WASHINGTON--(BUSINESS WIRE)--From the IASA Annual Conference, Delphi Technology, the recognized industry leader in technology solutions for the medical professional liability industry and a leading provider of technology solutions to the insurance and risk management industries, announces the release of the latest version of OASIS Predictive Analytics for Physician Loss, the only predictive analytics solution built specifically to enable medical professional liability insurers and healthcare risk managers to target, assess and manage physician risks.

The algorithms in this cutting edge analytic tool are proven, mature, and newly recalibrated to take advantage of the latest data available resulting in increasingly powerful results. Available as a stand-alone solution or as part of Delphi’s fully-integrated OASIS suite, OASIS Predictive Analytics for Physician Loss gives medical professional liability insurers and risk managers additional objective data-driven insights into the proclivity for a physician to cause a claim loss in the upcoming year. In addition to predicting likelihood and severity, the tool provides reason codes to provide further insight into the most critical driving factors underlying the prediction, enabling more effective underwriting and targeted risk management.

“OASIS Predictive Analytics for Physician Loss is not intended to replace the underwriter. It is intended to empower the underwriter, providing a broader array of objective details regarding the risk,” says Bill Moss, Chief Business Development Officer of Delphi Technology. “Some refer to this as ‘eyeglasses’ for the underwriter’s mind… helping to bring the data into focus.”

OASIS Predictive Analytics for Physician Loss is based on 12 years of experience of more than 60,000 physicians and leverages more than 30 source variables. The result is a model that produces segmentation based on severity, frequency, and within individual specialties.

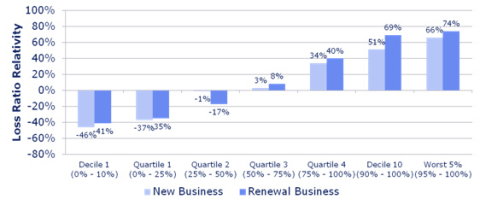

The predictive power of the model has been validated utilizing the most recent two years of data as “blind hold-back data” (i.e. not used in the building of the model). During the validation, each of the 60,000 physicians was analyzed looking forward to each of the two years (i.e. only using the historical data available prior to each year). Based on their scores, the physicians were segmented into “buckets” along the horizontal axis of the graph below. After the physicians were segmented, we aggregated the actual experience of the physicians in each “bucket” for the “upcoming” year. The results for both the new business and renewal models are depicted in the accompanying graphic with 10% of the physicians predicted to perform best having losses 41% to 46% lower than the average loss ratio of their insurer. The 5% predicted to perform the worst had losses 66% to 74% greater.

“Until recently, medical professional liability insurers have been slow to take advantage of advanced business analytics in underwriting,” says Sam Fang, CEO of Delphi Technology. “But the future success of those same insurers is going to be determined by their ability to take advantage of the latest technologies and effectively use predictive analytics to manage their underwriting risk exposures beyond the current processing cycle.”

In the past, such powerful predictive analytics were only accessible by the largest national carriers, due to the limitation of available data within each MPL insurer, the high cost of algorithm development and the technical challenges of making the algorithms operational within each carrier. Delphi has overcome each of these obstacles with its National Models for both New Business and Renewals. OASIS Predictive Analytics levels the playing field, by enabling:

- Access large volumes of internally generated, geographically dispersed medical professional liability risk, financial, claim and loss experience data

- Leverage a common data structure to make it easier to compile data and maintain its quality

- Integrate external data sources, for greater insight than a typical insurer can obtain using internal data alone

- Use state-of-the-art modeling techniques, methodologies, and resources

- Facilitate operational integration, by deploying the model within the nation’s leading medical professional liability end-to-end processing platform.

About Delphi Technology

For more than 20 years, Delphi Technology has been a leading provider of technology solutions to the insurance and risk management industries. By leveraging its extensive industry knowledge and experience, Delphi Technology delivers a comprehensive range of innovative technology solutions for professional liability insurers, property and casualty carriers, third party administrators (TPAs), self-insureds, and risk retention groups (RRGs).

Delphi Technology’s OASIS suite provides proven software applications to run core insurance operations including policy management, claims management, financial management, risk management, reinsurance, document management, advanced workflow, policy holder services, online applications, incident management, data warehouse and reporting, advanced business analytics, and predictive analytics, OASIS enables companies to optimize their business processes and respond to changing business needs resulting in reduced costs, increased operational efficiency, and improved business intelligence.

Delphi Technology’s professional services staff of 150+ technical and insurance experts utilize a proven implementation methodology ensuring the transfer of necessary market and business expertise throughout the deployment process resulting in successful implementations that come in on schedule and on budget.

Headquartered in Boston, MA, Delphi Technology has sales, support, and development offices throughout North America, as well as in Shanghai, China.

For more information, please visit www.Delphi-Tech.com or call 617-259-1247.