CAMPBELL, Calif.--(BUSINESS WIRE)--Market research firm Infonetics Research released excerpts from its 2013 Self-Organizing Networks (SON) and Optimization Software report, which tracks SON software by generation (3G, 4G) and by architecture (centralized, distributed) as well as 2G and 3G optimization software for the mobile network optimization market.

ANALYST NOTE

“Self-organizing networks (SON) remain baked in LTE, but as an evolutionary 3GGP technology, SON will continue to evolve, offering more and more advanced features. So deploying SON for 3G optimization – with the zero-touch network as the long-term goal – is something that’s natural and logical for many operators,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Téral adds: “There is at least one cumbersome task, however, that can’t be easily automated and will require human intervention for quite a long time: drive testing. Our discussions with large mobile operators confirm there’s no way to replace today’s rudimentary technique of having a crew cruising a neighborhood in a truck to measure what’s going on.”

SON AND OPTIMIZATION SOFTWARE MARKET HIGHLIGHTS

- Following 17% growth in 2012 driven by major deployments at AT&T and KDDI and many smaller deals, the global mobile network optimization and self-organizing network (SON) market is on track to grow 13% in 2013

-

In a large majority of cases, 3G network optimization, rather than LTE

alone, is a key driver for using SON

- Over 80% of mobile operators worldwide are using SON for 3G/HSPA/HSPA+ optimization

- Centralized SON (C-SON) is predominant in optimization schemes

- The burgeoning SON segment of the market tripled in 2012

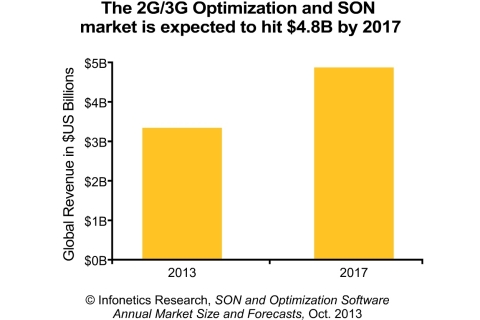

- Infonetics forecasts optimization and SON software to grow to nearly $5 billion by 2017

SON AND OPTIMIZATION SOFTWARE REPORT SYNOPSIS

Infonetics’ annual SON and optimization software report provides worldwide and regional market size, forecasts through 2017, analysis, and trends for the mobile network optimization market, including 2G and 3G optimization software and self-organizing network software by generation (3G, 4G) and by architecture (centralized, distributed). The report includes a mobile subscriber forecast (2G/3G/4G subscribers), a specialist vendor snapshot, and SON use cases from the Next Generation Mobile Networks (NGMN) Alliance.

The report tracks Tier 1 mobile infrastructure vendors with mobile network optimization tools, including Alcatel-Lucent, Ericsson, Huawei, NSN, Samsung, and ZTE, as well as specialist vendors: Actix/Amdocs, Aircom International, Airhop Communications, Aricent, Ascom, Astellia, Axis Technologies, Celcite, Cellwize, Celtro, Centri, Cisco (Intucell, Ubiquisys), Commsquare, Eden Rock Communications, Forsk, Infovista, InterDigital, JDSU/Arieso, Newfield Wireless, Optulink, P.I.Works, Plano Engineering, Reverb Networks, Schema, Teoco/Schema, Theta Networks, TTG International, Tulinx, Vector, and Xceed Technologies. To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp.

RELATED RESEARCH

- Infonetics’ latest Mobile and Wireless research brief: http://bit.ly/1d5DFWi

- Infonetics projects data center and enterprise SDN market will top $3 billion by 2017

- Mobile operators leaning on self-organizing networks to keep opex in check

- $8.5 billion to be spent on carrier WiFi equipment over next 5 years

- Infonetics projects data center and enterprise SDN market will top $3 billion by 2017

- Service provider capex increasing 6% in 2013, ignited by BRICs; revenue to hit $2 trillion

- DAS a big and bumpy — and still growing — $2-billion dollar business

- Telecom equipment vendors manage 45% of the world’s subscribers as outsourcing grows

- China mobilizing for huge LTE rollout; Mobile infrastructure growth braking in Japan

- Infonetics survey identifies operators’ LTE deployment challenges, top LTE vendors

RECENT & UPCOMING MARKET FORECASTS

Download Infonetics’ 2013 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

- Infonetics’ new 2014 Market Research Lineup

- 2G, 3G, 4G Mobile Infrastructure & Subscribers - 3Q13 Edition (Dec. 3)

- 3G & 4G Mobile Broadband Devices & Subscribers - 3Q13 Edition (Dec. 10)

- 2G, 3G, 4G Mobile Services & Subscribers: Voice, SMS/MMS & Broadband (Dec. 12)

- Telecom & Datacom Market Drivers (Dec. 14)

INFONETICS WEBINARS

Visit https://www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on demand, or learn about sponsoring a webinar.

- Monetizing Subscriber Data to Drive Big Revenue (Dec. 17: Attend)

- Small Cells Reality Check (View on demand)

- Finding the Right KPIs to Optimize LTE and LTE-Advanced Networks (2014: Sponsor)

- Distributed Antenna Systems: What's Next (2014: Sponsor)

TO BUY REPORTS, CONTACT:

N. America (West), Asia Pacific: Larry Howard, larry@infonetics.com, +1 408-583-3335

N. America (East), Midwest, L. America: Scott Coyne, scott@infonetics.com, +1 408-583-3395

EMEA, India, Singapore: George Stojsavljevic, george@infonetics.com, +44 755-488-1623

Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

ABOUT INFONETICS

Infonetics Research (www.infonetics.com) is an international market research and consulting firm serving the communications industry since 1990. A leader in defining and tracking emerging and established technologies in all world regions, Infonetics helps clients plan, strategize, and compete effectively. View Infonetics’ About Us slides at http://bit.ly/QUrbrV.