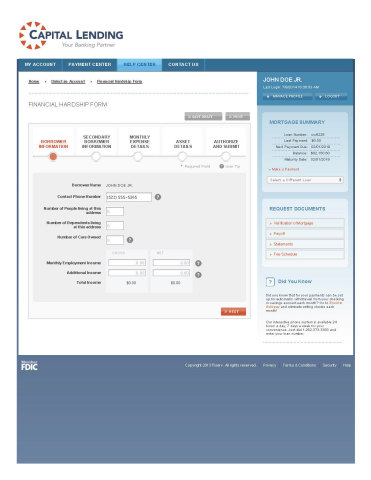

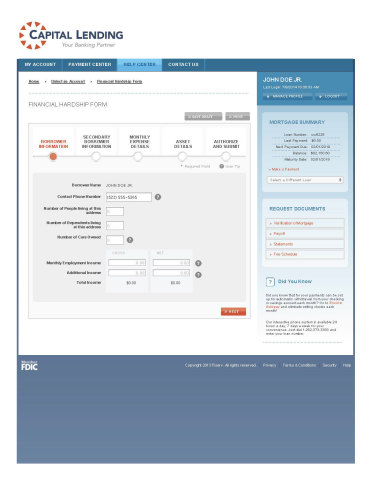

DEARBORN, Mich.--(BUSINESS WIRE)--ChannelNet, in partnership with Fiserv Inc. (NASDAQ: FISV), has launched unique functionality that gives borrowers facing hardship the power to restructure their own installment loan or mortgage payment. This first-to-market feature is only one aspect of the newly enriched LoanLink™ offering from Fiserv.

In addition to modifying their loan repayment, borrowers also are able to make payments online, receive loan payoff information, view transaction history and update personal and financial information related to their loans.

LoanLink, built on ChannelNet’s patented and scalable SiteBuilder™ software, enables Fiserv lending institution clients to provide their borrowers with self-service tools for mortgage, installment and revolving credit accounts. The consumer adoption rate for one Fiserv client is higher than average, with 42 percent of its customers actively using LoanLink within two months.

Paula Tompkins, CEO and founder of ChannelNet, says about the success, “The two most important things to serving consumers are understanding a person’s total financial needs and getting the design of online offerings right. Collaborating with Fiserv, we evaluated every design decision, from functionality to visual design, in terms of what best serves the consumer.”

“For lenders, LoanLink provides complete control over their content and delivers a number of efficiencies, but it’s what the solution lets consumers do for themselves that sets it apart,” says Monica Orluk, director of sales engineering, Lending Solutions, Fiserv.

Orluk explains, “Overall delinquency rates are improving, but many people are still experiencing financial hardship due to underemployment and other factors. Since most consumers do banking, bill paying, shopping, and more online, it makes sense to let them manage their own financial hardships online too.”

According to Fiserv data, when consumers modify their loans online, the average work-out time is reduced to three weeks instead of the typical two months. There are cost justifications as well. “Just in postage, lenders save an estimated $22 per modification,” says Orluk.

Orluk feels one of LoanLink’s big differentiators is in the consumer experience. “The seamless integration of ChannelNet and Fiserv technology enables consumers to navigate loan options easily, which enhances their overall experience and ultimately improves their relationship with the lender.”

Additional resources:

- Fiserv Inc. - www.fiserv.com or http://www.lending.fiserv.com/loan_servicing.asp

- LoanServ and LoanLink from Fiserv - https://www.fiserv.com/processing-services/lending-solutions/loanserv.aspx

About ChannelNet

ChannelNet is a leader and a pioneer in delivering digital customer acquisition, retention and conquest services that integrate a multi-channel sales environment. The company specializes in digital marketing and sales solutions for corporations with retail outlets. Using software-as-a-service (SAAS), its experts connect leading automotive, financial services, home improvement and retail companies with their customers to sell products and services through local channels, including personalized microsites. The privately-held company, founded more than 25 years ago, is based in Dearborn, Michigan. It has a Western U.S. office in Sausalito, California. For more information, visit www.channelnet.com.