PITTSBURGH--(BUSINESS WIRE)--EQT Corporation (NYSE: EQT) and NextEra US Gas Assets, LLC, an indirect, wholly owned subsidiary of NextEra Energy, Inc (NYSE: NEE) today announced the commencement of a non-binding open season for the Mountain Valley Pipeline project, which is expected to connect Marcellus and Utica natural gas supply to demand markets in the Southeast region of the United States. The companies also announced the signing of a letter of intent to form a joint venture that is expected to construct and own the Mountain Valley Pipeline. Under the letter of intent, EQT is expected to, through one or more of its affiliates, including EQT Midstream Partners, LP (NYSE: EQM), operate the pipeline and own a majority interest in the joint venture.

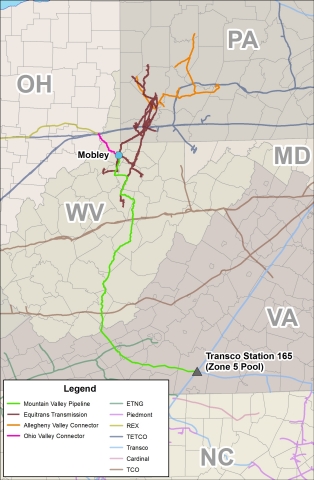

Subject to FERC approval, the 330-mile Mountain Valley Pipeline project will extend the Equitrans transmission system from Wetzel County, West Virginia; and travel south to its expected primary delivery point, Transcontinental Gas Pipeline Company’s (Transco) Zone 5 compressor station 165 in Pittsylvania County, Virginia. In addition to the primary delivery point, the Mountain Valley Pipeline has numerous potential interconnects with pipelines and processing facilities; and shippers will have the option to request a project extension to delivery points further south into North Carolina. The Mountain Valley Pipeline is expected to initially provide at least two billion cubic feet per day of firm transmission capacity. Including EQT, the open season has commitments from two foundation shippers that, combined, have agreed to one Bcf per day of firm transmission capacity through 20-year contracts on the Mountain Valley Pipeline. Delivery to Transco station 165 is expected to be in service by the fourth quarter of 2018.

“By leveraging our existing asset footprint and extensive pipeline network, this project will provide Marcellus and Utica producers a unique opportunity to transport their growing natural gas production to the southeast, one of the nation’s fastest growing demand markets,” stated Randy Crawford, senior vice president, EQT Corporation; and chief operating officer, EQT Midstream Partners.

“This is an exciting opportunity to invest in a high-quality natural gas pipeline that we expect to be fully contracted for the next 20 years,” said TJ Tuscai, president, NextEra US Gas Assets. “This project is expected to support production growth and physical takeaway capability in the Marcellus and Utica and provide new markets to producers and shippers in the region. In addition, customers in the southeast United States should benefit from a new reliable supply source.”

The open season was filed by Equitrans, LP (Equitrans), a subsidiary of EQT Midstream Partners; however, the ultimate EQT affiliate to own and/or operate the pipeline will be determined at a future date. EQT is the general partner of and also owns a 32% limited partner interest in EQT Midstream Partners. The open season document can be found at www.eqtmidstreampartners.com.

About EQT Corporation:

EQT

Corporation is an integrated energy company with emphasis on Appalachian

area natural gas production, gathering, and transmission. EQT is the

general partner and significant equity owner of EQT Midstream Partners,

LP. With more than 125 years of experience, EQT continues to be a leader

in the use of advanced horizontal drilling technology – designed to

minimize the potential impact of drilling-related activities and reduce

the overall environmental footprint. Through safe and responsible

operations, the Company is committed to meeting the country’s growing

demand for clean-burning energy, while continuing to provide a rewarding

workplace and enrich the communities where its employees live and work.

Company shares are traded on the New York Stock Exchange as EQT.

Visit EQT Corporation at www.EQT.com.

About EQT Midstream Partners:

EQT

Midstream Partners, LP is a growth-oriented limited partnership formed

by EQT Corporation to own, operate, acquire, and develop midstream

assets in the Appalachian Basin. The Partnership provides midstream

services to EQT Corporation and third-party companies through its

strategically located transmission, storage, and gathering systems that

service the Marcellus and Utica regions. The Partnership owns 700 miles

and operates an additional 200 miles of FERC-regulated interstate

pipelines; and also owns more than 1,600 miles of high- and low-pressure

gathering lines.

Visit EQT Midstream Partners, LP at www.eqtmidstreampartners.com.

About NextEra Energy, Inc.

NextEra

Energy, Inc. (NYSE: NEE) is a leading clean energy company with

consolidated revenues of approximately $15.1 billion, approximately

42,500 megawatts of generating capacity, and approximately 13,900

employees in 26 states and Canada as of year-end 2013. Headquartered in

Juno Beach, Fla., NextEra Energy’s principal subsidiaries are Florida

Power & Light Company, which serves approximately 4.7 million customer

accounts in Florida and is one of the largest rate-regulated electric

utilities in the United States, and NextEra Energy Resources, LLC, which

together with its affiliated entities is the largest generator in North

America of renewable energy from the wind and sun. Through its

subsidiaries, NextEra Energy generates clean, emissions-free electricity

from eight commercial nuclear power units in Florida, New Hampshire,

Iowa and Wisconsin. NextEra Energy has been recognized often by third

parties for its efforts in sustainability, corporate responsibility,

ethics and compliance, and diversity, and has been named No. 1 overall

among electric and gas utilities on Fortune’s list of “World’s Most

Admired Companies” for eight consecutive years, which is an

unprecedented achievement in its industry.

EQT Cautionary Statements

Consummation of the joint

venture contemplated by the letter of intent is subject to finalizing

definitive documentation and receipt of customary approvals, including

board approval from each of the parties, including EQT Midstream

Partners, LP.

Disclosures in this press release contain certain forward-looking statements. Statements that do not relate strictly to historical or current facts are forward-looking. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include the expectations of plans, strategies, and objectives, including guidance regarding the expected terms and structure of the joint venture, including the EQT affiliates to own and/or operate the pipeline, and the expected length, capacity, delivery points and in service date of the pipeline. These statements involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. EQT has based these forward-looking statements on current expectations and assumptions about future events. While EQT considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, most of which are difficult to predict and many of which are beyond EQT's control. With respect to the proposed pipeline project and joint venture, these risks and uncertainties include, among others, the ability to obtain regulatory permits and approvals for the pipeline, the ability to secure customer contracts for the pipeline, the availability of skilled labor, equipment and materials, and risks that the conditions to closing the joint venture may not be satisfied. Additional risks and uncertainties that may affect the operations, performance and results of EQT's business and forward-looking statements include, but are not limited to, those set forth under Item 1A, "Risk Factors" of EQT's Form 10-K for the year ended December 31, 2013, as updated by any subsequent Form 10-Qs.

Any forward-looking statement applies only as of the date on which such statement is made and EQT does not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise.

NextEra Cautionary Statements and Risk Factors That May Affect

Future Results

This press release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are not statements of historical facts, but instead represent

the current expectations of NextEra Energy, Inc. (together with its

subsidiaries, NextEra Energy) regarding future operating results and

other future events, many of which, by their nature, are inherently

uncertain and outside of NextEra Energy's control. Forward-looking

statements in this press release include, among others, statements

concerning adjusted earnings per share expectations and future operating

performance. In some cases, you can identify the forward-looking

statements by words or phrases such as “will,” “may result,” “expect,”

“anticipate,” “believe,” “intend,” “plan,” “seek,” “aim,” “potential,”

“projection,” “forecast,” “predict,” “goals,” “target,” “outlook,”

“should,” “would” or similar words or expressions. You should not place

undue reliance on these forward-looking statements, which are not a

guarantee of future performance. The future results of NextEra Energy

and its business and financial condition are subject to risks and

uncertainties that could cause actual results to differ materially from

those expressed or implied in the forward-looking statements, or may

require it to limit or eliminate certain operations. These risks and

uncertainties include, but are not limited to, the following: effects of

extensive regulation of NextEra Energy's business operations; inability

of NextEra Energy to recover in a timely manner any significant amount

of costs, a return on certain assets or an appropriate return on capital

through base rates, cost recovery clauses, other regulatory mechanisms

or otherwise; impact of political, regulatory and economic factors on

regulatory decisions important to NextEra Energy; disallowance of cost

recovery based on a finding of imprudent use of derivative instruments;

effect of any reductions to or elimination of governmental incentives

that support renewable energy projects or the imposition of additional

taxes or assessments on renewable energy; impact of new or revised laws,

regulations or interpretations or other regulatory initiatives on

NextEra Energy; effect on NextEra Energy of potential regulatory action

to broaden the scope of regulation of over-the-counter (OTC) financial

derivatives and to apply such regulation to NextEra Energy; capital

expenditures, increased operating costs and various liabilities

attributable to environmental laws, regulations and other standards

applicable to NextEra Energy; effects on NextEra Energy of federal or

state laws or regulations mandating new or additional limits on the

production of greenhouse gas emissions; exposure of NextEra Energy to

significant and increasing compliance costs and substantial monetary

penalties and other sanctions as a result of extensive federal

regulation of its operations; effect on NextEra Energy of changes in tax

laws and in judgments and estimates used to determine tax-related asset

and liability amounts; impact on NextEra Energy of adverse results of

litigation; effect on NextEra Energy of failure to proceed with projects

under development or inability to complete the construction of (or

capital improvements to) electric generation, transmission and

distribution facilities, gas infrastructure facilities or other

facilities on schedule or within budget; impact on development and

operating activities of NextEra Energy resulting from risks related to

project siting, financing, construction, permitting, governmental

approvals and the negotiation of project development agreements; risks

involved in the operation and maintenance of electric generation,

transmission and distribution facilities, gas infrastructure facilities

and other facilities; effect on NextEra Energy of a lack of growth or

slower growth in the number of customers or in customer usage; impact on

NextEra Energy of severe weather and other weather conditions; threats

of terrorism and catastrophic events that could result from terrorism,

cyber-attacks or other attempts to disrupt NextEra Energy's business or

the businesses of third parties; inability to obtain adequate insurance

coverage for protection of NextEra Energy against significant losses and

risk that insurance coverage does not provide protection against all

significant losses; risk of increased operating costs resulting from

unfavorable supply costs necessary to provide full energy and capacity

requirement services; inability or failure to manage properly or hedge

effectively the commodity risk within its portfolio; potential

volatility of NextEra Energy's results of operations caused by sales of

power on the spot market or on a short-term contractual basis; effect of

reductions in the liquidity of energy markets on NextEra Energy's

ability to manage operational risks; effectiveness of NextEra Energy's

risk management tools associated with its hedging and trading procedures

to protect against significant losses, including the effect of

unforeseen price variances from historical behavior; impact of

unavailability or disruption of power transmission or commodity

transportation facilities on sale and delivery of power or natural gas;

exposure of NextEra Energy to credit and performance risk from

customers, hedging counterparties and vendors; failure of counterparties

to perform under derivative contracts or of requirement for NextEra

Energy to post margin cash collateral under derivative contracts;

failure or breach of NextEra Energy's information technology systems;

risks to NextEra Energy's retail businesses from compromise of sensitive

customer data; losses from volatility in the market values of derivative

instruments and limited liquidity in OTC markets; impact of negative

publicity; inability to maintain, negotiate or renegotiate acceptable

franchise agreements; increasing costs of health care plans; lack of a

qualified workforce or the loss or retirement of key employees;

occurrence of work strikes or stoppages and increasing personnel costs;

NextEra Energy's ability to successfully identify, complete and

integrate acquisitions, including the effect of increased competition

for acquisitions; environmental, health and financial risks associated

with ownership and operation of nuclear generation facilities; liability

of NextEra Energy for significant retrospective assessments and/or

retrospective insurance premiums in the event of an incident at certain

nuclear generation facilities; increased operating and capital

expenditures at nuclear generation facilities resulting from orders or

new regulations of the Nuclear Regulatory Commission; inability to

operate any owned nuclear generation units through the end of their

respective operating licenses; liability for increased nuclear licensing

or compliance costs resulting from hazards, and increased public

attention to hazards, posed to owned nuclear generation facilities;

risks associated with outages of owned nuclear units; effect of

disruptions, uncertainty or volatility in the credit and capital markets

on NextEra Energy's ability to fund its liquidity and capital needs and

meet its growth objectives; inability to maintain current credit

ratings; impairment of liquidity from inability of creditors to fund

their credit commitments or to maintain their current credit ratings;

poor market performance and other economic factors that could affect

NextEra Energy's defined benefit pension plan's funded status; poor

market performance and other risks to the asset values of nuclear

decommissioning funds; changes in market value and other risks to

certain of NextEra Energy's investments; effect of inability of NextEra

Energy subsidiaries to pay upstream dividends or repay funds to NextEra

Energy or of NextEra Energy's performance under guarantees of subsidiary

obligations on NextEra Energy's ability to meet its financial

obligations and to pay dividends on its common stock; and effect of

disruptions, uncertainty or volatility in the credit and capital markets

of the market price of NextEra Energy's common stock. NextEra Energy

discusses these and other risks and uncertainties in its annual report

on Form 10-K for the year ended December 31, 2013 and other SEC filings,

and this press release should be read in conjunction with such SEC

filings made through the date of this press release. The forward-looking

statements made in this press release are made only as of the date of

this press release and NextEra Energy undertakes no obligation to update

any forward-looking statements.