DES MOINES, Iowa--(BUSINESS WIRE)--While more than two-thirds of Americans (68 percent) feel that now is a good time to buy a home, many may be reluctant to do so because of uncertainty about qualifying for a mortgage or navigating the homebuying process, according to the recent “How America Views Homeownership” survey by Wells Fargo & Company (NYSE: WFC) and Ipsos Public Affairs.

“Although the homebuying process has changed in many ways in recent years, our survey found Americans still view homeownership as an achievement to be proud of and many believe that now is a good time to buy a home,” said Franklin Codel, head of Wells Fargo Home Mortgage Production. “Our survey also suggests we have an opportunity as lenders, nonprofit agencies and real estate agents to better inform Americans about credit ratings, mortgage costs and housing affordability. This would help demystify the homebuying experience for many consumers.”

Solid Financial Foundation

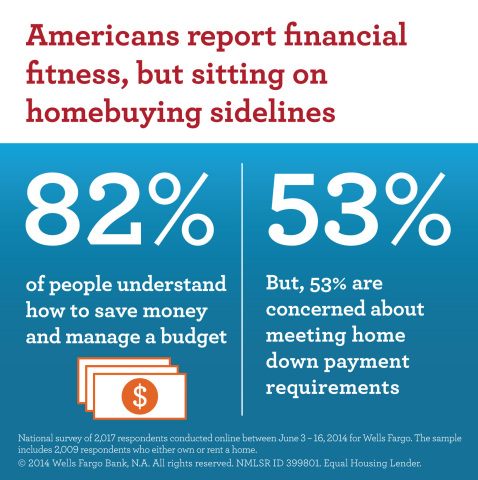

The “How America Views Homeownership” nationwide survey of 2,017 adults also revealed many Americans report that their financial houses are in order, which improves their ability to buy a home. For example:

- 82 percent of respondents said that they understand how to manage their personal finances (how to save, earn and invest money, and work within a budget), and the same proportion, 82 percent, agreed that they generally do not spend beyond their means.

- 63 percent of respondents have a “rainy day fund,” including more than half of the millennial respondents, ages 18-34.

- Most respondents are also careful with their money: Only 27 percent agreed that they tend to spend their money and not think twice about it.

Homebuying: What Consumers Know

Though 74 percent of the survey respondents said they “know and understand” the financial process involved in buying a home, respondents also gave answers that suggest they may not be aware of all their options as prospective homebuyers.

- 30 percent of respondents believe that only individuals with high incomes can obtain a mortgage.

- 64 percent of respondents believe they must have a “very good” credit score to buy a home.

-

While 64 percent of respondents said that they are knowledgeable about

how much of a down payment is needed to buy a home, nearly half (44

percent) also believe that a 20 percent down payment is required. In

reality, a 20 percent down payment is not a requirement on many loan

programs.

- When respondents were asked to list the biggest barriers to owning a home, lacking the funds for a down payment was among the top issues, especially for respondents aged 18-34.

- Nearly half (44 percent) of the respondents said that they know nothing or very little about the closing costs required for buying a home.

- About half of the respondents feel they do not have access to homes that fit their needs financially.

Homebuyer Education Helps People Become Homeowners

“It is important for prospective homebuyers to feel empowered to ask lenders and real estate agents questions about available options, such as down payment assistance or FHA loan programs or VA loans for veterans,” Codel said. “Ninety-five percent of survey respondents said they want to own a home if they don’t already. Informing prospective homebuyers about their options is the first step toward helping them realize their goals.”

Wells Fargo offers many homebuyer education tools within our Online Learning and Planning Center in addition to the following:

- My FirstHomesm: Thousands have visited this free, interactive online tool to help first-time and ready-again homebuyers learn and prepare for the process.

- NeighborhoodLIFTsm and CityLIFTsm: A collaboration between Wells Fargo and NeighborWorks America, these programs help borrowers understand the responsibilities of homeownership and provide down payment assistance to qualified prospective homebuyers. Since 2012, the programs have helped over 7,500 new homeowners and provided over $210 million in down payment assistance.

- Wells Fargo Home Mortgage provides a wide range of conventional and government loans to serve the needs of qualified borrowers with programs focused on the needs of low- to moderate-income and first-time homebuyers. These include: FHA and VA loans, renovation loans in amounts to cover both the home purchase and needed repairs, and regional programs that typically provide lower interest rates and closing costs.

These are some of the findings of an Ipsos Public Affairs poll conducted on behalf of Wells Fargo from June 3-16, 2014. For the survey, a randomly selected representative sample of 2,017 adults were interviewed online. With a sample of this size, the results are considered accurate to within ± 2.18 percentage points, 19 times out of 20, of what they would have been had the entire adult population of the U.S. been polled. The margin of error will be larger within sub-groupings of the survey population. These data were weighted to ensure that the sample's age/sex composition reflects that of the actual U.S. population according to Census information.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a nationwide, diversified, community-based financial services company with $1.6 trillion in assets. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through more than 9,000 locations, 12,500 ATMs, and the internet (wellsfargo.com), and has offices in 36 countries to support customers who conduct business in the global economy. With approximately 265,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 29 on Fortune’s 2014 rankings of America’s largest corporations. Wells Fargo’s vision is to satisfy all our customers’ financial needs and help them succeed financially. Wells Fargo perspectives and stories are also available at blogs.wellsfargo.com and at wellsfargo.com/stories.