NEW YORK--(BUSINESS WIRE)--H Partners Management, LLC (“H Partners”), which together with certain of its affiliates, currently owns 10% of the outstanding shares of Tempur Sealy International, Inc. (NYSE:TPX) and is the largest shareholder, today sent a letter to the Company’s Board of Directors.

The letter outlines significant concerns regarding the continued mismanagement and value destruction at Tempur Sealy under its current CEO, Mark Sarvary, who to this point is supported by the Company’s complacent and misaligned Board. H Partners is demanding an immediate leadership change to address Tempur Sealy’s lack of strategic direction, poor operational execution, contracting margins, and stock underperformance, including the immediate resignation of directors P. Andrews McLane of TA Associates and Christopher Masto of Friedman Fleischer & Lowe, both of whose private equity firms exited their investments many years ago.

The full text of the letter follows:

February 17, 2015

The Board of Directors

Tempur Sealy International, Inc.

1000

Tempur Way

Lexington, Kentucky 40511

Dear Mmes. Dilsaver and Koehn and Messrs. Doyle, Heil, Hoffman, Judge, Rogers and Trussell, Jr.:

H Partners Management, LLC (“H Partners”) currently owns 6,075,000 shares or 10% of the outstanding shares of Tempur Sealy International, Inc. (“Tempur Sealy” or the “Company”), making us the Company’s largest shareholder. We are long-term shareholders, having held shares of Tempur Sealy since 2012. We were also a large investor in Sealy Corporation (“Sealy”) for several years before it was acquired by Tempur-Pedic International, Inc. (“Tempur-Pedic”).

H Partners is an independent investment firm that aims to invest in good businesses with capable, well-aligned fiduciaries focused on long-term value creation. Since our inception in 2005, H Partners has generated an annualized return of 30% compared to 8% for the S&P 500 Index.1 We have a track record of significant value enhancement at companies in which we have become involved on the board and in decisions regarding management.

For almost two years, we have attempted to communicate constructively with Tempur Sealy Chairman P. Andrews McLane, an employee of TA Associates, Inc. (“TA Associates”), regarding the Company’s deteriorating operational performance, the serious shortcomings of CEO Mark Sarvary, and our considerable governance concerns. Our hope was that we could work together with Mr. McLane and Tempur Sealy’s board of directors (the “Board”) in a private manner to address these fundamental problems. Unfortunately, Mr. McLane has been unresponsive to our concerns and suggestions. Mr. McLane has also repeatedly blocked our requests for a single board seat, which would have allowed us to share our views with the Board. As such, we have no choice but to make our concerns regarding Tempur Sealy publicly known at this time.

In our view, the Board must immediately replace current CEO Mark Sarvary due to his consistently poor performance and failure to deliver on his promises to shareholders. Unfortunately, it has become clear that the current Board lacks a shareholder-focused mindset, is unwilling to hold management or itself accountable, and seems to be placing its own personal interests far ahead of the best interests of its shareholders. Therefore, the Board must also be immediately and voluntarily reconstituted with meaningful shareholder representation.

Tempur Sealy has the strongest brands in the mattress sector along with an outstanding team of dedicated employees. By replacing CEO Mark Sarvary with a proven leader, we believe Tempur Sealy can regain its status as the best mattress manufacturer in the world and can create substantial shareholder value.

In the following pages, we describe in greater detail:

1. A troubling history of underperformance and mismanagement under CEO

Mark Sarvary, which makes an immediate CEO change necessary;

2. Our

concerns regarding Tempur Sealy’s complacent and misaligned Board,

dominated by representatives of former investors TA Associates and

Friedman Fleischer & Lowe, LLC (“Friedman Fleischer”), even though both

private equity firms exited their investments in the Company many years

ago; and

3. Why H Partners’ track record of significant value

creation at Six Flags Entertainment, Inc. (“Six Flags”) is highly

relevant to helping Tempur Sealy overcome its current challenges.

1. A Troubling History of Underperformance and Mismanagement Under CEO Mark Sarvary

Under the leadership of CEO Mark Sarvary, Tempur Sealy has continuously underperformed. Simply stated, we have lost all faith in Mr. Sarvary’s ability to lead this large, increasingly complex company.

Shareholder Returns Have Suffered Dramatically Under Mr. Sarvary

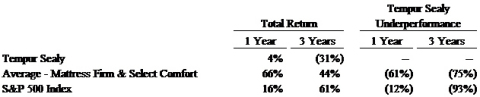

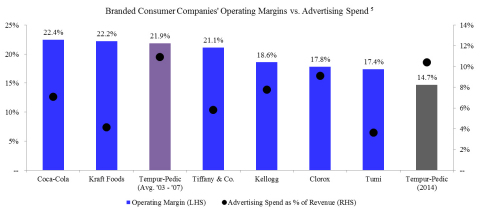

Tempur Sealy’s stock has dramatically underperformed the Company’s mattress sector peers and the S&P 500 Index by 75% and 93%, respectively, over the past three years.2

(For Tempur Sealy's 1 and 3 Year Stock Underperformance chart, see additional multimedia)

Profitability Has Collapsed Under Mr. Sarvary

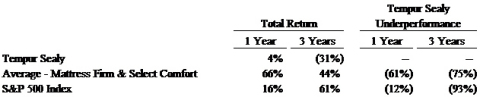

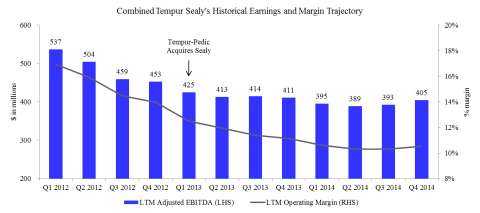

Tempur Sealy’s operating margins at nearly half of historical levels reveal Mr. Sarvary’s struggle to convert sales into profits. The chart below shows that while the Company’s current sales of $3 billion are in line with historical levels achieved by an independent Tempur-Pedic and Sealy, the Company’s combined operating margin has precipitously declined from 19.4% to 10.5%.3 The margin deterioration has occurred at both Tempur-Pedic and Sealy.

(For Tempur Sealy Current Revenue and Operating Margin vs. Historical Peak chart, see additional multimedia)

Tempur-Pedic Has Lost its Position of Dominance and its Pricing Power in the Memory Foam Segment Under Mr. Sarvary

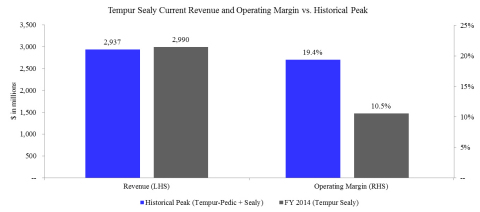

As shown in the following chart, in the five years prior to Mr. Sarvary’s arrival in 2008, Tempur-Pedic closely resembled certain consumer businesses whose high level of brand investments translate into pricing power and high operating margins. Under Mr. Sarvary, however, Tempur-Pedic’s memory foam business now spends more on advertising than any of its branded peers while the Company’s operating margins have fallen from 21.9% to a mere 14.7%.4 We believe much of this margin deterioration is directly attributable to Mr. Sarvary’s failure to comprehend product vulnerabilities, foresee competitive threats, and engage with retail partners.

(For Branded Consumer Companies' Operating Margins vs. Advertising Spend chart, see additional multimedia)

Mr. Sarvary Failed to Effectively Integrate Sealy and Realize the Expected Synergies

Mr. Sarvary frequently touts his realization of synergies from the 2013 Sealy acquisition, with a $40 million benefit in 2014.6 But the following chart tells a different story. Tempur Sealy’s EBITDA has decreased from $425 million when Sealy was acquired to $405 million today,7 a decline of $20 million. If there is in fact a $40 million synergy benefit baked into current earnings, then it implies that Tempur Sealy’s core earnings (i.e. before synergies) have actually declined by $60 million since the Sealy combination.8 Over the same period, Tempur Sealy’s operating margins have declined in six out of seven quarters.9 Mr. Sarvary occasionally suggests that he has “re-invested” some of the realized synergies into R&D programs and marketing. If this is the case, then Mr. Sarvary should explain to shareholders what return they have received from his purported re-investment.

(For Combined Tempur Sealy's Historical Earnings and Margin Trajectory chart, see additional multimedia)

Mr. Sarvary Consistently Misses Both Long-Term and Short-Term Targets Due to Repeated Execution Errors

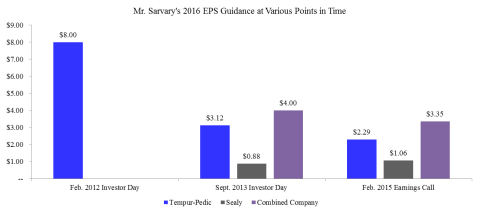

We are struck by the dramatic magnitude by which Mr. Sarvary consistently misses his own long-term targets. The following table shows that Mr. Sarvary has reduced long-term EPS targets twice over the past two years. At the Company’s February 2012 Investor Day, Mr. Sarvary forecasted $8.00 in EPS for a stand-alone Tempur-Pedic by year-end 2016.10 Eighteen months later, at the September 2013 Investor Day, Mr. Sarvary cut his 2016 forecast by 50%, and his new $4.00 EPS target even included an estimated $0.88 EPS contribution from the recently-acquired Sealy business.11 Once again, only eighteen months later in February 2015, Mr. Sarvary reduced his 2016 target EPS even further, this time by almost 20%, even though large synergies from Sealy should have been realized by this stage in the integration process.12

(For Mr. Savary's 2016 EPS Guidance at Various Points in Time chart, see additional multimedia)

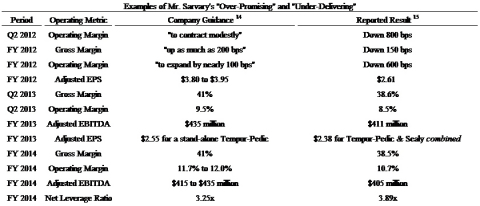

As shown in the previous chart, Mr. Sarvary has clearly struggled to hit long-term targets. But as the following table shows, shareholders are painfully aware that Mr. Sarvary fails to achieve short-term financial targets as well. In fact, Mr. Sarvary has missed earnings estimates in six out of the last seven quarters since acquiring Sealy.13

(For Examples of Mr. Savary's "Over-Promising" and "Under-Delivering" chart, see additional multimedia)

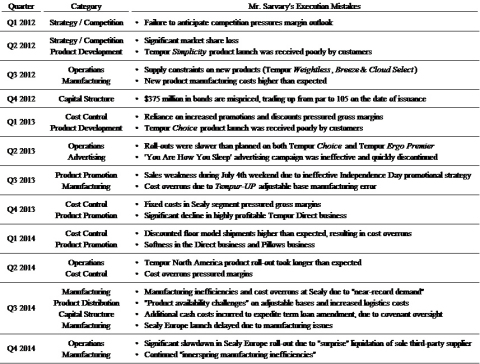

To be clear, Mr. Sarvary’s repeated failure to achieve both short and long-term targets is a symptom of a deeper and more fundamental problem. Mr. Sarvary struggles with the basic aspects of running Tempur Sealy – from his strategic vision, to functional areas such as manufacturing and operations. The following table shows that under Mr. Sarvary, there has been an unrelenting stream of execution mistakes in every single quarter over the past three years.

(For Mr. Savary's Execution Mistakes chart, see additional multimedia)

Tempur Sealy is Significantly Larger and More Complex Than the Stand-Alone Tempur-Pedic Business Mr. Sarvary Initially Ran in 2008

Mr. Sarvary was initially hired to run Tempur-Pedic in 2008, when the Company was smaller and easier to manage. At that time, Tempur-Pedic had only two manufacturing facilities in North America, one manufacturing facility in Europe, and 1,200 employees.16 With a relatively small manufacturing footprint and a near-monopoly memory foam business model established by prior management, Mr. Sarvary could concentrate his initial efforts on tweaks to marketing and product development. However, beginning in 2012, Mr. Sarvary faced new competition for which he was entirely unprepared, and later that year Tempur-Pedic announced the acquisition of Sealy, a significantly more complex and operationally-intensive business than the stand-alone Tempur-Pedic. Today, Tempur Sealy’s manufacturing footprint of 28 facilities is nine times larger than when Mr. Sarvary initially joined Tempur-Pedic, and the Company’s current 7,100 employee base is six times the size of the previous Tempur-Pedic workforce.17 Further, as the Company acquires Sealy’s international licensees, the business will become even more complex, and Mr. Sarvary’s handle on the Company will only slip further. In our view, it is clear that Mr. Sarvary is incapable of leading a significantly larger and more complex company in a more competitive industry.

An Immediate CEO Change is Necessary in Order to Halt Value Destruction

We believe that the Company’s earnings potential is not being achieved due to poor leadership. Tempur Sealy possesses all the components of a successful company – industry-leading products and technologies, highly recognizable brands, and a talented team of dedicated employees. However, Tempur Sealy is lacking in one critical area: leadership. We firmly believe that in order to improve Tempur Sealy’s performance, the Company must immediately terminate CEO Mark Sarvary and replace him with a proven leader who is capable of realizing the Company’s true potential.

2. Tempur Sealy’s Board is Poorly Aligned and Complacent

Based upon our interactions with the Board, it is clear that Tempur Sealy Board members are apathetic towards the Company’s underperformance and prefer to insulate themselves from shareholder accountability rather than engage in constructive dialogue with well-intentioned, long-term shareholders. We are no longer willing to sit idly by as the Board fails to hold Mr. Sarvary accountable for destroying shareholder value quarter after quarter.

Why are Employees of Former Shareholders TA Associates and Friedman Fleischer Still on the Tempur Sealy Board?

We are puzzled why employees of TA Associates and Friedman Fleischer cannot understand the concept that when an investor sells out of his business interest, that investor must hand over the reins to new shareholder representatives. Mr. McLane and Mr. Masto both joined the Board in 200218 when their respective private equity firms, TA Associates and Friedman Fleischer, invested in Tempur-Pedic. TA Associates and Friedman Fleischer exited their initial investments in the Company in 200919 and 2006,20 respectively, yet Messrs. McLane and Masto have clung to their directorships and positions of influence over the Board. Mr. McLane has lingered on Tempur Sealy’s Board for six years following TA Associates’ exit and Mr. Masto has lingered for nine years following Friedman Fleischer’s initial exit. Even more disturbing is the fact that Mr. McLane continues to serve as Chairman, a position he has held since 2002,21 and Mr. Masto continues to serve as Chairman of the Nominating and Corporate Governance Committee, a position he has held since 2010.22

Friedman Fleischer and Mr. McLane Have Pocketed Millions of Dollars by Opportunistically Exploiting Their Access to Information

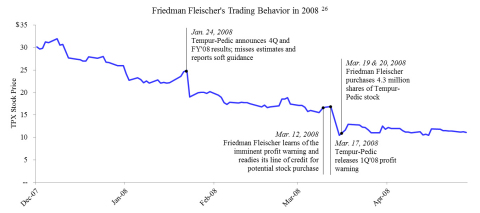

After exiting its investment in Tempur-Pedic stock in 2006, Friedman Fleischer perfectly timed its re-investment in March 2008 while Mr. Masto was on the Board. Friedman Fleischer purchased Tempur-Pedic stock at $12 per share23 after the announcement of a material earnings miss. Friedman Fleischer then sold these shares several years later at approximately $35 per share, netting the firm an estimated $100 million profit.24 We are disturbed because Friedman Fleischer was able to purchase the stock at a 29% discount while Mr. Masto was on the Board.25, 26 Public market investors did not enjoy this special advantage. The following chart illustrates Friedman Fleischer’s highly questionable trades of Tempur-Pedic stock during Mr. Masto’s tenure on the Board.

(For Friedman Fleischer's Trading Behavior in 2008 chart, see additional multimedia)

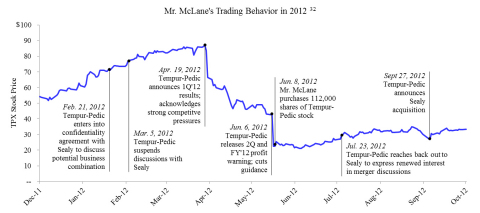

Mr. McLane also perfectly timed a personal investment in Tempur-Pedic stock in 2012. While public shareholders lost 40% – or $1.5 billion – in 2012,27 it appears that Mr. McLane’s well-timed trade enabled him to generate a 26% return – or a $725,000 gain – on his investment that same year.28 Tempur-Pedic had started to miss earnings expectations in early 2012. Unlike most public market investors, Tempur Sealy Chairman Mr. McLane was able to “catch the falling knife,” purchasing 112,000 shares at approximately $25 per share immediately following the June 2012 guidance reduction in which the stock fell 49%.29 Even more disturbing, Mr. McLane made his investment right before Tempur-Pedic’s board reached out to Sealy to re-engage in merger discussions.30 When Tempur-Pedic announced a highly accretive deal to acquire Sealy, it resulted in an immediate 14% increase in Tempur-Pedic’s stock price.31 The two companies had engaged in discussions about a potential business combination as recently as March 2012. The following chart illustrates Mr. McLane’s highly questionable trading technique.

(For Mr. McLane's Trading Behavior in 2012 chart, see additional multimedia)

Mr. Masto’s Colleague at Friedman Fleischer was Convicted of Insider Trading in Tempur-Pedic Stock

We also have serious concerns as to how Mr. Masto has been permitted to continue serving on the Board, not only despite his private equity firm’s initial exit from Tempur-Pedic in 2006 but also despite the insider trading conviction of his colleague at Friedman Fleischer, stemming from the use of material, non-public information regarding Tempur-Pedic.33

Is Tempur Sealy’s Multi-Year Sponsorship of the U.S. Ski and Snowboard Association a Good Marketing Move for the Company or an Extraneous Related Party Transaction that Benefits Mr. McLane?

We do not think it is any coincidence that since 2010, Tempur Sealy has paid to sponsor the U.S. Ski and Snowboard Association (the “USSA”).34 Mr. McLane has served for many years as a member of the Board of Directors of the USSA, and additionally, he and his wife are Inner Circle Members of the U.S. Ski and Snowboard Team Foundation’s Annual Fund, Legacy Campaign donors, and Team Sochi Members.35 This past December, this sponsorship was extended through 2016, even though the Company was on the cusp of reducing long-term earnings guidance for the second time in two years.36

We question whether this sponsorship is a good use of the Company’s marketing dollars, and whether the USSA sponsorship was championed by Mr. McLane in connection with his years of involvement with the organization. We intend to conduct a comprehensive books and records audit under Delaware law so that we can understand (i) the true nature and terms of the USSA sponsorship and Mr. McLane’s involvement with the sponsorship, (ii) whether it is a related party transaction under the Company’s Related Party Transactions Policy that has not been disclosed in any Company proxy statement, and (iii) whether any directors have violated their fiduciary duties in approving this sponsorship.

The Board’s Collective Ownership of Approximately 1% of Tempur Sealy is One-Tenth the Size of H Partners’ Stake in the Company

Messrs. McLane and Masto together own less than 1% of the Company’s stock, and that includes a large number of shares that have been granted to them as directors.37 In fact, the entire Tempur Sealy board collectively owns just over 1% of the Company.38 H Partners, on the other hand, owns 10% of the Company’s stock, or almost ten times the amount of stock as the entire Tempur Sealy Board combined.

Messrs. McLane and Masto Have Repeatedly Rejected the Idea of Board Representation for the Company’s Largest Shareholder

In September 2013, H Partners’ Usman Nabi met with Mr. McLane at TA Associates’ headquarters in Boston to express his views and concerns regarding the Company’s performance. During the meeting, Mr. Nabi asked to be considered for a seat on the Board given H Partners’ status as a large, long-term shareholder of the Company and H Partners’ serious concerns with the Company’s CEO, Mark Sarvary. Mr. McLane summarily dismissed the notion of Mr. Nabi joining the Board without contacting either of Mr. Nabi’s references – both of whom were highly reputable public company CEOs. H Partners later learned that the Mr. Masto-chaired Nominating and Corporate Governance Committee also summarily rejected the idea of Mr. Nabi joining the Board when Mr. Nabi’s candidacy was raised at the committee level, without even contacting Mr. Nabi to understand his and H Partners’ record of value creation.

One year ago, Mr. Nabi wrote a letter to Tempur Sealy’s Compensation Committee in which he highlighted the complex challenges facing the Company and suggested a program to reward employees with 1 million shares – an estimated $150 million in value39 – if they achieved an aspirational earnings target. The Compensation Committee failed to respond to this letter. Instead, CEO Mark Sarvary, who is not a member of the Compensation Committee, responded with a brief letter dismissing this idea and depriving his own employees of this opportunity. It is entirely inappropriate for Mr. Sarvary to be communicating with us over the issue of his own compensation. We would have expected this Board to better understand proper corporate governance.

Over the past few weeks, Mr. Nabi offered to meet with Mr. McLane at whatever time and place was convenient for him. After attempts to delay the meeting by nearly a month, Mr. McLane eventually informed Mr. Nabi that he was unable to meet and agreed only to speak with Mr. Nabi over the phone. During this call, Mr. Nabi explained that H Partners had lost confidence in CEO Mark Sarvary and described Mr. Sarvary’s numerous execution errors and record of value destruction. Mr. Nabi demanded (i) the immediate termination of Mr. Sarvary, (ii) the resignations of Messrs. McLane and Masto, and (iii) the appointment of Mr. Nabi to the Tempur Sealy Board, as a member of the Compensation Committee and Chairman of a newly-established CEO Search Committee. Mr. McLane failed to act on any of these demands, thereby compelling us to share our demands with you in this format.

3. H Partners’ Capabilities and Record of Value Creation at Six Flags Are Highly Relevant to Tempur Sealy’s Current Challenges

Since H Partners and Mr. Nabi became involved at Six Flags more than four years ago, Six Flags’ stock has returned 450%40 and its operating margins have increased substantially from an industry low of 14% to an industry high of 31%.41 This outcome was in part achieved because Mr. Nabi, as the initial Chairman of Six Flags’ board, successfully led the Company’s effort to recruit a CEO with a proven track record of exceptional operating performance and shareholder returns. Throughout this period, H Partners remained Six Flags’ largest shareholder, and Mr. Nabi waived his personal board fees to maintain close alignment with shareholder interests.

Tempur Sealy now finds itself in a predicament similar to that which Six Flags experienced prior to 2010 – a lack of strong leadership, a poorly-aligned board, and a multi-year track record of value destruction. Shareholders can no longer afford to watch in silence as the Company languishes due to CEO Mark Sarvary’s poor performance and the Tempur Sealy Board’s failure to hold the CEO accountable. H Partners has the experience and alignment required to fix Tempur Sealy’s problems.

H Partners is in Advanced Discussions with Potential Replacement CEO Candidates

Since the Board is unwilling to consider a CEO change at this time, we have taken it upon ourselves to identify potential replacement CEO candidates. We are currently in advanced discussions with certain tremendously qualified candidates who have a track record of margin enhancement, successful business integrations, and a history of consistent value creation for shareholders. Following our determination of the best candidate to be installed as the next CEO of Tempur Sealy, we look forward to announcing the identity of such individual and showing the Company’s shareholders that, with the right leader in place, there is a bright future ahead for their investment.

* * *

The dismal operating performance under Mark Sarvary’s leadership, the deeply concerning activities and poor alignment of TA Associates’ P. Andrews McLane and Friedman Fleischer’s Christopher Masto, and the lack of accountability of both the Board and CEO all solidify our view that material change in executive leadership, board composition, and corporate strategy are immediately required at Tempur Sealy.

Tempur Sealy has the best brands and the most talented employees in the bedding industry. With the right leadership, alignment of interests, and governance structures in place, we are confident that the Company can deliver substantial value for all stakeholders. It is time for this Board to prove to its shareholders that it is committed to protecting and enhancing shareholder value. We hope that the Board will take the required steps we have outlined herein to drive shareholder value creation, and we are willing to assist with the implementation of our proposals.

We must, however, reserve our rights to take whatever actions in the future we believe may be required to protect the best interests of shareholders, including a withhold campaign at the 2015 Annual Meeting. The proposed withhold campaign will act both as a referendum on the Board’s many failures as fiduciaries and a platform for shareholders to unequivocally demonstrate their strong dissatisfaction with the lack of accountability at Tempur Sealy and management’s consistently poor performance. We hope that this will ultimately prove unnecessary.

Sincerely,

| Usman S. Nabi | Arik W. Ruchim |

About H Partners Management

H

Partners Management, LLC is an independent investment firm founded in

2005 based in New York City.

________________________________________

1 Returns reflect period from January 1, 2005 to December 31, 2014.

2 One year total return reflects period from February 7, 2014 to February 9, 2015. Three year total return reflects period from February 9, 2012 to February 9, 2015. Dates reflect the one and three-year periods prior to H Partners’ 13D filing on February 10, 2015.

3 Historical peak earnings for Tempur-Pedic occurred during the trailing twelve-month period ended Q1 2012; net sales figures for Tempur-Pedic correspond to the same period. Historical peak earnings for Sealy occurred during the trailing twelve-month period ended FY 2006; net sales figures for Sealy correspond to the same period. Operating margins are calculated as follows: (Adjusted EBITDA - Depreciation & Amortization) ÷ Net Sales.

4 Tempur-Pedic’s operating margins between 2003 and 2007 are calculated as follows: Operating Income (GAAP) ÷ Net Sales. The average of Tempur-Pedic’s operating margins for these five fiscal years is 21.9%. Tempur-Pedic’s operating margin for 2014 is calculated as follows: (Adjusted EBITDA – Depreciation & Amortization – Sealy Operating Income) ÷ (Tempur-Pedic North America Sales + Tempur-Pedic International Sales).

5 Operating margins for Tempur-Pedic are as defined in the previous endnote. All other company figures are reflective of the most recent trailing twelve-month GAAP figures available in respective 10-K and 10-Q filings. Tiffany & Co. FY 2014 operating income is adjusted for $480 million of arbitration award expense.

6 Source: Q4 and FY 2014 Earnings Call (February 5, 2015).

7 Source: 10-K and 10-Q filings from Tempur-Pedic International, Inc., Sealy Corporation and Tempur Sealy International, Inc.

8 At the time of the Sealy acquisition, the combined Company’s adjusted EBITDA was $425 million. In 2014, the combined Company’s adjusted EBITDA was $405 million, or $20 million less than at the time of the Sealy acquisition. Assuming a $40 million synergy benefit, this implies that 2014 adjusted EBITDA before synergies was $405 million less $40 million, which equals $365 million, or $60 million less than the $425 million of adjusted EBITDA at the time of the Sealy acquisition.

9 Source: 10-K and 10-Q filings from Tempur-Pedic International, Inc., Sealy Corporation and Tempur Sealy International, Inc. Operating margin is calculated as follows: (Adjusted EBITDA – Depreciation & Amortization) ÷ Net Sales; LTM operating margin declines calculated on a sequential basis.

10 Source: Tempur-Pedic International, Inc. 2012 Investor Day Presentation (February 22, 2012).

11 Source: Tempur Sealy International, Inc. 2013 Investor Day Presentation (September 10, 2013) and 2013 10-K filing. Estimated $0.88 of adjusted EPS contribution from Sealy is calculated by multiplying Sealy’s adjusted operating income contribution as of FY 2013 (approximately 22%) by the $4.00 adjusted EPS target for the combined Company. Total adjusted operating income is calculated as follows: (Adjusted EBITDA – Depreciation & Amortization). Sealy’s adjusted operating income for FY 2013 is assumed to be equal to the reported Sealy segment-level operating income of $68.7 million (purchase price accounting and other adjustments are assumed to be incurred by the Tempur-Pedic North America segment). Tempur-Pedic’s adjusted EPS contribution of $3.12 is calculated by multiplying Tempur-Pedic’s adjusted operating income contribution as of FY 2013 (approximately 78%) by the $4.00 EPS target for the combined Company. Tempur-Pedic’s adjusted operating income is calculated as follows: (Adjusted EBITDA – Depreciation & Amortization – Sealy Operating Income).

12 Source: Q4 and FY 2014 Earnings Call (February 5, 2015) and 2014 10-K filing (February 13, 2015). Estimated $3.35 of adjusted EPS for the combined Company in 2016 is based upon Mr. Sarvary’s statement on the February 5, 2015 earnings call that the Company would achieve $4.00 of adjusted EPS by 2017 assuming that the Company achieves the high-end of its guidance. In order to bridge from the high-end of the Company’s 2015 adjusted EPS guidance of $3.10 to the $4.00 of adjusted EPS that Mr. Sarvary expects in 2017, the Company would need to earn an incremental $0.45 of adjusted EPS in 2016 and 2017. The midpoint of the Company’s 2015 adjusted EPS guidance is $2.90. Adding an incremental $0.45 of adjusted EPS in 2016 to the midpoint of the Company’s 2015 adjusted EPS guidance implies a $3.35 midpoint for the Company’s 2016 adjusted EPS guidance. Sealy’s estimated adjusted EPS contribution of $1.06 is calculated by multiplying Sealy’s adjusted operating income contribution as of FY 2014 (approximately 32%) by the estimated $3.35 2016 adjusted EPS target for the combined Company. Total adjusted operating income is calculated as follows: (Adjusted EBITDA – Depreciation & Amortization). Sealy’s adjusted operating income for FY 2014 is assumed to be equal to the reported Sealy segment-level operating income of $99.8 million (purchase price accounting and other adjustments are assumed to be incurred by the Tempur-Pedic North America segment). Tempur-Pedic’s estimated adjusted EPS contribution of $2.29 is calculated by multiplying Tempur-Pedic’s adjusted operating income contribution as of FY 2014 (approximately 68%) by the estimated $3.35 2016 adjusted EPS target for the combined Company. Tempur-Pedic’s adjusted operating income is calculated as follows: (Adjusted EBITDA – Depreciation & Amortization – Sealy Operating Income).

13 Represents ‘misses’ at the adjusted EBITDA level relative to Bloomberg consensus estimates.

14 Source (in descending order): Q1 2012 Earnings Call (April 19, 2012); Q4 and FY 2011 Earnings Call (January 24, 2012); Ibid; Ibid; Q1 2013 Earnings Call (May 2, 2013); Ibid; Ibid; Q4 and FY 2012 Earnings Call (January 24, 2013); Q4 and FY 2013 Earnings Call (February 6, 2014); Ibid; Ibid; Form 8-K (April 19, 2013).

15 Source (in descending order): Q2 2012 Earnings Press Release (July 24, 2012); Q4 and FY 2012 Earnings Press Release (January 24, 2013); Ibid; Ibid; Q2 2013 Earnings Call (July 25, 2013); Ibid; Q4 and FY 2013 Earnings Press Release (February 6, 2014); Ibid; Q4 and FY 2014 Earnings Press Release (February 5, 2015); Ibid; Ibid; Ibid.

16 Source: 2008 10-K filing (February 12, 2009); includes “principal” manufacturing facilities only.

17 Source: 2014 10-K filing (February 13, 2015); includes “principal” manufacturing facilities only.

18 Source: 2014 Proxy Statement (March 27, 2014).

19 Source: 2008 Proxy Statement (March 24, 2008), Bloomberg. As of 2008 Proxy Statement, TA Associates owned 4,437,877 shares of Tempur-Pedic stock, which were divested over the subsequent months, with the final open market sale occurring on January 27, 2009.

20 Source: Friedman Fleischer & Lowe, LLC website; http://www.fflpartners.com/portfolio/tempurpedic.

21 Source: 2014 Proxy Statement (March 27, 2014).

22 Source: 2011 Proxy Statement (March 16, 2011), backward-looking for period following 2010 Annual Shareholder Meeting.

23 Source: Friedman Fleischer & Lowe 13D filing (March 31, 2008), Bloomberg. On March 19, 2008, Friedman Fleischer purchased approximately 2,952,000 shares of Tempur-Pedic stock, which closed at $11.65 per share. On March 20, 2008, Friedman Fleischer purchased approximately 1,305,000 shares of Tempur-Pedic stock, which closed at $12.93 per share. The weighted average purchase price pursuant to these two transactions is thus approximated to be $12.04 per share.

24 Source: Bloomberg. From February 3, 2010 to February 16, 2011, Friedman Fleischer sold approximately 3,198,000 shares in the open market at a weighted average price of approximately $35.19 per share. Approximately 1,059,000 shares owned by Friedman Fleischer, net of the reported 3,198,000 shares disposed of in the open market between February 3, 2010 and February 16, 2011 cannot be accounted for in Form 4 or 13D disclosures. Therefore, we have assumed that these residual shares were sold at the same weighted average price of $35.19 per share for which the reported shares were sold. On March 19 and 20, 2008, Friedman Fleischer purchased approximately 4,257,000 shares of Tempur-Pedic stock at a weighted average price of $12.04 per share, or a nominal value of approximately $51,264,000. Pursuant to the assumption described herein, Friedman Fleischer divested of these shares at a weighted average price of $35.19 per share, or a nominal value of approximately $149,787,000. The difference between the nominal value of Friedman Fleischer’s open market purchases and Friedman Fleischer’s estimated open market sales is approximately $98,522,000.

25 Tempur-Pedic shares closed on March 14, 2008 at $16.86 per share, the trading day immediately prior to the announcement of the Q1 2008 profit warning (March 17, 2008). Friedman Fleischer’s estimated cost base for its open market purchase of approximately 4,257,000 shares was $12.04 per share, representing a 29% discount to the March 14, 2008 close price of $16.86 per share.

26 Source: Friedman Fleischer & Lowe 13D filing (March 31, 2008), Bloomberg, Court Records – Securities and Exchange Commission v. King Chuen Tang (January 3, 2012); http://www.leagle.com/decision/In%20FDCO%2020120103499.

27 Source: Bloomberg. Tempur-Pedic stock closed on December 30, 2011 at $52.53 per share, and closed on December 31, 2012 at $31.49 per share, representing a share price decline of approximately 40%. As of December 31, 2011, Tempur-Pedic’s market capitalization was approximately $3.35 billion, compared to Tempur-Pedic’s market capitalization of $1.88 billion as of December 31, 2012. The change in market capitalization between December 31, 2011 and December 31, 2012 was approximately $1.5 billion.

28 Source: Bloomberg. Mr. McLane purchased approximately 112,000 shares of Tempur-Pedic stock on June 8, 2012 at a weighted average price of $25.02 per share, representing a nominal value of approximately $2,802,000. As of December 30, 2012, Tempur-Pedic stock closed at $31.49 per share, representing a share price appreciation of approximately 26%. As of December 31, 2012, the value of Mr. McLane’s 112,000 shares was approximately $3,527,000, representing an increase of approximately $725,000 in the value of his holdings.

29 Source: Bloomberg. As of June 5, 2012 – the day prior to Tempur-Pedic’s 2Q and FY’12 profit warning – Tempur-Pedic stock closed at $43.67 per share. As of June 6, 2012 – the day of Tempur-Pedic’s 2Q and FY’12 profit warning – Tempur-Pedic stock closed at $22.39 per share, representing an approximately 49% decline in the Company’s share price.

30 Source: Sealy Corporation Schedule 14C Proxy Statement (October 30, 2012).

31 Source: Bloomberg. As of September 26, 2012, the day prior to Tempur-Pedic’s merger announcement with Sealy Corporation, Tempur-Pedic stock closed at $26.78 per share. On September 27, 2012, the day of Tempur-Pedic’s merger announcement with Sealy Corporation, Tempur-Pedic stock closed at $30.64 per share, representing a share price appreciation of approximately 14%.

32 Source: Bloomberg, Sealy Corporation Schedule 14C Proxy Statement (October 30, 2012).

33 Source: Federal Bureau of Investigation, San Francisco Division – “Former CFO and Two Associates Given Prison Sentences in Multi-Million-Dollar Insider Trading Scheme”; http://www.fbi.gov/sanfrancisco/press-releases/2013/former-cfo-and-two-associates-given-prison-sentences-in-multi-million-dollar-insider-trading-scheme.

34 Tempur Sealy Press Release (December 3, 2014); http://investor.tempurpedic.com/releasedetail.cfm?ReleaseID=886030.

35 Source: USSA Annual Report 2014; http://ussa.org/sites/default/files/documents/executive/2014-15/documents/USSA%202014%20Annual%20Report.pdf.

36 Tempur Sealy Press Release (December 3, 2014); http://investor.tempurpedic.com/releasedetail.cfm?ReleaseID=886030.

37 Source: 2014 Proxy Statement (March 27, 2014), 2014 10-K filing. Represents beneficial ownership of Messrs. McLane and Masto calculated as follows: number of shares beneficially owned less shares of common stock which a director has the right to acquire upon the exercise of stock options that were exercisable as of March 10, 2014, or that will become exercisable within sixty days after that date, or other equity instruments which are scheduled to vest and convert into common shares within sixty days after that date, as a percentage of the reported 60,922,491 basic shares outstanding as of February 10, 2015 per the Company’s 10-K filing (February 13, 2015).

38 Ibid. Represents cumulative beneficial ownership of current Board members calculated as follows: number of shares beneficially owned less shares of common stock which a director has the right to acquire upon the exercise of stock options that were exercisable as of March 10, 2014, or that will become exercisable within sixty days after that date, or other equity instruments which are scheduled to vest and convert into common shares within sixty days after that date, as a percentage of the reported 60,922,491 basic shares outstanding as of February 10, 2015 per the Company’s 10-K filing (February 13, 2015).

39 Per H Partners’ Letter to the Tempur Sealy Compensation Committee (February 20, 2014). The estimated value of the proposed 1 million share grant was contingent upon the Company achieving $700 million of EBITDA in 2016, and sustaining this level of earnings in 2017. H Partners estimated that, in such a scenario, Tempur Sealy’s market capitalization may have risen to approximately $9 billion, or $150 per share.

40 Source: Bloomberg. Total return reflects period from May 11, 2010 to February 13, 2015.

41 Source: Six Flags Entertainment, Inc. Press Releases dated March 5, 2010 and October 21, 2014. Operating margins calculated as follows: (Adjusted EBITDA – Capital Expenditures) ÷ Revenue. Capital expenditures are used in lieu of depreciation & amortization due to an inflated level of depreciation and amortization related to Six Flags’ bankruptcy emergence.