TOKYO--(BUSINESS WIRE)--Renesas Electronics Corporation (TSE: 6723, “Renesas Electronics”), a premier provider of advanced semiconductor solutions, today announced that, under the approval of Renesas Electronics’ Board of Directors, it will reorganize its manufacturing-related group companies in Japan by means of absorption-type separations and absorption-type mergers, with Renesas Electronics and its subsidiaries as the affected parties (the “reorganization”)

1. Objectives of the reorganization of the manufacturing-related group companies

As announced in the press releases, “Renesas Electronics Shows Direction of Renesas Group” dated August 2, 2013, and “Renesas Electronics Issues New Business Direction Presentation ‘Reforming Renesas’” dated October 30, 2013, with an aim of realizing a company that excels in the global arena and contributes to all aspects of society, Renesas Electronics is implementing a reform plan, to be achieved by promoting growth strategies while pursuing profitability with a two-digit operating profit ratio as its target for the fiscal year ending March 31, 2017.

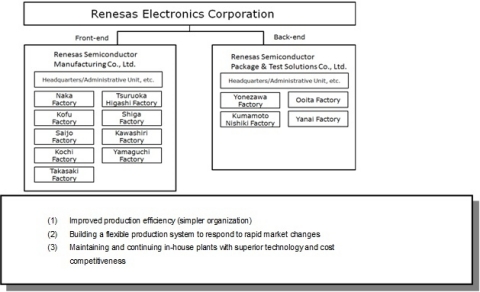

As part of this effort, the semiconductor manufacturing business of the Renesas Group is moving forward with reforms with a consistent focus on profitability and promotion of autonomous management as its hallmarks. Specifically, the semiconductor manufacturing business is undergoing structural reforms based on (1) boosting production efficiency, (2) building a flexible manufacturing system to respond to rapid market changes, and (3) maintaining and continuing in-house plants with advanced technologies and cost competitiveness.

In line with these policies, the semiconductor manufacturing business, etc. at the front-end and back-end manufacturing sites will undergo consolidation and the reorganization of (manufacturing-related) group companies, with Renesas Electronics and its subsidiaries in Japan as the affected parties. The goals of this undertaking are speeding up decision-making by simplifying and improving the efficiency of the organization, uniformity of operation and overall optimization through sharing of technology and expertise as well as establishment of common benchmarks and regulations, clarification of responsibility and authority as well as a shift in consciousness toward a focus on profitability through the setting up of independent companies, and further improvement of QCD through specialization in manufacturing tasks.

The reorganization aims to boost production efficiency to the utmost and, while maintaining a high production ratio, boost cost competitiveness through overall optimization and improved efficiency, thereby realizing a manufacturing system capable of generating profits.

2. Outline of the reorganization of manufacturing-related group companies

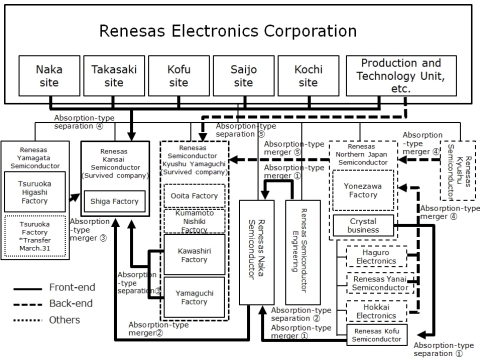

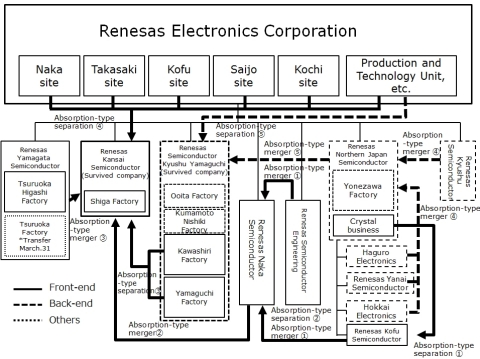

[Reorganization of front-end production business]

As shown in figure-1 below, the reorganization to be implemented on April 1, 2014, will involve the front-end production business of Renesas Electronics, the front-end production businesses of its subsidiaries in Japan. It will involve absorption-type separations and absorption-type mergers, with Renesas Kansai Semiconductor Co., Ltd. (Renesas Kansai Semiconductor) as the successor company. The specifics are as follows:

① In an absorption-type separation, the crystal business of Renesas Northern Japan Semiconductor, Inc. (Renesas Northern Japan Semiconductor) will be spun off and absorbed by Renesas Kofu Semiconductor, Co., Ltd. (Renesas Kofu Semiconductor), a wholly-owned subsidiary of Renesas Northern Japan Semiconductor (absorption-type separation ①).

② After the implementation of ①, all the shares of Renesas Kofu Semiconductor will be spun off from Renesas Northern Japan Semiconductor and absorbed by Renesas Naka Semiconductor Co., Ltd. (Renesas Naka Semiconductor) in an absorption-type separation (absorption-type separation ②). As a result, Renesas Kofu Semiconductor will become a wholly-owned subsidiary of Renesas Naka Semiconductor.

③ After the implementation of ②, Renesas Naka Semiconductor, Renesas Semiconductor Engineering Corp. (Renesas Semiconductor Engineering), and Renesas Kofu Semiconductor will undergo an absorption-type merger, with Renesas Naka Semiconductor as the surviving company and Renesas Semiconductor Engineering and Renesas Kofu Semiconductor as the absorbed companies (absorption-type merger ①).

④ After the implementation of ① to ③, the semiconductor front-end production business of Renesas Semiconductor Kyushu Yamaguchi Co., Ltd. (Renesas Semiconductor Kyushu Yamaguchi) will be spun off and absorbed by Renesas Kansai Semiconductor In an absorption-type separation, (absorption-type separation ③).

⑤ After the implementation of ① to ④, Renesas Kansai Semiconductor and Renesas Naka Semiconductor will undergo an absorption-type merger, with Renesas Kansai Semiconductor as the surviving company and Renesas Naka Semiconductor as the absorbed company (absorption-type merger ②).

⑥ After the implementation of ⑤, the semiconductor front-end production business of Renesas Electronics will be spun off and absorbed by Renesas Kansai Semiconductor in an absorption-type separation (absorption-type separation ④).

⑦ After the implementation of ⑥, Renesas Kansai Semiconductor and Renesas Yamagata Semiconductor Co., Ltd. (Renesas Yamagata Semiconductor) will undergo an absorption-type merger, with Renesas Kansai Semiconductor as the surviving company and Renesas Yamagata Semiconductor as the absorbed company (absorption-type merger ③).

⑧ After the implementation of ⑦, the company name of Renesas Kansai Semiconductor will be changed to Renesas Semiconductor Manufacturing Co., Ltd., and the address of the head office will be changed to Hitachinaka, Ibaraki Pref.

[Reorganization of back-end production business]

As shown in figure-1 below, the reorganization to be implemented on April 1, 2014, will involve the back-end production business of Renesas Electronics and the back-end production businesses of its domestic subsidiaries, etc. It will involve an absorption-type separation and absorption-type mergers, with Renesas Semiconductor Kyushu Yamaguchi as the successor company. The specifics are as follows:

⑨ After the implementation of ②, Renesas Northern Japan Semiconductor; Renesas Yanai Semiconductor, Inc. (Renesas Yanai Semiconductor), Haguro Electronics Co., Ltd. (Haguro Electronics), and Hokkai Electronics Co., Ltd. (Hokkai Electronics), which are wholly-owned subsidiaries of Renesas Northern Japan Semiconductor; and Renesas Kyushu Semiconductor Corp. (Renesas Kyushu Semiconductor), a wholly-owned subsidiary of Renesas Electronics, will undergo an absorption-type merger, with Renesas Northern Japan Semiconductor as the surviving company and Haguro Electronics, Renesas Yanai Semiconductor, Hokkai Electronics, and Renesas Kyushu Semiconductor as the absorbed companies (absorption-type merger ④).

⑩ After the implementation of ⑥, the semiconductor back-end production business of Renesas Electronics will be spun off and absorbed by Renesas Semiconductor Kyushu Yamaguchi in an absorption-type separation (absorption-type separation ⑤).

⑪ After the implementation of ⑨ and ⑩, Renesas Semiconductor Kyushu Yamaguchi and Renesas Northern Japan Semiconductor will undergo an absorption-type merger, with Renesas Semiconductor Kyushu Yamaguchi as the surviving company and Renesas Northern Japan Semiconductor as the absorbed company (absorption-type merger ⑤).

⑫ After the implementation of ⑪, the company name of Renesas Semiconductor Kyushu Yamaguchi will be changed to Renesas Semiconductor Package & Test Solutions Co., Ltd., and the address of the head office will be changed to Takasaki, Gunma Pref.

3. Absorption-type separation with Renesas Northern Japan Semiconductor as transferor and Renesas Kofu Semiconductor as successor

3-1. Summary of absorption-type separation

3-1-1. Schedule of absorption-type separation

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

3-1-2. Method of absorption-type separation

Refer to ① in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

3-1-3. Allocations associated with absorption-type separation

No allocations of stock, funds, etc., are associated with this absorption-type separation.

3-1-4. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights.

3-1-5. Rights and obligations transferred to the successor company

On the occasion of this absorption-type separation, Renesas Kofu Semiconductor will inherit from Renesas Northern Japan Semiconductor such assets, liabilities, contractual standing, and other rights and obligations pertaining to the business activities covered by the separation as are stipulated in the absorption-type separation agreement.

3-1-6. Ability to fulfill obligations

Renesas Electronics concludes that Renesas Kofu Semiconductor shall have abilities to fulfill all their debt obligations for which it is responsible.

3-2. Overview of parties to absorption-type separation (Fiscal year ended March 31, 2013)

| Successor in absorption-type separation | Transferor in absorption-type separation | |||

|

① Company Name |

Renesas Kofu Semiconductor, Co., Ltd. | Renesas Northern Japan Semiconductor, Inc. | ||

|

② Address |

4617, Nishiyahata, Kai, Yamanashi Pref. | 2-14-1, Kyobashi, Chuo-Ku, Tokyo | ||

|

③ Representative |

Takanobu Ihara, President | Masashi Mori, President | ||

|

④ Major Operations |

- IT solution business

- Semiconductor wafer testing business - Facility services business |

- Semiconductor back-end production and contact manufacturing | ||

|

⑤ Capital |

90 million yen |

2.55 billion yen |

||

|

⑥ Established |

May 1, 1986 | October 1, 2002 | ||

|

⑦ Shares Issued |

1,800 | 6,648,000 | ||

|

⑧ Fiscal Term |

March 31 | March 31 | ||

|

⑨ Major Stockholder and Ownership Ratios |

Renesas Northern Japan Semiconductor, Inc.: 100% | Renesas Electronics Corporation: 100% | ||

|

⑩ Net Assets |

1,095 million yen | 7,720 million yen | ||

|

⑪ Total Assets |

1,507 million yen | 19,297 million yen | ||

|

⑫ Net Assets per Share |

608,447 yen | 1,161.27 yen | ||

|

⑬ Net Sales |

2,761 million yen | 31,915 million yen | ||

|

⑭ Operating Income (Loss) |

297 million yen | 1,379 million yen | ||

|

⑮ Ordinary Income (Loss) |

309 million yen |

1,991 million yen | ||

|

⑯ Net Income (Loss) |

216 million yen | 189 million yen | ||

|

⑰ Net Income (Loss) per Share |

120,435 yen | 28.42 yen |

4. Absorption-type separation with Renesas Northern Japan Semiconductor as transferor and Renesas Naka Semiconductor as successor, and absorption-type merger with Renesas Kofu Semiconductor and Renesas Semiconductor Engineering as absorbed companies and Renesas Naka Semiconductor as surviving company

4-1. Summary of absorption-type separation and absorption-type merger

4-1-1. Schedule of absorption-type separation

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

4-1-2. Schedule of absorption-type merger

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

4-1-3. Method of absorption-type separation and absorption-type merger

Refer to ② and ③ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

4-1-4. Allocations associated with absorption-type separation and absorption-type merger

No allocations of stock, funds, etc., are associated with this absorption-type separation and absorption-type merger.

4-1-5. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights

4-1-6. Rights and obligations transferred to the successor company in absorption-type separation and surviving company in absorption-type merger

As the successor company in the absorption-type separation, the assets that Renesas Naka Semiconductor will inherit shall consist of all 1,800 shares in Renesas Kofu Semiconductor, which are currently held by Renesas Northern Japan Semiconductor, and Renesas Naka Semiconductor will inherit no other liabilities, agreements, or other rights and obligations.

In addition, as the surviving company in the absorption-type merger, after inheriting all shares in Renesas Kofu Semiconductor from Renesas Northern Japan Semiconductor, as mentioned above, Renesas Naka Semiconductor will inherit all the rights and obligations of Renesas Semiconductor Engineering and Renesas Kofu Semiconductor.

4-1-7. Ability to fulfill obligations

Renesas Electronics concludes that the successor company in the absorption-type separation and the surviving company in the absorption-type merger shall have abilities to fulfill all their debt obligations for which it is responsible.

4-2. Overview of parties to absorption-type separation and absorption-type merger (Fiscal year ended March 31, 2013)

(Note) For information on Renesas Northern Japan Semiconductor and Renesas Kofu Semiconductor, refer to “Overview of parties to absorption-type separation” in section 3.2 on page 7.

| Successor in absorption-type separation and surviving company in absorption-type merger | Absorbed company in absorption-type merger | |||

|

① Company Name |

Renesas Naka Semiconductor Co., Ltd. | Renesas Semiconductor Engineering Corp. | ||

|

② Address |

730, Horiguchi, Hitachinaka, Ibaraki Pref. | 4-1-3, Mizuhara, Itami, Hyogo Pref. | ||

|

③ Representative |

Takashi Araki, President | Takashi Aoyagi, President | ||

|

④ Major Operations |

- Processing and inspection of semiconductor devices

- Chemical and physical analysis - Other work related to the above |

- Semiconductor engineering work | ||

|

⑤ Capital |

50 million yen |

30 million yen |

||

|

⑥ Established |

June 1999 | September 1, 1988 | ||

|

⑦ Shares Issued |

1,000 | 600 | ||

|

⑧ Fiscal Term |

March 31 | March 31 | ||

|

⑨ Major Stockholders and Ownership Ratios |

Renesas Electronics Corporation: 100% | Renesas Electronics Corporation: 100% | ||

|

⑩ Net Assets |

672 million yen | 267 million yen | ||

|

⑪ Total Assets |

2,940 million yen | 2,381 million yen | ||

|

⑫ Net Assets per Share |

672,612 yen | 445,184 yen | ||

|

⑬ Net Sales |

8,314 million yen | 3,790 million yen | ||

|

⑭ Operating Income (Loss) |

395 million yen | 563 million yen | ||

|

⑮ Ordinary Income (Loss) |

392 million yen | 571 million yen | ||

|

⑯ Net Income (Loss) |

319 million yen | 412 million yen | ||

|

⑰ Net Income (Loss) per Share |

319,045.44 yen | 685,846 yen |

4-3. Overview of surviving company following the absorption-type merger

| Surviving company in absorption-type merger | ||

|

① Company Name |

Renesas Naka Semiconductor Co., Ltd. | |

|

② Address |

730, Horiguchi, Hitachinaka, Ibaraki Pref. | |

|

③ Representative |

Takashi Araki, President | |

|

④ Major Operation |

- Processing and inspection of semiconductor devices

- Chemical and physical analysis - Other work related to the above - Semiconductor engineering work |

|

|

⑤ Capital |

50 million yen | |

|

⑥ Fiscal Term |

March 31 |

5. Absorption-type separation with Renesas Semiconductor Kyushu Yamaguchi as transferor company and Renesas Kansai Semiconductor as successor company

5-1. Summary of absorption-type separation

5-1-1. Schedule of absorption-type separation

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

5-1-2. Method of absorption-type separation

Refer to ④ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

5-1-3. Allocations associated with absorption-type separation

No allocations of stock, funds, etc., are associated with this absorption-type separation.

5-1-4. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights.

5-1-5. Rights and obligations transferred to the successor company in absorption-type separation

On the occasion of this absorption-type separation, Renesas Kansai Semiconductor will inherit from Renesas Semiconductor Kyushu Yamaguchi such assets, liabilities, contractual standing, and other rights and obligations pertaining to the business activities covered by the separation as are stipulated in the absorption-type separation agreement.

5-1-6. Ability to fulfill obligations

Renesas Electronics concludes that the successor company in the absorption-type separation shall have abilities to fulfill all their debt obligations for which it is responsible.

5-2. Overview of parties to absorption-type separation (Fiscal year ended March 31, 2013)

| Successor company in absorption-type separation | Transferor company in absorption-type separation | |||

|

① Company Name |

Renesas Kansai Semiconductor Co., Ltd. | Renesas Semiconductor Kyushu Yamaguchi Co., Ltd. | ||

|

② Address |

2-9-1 Seiran, Otsu, Shiga Pref. | 1-1-1 Yahata Minami-ku Kumamoto, Kumamoto Pref. | ||

|

③ Representative |

Yasuhiro Funakoshi, President | Hirofumi Ariizumi, President (As of April 2013) | ||

|

④ Major Operations |

Manufacture and sale of electrical and electronic components | Manufacture and sale of integrated circuit devices | ||

|

⑤ Capital |

1.0 billion yen | 1.0 billion yen | ||

|

⑥ Established |

July 1, 1983 | September 12, 1969 | ||

|

⑦ Shares Issued |

20,000 | 2,000,000 | ||

|

⑧ Fiscal Term |

March 31 | March 31 | ||

|

⑨ Major Stockholders and Ownership Ratios |

Renesas Electronics Corporation: 100% | Renesas Electronics Corporation: 100% | ||

|

⑩ Net Assets |

1,042 million yen | 11,490 million yen | ||

|

⑪ Total Assets |

39,549 million yen | 67,479, million yen | ||

|

⑫ Net Assets per Share |

52,110 yen | 5,745 yen | ||

|

⑬ Net Sales |

43,634 million yen | 84,302 million yen | ||

|

⑭ Operating Income (Loss) |

2,579 million yen | 8,006 million yen | ||

|

⑮ Ordinary Income (Loss) |

1,660 million yen | 7,046 million yen | ||

|

⑯ Net Income (Loss) |

481 million yen | 4,498 million yen | ||

|

⑰ Net Income (Loss) per Share |

24,033.73 yen | 2,249.20 yen |

6. Absorption-type merger with Renesas Naka Semiconductor as absorbed company and Renesas Kansai Semiconductor as surviving company

6-1. Summary of absorption-type merger

6-1-2. Schedule of absorption-type merger

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

6-1-3. Method of absorption-type merger

Refer to ⑤ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

6-1-4. Allocations associated with absorption-type merger

This item does not apply as the parties to the merger are both wholly-owned subsidiaries of Renesas Electronics.

6-1-5. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights.

6-1-6. Rights and obligations transferred to the surviving company in absorption-type merger

As the surviving company in the absorption-type merger, Renesas Kansai Semiconductor will inherit all rights and obligations of Renesas Naka Semiconductor after implementation of the transaction described in section 4.

6-1-7. Ability to fulfill obligations

Renesas Electronics concludes that the surviving company in the absorption-type merger shall have abilities to fulfill all their debt obligations for which it is responsible.

6-2. Overview of parties to absorption-type merger

For information on Renesas Naka Semiconductor, the absorbed company in the absorption-type merger, refer to the overview of the company in section 4.

For information on Renesas Kansai Semiconductor, the surviving company in the absorption-type merger, refer to the overview of the company in section 5.

6-3. Overview of surviving company following absorption-type merger

| Surviving company in absorption-type merger | ||

|

① Company Name |

Renesas Kansai Semiconductor Co., Ltd. | |

|

② Address |

2-9-1 Seiran, Otsu, Shiga Pref. | |

|

③ Representative |

Yasuhiro Funakoshi, President | |

|

④ Major Operation |

Manufacture and sale of electrical and electronic components | |

|

⑤ Capital |

1.0 billion yen | |

|

⑥ Fiscal Term |

March 31 |

7. Absorption-type separation with Renesas Electronics as transferor company and Renesas Kansai Semiconductor as successor company

7-1. Summary of absorption-type separation

7-1-1. Schedule of absorption-type separation

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

(Note) Renesas Electronics will follow the procedure for a simple absorption-type separation that will be executed without the requirement of the approval of Renesas’ shareholders’ meeting as stipulated under Article 784, §3 of the Japan Corporation Law.

7-1-2. Method of absorption-type separation

Refer to ⑥ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

7-1-3. Allocations associated with absorption-type separation

This item does not apply as the parties to the absorption-type separation are Renesas Electronics and its wholly-owned subsidiary.

7-1-4. Share subscription rights and bonds with share subscription rights

Renesas Electronics has not issued share subscription rights or bonds with share subscription rights.

7-1-5. Rights and obligations Inherited by successor company in absorption-type separation

On the occasion of this absorption-type separation, Renesas Kansai Semiconductor will inherit from Renesas Electronics such assets, liabilities, contractual standing, and other rights and obligations pertaining to the business activities covered by the separation as are stipulated in the absorption-type separation agreement.

7-1-6. Ability to fulfill obligations

Renesas Electronics concludes that the successor company in the absorption-type separation shall have abilities to fulfill all their debt obligations for which it is responsible.

7-2. Overview of transferor company in absorption-type separation (Fiscal year ended March 31, 2013)

(Note) For information on Renesas Kansai Semiconductor, the successor company in the absorption-type separation, refer to “Overview of parties to absorption-type separation” in section 5 on page 11.

| Transferor company in absorption-type separation | ||

|

① Company Name |

Renesas Electronics Corporation | |

|

② Address |

1753 Shimonumabe, Nakahara-Ku, Kawasaki, Kanagawa Pref. | |

|

③ Representative |

Hisao Sakuta, Representative Director, Chairman and CEO (As of June 26, 2013) | |

|

④ Major Operations |

Research, development, design, manufacture, sale, and servicing of semiconductor products | |

|

⑤ Capital |

228.2 billion yen (As of December 31, 2013) | |

|

⑥ Established |

November 1, 2002 (Started operation on April 1, 2010) | |

|

⑦ Shares Issued |

1,667,124,490 (As of December 31, 2013) | |

|

⑧ Fiscal Term |

March 31 | |

|

⑨ Major Stockholders and Ownership Ratios (as of September 30, 2013) |

Innovation Network Corporation of Japan: 69.15%

Japan Trustee Services Bank, Ltd. (Re-trust of Sumitomo Mitsui Trust Bank, Limited / NEC Corporation pension and severance payments Trust Account): : 8.11% Hitachi, Ltd.: 7.66% Mitsubishi Electric Corporation: 6.26% |

|

|

⑩ Net Assets |

252.2 billion yen (As of December 31, 2013) | |

|

⑪ Total Assets |

795.8 billion yen (As of December 31, 2013) | |

|

⑫ Net Assets per Share |

151.30 yen (As of December 31, 2013) | |

|

⑬ Net Sales |

785,764 million yen (Consolidated, as of March 31, 2013) | |

|

⑭ Operating Income (Loss) |

- 23,217 million yen (Consolidated, as of March 31, 2013) | |

|

⑮ Ordinary Income (Loss) |

- 26,862 million yen (Consolidated, as of March 31, 2013) | |

|

⑯ Net Income (Loss) |

- 167,581 million yen (Consolidated, as of March 31, 2013) | |

|

⑰ Net Income (Loss) per Share (yen) |

— |

7-3. Overview of business to be carved out through the separation

7-3-1. Business activities of business to be carved out

Front-end production business of Renesas Electronics’ semiconductor products.

7-3-2. Financial results of business to be carved out

The business which will be carved out is a semiconductor production for Renesas Electronics’ semiconductor products, thereby its financial result is omitted.

7-3-3. List of assets and liabilities of business to be carved out

Total asset: 18,773 million yen

Total liability: 5,237 million yen

7-4. Status of listing on stock exchange following absorption-type separation

There will be no change to Renesas Electronics’ company name, address, representative, major operations, capital, and fiscal term from those listed in “Overview of transferor company in absorption-type separation” on page 15.

8. Absorption-type merger with Renesas Northern Japan Semiconductor as surviving company and Haguro Electronics, Renesas Yanai Semiconductor, Hokkai Electronics, and Renesas Kyushu Semiconductor as absorbed companies

8-1. Summary of absorption-type merger

8-1-1. Schedule of absorption-type merger

| ① Approval of Board of Directors | February 19, 2014 | |||||

| ② Conclusion of agreement | February 19, 2014 | |||||

| ③ General meeting of shareholders | March 24, 2014 (planned) | |||||

| ④ Effective date | April 1, 2014 (planned) |

8-1-2. Method of absorption-type merger

Refer to ⑩ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

8-1-3. Allocations associated with absorption-type merger

This item does not apply as the parties to the absorption-type merger are wholly-owned subsidiaries of Renesas Electronics.

8-1-4. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights

8-1-5. Rights and Obligations transferred to surviving company in absorption-type merger

As the surviving company in the absorption-type merger, Renesas Northern Japan Semiconductor will inherit all rights and obligations of Haguro Electronics, Renesas Yanai Semiconductor, Hokkai Electronics, and Renesas Kyushu Semiconductor.

8-1-6. Ability to fulfill obligations

Renesas Electronics concludes that the surviving company in the absorption-type merger shall have abilities to fulfill all their debt obligations for which it is responsible.

8-2. Overview of parties to absorption-type merger (Fiscal year ended March 31, 2013)

(Note) For information on Renesas Northern Japan Semiconductor, the surviving company in the absorption-type merger, refer to “Overview of Parties to Absorption-Type Separation” in section 3-2 on page 7.

| Absorbed company in absorption-type merger | Absorbed company in absorption-type merger | |||

|

① Company Name |

Renesas Yanai Semiconductor, Inc. | Haguro Electronics Co., Ltd. | ||

|

② Address |

3-1-1, Minamihama, Yanai, Yamaguchi Pref. | 3091-6, Oaza-Hanazawa, Yonezawa, Yamagata Pref. | ||

|

③ Representative |

Kurata Nishi, President | Akira Ohashi, President | ||

|

④ Major Operations |

Manufacture and sale of semiconductor elements | Manufacture and sale of boards of various types, including board units for semiconductor manufacturing equipment, image recognition boards, and burn-in boards | ||

|

⑤ Capital |

90 million yen | 90 million yen | ||

|

⑥ Established |

April 1999 | October 1983 | ||

|

⑦ Shares Issued |

1,800 | 1,800 | ||

|

⑧ Fiscal Term |

March 31 | March 31 | ||

|

⑨ Main Stockholders and Ownership Ratios |

Renesas Northern Japan Semiconductor, Inc.: 100% | Renesas Northern Japan Semiconductor, Inc.: 100% | ||

|

⑩ Net Assets |

592 million yen | 722 million yen | ||

|

⑪ Total Assets |

1,767 million yen | 992 million yen | ||

|

⑫ Net Assets per Share |

328.63 yen | 401.33 yen | ||

|

⑬ Net Sales |

2,832 million yen | 623 million yen | ||

|

⑭ Operating Income (Loss) |

227 million yen | 71 million yen | ||

|

⑮ Ordinary Income (Loss) |

230 million yen | 67 million yen | ||

|

⑯ Net Income (Loss) |

-35 million yen | 43 million yen | ||

|

⑰ Net Income (Loss) per Share |

-19,599.98 yen | 23,675.12 yen |

| Absorbed Company in absorption-type merger | Absorbed Company in absorption-type merger | |||

|

① Company Name |

Hokkai Electronics Co., Ltd. | Renesas Kyushu Semiconductor Corp. | ||

|

② Address |

289-12 Higashi-cho, Yakumo-cho, Futami-gun, Hokkaido Pref. | 272-10 Oaza-Takaono, Ozu-machi, Kikuchi-gun, Kumamoto Pref. | ||

|

③ Representative |

Keiichi Nakamura, President | Akira Furuki, President | ||

|

④ Major Operations |

Ancillary business activities related to semiconductor manufacturing | Research, development, design, manufacture, and sale of electronic components such as semiconductor elements and integrated circuit devices | ||

|

⑤ Capital |

20 million yen | 500 million yen | ||

|

⑥ Established |

November 2, 1978 | August 1, 1991 | ||

|

⑦ Shares Issued |

400 | 7,000 | ||

|

⑧ Fiscal Term |

March 31 | March 31 | ||

|

⑨ Main Stockholders and Ownership Ratios |

Renesas Northern Japan Semiconductor, Inc.: 100% | Renesas Electronics Corporation: 100% | ||

|

⑩ Net Assets |

41 million yen | 1,327 million yen | ||

|

⑪ Total Assets |

157 million yen | 12,097 million yen | ||

|

⑫ Net Assets per Share |

102,555.00 yen | 189,558.71 yen | ||

|

⑬ Net Sales |

223 million yen | 21,023 million yen | ||

|

⑭ Operating Income (Loss) |

30 million yen | 528 million yen | ||

|

⑮ Ordinary Income (Loss) |

30 million yen | 362 million yen | ||

|

⑯ Net Income (Loss) |

-34 million yen | 202 million yen | ||

|

⑰ Net Income (Loss) per Share |

-85,629.90 yen | 28,924.08 yen |

8-3. Overview of surviving company following the absorption-type merger

| Surviving company in absorption-type merger | ||

|

① Company Name |

Renesas Northern Japan Semiconductor, Inc. | |

|

② Address |

2-14-1, Kyobashi, Chuo-Ku, Tokyo | |

|

③ Representative |

Masashi Mori, President | |

|

④ Major Operations |

Semiconductor back-end production and contact manufacturing | |

|

⑤ Capital |

2.55 billion yen | |

|

⑥ Fiscal Term |

March 31 |

9. Absorption-type separation with Renesas Electronics as transferor company and Renesas Semiconductor Kyushu Yamaguchi as successor company

9-1. Summary of absorption-type separation

9-1-1. Schedule of absorption-type separation

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

(Note) Renesas Electronics will follow the procedure for a simple absorption-type separation that will be executed without the requirement of the approval of Renesas’ shareholders’ meeting as stipulated under Article 784, §3 of the Japan Corporation Law.

9-1-2. Method of absorption-type separation

Refer to ⑨ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

9-1-3. Allocations associated with absorption-type separation

This item does not apply as the parties to the absorption-type separation are Renesas Electronics and its wholly-owned subsidiary.

9-1-4. Share subscription rights and bonds with share subscription rights

Renesas Electronics has not issued share subscription rights or bonds with share subscription rights

9-1-5. Rights and obligations transferred to the successor company in absorption-type separation

On the occasion of this absorption-type separation, Renesas Semiconductor Kyushu Yamaguchi will inherit from Renesas Electronics such assets, liabilities, contractual standing, and other rights and obligations pertaining to the business activities covered by the separation as are stipulated in the absorption-type separation agreement.

9-1-6. Ability to fulfill obligations

Renesas Electronics concludes that the successor company in the absorption-type separation shall have abilities to fulfill all their debt obligations for which it is responsible.

9-2. Overview of parties to absorption-type separation

For information on Renesas Electronics, the transferor company in the absorption-type separation, refer to the “Overview of transferor company in absorption-type separation” in section 7 on page 15.

For information on Renesas Semiconductor Kyushu Yamaguchi, the successor company in the absorption-type separation, refer to the “Overview of parties to absorption-type separation” in section 5 on page 11.

9-3. Overview of business to be carved out

9-3-1. Business activities of business to be carved out

Back-end production business of Renesas Electronics’ semiconductor products.

9-3-2. Financial results of business to be carved out

The business which will be carved out is a semiconductor production for Renesas Electronics semiconductor products, thereby its financial result is omitted.

9-3-3. List of assets and liabilities of business to be carved out

Total asset: 68 million yen

Total liability: 833 million yen

9-4. Status of listing on stock exchange following absorption-type separation

There will be no change to Renesas Electronics’ company name, address, representative, major operations, capital, and fiscal term from those listed in “Overview of transferor company in absorption-type separation” on page 15.

10. Absorption-type merger with Renesas Kansai Semiconductor as surviving company and Renesas Yamagata Semiconductor as absorbed company

10-1. Summary of absorption-type merger

10-1-1. Schedule of absorption-type merger

|

① Approval of Board of Directors |

February 19, 2014 | |||||

|

② Conclusion of agreement |

February 19, 2014 | |||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) | |||||

|

④ Effective date |

April 1, 2014 (planned) |

10-1-2. Method of absorption-type merger

Refer to ⑦ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

10-1-3. Allocations associated with absorption-type merger

This item does not apply as the parties to the absorption-type merger are both wholly-owned subsidiaries of Renesas Electronics.

10-1-4. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights

10-1-5. Rights and obligations transferred to surviving company in absorption-type merger

As the surviving company in the absorption-type merger, Renesas Kansai Semiconductor will inherit all rights and obligations of Renesas Yamagata Semiconductor after implementation of the transaction described in section 5.

10-1-6. Ability to fulfill obligations

Renesas Electronics concludes that the surviving company in the absorption-type merger shall have abilities to fulfill all their debt obligations for which it is responsible.

10-2. Overview of the parties to absorption-type merger

(Note) For information on Renesas Kansai Semiconductor, the surviving company in the absorption-type merger, refer to “Overview of parties to absorption-type separation” in section 5 on page 11.

| Absorbed company in absorption-type merger | ||

|

① Company Name |

Renesas Yamagata Semiconductor Co., Ltd. | |

|

② Address |

1-11-73 Takarada, Tsuruoka, Yamagata Pref. |

|

|

③ Representative |

Toshihide Kobayashi, President (As of April 1, 2013) | |

|

④ Major Operations |

Manufacture and sale of microchips, IC devices, transistors, etc. | |

|

⑤ Capital |

1.0 billion yen | |

|

⑥ Established |

June 22, 1964 | |

|

⑦ Shares Issued |

2,000,000 | |

|

⑧ Fiscal Term |

March 31 | |

|

⑨ Main Stockholders and Ownership Ratios |

Renesas Electronics Corporation: 100% | |

|

⑩ Net Assets |

4,130 million yen | |

|

⑪ Total Assets |

51,742 million yen | |

|

⑫ Net Assets per Share |

2,065.20 yen | |

|

⑬ Net Sales |

56,910 million yen | |

|

⑭ Operating Income (Loss) |

1,157 million yen | |

|

⑮ Ordinary Income (Loss) |

354 million yen | |

|

⑯ Net Income (Loss) |

559 million yen | |

|

⑰ Net Income per Share |

279.48 yen |

10-3. Overview of surviving company following the absorption-type merger (as of April 1, 2014)

| Surviving company in absorption-type merger | ||

|

① Company Name |

Renesas Semiconductor Manufacturing Co., Ltd. | |

|

② Address |

Hitachinaka, Ibaraki Pref. (within current Naka facility) | |

|

③ Representative |

Yoshiyuki Miyamoto, President (currently manager of Naka factory) | |

|

④ Major Operations |

Manufacture and sale of electrical and electronic components | |

|

⑤ Capital |

1.0 billion yen | |

|

⑥ Fiscal Term |

March 31 |

(Note) Plans call for the company name, address, and representative of Renesas Kansai Semiconductor to change on April 1, 2014. There will be no change to the major operations, capital, and fiscal term.

11. Absorption-type merger with Renesas Semiconductor Kyushu Yamaguchi as surviving company and Renesas Northern Japan Semiconductor as absorbed company

11-1. Summary of absorption-type merger

11-1-1. Schedule of absorption-type merger

|

① Approval of Board of Directors |

February 19, 2014 |

|||||

|

② Conclusion of agreement |

February 19, 2014 |

|||||

|

③ General meeting of shareholders |

March 24, 2014 (planned) |

|||||

|

④ Effective date |

April 1, 2014 (planned) |

11-1-2. Method of absorption-type merger

Refer to ⑪ in section 2 “Outline of the reorganization of manufacturing-related group companies” on page 2.

11-1-3. Allocations associated with absorption-type merger

This item does not apply as the parties to the absorption-type merger are both wholly-owned subsidiaries of Renesas Electronics.

11-1-4. Share subscription rights and bonds with share subscription rights

None of the companies involved has issued share subscription rights or bonds with share subscription rights

11-1-5. Rights and obligations transferred to surviving company in absorption-type merger

As the surviving company in the absorption-type merger, Renesas Semiconductor Kyushu Yamaguchi will inherit all rights and obligations of Renesas Northern Japan Semiconductor after implementation of the transaction described in section 8.

11-1-6. Ability to fulfill obligations

Renesas Electronics concludes that the surviving company in the absorption-type merger shall have abilities to fulfill all their debt obligations for which it is responsible.

11-2. Overview of the parties to absorption-type merger

For information on Renesas Semiconductor Kyushu Yamaguchi, the absorbed company in the absorption-type merger, refer to the “Overview of parties to absorption-type separation” in section 5 on page 11.

For information on Renesas Northern Japan Semiconductor, the surviving company in the absorption-type merger, refer to the “Overview of parties to absorption-type separation” in section 3 on page 7.

11-3. Overview of surviving company following the absorption-type merger (as of April 1, 2014)

| Surviving company in absorption-type merger | ||

|

① Company Name |

Renesas Semiconductor Package & Test Solutions Co., Ltd. | |

|

② Address |

111, Nishiyokote cho, Takasaki, Gunma Pref. | |

|

③ Representative |

Osamu Nogimura, President (currently an executive of Renesas Electronics) | |

|

④ Major Operations |

Manufacture and sale of integrated circuit devices | |

|

⑤ Capital |

1.0 billion yen | |

|

⑥ Fiscal Term |

March 31 |

(Note) Plans call for the company name, address, and representative of Renesas Semiconductor Kyushu Yamaguchi to change on April 1, 2014. There will be no change to the major operations, capital, and fiscal term.

12. Future Outlook

This reorganization of the Renesas Group involves separations and mergers of Renesas Electronics and its consolidated subsidiaries, so the impact on the consolidated performance of the Renesas Group will be minimal.

(Note) Some details of the reorganization are omitted from the information disclosed above as the affected parties are Renesas Electronics and its wholly-owned subsidiaries.

Forward-Looking Statements

The statements in this press release with respect to the plans, strategies and financial outlook of Renesas Electronics and its consolidated subsidiaries (collectively “we”) are forward-looking statements involving risks and uncertainties. We caution you in advance that actual results may differ materially from such forward-looking statements due to several important factors including, but not limited to, general economic conditions in our markets, which are primarily Japan, North America, Asia, and Europe; demand for, and competitive pricing pressure on, products and services in the marketplace; ability to continue to win acceptance of products and services in these highly competitive markets; and fluctuations in currency exchange rates, particularly between the yen and the U.S. dollar. Among other factors, downturn of the world economy; deteriorating financial conditions in world markets, or deterioration in domestic and overseas stock markets, may cause actual results to differ from the projected results forecast.

About Renesas Electronics Corporation

Renesas Electronics Corporation (TSE: 6723), the world’s number one supplier of microcontrollers, is a premier supplier of advanced semiconductor solutions including microcontrollers, SoC solutions and a broad-range of analog and power devices. Business operations began as Renesas Electronics in April 2010 through the integration of NEC Electronics Corporation (TSE:6723) and Renesas Technology Corp., with operations spanning research, development, design and manufacturing for a wide range of applications. Headquartered in Japan, Renesas Electronics has subsidiaries in 20 countries worldwide. More information can be found at www.renesas.com.