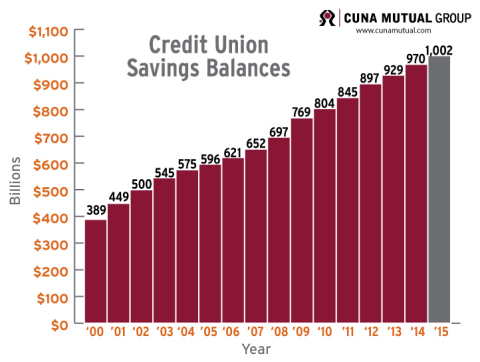

MADISON, Wis.--(BUSINESS WIRE)--Credit union member savings balances in the U.S. rose above a trillion dollars this year – for the first time in history – according to CUNA Mutual Group, the leading provider of lending, insurance and wealth management products for credit unions. The company revealed this in its latest Credit Union Trends Report, a monthly economic snapshot of the industry.

The new report reflects strong financials for credit unions and their members, who represent a third of the U.S. population1. This includes credit union loans and memberships: During the last 12 months, loan portfolios increased 10.6 percent, the fastest pace since December 20052. And, memberships grew by nearly half a million members2.

“Credit union members are an extremely close proxy for the American middle-market consumer, and this report goes beyond sentiment data to demonstrate that these consumers are feeling better than they have in quite some time,” said Steven Rick, Chief Economist, CUNA Mutual Group. “The savings and lending growth that we’re seeing in the credit union landscape speaks to rising economic confidence.”

CUNA Mutual Group’s latest report also shows a number of notable points, including:

- Strengthening savings: Credit union savings balances grew at a 5.5 percent seasonally-adjusted annualized growth rate – due to low gas prices, rising household income, strong job growth and fast credit union membership growth2.

-

Auto loans on the rise:

- Used auto loan balances grew at a 14.9 percent seasonally-adjusted annualized growth rate – the fastest pace since November 19992.

- New auto loan balances grew at a 24.2 percent seasonally-adjusted annualized growth rate – the fastest pace on record2.

-

Strong membership expansion: Credit union memberships rose 496,000

in March to reach 102.8 million, and the underlying annual

growth rate for memberships is now 4 percent – the highest

since March 19972.

- Credit union memberships also grew at a record pace in the first quarter of 2015 – up 3.6 percent in the year ending in March 2015, faster than the 3.1 percent pace set in 20142.

“Breaking the trillion dollar mark is an important moment for the credit union movement,” said Rick. “It captures the improving financial health for millions of Americans and demonstrates the trust they continue to have in their local credit unions.”

The full CUNA Mutual Group report can be found here.

About CUNA Mutual Group:

CUNA Mutual Group was founded in 1935 by credit union pioneers, and our commitment to their vision continues today. We offer insurance and protection for credit unions, employees and members; lending solutions and marketing programs; TruStage™ – branded consumer insurance products; and investment and retirement services to help our customers succeed. More information is available on the company’s website at www.cunamutual.com.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Life, accident, health and annuity insurance products are issued by CMFG Life Insurance Company and MEMBERS Life Insurance Company. Property and casualty insurance products are issued by CUMIS Insurance Society, Inc. Each insurer is solely responsible for the financial obligations under the policies and contracts it issues. Corporate headquarters are located in Madison, Wis.

SOURCES:

(1) Harris Interactive

(2) CUNA Mutual Group Credit Union Trends Report