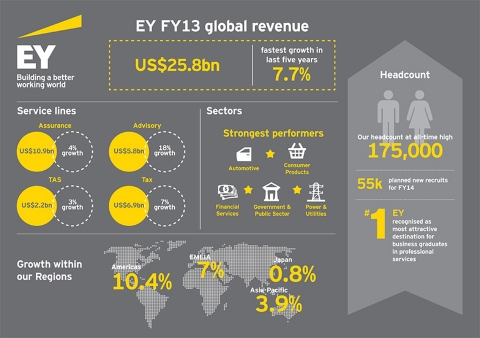

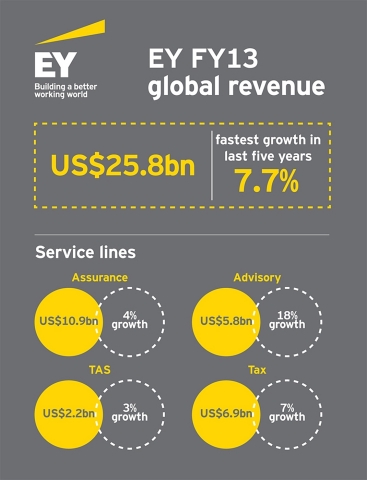

LONDON--(BUSINESS WIRE)--EY today announced combined global revenues of US$25.8 billion for its financial year ended 30 June 2013. This represents 7.7% growth over the previous financial year in local-currency terms - EY’s fastest growth since 2008. Revenues grew 5.8% in US dollar terms. All EY’s service lines and geographies continued to grow revenues and headcount despite uneven market conditions in many parts of the world.

“I congratulate our 175,000 great people around the world for providing exceptional, high quality service to our clients, contributing to our strong sense of purpose, and delivering an impressive set of results. Everything we have accomplished this year is due to them and I am extremely grateful for everything they have done,” says Mark Weinberger, EY’s Global Chairman and CEO. “To achieve a robust performance despite a difficult economic environment in the last 12 months demonstrates their talent and energy as well as their commitment to quality.

“Looking forward, there remain significant economic and geopolitical uncertainties in developed and fast-growth emerging markets. Despite these short term uncertainties, we continue to invest for the long term. In FY14 we are demonstrating our confidence in the future of the global economy and our profession by investing heavily in new markets and new services as well as planning to add 55,000 new recruits and interns over the next 12 months.”

Performance highlights by services and sector

John Ferraro, EY’s Global Chief Operating Officer comments, “Across all of our service lines we continue to perform well in a highly competitive and challenging market place.” Growth in all of EY’s service lines was almost entirely organic.

Assurance, our largest practice, delivered a positive year growing revenues by over 4% to US$10.9b. Despite the continuing challenging economic environment our audit revenues grew by 2.4%, strengthening our competitive market position. Our fraud and investigation services and financial accounting advisory services grew by 23% and 30% respectively, demonstrating our ability to respond well to the growing demand in the marketplace.

EY’s global Tax revenues increased over 7% to US$6.9b, marking a third consecutive year of strong growth. These results reflect our commitment to providing exceptional client service and assisting our clients in a dynamic and more connected marketplace with tax compliance, tax advisory, and human capital services around the world.

Advisory achieved its third year of double-digit growth in FY13, with revenue of US$5.8b and growth of 18%. This strong organic growth is against a backdrop of slower growth in the wider market for Advisory services. These results reflect our strategic focus on leveraging all our core consulting and technology competencies on delivering transformational Risk and Performance Improvement services in high-growth sectors.

Our Transaction Advisory Services (TAS) service line grew by 3% to US$2.2b – the fourth consecutive year of growth at a time when global M&A activity continues to suffer sharp falls in virtually every market. TAS achieved this with an unrelenting focus on our clients’ capital agenda – how businesses raise, invest, optimize and preserve capital – which enabled EY to support 6 of the world’s top 10 deals globally this year.

EY’s strongest performing industry sectors, all with double-digit growth, were: Automotive, Consumer Products, Financial Services, Government & Public Sector and Power & Utilities.

Performance highlights by region

Our Americas revenues were up by 10.4% in FY13 with strong growth in both North and South America. The highlights included 10% growth in the US and 24% growth in Brazil. This revenue increase was primarily driven by our Advisory and Financial Services practices.

Europe, Middle East, India and Africa saw good growth of 7% given the ongoing economic problems in several countries. There were strong individual performances from emerging markets such as Turkey (19%), India (17%), the Middle East (13%) and Africa (11%) but also in developed countries such as Italy (9%) and Germany (8%).

Despite weakening economic conditions across parts of the region our Asia-Pacific practice grew by 3.9%, led by strong growth of 10% in China. Vietnam was another highlight with an increase of 14%.

Japan saw a welcome return to modest growth of 0.8% after several years of flat revenues despite the slower economic recovery in the country.

Overall our emerging markets practices had a combined revenue growth of 12%.

John adds, “Our leading growth across many emerging markets is tied to the investments that we have made in our practices in these countries over the past decade – investments that we will increase in future years.”

Investing in the future

As well as setting aside significant sums to continue our commitment to the emerging markets, EY has also made major investments in the services it provides to clients as part of its Vision 2020 that was launched earlier this year.

Mark Weinberger explains, “Over the next three years we will spend US$400m on improving our audit methodologies and tools to continue to enhance audit quality. At the same time a major investment in technology and services, US$1.2b over the next three years, will deliver transformational technologies to help EY better connect with our clients.”

People

During FY13 EY recruited more than 38,000 full time people (24,000 graduates and 14,000 experienced hires) and 12,500 interns and grew its headcount to 175,000. EY expects to hire more than 42,000 (27,000 graduates and 15,000 experienced hires) full time people and 13,000 interns in FY14. In July EY announced that 131 (26%) of its 520 new partners were women, up from 19% five years ago.

EY was recently recognized by Universum as the most attractive destination for business graduates looking for a career in professional services, and as the second-most attractive employer overall.

“We are delighted and honored to feature as the world’s most attractive professional services employer, and second among all employers across the world,” says Mark. “At EY we are committed to attracting, developing and inspiring great people and developing future leaders; this is fundamental to our purpose of building a better working world.”

In May nearly 120,000 people responded to EY’s biennial Global People Survey – a record number. Our engagement score has risen by four percentage points globally since 2011 with an improvement across all service lines. “Pride in our organization” has increased steadily since 2009 and is well above the industry average.

Building a better working world

On 1 July EY announced a new global brand name, unveiled a new logo and adopted Building a better working world as its purpose and tagline.

Mark explains, “Every day, every EY person is part of building a better working world – for our clients, our communities, and our families. We believe that everything we do – every audit, every tax return, every advisory opportunity, every interaction with a client or colleague – contributes to building a better working world.”

Mark adds, “We provide timely and transparent information, assisting the world’s capital markets; help our clients improve and grow so they could hire more people and invest in their communities; assist entrepreneurs in bringing their products and ideas to fruition; develop and inspire leaders in EY and those who go on to other critical roles in society; and give back to the communities in which we serve and live in many different ways.

“Recognizing the particular contribution that women can make to economic and social wellbeing, last month we announced our participation in a Clinton Global Initiative Commitment to develop and support 15,000 women-owned businesses, by strengthening their capacity to enter corporate supply chains and increasing the spend they receive by US$1.5b annually.

“Last year we also continued our involvement with organizations such as Endeavor, a leading global not-for-profit organization focusing on high-impact entrepreneurs in emerging markets who have to date created more than 200,000 jobs and annually generate US$5b of revenues. Since we began our relationship with Endeavor we have provided monetary and in-kind value of more than US$31m. This includes around US$6.5m in the last year, of which US$5.2m represented the value provided by basing some of our highest performing people in the entrepreneurs’ companies for five to seven week periods.

“EY are also key supporters of The Network for Teaching Entrepreneurship's mission to provide programs that inspire young people from low-income communities to stay in school, recognize business opportunities and plan for successful futures.”

- ends -

Notes to editors

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

|

Selected information

EY revenues by service line – US$ millions |

|||||||||||||||||

| FY13 | FY12 | % Change | |||||||||||||||

| Local Currency | US$ | ||||||||||||||||

| Assurance | 10,936 | 10,714 | 4.1% | 2.1% | |||||||||||||

| Tax | 6,946 | 6,579 | 7.2% | 5.6% | |||||||||||||

| Advisory | 5,751 | 4,956 | 18.0% | 16.0% | |||||||||||||

| Transaction Advisory Services | 2,196 | 2,171 | 2.7% | 1.2% | |||||||||||||

| Total | 25,829 | 24,420 | 7.7% | 5.8% | |||||||||||||

|

EY revenues by Area – US$ millions |

|||||||||||||||||

| FY13 | FY12 | % Change | |||||||||||||||

| Local Currency | US$ | ||||||||||||||||

| Americas | 10,750 | 9,820 | 10.4% | 9.5% | |||||||||||||

| EMEIA | 10,943 | 10,459 | 7.0% | 4.6% | |||||||||||||

| Asia-Pacific | 2,934 | 2,813 | 3.9% | 4.3% | |||||||||||||

| Japan | 1,202 | 1,328 | 0.8% | -9.5% | |||||||||||||

| Total | 25,829 | 24,420 | 7.7% | 5.8% | |||||||||||||

|

EY people by service line |

|||||||||||||||||

| FY13 | FY12 | % Change | |||||||||||||||

| Assurance | 66,156 | 64,544 | 2.5% | ||||||||||||||

| Tax | 35,358 | 33,676 | 5.0% | ||||||||||||||

| Advisory | 29,747 | 27,046 | 10.0% | ||||||||||||||

| Transaction Advisory Services | 8,776 | 8,598 | 2.1% | ||||||||||||||

| Practice support | 34,771 | 33,361 | 4.2% | ||||||||||||||

| Total | 174,808 | 167,225 | 4.5% | ||||||||||||||

|

EY people by Area |

|||||||||||||||||

| FY13 | FY12 | % Change | |||||||||||||||

| Americas | 53,835 | 50,256 | 7.1% | ||||||||||||||

| EMEIA | 84,224 | 81,022 | 4.0% | ||||||||||||||

| Asia-Pacific | 29,893 | 29,294 | 2.0% | ||||||||||||||

| Japan | 6,856 | 6,653 | 3.1% | ||||||||||||||

| Total | 174,808 | 167,225 | 4.5% | ||||||||||||||

Basis of presentation

Revenues include expenses billed to clients. For purposes of reporting combined global revenues, revenues between member firms have been eliminated. Headcount numbers reflect personnel as of 30 June of each fiscal year. FY12 revenues and headcount for Assurance and Tax have been reclassified to conform to FY13 service line definitions.

Following is a reconciliation of aggregated member firm revenues to combined global revenues:

|

|

|||||||||

| US$ millions | FY13 | FY12 | % Change | ||||||

| Local Currency | US$ | ||||||||

| Aggregated Member Firm Revenues | 28,614 | 26,835 | 8.6% | 6.6% | |||||

| Less elimination of inter- firm billings | 2,785 | 2,415 | 18.2% | 15.3% | |||||

| Combined global revenues | 25,829 | 24,420 | 7.7% | 5.8% | |||||