virgin Islands, Puerto Rico and more than 35 countries. Bank of America

Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

Visit the Bank of America newsroom for more Bank of America news.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

Merrill Edge® is available through Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S), and consists of the Merrill Edge Advisory Center (investment guidance) and self-directed online investing.

MLPF&S is a registered broker-dealer, Member SIPC and wholly owned subsidiary of Bank of America Corporation.

Investment products:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value | ||||||||

© 2015 Bank of America Corporation. All rights reserved.