FAIRFIELD, Conn.--(BUSINESS WIRE)--GE [NYSE:GE] announced today it has signed a definitive agreement to sell its Appliances business to Electrolux for $3.3 billion. As part of the transaction, GE has entered into a long-term agreement with Electrolux to continue use of the GE Appliances brand. The transaction has been approved by the boards of directors of GE and Electrolux and remains subject to customary closing conditions and regulatory approvals, and is targeted to close in 2015.

“This transaction is consistent with our strategy to be the world’s best infrastructure and technology company,” said GE Chairman and CEO Jeff Immelt. “We are creating a new type of industrial company, one with a balanced, competitively positioned portfolio of infrastructure businesses with strong advantages in technology, growth markets, driving customer outcomes, and a culture of simplification.”

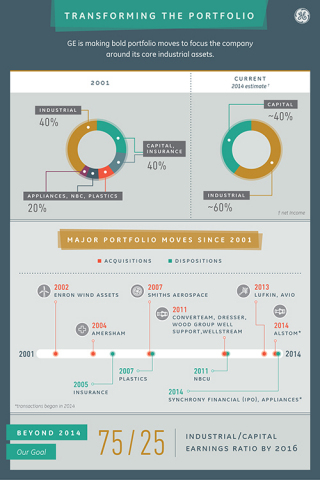

GE has taken significant steps in 2014 to reshape and focus its portfolio. In June, GE’s offer for Alstom’s Power and Grid businesses was accepted by the Alstom board and recommended by the French government. Power & Water is one of GE’s higher growth and margin industrial segments and is core to the future of GE. In August, GE completed the IPO of its North American Retail Finance business, Synchrony Financial, the first step in a planned, staged exit from that business.

The 2014 portfolio activity continues the Company’s longer-term redeployment of capital from non-core assets like media, plastics and insurance to higher-growth, higher-margin businesses in Oil & Gas, Power, Aviation and Healthcare. These moves support the Company’s portfolio strategy to achieve 75% of earnings from its Industrial business by 2016, and along with today’s announcement, highlight GE’s focus on core infrastructure businesses supported by a valuable specialty finance business.

“GE Appliances is a great business and we are proud of the role it has played in GE’s history,” Immelt continued. “Electrolux is the right global business for our customers, consumers and employees. We have greatly strengthened this franchise in the past few years. GE Appliances’ people, valuable home appliances brand, products, distribution, and service capabilities make it a perfect fit with Electrolux and its goal of accelerating growth in the U.S. Like GE Appliances, Electrolux has a nearly 100-year history in home appliances and they share the same principles of quality, innovation and customer value as GE. They are committed to supporting the growth of GE Appliances and value the GE Appliances team and its capabilities.”

“GE Appliances is a well-run operation with strong capabilities in key areas such as R&D, engineering, supply chain and customer service,” said Keith McLoughlin, President and CEO of Electrolux. “We look forward to joining forces with their team of talented and competent people.”

The transaction values GE Appliances at 8.0 times the last 12 months of earnings before interest, taxes, depreciation, and amortization. The sale will generate an approximate after-tax gain of $0.05-$0.07 per share at closing.

Goldman Sachs provided financial advice to GE, and Sidley Austin LLP was GE’s legal advisor.

About GE

GE (NYSE:GE) works on things that matter. The best people and the best technologies taking on the toughest challenges. Finding solutions in energy, health and home, transportation and finance. Building, powering, moving and curing the world. Not just imagining. Doing. GE works. For more information, visit the company’s website at www.ge.com.

Caution Concerning Forward-Looking Statements

This document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” or “would.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include: current economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets; potential market disruptions or other impacts arising in the United States or Europe from developments in sovereign debt situations; the impact of conditions in the financial and credit markets on the availability and cost of General Electric Capital Corporation’s (GECC) funding and on our ability to reduce GECC’s asset levels as planned; the impact of conditions in the housing market and unemployment rates on the level of commercial and consumer credit defaults; pending and future mortgage securitization claims and litigation in connection with WMC, which may affect our estimates of liability, including possible loss estimates; our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; the adequacy of our cash flows and earnings and other conditions which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; GECC’s ability to pay dividends to GE at the planned level, which may be affected by GECC's cash flows and earnings, financial services regulation and oversight, and other factors; our ability to convert pre-order commitments/wins into orders; the price we realize on orders since commitments/wins are stated at list prices; the level of demand and financial performance of the major industries we serve, including, without limitation, air and rail transportation, power generation, oil and gas production, real estate and healthcare; the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of financial services regulation; our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; our success in completing announced transactions and integrating acquired businesses; adverse market conditions, timing of and ability to obtain required bank regulatory approvals, or other factors relating to us or Synchrony Financial could prevent us from completing the Synchrony IPO and split-off as planned; our ability to complete the proposed transactions and alliances with Alstom and realize anticipated earnings and savings; the impact of potential information technology or data security breaches; and numerous other matters of national, regional and global scale, including those of a political, economic, business and competitive nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.