STAMFORD, Conn.--(BUSINESS WIRE)--Less than nine months since its launch, the Sam’s Club 5-3-1 cash back credit card program, managed by Synchrony Financial (NYSE:SYF), has been recognized with a PYMNTS.com® 2015 Innovator Award for innovation in payments and commerce. Announced during The Innovation Project® 2015 event powered by PYMNTS.com, Sam’s Club earned a Gold Medal in the Best Comeback Story category and was selected for the top honor by a judging panel and public, online vote.

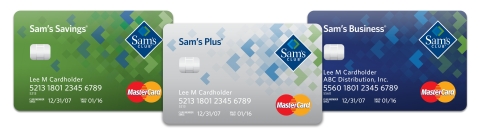

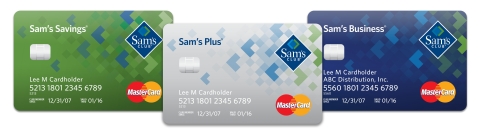

Sam’s Club was the first U.S. mass retailer to implement chip-enabled technology when it introduced the 5-3-1 cash back credit card program last June to Sam’s Business, Sam’s Savings and Sam’s Plus members. The 5-3-1 value proposition, available in the U.S. and Puerto Rico, makes the Sam’s Club co-branded MasterCard® the most competitive credit reward program in the club category.

“This PYMNTS.com 2015 Innovator Award is an important recognition because it reflects public input and underscores the industry-leading work of our teams to bring relevant payment options and features to Sam’s Club members to simplify and enhance their shopping experience,” said Steve Hacala, senior vice president and general manager of the Sam’s Club Credit Program for Synchrony Financial, a premier consumer financial services company with 80 years of retail heritage. “We’re proud to partner with Sam’s Club over the last two decades to continue to evolve the program in innovative ways to combine savings and rewards with easy-to-use payment and mobile capabilities.”

Sam’s Club credit cardholders can shop and manage their account online or on their mobile device. Available at in-club Member Services or at SamsClub.com/credit, the Sam’s Club MasterCard Dual Card is Synchrony Financial’s patented version of a co-branded credit card, offering qualifying members the opportunity to earn up to $5,000 cash back annually including: 5 percent cash back on their first $6,000 in fuel purchases; 3 percent cash back on dining and travel; and 1 percent cash back on all other purchases. There is no annual fee and earned rewards can be redeemed for cash, purchases in-club or toward annual club membership fees.

“Sam’s Club is proud to be recognized as innovators in the payments industry. It’s really our members who gain the greatest reward from the Sam’s Club MasterCard,” said Seong Ohm, senior vice president of Membership Services at Sam’s Club. “Last month, we delivered millions of dollars in cash back to Sam’s Club MasterCard-holding members, more than justifying the price of each member’s annual membership fee. Sam’s Club is on a mission to enhance membership with valuable programs, including credit, travel and legal solutions, to save our members money and time on the services they need most. Our members are seeing the results.”

PYMNTS Awards winners are chosen from submissions received by PYMNTS.com and reviewed by a panel of judges who are experts in innovation. A field of five finalists is selected for each category and presented to the PYMNTS community to vote for Gold, Silver and Bronze medalists. This year more than 600 submissions were received and 10,000 votes tallied to determine the leading innovators shaping and reinventing the industry.

Each Sam’s Club co-branded MasterCard includes chip-enabled technology and is issued by Synchrony Bank pursuant to a license by MasterCard International Incorporated.

About Synchrony Financial

Synchrony Financial (NYSE: SYF), formerly GE Capital Retail Finance, is one of the premier consumer financial services companies in the United States. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ more than 300,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Our offerings include private label and co-branded credit cards, promotional financing and installment lending, loyalty programs and Optimizer+plus branded FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com and twitter.com/SYFNews.

©2015 Synchrony Bank/Synchrony Financial, All rights reserved.