COLUMBIA, S.C.--(BUSINESS WIRE)--Though 82 percent of American workers say they’re concerned about paying for expenses no longer covered by their health plans,1 they’re not necessarily putting their money where their mouth is.

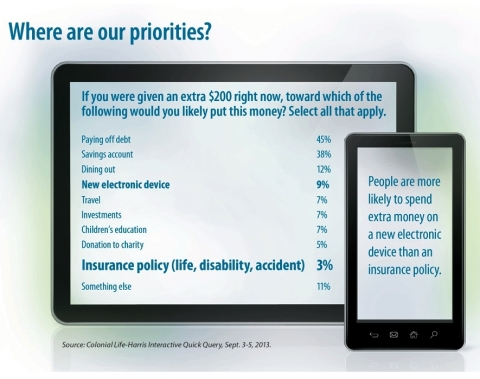

That’s just one of the findings of a poll of more than 1,000 U.S. employees (full-time and/or part-time) conducted online by Harris Interactive on behalf of Colonial Life & Accident Insurance Company. The survey revealed more workers are likely to invest an extra $200 in a new electronic device or dinner out than would put it toward an insurance policy. And more would spend several days or more researching the purchase of a new car (77 percent) or vacation destination (70 percent) than researching a life or health insurance purchase (67 percent).

“Although the majority of workers are concerned about the rising costs of health care, they’re still not making insurance and financial protection a priority,” says Steve Bygott, assistant vice president of core market services at Colonial Life. “It’s good to see that more people would use an extra $200 to pay off debt or add to a savings account than anything else, but it’s worrisome that protecting their families and lifestyles from financial problems doesn’t rank higher than a smartphone or a nice meal.”

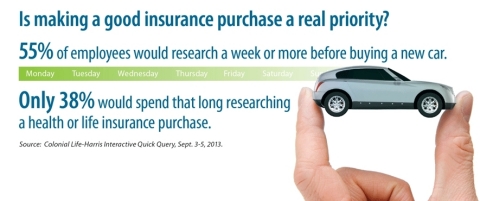

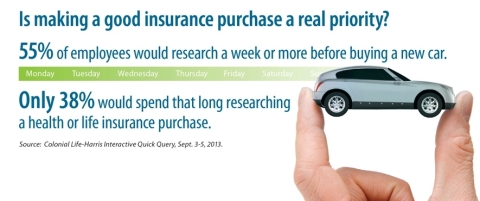

In the poll, 83 percent of workers say they’re at least somewhat concerned about increased health insurance premiums. And 81 percent express concern about paying for unexpected medical expenses (emergency room visits, major surgery, etc.). When asked how much time they would spend researching the purchase of various items, 55 percent of employees say they would spend a week or more deciding which car to buy. Only 38 percent of those surveyed say they would spend that much time deciding on an insurance plan.

“We still have a long way to go in helping employees understand the importance of workplace benefits and the valuable role they play in helping to protect their health and the income,” says Bygott. “But employers who provide good benefits education are helping bridge this knowledge gap.”

About Colonial Life

Colonial Life & Accident Insurance Company is a market leader in providing financial protection benefits through the workplace, including disability, life, accident, cancer, critical illness and supplemental health insurance. The company’s benefit services and education, innovative enrollment technology and personal service support more than 79,000 businesses and organizations, representing more than 3 million working Americans and their families. For more information visit www.coloniallife.com or connect with the company at www.facebook.com/coloniallifebenefits, www.twitter.com/coloniallife and www.linkedin.com/company/colonial-life.

Survey Methodology

This survey was conducted online within the United States by Harris Interactive on behalf of Colonial Life from September 3-5, 2013 among 2,046 adults ages 18 and older, among whom 1,023 are employed full-time or part-time. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact Jeanna Moffett at Colonial Life at JMoffett@ColonialLife.com.

1 Online survey conducted within the United States for Colonial Life & Accident Insurance Company by Harris Interactive, Sept. 3-5, 2013, among 2,046 U.S. adults age 18 and older, among whom 1,023 are employed full-time or part-time.