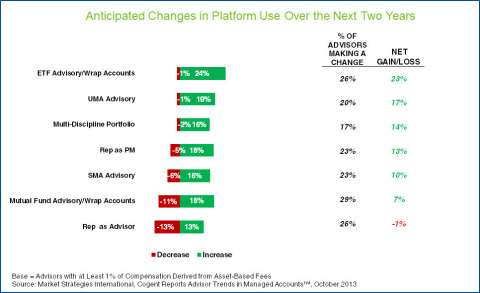

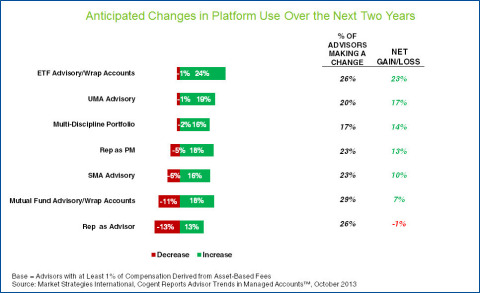

CAMBRIDGE, Mass.--(BUSINESS WIRE)--All types of managed money solutions used by fee-based advisors are expected to grow over the next two years, but the use of ETF-managed accounts will far outpace adoption of other solutions. In fact, on a net basis the proportion of fee-based advisors expecting to increase their use of ETF advisory/wrap accounts (23%) is three times the proportion who expect to increase their use of mutual fund advisory/wrap accounts (7%). These and other findings are included in the Advisor Trends in Managed Accounts™, a Cogent Reports study from Market Strategies International.

Remarkably, three quarters (76%) of fee-based advisors now use some type of managed account solution within their practice, accounting for 61% of their total assets under management, on average. Mutual fund wrap programs and Rep as Advisor models are currently the most commonly utilized advisory platforms. However, over the next two years, growth for each platform will be stymied by significant proportions of advisors who plan to pull back from using these solutions. By contrast, one in four (24%) fee-based advisors plans to expand their use of ETF wrap accounts, while virtually none (1%) say they plan to decrease use.

“From a practical standpoint, the use of ETF wrap accounts is still relatively new, but considering the tremendous demand for ETF products there is certainly room for growth,” said Meredith Lloyd Rice, senior product director and author of the study. “The proliferation of ETF products and investment strategies make building a managed solution around these products quite attractive to advisors, especially as they become more comfortable with ETFs in general. However, in today’s fee conscious environment, advisors and providers alike will have to monitor the ‘all-in’ ETF wrap account cost given a penchant for lower expenses among advisors and investors.”

About the Advisor Trends in Managed Accounts Study

Cogent Reports conducted an online survey with 1,694 fee-based advisors in March and April of this year. Survey participants were required to have an active book of business of at least $5M, and offer investment advice or planning services to individual investors on a fee or transactional basis. Cogent Reports set quota targets and weighted the data by AUM, channel, age, gender, and region to be representative of the overall advisor universe according to the Discovery Data Financial Services Industry database. The survey has a sampling error of + 2.4 percentage points at the 95% confidence level. Market Strategies will supply the exact wording of any survey questions upon request

About Market Strategies International

Market Strategies International is a market research consultancy with deep expertise in communications, consumer/retail, energy, financial services, healthcare and technology. The firm is ISO 20252 certified, reflecting its commitment to providing intelligent research, designed to the highest levels of accuracy, with meaningful results that help companies make confident business decisions.

Market Strategies conducts qualitative and quantitative research in 75 countries, and its specialties include brand, communications, customer experience, product development, segmentation and syndicated. Its syndicated products, known as Cogent Reports, help clients understand the market environment, explore industry trends and evaluate and monitor their brand and products within the competitive landscape. Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China. Read Market Strategies’ blog at FreshMR, and follow us on Facebook, Twitter and LinkedIn.