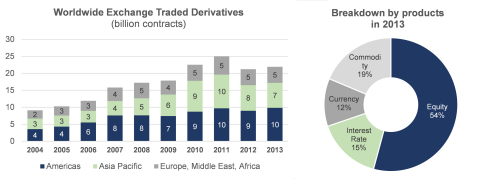

LONDON--(BUSINESS WIRE)--In 2013, the number of Exchange Traded Derivatives (ETD) worldwide increased by 3% to 22 billion contracts, according to statistics compiled by the World Federation of Exchanges (WFE).

The WFE, which annually conducts a survey on derivative markets, found that in 2013, 22 billion derivative contracts (12 billion futures and 10 billion options) were traded on exchanges worldwide – a 685 million increase above derivatives contracts traded in 2012. The complete WFE analysis of global derivatives markets will be available in May 2013.

Other highlights of the preliminary WFE derivatives report regarding exchange traded derivatives (ETD):

- Equity derivatives: The drop in equity derivatives (-5.3%) is mainly explained by the size changing of the KRX (Korea Exchange) KOSPI 200 contracts, the weight of which is very significant. The overall 2013 equity derivatives volume increased by 3.2% when those contracts are excluded from the statistics.

- Interest rate derivatives: The volume of Interest Rate options and futures traded increased significantly (+13%) after the sharp decline observed in 2012 (-15%). Both Short Term and Long Term segments experienced vivid growth.

- Currency derivatives: Currency derivatives increased in volume by 2.2% in 2013.

- Commodity derivatives: Commodity derivatives (+23%) saw the greatest increase in volume in 2013, largely as a result of two major factors: 1.) the transfer of cleared OTC energy swaps to futures in the United States by the InterContinental Exchange (ICE) in 2012 in anticipation of the final Dodd-Frank regulatory requirements, and 2.) the continuing sharp increase in volume at Mainland Chinese Exchanges (+40%). The United States and Mainland China accounted for 79% of the global volumes in 2013.

- Other derivatives: The “other derivatives” category comprises a wide range of products including Volatility Index options, Exotic options and futures, REIT derivatives, Dividend and Dividend Index derivatives or CFDs. Volumes in this category increased sharply (+38.5%) in 2013, highlighting the ongoing innovation in derivatives offered by Exchanges.

|

Volume and Growth Rate of Derivative Contracts Traded on Regulated Exchanges |

||||

|

(million contracts) |

||||

| 2013 | 2012 | 2013/2012 | ||

| Single Stock Options | 4,074 | 3,990 | 2.1% | |

| Single Stock Futures | 947 | 1,024 | -7.5% | |

| Stock Index Options | 2,780 | 3,637 | -23.6% | |

| Stock Index Futures | 2,333 | 2,243 | 4.0% | |

| ETF Options | 1,482 | 1,375 | 7.8% | |

| ETF Futures | 0 | 0 | -3.8% | |

| Total Equity | 11,617 | 12,270 | -5.3% | |

| STIR Options | 348 | 379 | -8.1% | |

| STIR Futures | 1,437 | 1,224 | 17.4% | |

| LTIR Options | 211 | 171 | 23.1% | |

| LTIR Futures | 1,335 | 1,161 | 15.0% | |

| Total Interest Rate | 3,330 | 2,934 | 13.5% | |

| Currency Options | 403 | 288 | 40.1% | |

| Currency Futures | 2,081 | 2,143 | -2.9% | |

| Total Currency | 2,485 | 2,431 | 2.2% | |

| Commodity Options | 224 | 192 | 16.5% | |

| Commodity Futures | 3,776 | 3,051 | 23.8% | |

| Other Commodity Derivatives | 1 | 0 | 113.3% | |

| Total Commodity | 4,001 | 3,243 | 23.3% | |

| Other Options | 188 | 116 | 61.5% | |

| Other Futures | 180 | 121 | 48.9% | |

| Other Derivatives | 102 | 102 | 0.0% | |

| Total Other derivatives | 469 | 339 | 38.5% | |

| Grand Total | 21,902 | 21,217 | 3.2% | |

| Americas | 9,820 | 8,955 | 9.7% | |

| Asia Pacific | 7,357 | 7,561 | -2.7% | |

| Europe, Africa, Middle East | 4,725 | 4,701 | 0.5% | |

| Grand Total | 21,902 | 21,217 | 3.2% | |

|

Source: WFE IOMA Survey – Including OTC trades registered on the exchanges |

||||

Excluding Kospi 200 options, the highest increase in exchange traded derivatives volume in 2013 was observed in Asia Pacific region (+13.2%), followed by Americas (+9.7%) and Europe, Africa, and Middle East (+0.5%).

ABOUT THE WFE:

The World Federation of Exchanges is the trade association for the operators of regulated financial exchanges. With 60 members from around the globe, the WFE develops and promotes standards in markets, supporting reform in the regulation of OTC derivatives markets, international cooperation and coordination among regulators. WFE exchanges are home to more than 45,000 listed companies.

For additional information please contact Stephanie DiIorio, 212-754-5448, sdiiorio@intermarket.com.