RIO DE JANEIRO--(BUSINESS WIRE)--OGX Petróleo e Gás Participações S.A. (Bovespa: OGXP3), Brazil’s largest private oil and natural gas exploration company, announces its first quarter results for the three months ended March 31, 2013.

| Key Financial Metrics | 1Q 2013 | 4Q 2012 | ||||||||

| Net Revenue (R$ mm) | 289 | 175 | ||||||||

| EBITDA (R$ mm) | 74 | (38) | ||||||||

| Net Profit (Loss) (R$ mm) | (805) | (286) | ||||||||

| Realized oil price per barrel (US$) | 103 | 104 | ||||||||

| CAPEX (US$ mm) | 289 | 550 | ||||||||

| Cash Position (US$ mm) | 1,148 | 1,655 | ||||||||

| Production volume (kboepd) | 10.9 | 10.2 | ||||||||

Luiz Carneiro, Chief Executive Officer of OGX, commented:

“OGX delivered a sequential improvement in its performance in the first quarter of 2013, posting higher revenues and positive EBITDA for the first time, while also achieving higher total production volume at the Tubarão Azul Field in the Campos Basin, which totaled 954 thousand barrels of oil. OGX also achieved total production of 4 million cubic meters of gas per day at the Gavião Real Field, in the Parnaíba Basin, after the fourth turbine at the Parnaíba I Thermo Power Plant has been synchronized with the National System.

“Despite this progress, the first quarter of 2013 was a challenging one for OGX as operational issues led to production stoppages at the OGX-68HP and TBAZ-1HP wells, along with intermittent production at the OGX-26HP well. We continue to analyze the reservoir behavior, as well as the impact on total estimated recoverable volume.

“As announced on May 7, 2013, the company has entered into an important strategic partnership with Petronas, the Malaysian oil major, to jointly exploit two blocks in the Campos Basin that encompass the Tubarão Martelo Field besides Peró and Ingá accumulations. Under the transaction, Petronas will acquire a 40% non-operating work interest in the two blocks, BM-C-39 and BM-C-40, for a total value of US$850 million, and has an option to acquire a 5% stake of our company from our controlling shareholder, Mr. Eike Batista. The partnership with Petronas, which has more than 32 billion barrels of recoverable resources and produces about 2 million barrels of oil equivalent per day, underscores the quality of our assets and our management team, strengthens our cash position and secures additional funding to continue developing our portfolio and pursuing new growth opportunities.”

SHORT TERM OUTLOOK

UPCOMING EVENTS

OGX has several important events planned for the coming months:

- Continue the execution of the Discovery Evaluation Plans (PADs) by drilling appraisal wells and performing tests in the Campos and Santos basins

- Continue the exploration and wildcat campaigns in the Parnaíba and Espírito Santo basins

- Update our resource evaluation report

- Continue to develop the Tubarão Martelo Field by preparing for OSX-3’s arrival and conclude studies for OSX-2’s development area

- Commence drilling of the first development well in the Atlanta Field (BS-4 Block) in 2H13

- FPSOs OSX-2 and OSX-3 expected to arrive in the 3Q13 and first production wells expected to come on-stream by the end of the year

STRATEGIC PARTNERSHIP WITH PETRONAS

- OGX has entered into an agreement with Petronas to sell a 40% non-operating work interest in the BM-C-39 and BM-C-40 blocks, located in the Campos Basin, for a total value of US$850 million. The blocks encompass the Tubarão Martelo Field (2C resources of 212 million barrels estimated by DeGolyer and MacNaughton in February 2012) and the Peró and Ingá accumulations. The transaction is subject to approval from Brazil’s National Petroleum, Natural Gas and Biofuels Agency (ANP) and the Brazilian Council for Economic Defense (CADE)

-

Upon financial closing of the transaction, US$250 million and an

additional amount equivalent to 40% of the development costs of TBMT

field incurred since May 1st 2013 (capex and opex) will be

paid directly to OGX (and will become immediately available for any

purpose). The remaining US$600 million will be deposited on behalf of

OGX into an escrow account and released as described below:

- US$500 million upon first oil

- US$50 million upon achievement of an aggregate production of 40 kboepd

- US$25 million upon achievement of an aggregate production of 50 kboepd

- US$25 million upon achievement of an aggregate production of 60 kboepd

- In addition to the stake in the BM-C-39 and BM-C-40 blocks, Petronas has an option to purchase 5% of OGX’s capital at a price of R$6.30 per share at any time until April 2015. Exercise of this option will not involve any issuance of new shares or imply dilution for minority shareholders since the shares will come from the current holdings of OGX´s controlling shareholder, Mr. Eike Batista

OPERATIONS REVIEW

HIGHLIGHTS

- Attained total production volume of 954 thousand barrels of oil in the Tubarão Azul Field (Campos Basin) in 1Q13, up 5.1% on the previous quarter

- 1.2 million barrels of oil sold in 1Q13, delivered in two different cargos

- Third production well in the Tubarão Azul Field (Campos Basin), TBAZ-1HP, was connected to FPSO OSX-1 and commenced production on January 4, 2013

- OGX-68HP well: operational issues in the electrical submersible pump (ESP) resulted in a 15 day stoppage of production in March. Repairs commenced in mid-April and its conclusion is expected for mid-May

- TBAZ-1HP well: unstable electrical generation at OSX-1 along with lower than expected flow rate at the well led to intermittent operations and damage to the ESP resulting in an 11 day stoppage during March. Repairs to begin once OGX-68HP is back in operation

- OGX-26HP well: 2 day stoppage at the well in March caused by unstable electrical generation at OSX-1. Well production has been periodically stopped since the beginning of April to prevent damages at the ESP, and its production is being monitored

- Drilled and made the lower completion of six production wells in the Tubarão Martelo Field (Campos Basin). The first well is projected to come on-stream late 2013 after the arrival of FPSO OSX-3

- Final stage of reservoir engineering for FPSO OSX-2 installation, with delivery scheduled for 2H13

- Average net gas production of 3.2 kboepd, 5.5 kboepd, 6.8 kboepd and 12.1 kboepd in January, February, March and April 2013, respectively, in the Gavião Real Field (Parnaíba Basin)

- Achieved total production of 4.0 M m3/d (~25 kboepd) in the Gavião Real Field after the fourth turbine at the Parnaíba I Thermo Power Plant has been synchronized with the National System on April 5, 2013

PRODUCTION - CAMPOS BASIN

- Total production volume of 954 thousand barrels of oil in the Tubarão Azul Field in 1Q13

-

Sale of 1.2 million barrels of oil in 1Q13, distributed in two cargos

- 779 thousand barrels of oil to ENAP, in January 2013

- 425 thousand barrels of oil to BP, in February 2013

- Sale of 394 thousand barrels of oil to Shell, in April 2013

- Connection start-up of the third production well in the Tubarão Azul Field, TBAZ-1HP on January 4, 2013

- Drilling and lower completion of six production wells concluded in the Tubarão Martelo Field

- Final stage of reservoir engineering for FPSO OSX-2 installation, with delivery scheduled for 3Q13

Tubarão Azul Field Development

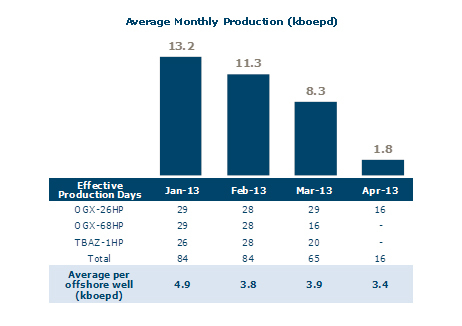

In March, production in the Tubarão Azul Field was mainly affected by operational issues that caused damage to the ESP at wells OGX-68HP and TBAZ-1HP, resulting in a 15 day stoppage and an 11 day stoppage, respectively. Works to repair OGX-68HP have already commenced and are expected to complete in mid-May. Work on the TBAZ-1HP well should commence once repairs on the OGX-68HP have been completed. Production at both wells will remain interrupted until the ESP overhauls are completed. Additionally, production at the OGX-26HP well also stopped for 2 days in March as a result of unstable electrical generation at FPSO OSX-1.

In the first two months of the year, before the operational issues occurred, average daily production was 12.3 kboepd, while in March it decreased to 8.3 kboepd as a result of these issues.

In April after the OGX-26HP well returned to production, we noticed that the gas oil ratio (GOR) increased, resulting in the ESP overheating. In order to prevent any damage to the equipment, we decided to periodically stop the well production, which led to intermittent operations, producing only during 16 days with an average daily flow rate of 3.4 kboepd, considering the effective production days.

OGX’s technical team is currently analyzing the reservoir behavior to define the next steps on the development of this field.

During 2013, we delivered the fifth, sixth and seventh shipments of approximately 779 thousand barrels, 425 thousand barrels and 394 thousand barrels, respectively. The first shipment was delivered to ENAP (Chile) on January 5, the second to BP on February 7 and the third to Shell on April 6.

The table below shows the pro-forma OSX-1 EBITDA after the delivery of the first six shipments.

| Delivered cargos | 2012 | 2013 | ||||||||||||||||||||||||

| 1st ¹ | 2nd ¹ | 3rd | 4th | Total 2012 | 5th | 6th |

Overall Total |

|||||||||||||||||||

| Delivery Date | 03/28/2012 | 4/21/2012 | 07/26/2012 | 10/15/2012 | 5/1/2013 | 7/2/2013 | ||||||||||||||||||||

| Operation Period | 51 days | 27 days | 98 days | 80 days | 73 days | 39 days | ||||||||||||||||||||

| Production related to the shipments - in barrels (bbls) | 547,376 | 246,809 | 789,774 | 809,495 | 2,393,454 | 779,110 | 425,313 | 3,597,877 | ||||||||||||||||||

| R$ ('000) | ||||||||||||||||||||||||||

| Sales Revenues | 118,003 | 55,996 | 150,686 | 174,707 | 499,392 | 165,000 | 89,634 | 754,026 | ||||||||||||||||||

| Sales Taxes | - | - | - | - | - | - | - | - | ||||||||||||||||||

| Royalties | (10,687 | ) | (4,938 | ) | (14,842 | ) | (15,772 | ) | (46,239 | ) | (15,351 | ) | (8,685 | ) | (70,275 | ) | ||||||||||

| Leasing | (24,078 | ) | (13,222 | ) | (52,708 | ) | (41,998 | ) | (132,006 | ) | (39,116 | ) | (20,868 | ) | (191,990 | ) | ||||||||||

| OSX Services | (13,944 | ) | (7,236 | ) | (28,071 | ) | (22,499 | ) | (71,750 | ) | (25,194 | ) | (12,471 | ) | (109,415 | ) | ||||||||||

| Logistics | (12,005 | ) | (7,410 | ) | (27,795 | ) | (18,405 | ) | (65,615 | ) | (8,355 | ) | (4,310 | ) | (78,280 | ) | ||||||||||

| Freight cost on sales | - | - | - | (5,831 | ) | (5,831 | ) | (3,877 | ) | (1,631 | ) | (11,339 | ) | |||||||||||||

| Others | (871 | ) | 36 | (1,183 | ) | (1,529 | ) | (3,547 | ) | (2,394 | ) | (1,200 | ) | (7,141 | ) | |||||||||||

| EBITDA | 56,418 | 23,226 | 26,087 | 68,673 | 174,404 | 70,713 | 40,469 | 285,586 | ||||||||||||||||||

| % EBITDA / Revenues | 47.81 | % | 41.48 | % | 17.31 | % | 39.31 | % | 34.92 | % | 42.86 | % | 45.15 | % | 37.87 | % | ||||||||||

| EBITDA / barrel - (R$/barrel) | 103.07 | 94.11 | 33.03 | 84.83 | 72.87 | 90.76 | 95.15 | 79.38 | ||||||||||||||||||

| Note: | ||

| ¹Sales occurred during the Extended Well Test and before the declaration of commerciality - not accounted in Results and recorded as a reduction of "Fixed Assets" | ||

The following table demonstrates the effective daily rates (in USD) of each of the costs associated with the FPSO OSX-1 operation, related to the operation period in each of the first six delivered cargos:

| Daily Cost (USD '000) | 2012 | 2013 | ||||||||||||||||

| 1st cargo | 2nd cargo | 3rd cargo | 4th cargo | Avg. 2012 | 5th cargo | 6th cargo |

Overall Average |

|||||||||||

| Leasing | (268) | (262) | (268) | (259) | (264) | (263) | (263) | (264) | ||||||||||

| OSX Services | (155) | (143) | (143) | (139) | (145) | (169) | (157) | (151) | ||||||||||

| Logistics | (134) | (147) | (141) | (113) | (134) | (56) | (54) | (108) | ||||||||||

| Others | (10) | 1 | (6) | (9) | (6) | (16) | (15) | (9) | ||||||||||

| Total | (567) | (551) | (557) | (520) | (549) | (504) | (489) | (531) | ||||||||||

Tubarão Martelo Field Development

OGX has drilled and made the lower completion of six horizontal production wells (TBMT-2HP, TBMT-4HP, TBMT-6HP, OGX-44HP, TBMT-8H and TBMT-10H). FPSO OSX-3 is scheduled to arrive by 3Q13 and its first production well is expected to come on-stream by 4Q13.

We have performed drill-stem tests on five production wells and the results were in line with our expectations.

PRODUCTION – PARNAÍBA BASIN

- Revenue generation commenced in January 2013, starting with gas dispatch for the synchronization of the first Parnaíba I Thermo Power Plant (TPP) turbine

- Average net gas production of 3.2 kboepd, 5.5 kboepd, 6.8 kboepd and 12.1 kboepd in January, February, March and April, respectively

- Achieved total production of 4.0 M m3/d (~25 kboepd) in the Gavião Real Field after synchronizing the fourth turbine at the Parnaíba I Thermo Power Plant with Brazil’s National Interconnected System (SIN) on April 5, 2013

Gavião Real and Gavião Azul Field Development

In January 2013, OGX started gas dispatch for the synchronization of the first Parnaíba I TPP turbine, initiating the project’s revenue generation only 16 months after the drilling of the first development well in the Parnaíba Basin.

In a 12-day production period in January with only one turbine synchronized, we registered an average net gas production of 3.2 kboepd (0.5 M m³/d). In February, operating with 2 turbines from February 9, we registered an average net gas production of 5.5 kboepd (0.9 M m³/d). In March, the third turbine was synchronized with the system on March 16 and we reached an average net gas production of 6.8 kboepd (1.1 M m³/d). In April, operating with 4 turbines synchronized from April 5, we registered an average net gas production of 12.1 kboepd (1.9 M m³/d) and the Thermal Power Plant Parnaíba I reached its total installed capacity of 676 MW.

We have also started the drilling of two additional development wells: GVR-17 and GVR-18, which will be completed and connected to the production clusters soon.

The table below shows the pro-forma GTU EBITDA after the three months of operations. The pro-forma EBITDA margin of approximately 73% reflects the asset’s profitability, still leaving room for margin increase with the full ramp-up of our production, in particular in April and May, with the synchronization of the fourth and fifth turbines.

|

|

Jan-13 | Feb-13 | Mar-13 | Total | ||||||||||||

| Operation Period¹ | From | 20-Jan | 26-Jan | 26-Feb | ||||||||||||

| To | 25-Jan | 25-Feb | 25-Mar | |||||||||||||

| OGX Maranhão gas production - in Mm3 | 3.62 | 35.42 | 44.49 | 83.53 | ||||||||||||

| R$ ('000) | ||||||||||||||||

| Revenues² | 4,259 | 18,504 | 16,516 | 39,279 | ||||||||||||

| Sales Taxes³ | (433 | ) | (2,088 | ) | (2,002 | ) | (4,523 | ) | ||||||||

| O&M | (1,089 | ) | (1,246 | ) | (1,262 | ) | (3,597 | ) | ||||||||

| Royalties & Landowners' right | (272 | ) | (1,038 | ) | (1,408 | ) | (2,718 | ) | ||||||||

| EBITDA | 2,465 | 14,132 | 11,844 | 28,441 | ||||||||||||

| % EBITDA / Revenue | 57.88 | % | 76.37 | % | 71.71 | % | 72.41 | % | ||||||||

| EBITDA / Mm3 - (R$/Mm3) | 681.71 | 398.97 | 266.20 | 340.49 | ||||||||||||

| Notes: | |||

| ¹ Closing date for accounting numbers: 25th day of the month | |||

| ² Gross revenue composed by gas sales revenue and GTU rental revenue | |||

| ³ Sales taxes composed by: PIS/COFINS/ICMS | |||

EXPLORATION REVIEW

HIGHLIGHTS

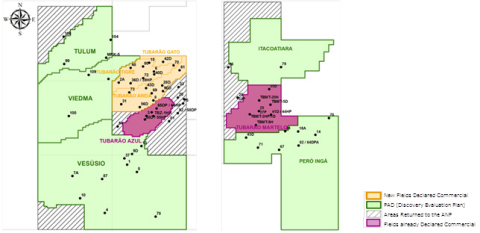

- Presented Declaration of Commerciality for the Pipeline, Fuji and Illimani accumulations to the ANP. The fields will be named Tubarão Gato, Tubarão Tigre and Tubarão Areia, with total estimated volume of oil in place of 823 million barrels of oil (P50)

- Submission of Discovery Evaluation Plans (PAD) to the ANP for Vesúvio, Viedma, Tulum and Itacoatiara accumulations in the Campos Basin, and for Curitiba, Belém and Natal accumulations in the Santos Basin

- Drilled the first appraisal well, OGX-109, committed at the PAD for Viedma accumulation, where 6 meters of net pay was discovered in the Santonian section

- Decided to not continue the exploration of the Cozumel and Cancun areas in the Campos Basin after not identifying the presence of hydrocarbons

- Returned Tambora and Tupungato accumulations to the ANP as the Company decided not to continue its development

- Made new and important discoveries of gas in the Parnaíba Basin: Fazenda Chicote (OGX-107) and São Raimundo (OGX-110) prospects, as well as Fazenda Santa Isabel (OGX-108), a wildcat adjacent to the OGX-88 (Bom Jesus) discovery

CAMPOS BASIN

The Company commenced the execution of the PADs by drilling the first appraisal well, OGX-109, for the Viedma accumulation, situated in the Campos Basin, where 6 meters of net pay was discovered in the Santonian section. OGX is currently evaluating whether to continue exploring the area.

Following the submission of the Declaration of Commerciality of the Pipeline, Fuji and Illimani accumulations, with total estimated volume of oil in place of 823 million barrels of oil (P50), we should submit the fields’ Development Plans. Currently, we also continue to work on the reservoir engineering for the installation of FPSO OSX-2, with delivery scheduled for 2H13.

In March, we have decided to not continue the exploration of the Cancun and Cozumel areas in the Campos Basin, BM-C-37 block, after not identifying significant presence of hydrocarbons. In April, we returned the Tambora and Tupungato accumulations, BM-C-41 block, as the Company decided not to continue this development.

Furthermore, the ANP approved the PADs for the Vesuvio, Krakatoa and Honolulu areas in blocks BM-C-38, BM-C-41, BM-C-42 and BM-C-43, and for Peró-Ingá areas in block BM-C-40, enabling us to extend the exploration period for these accumulations while we continue to wait for the approval of the submitted PADs for Tulum and Itacoatiara areas.

PARNAÍBA BASIN

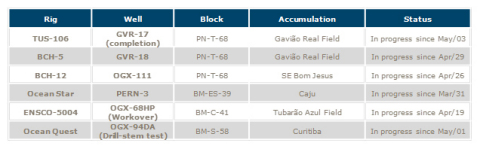

With two rigs focused on drilling exploratory wells and one completion rig, we initiated the drilling of five new wells in 2013. Of these five, three are wildcats: OGX-105, Rocha Lima prospect, a dry well; OGX-107, Fazenda Chicote prospect, where we discovered gas; and OGX-110, São Raimundo prospect, where we also discovered gas.

In addition, we commenced the drilling of two wildcat adjacent to the OGX-88 (Bom Jesus), named Fazenda Santa Isabel (OGX-108), where we discovered gas, and SE Bom Jesus (OGX-111), which is still in progress.

In January 2013, we presented to the ANP the Declaration of Commerciality for the Bom Jesus accumulation (named the Gavião Branco Field) after discovering gas in four exploratory wells in the area. We estimate a total volume in place between 0.2 and 0.5 Tcf of gas for the Gavião Branco Field.

In March 2013, after notifying to the ANP a gas discovery of approximately 66 net pay meters in the Fazenda Chicote prospect (OGX-107), we performed a drill-stem test in the well and obtained a gas flow rate of 3.2 million cubic meters per day in Absolute Open Flow (AOF). The interval tested was of only 19 meters (between 1,342 meters and 1,361 meters) in the Poti Formation and lasted approximately 36 hours. The test also confirmed a low gas condensate ratio (GCR), indicating dry gas and demonstrating the similarity of these results with the previous tests carried out in the Gavião Real and Gavião Branco fields. We are planning to continue the drilling campaign in this area in the coming months.

SANTOS BASIN

In the coming days, OGX will begin the Curitiba PAD where we will perform a drill-stem test at the OGX-94DA well, where we have already notified presence of light oil and gas. The success of this test will be important for the continuation of our exploration efforts in the Santos Basin, where we also submitted PADs for the Belém and Natal accumulations.

In January, ANP approved the Development Plan for the Atlanta Field, in block BS-4 where we have a 40% participating interest. The first production well is expected for the second half of 2013 using the Ocean Star rig which is part of our current fleet.

In March, the Company decided not to proceed with the development of the Fortaleza accumulation and returned the BM-S-57 block to the ANP.

ESPÍRITO SANTO BASIN

Perenco, our partner and operator of the blocks in the Espírito Santos Basin, commenced drilling of the exploration well, PERN-3, at the Caju prospect in the BM-ES-39 block using the Ocean Star rig, which is part of our current fleet. Another prospect in the BM-ES-40 block should commence after Caju’s drilling has been concluded.

In March 2013, OGX returned the BM-ES-37 block to the ANP, in which OGX had a 50% stake.

COLOMBIA

In the first quarter, OGX concluded the 3D seismic processing in the VIM-5 block and we are currently analyzing the results. The first exploration well in this block should be drilled in the beginning of 2014.

OTHER

EXPLORATION AND DEVELOPMENT EQUIPMENT

As part of our transition to a production-focused campaign in the Campos and Santos basins, we returned the drilling rigs Ocean Lexington and ENSCO-5002 in February and April, respectively.

Going forward, we expect to continue reducing our fleet, which is currently comprised of 3 rigs. One of them, Ocean Star, is already being shared with Perenco (OGX 50% / Perenco 40% / Sinochem 10%) and, after the conclusion of the works in the Espírito Santo Basin, should be used for the development of the Atlanta field and therefore shared with our partners in the consortium (OGX 40% / Consortium 60%).

PEOPLE MANAGEMENT

As of March 31, 2013, OGX had 357 employees and 3,869 third party service providers responsible for conducting all administrative, exploration and oil and gas production activities, down approximately 33% year over year. In addition to our strategy of contracting internationally respected suppliers to conduct operating activities, we maintain a high-performance, streamlined structure focused on managerial excellence and with broad experience in the oil and gas sector.

FINANCIALS

The financial and operational data below is presented on a consolidated basis, in accordance with the International Financial Reporting Standards (IRFS) issued by the International Accounting Standards Board – IASB and, in reais (R$), except where otherwise indicated.

Sales Revenues

The Company’s sales in the first quarter of 2013 totaled R$293 million. Of this total, R$254 million corresponded to the sale of 1.2 million barrels from the Tubarão Azul Field and R$39 million related to the sale of 84 M m3 of gas from the Gavião Real Field. R$4 million of taxes (ICMS, PIS and COFINS) were incurred in the gas operation.

Net Income

We ended 1Q13 with net losses of R$805 million, largely without impact on cash. This result is chiefly due to expenses of R$1,195 million related to dry wells and sub-commercial areas relinquished to the ANP after the conclusion of the exploratory period in March 2013, partially offset by the positive effect of deferred income tax and social contribution of R$424 million.

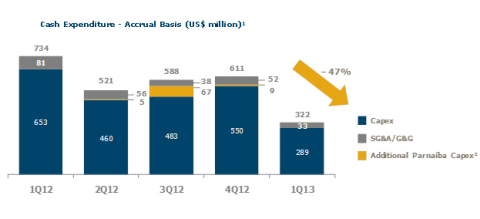

Cash Expenditure

OGX expenditures on an accrual basis were US$322 million in the first quarter. Compared to the previous quarter, the Company’s expenditure has significantly decreased, in particular due to the Capex rationalization process that the Company has begun with the plan of gradually returning our drilling rigs.

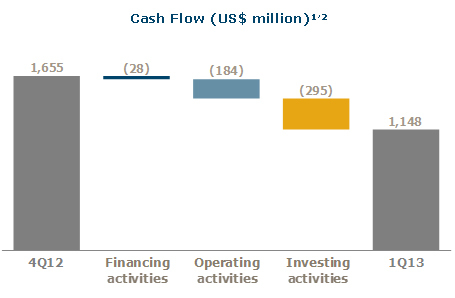

Cash Position

Despite our investing activities expenditures decline, our cash holdings decreased approximately US$500 million, ending at US$1.15 billion in 1Q13. The reduction was mainly driven by negative operational activities due to increased disbursements with our recurring suppliers as a result of the effective payment of previous accrued expenses - around R$400 million - as reflected on our Trade Payables account.

Exploration Expenses

Exploration expenses decreased R$27 million compared with 4Q12. This change was primarily the result of the reduction of the exploration campaign as part of our transition to a production-focused campaign.

General and Administrative Expenses

General and administrative expenses decreased R$14 million compared with 4Q12, driven by a reduction in headcount.

Dry and Sub-commercial Wells

In the first quarter of 2013, the Company posted an expense of R$1,195 million with dry wells and sub-commercial areas. Of this amount, R$952 million accounts for previously capitalized expenses, which include signature bonus and expenses of drilled wells in relinquished areas. The remaining balance of R$243 million refers to dry or sub-commercial wells.

Financial Result

The financial expense of R$103 million in 1Q13 is explained by: (a) the un-capitalized interest on financing of R$119 million, partially offset by (b) gains on financial investments of R$19 million.

Cost of Goods Sold

The cost of goods sold of R$138 million incurred with the oil sales is broken down as: (a) expenses with leasing of R$60 million; (b) O&M services of R$38 million; (c) logistics of R$13 million; (d) royalties of R$24 million; and (e) others of R$3 million.

The R$6.3 million cost of goods sold incurred with the gas sales is due to: (a) O&M services of R$3.6 million; and (b) royalties and landowners’ right of R$2.7 million.

Cash and Cash Equivalents

Cash and cash equivalents totaled R$2.3 billion (equivalent to about US$1.15 billion) on March 31, 2013, down R$1.1 billion from December 31, 2012. This decrease is chiefly due to: (a) CAPEX of R$578 million; (b) payment of interest totaling R$113 million; and (c) payment of recurring suppliers of R$403 million; partially offset by (d) pro-forma EBITDA from FPSO OSX-1 of R$111 million (5th and 6th cargos); and (e) pro-forma EBITDA from GTU Parnaíba of R$28 million.

Property, Plant and Equipment (CAPEX)

Property, plant and equipment represented by capital expenditures during the exploration and development phases include expenses related to drilling campaigns and the acquisition of E&P equipment. From December 31, 2012 to March 31, 2013, this balance increased by R$578 million.

Loans and Financing

The R$54 million decrease in the balance of loans and financing between December 31, 2012 and March 31, 2013 is detailed in the loans and financing table in the appendix.

Income Statement

|

R$ ('000) |

||||||||||||||||||||||

|

|

1Q13 | 4Q12 | ∆ | 1Q13 | 1Q12 | ∆ | ||||||||||||||||

| Net revenue | 289,391 | 174,707 | 114,684 | 289,391 | - | 289,391 | ||||||||||||||||

| Cost of goods sold (COGS) ¹ | (144,259 | ) | (100,203 | ) | (44,056 | ) | (144,259 | ) | - | (144,259 | ) | |||||||||||

| Exploration expenses | (27,851 | ) | (54,784 | ) | 26,933 | (27,851 | ) | (89,202 | ) | 61,351 | ||||||||||||

| Sales expenses | (5,508 | ) | (5,831 | ) | 323 | (5,508 | ) | - | (5,508 | ) | ||||||||||||

| General and administrative expenses | (37,949 | ) | (52,121 | ) | 14,172 | (37,949 | ) | (54,266 | ) | 16,317 | ||||||||||||

| EBITDA | 73,824 | (38,232 | ) | 112,056 | 73,824 | (143,468 | ) | 217,292 | ||||||||||||||

| Depreciation (part of COGS) | (38,776 | ) | (17,173 | ) | (21,603 | ) | (38,776 | ) | (1,533 | ) | (37,243 | ) | ||||||||||

| Amortization (part of COGS) | (5,202 | ) | (4,522 | ) | (680 | ) | (5,202 | ) | (1,757 | ) | (3,445 | ) | ||||||||||

| Stock option | (20,566 | ) | (7,372 | ) | (13,194 | ) | (20,566 | ) | (35,334 | ) | 14,768 | |||||||||||

| Dry/subcommercial wells/areas | (1,194,862 | ) | (231,238 | ) | (963,624 | ) | (1,194,862 | ) | (19,941 | ) | (1,174,921 | ) | ||||||||||

| Equity results | (479 | ) | - | (479 | ) | (479 | ) | - | (479 | ) | ||||||||||||

| EBIT | (1,186,061 | ) | (298,537 | ) | (887,524 | ) | (1,186,061 | ) | (202,033 | ) | (984,028 | ) | ||||||||||

| Financial revenue | 24,435 | 43,145 | (18,710 | ) | 24,435 | 87,719 | (63,284 | ) | ||||||||||||||

| Financial expense | (127,485 | ) | (149,637 | ) | 22,152 | (127,485 | ) | (94,769 | ) | (32,716 | ) | |||||||||||

| Net financial results | (103,050 | ) | (106,492 | ) | 3,442 | (103,050 | ) | (7,050 | ) | (96,000 | ) | |||||||||||

| Currency exchange | 66,160 | 1,788 | 64,372 | 66,160 | 31,070 | 35,090 | ||||||||||||||||

| Derivatives | (5,704 | ) | (1,909 | ) | (3,795 | ) | (5,704 | ) | (5,461 | ) | (243 | ) | ||||||||||

| EBT | (1,228,655 | ) | (405,150 | ) | (823,505 | ) | (1,228,655 | ) | (183,474 | ) | (1,045,181 | ) | ||||||||||

| (-) Income tax | 424,068 | 119,444 | 304,624 | 424,068 | 38,672 | 385,396 | ||||||||||||||||

| Net profit (loss) for the year- Pro forma | (804,587 | ) | (285,706 | ) | (518,881 | ) | (804,587 | ) | (144,802 | ) | (659,785 | ) | ||||||||||

| OGX Campos Merger | - | - | - | - | - | - | ||||||||||||||||

| Net profit (loss) for the year- Book value | (804,587 | ) | (285,706 | ) | (518,881 | ) | (804,587 | ) | (144,802 | ) | (659,785 | ) | ||||||||||

| Attributed to: | ||||||||||||||||||||||

| Non controlling interests | 5,818 | (12,803 | ) | 18,621 | 5,818 | (12,399 | ) | 18,217 | ||||||||||||||

| Controlling shareholders | (810,405 | ) | (272,903 | ) | (537,502 | ) | (810,405 | ) | (132,403 | ) | (678,002 | ) | ||||||||||

| Note: |

| ¹ This balance does not include parts of COGS related to depreciation, amortization and royalties that are disclosed in specific lines of the table above |

Balance Sheet

|

R$ ('000) |

||||||||||||

|

|

Mar 31, 2013 |

Dec 31, 2012 | Mar 31, 2013 | Dec 31, 2012 | ||||||||

| ASSETS | LIABILITIES AND EQUITY | |||||||||||

| Current assets | Current Liabilities | |||||||||||

| Cash and cash equivalents | 2,311,016 | 3,381,326 | Trade payables | 522,944 | 925,513 | |||||||

| Escrow deposits | 15,180 | 14,963 | Taxes, contributions and profit sharing payable | 28,617 | 22,894 | |||||||

| Taxes and contributions recoverable | 28,879 | - | Salaries and payroll charges | 70,297 | 58,921 | |||||||

| Derivative financial instruments | 24,975 | 26,350 | Loans and financings | 136,967 | 84,534 | |||||||

| Oil inventories | 77,107 | 118,027 | Derivative financial instruments | 2 | 1,416 | |||||||

| Other credits | 106,226 | 94,686 | Accounts payable to related parties | 84,244 | 100,845 | |||||||

| Other accounts payable | 23,576 | 20,096 | ||||||||||

| 2,563,383 | 3,635,352 | |||||||||||

| 866,647 | 1,214,219 | |||||||||||

| Noncurrent Liabilities | ||||||||||||

| Loans and financings | 7,854,127 | 7,960,166 | ||||||||||

| Provisions | 218,250 | 210,887 | ||||||||||

| Noncurrent Assets | ||||||||||||

| Inventories | 231,895 | 206,511 | 8,072,377 | 8,171,053 | ||||||||

| Taxes and contributions recoverable | 199,080 | 215,311 | Shareholders’ Equity | |||||||||

| Deferred income taxes and social contributions | 1,216,497 | 791,893 | Capital stock | 8,821,155 | 8,821,155 | |||||||

| Credits with related parties | 180,514 | 179,454 | Capital reserves | 191,013 | 178,793 | |||||||

| Earnings reserves | - | - | ||||||||||

| Investments | 12,490 | - | Currency translation adjustments | 38,583 | 42,571 | |||||||

| Retained earnings (deficit) | (2,142,075) | (1,343,306) | ||||||||||

| Fixed assets | 9,756,663 | 10,027,389 | ||||||||||

| Portion attributed to controlling shareholders | 6,908,676 | 7,699,213 | ||||||||||

| Intangible assets | 1,713,223 | 2,060,438 | Portion attributed to non-controlling interests | 26,045 | 31,863 | |||||||

| 13,310,362 | 13,480,996 | 6,934,721 | 7,731,076 | |||||||||

| Total Assets | 15,873,745 | 17,116,348 | Total Shareholders’ Equity | 15,873,745 | 17,116,348 | |||||||

Fixed Assets

|

R$ ('000) |

|||||||

| FIXED ASSETS | |||||||

| Balance as of December 31, 2012 | 10,027,389 | ||||||

| (+) CAPEX | |||||||

| Campos Basin | 422,764 | ||||||

| Santos Basin | 10,969 | ||||||

| Parnaíba Basin | 49,688 | ||||||

| Espirito Santo Basin | 6,947 | ||||||

| Pará Maranhão Basin | 3,974 | ||||||

| Colombian Basins | 0 | ||||||

| Corporate | 83,854 | ||||||

| 578,196 | |||||||

| (+) Borrowing costs | 44,477 | ||||||

| (+) Asset retirement obligation | - | ||||||

| (-) Gross margin EWT | - | ||||||

| (-) Disposals | - | ||||||

| (-) Depreciation | (37,189 | ) | |||||

| (-) Write off Dry/Subcommercial wells | (856,210 | ) | |||||

| Balance as of March 31, 2013 | 9,756,663 | ||||||

Loans and Financing

|

R$ ('000) |

||||||

| LOANS AND FINANCING | ||||||

| Balance as of December 31, 2012 | (8,044,700 | ) | ||||

| (-) New fundings | - | |||||

| (-) Accrued interests | (163,884 | ) | ||||

| (-) Currency exchange | 109,169 | |||||

| (+) Interest paid | 112,658 | |||||

| (+) Funding costs | - | |||||

| (-) Amortization of funding costs | (4,337 | ) | ||||

| Balance as of March 31, 2013 | (7,991,094 | ) | ||||

|

Conference Call: |

| Friday, May 10 at 1:00 P.M. (Brasília Time); 12:00 P.M. (EST) |

| Telephone (Brazil): +55 11 4688-6341 |

| Telephone Toll-free (US): +1 855 281-6021 |

| Telephone (US): +1 786 924-6977 |

| Code: OGX |

|

Webcast in Portuguese: www.ccall.com.br/ogx/1t13.htm Webcast in English: www.ccall.com.br/ogx/1q13.htm |

|

Audio will be available three hours after the conference call on the IR website: www.ogx.com.br/ri The conference call will be conducted in English with simultaneous translation to Portuguese. |

ABOUT OGX

OGX Petróleo e Gás SA is focused on oil and natural gas exploration and production and is conducting the largest private-sector exploratory campaign in Brazil. OGX has a diversified, high-potential portfolio, comprised of 26 exploratory blocks in the Campos, Santos, Espírito Santo, Pará-Maranhão and Parnaíba Basins in Brazil, and 5 exploratory blocks in Colombia, in the Lower Magdalena Valley and the Cesar-Ranchería basins. The total extension area is of approximately 4,600 km² in sea and approximately 36,700 km² on land, with 24,500 km² in Brazil and 12,200 km² in Colombia. OGX relies upon an experienced management team and has a solid cash position, with approximately US$1.1 billion in cash (as of March 2013) to fund its E&P investments and new opportunities. In June of 2008, the company went public, raising R$6.7 billion, which at the time was the largest amount ever raised in a Brazilian IPO. OGX is part of the EBX Group, an industrial group founded and led by Brazilian entrepreneur Eike F. Batista, who has a proven track record in developing new ventures in the natural resources and infrastructure sectors. For more information, please visit: www.ogx.com.br/ri

LEGAL NOTICE

This document contains Company-related statements and information that reflect the current vision and/or expectations the Company and its management have regarding its business plan. These include, among others, all forward-looking statements that involve forecasts and projections, indicate or imply results, performance or future achievements, and may contain words such as “believe,” “foresee,” “expect,” “consider,” “is likely to result in” or other words or expressions of similar meaning. Such statements are subject to a series of expressive risks, uncertainty and premises. Please be advised that several important factors can cause the actual results to diverge materially from the plans, objectives, expectations, estimations, and intentions expressed in this document. In no event shall the Company or the members of its board, directors, assigns or employees be liable to any third party (including investors) for investment decisions or acts or business carried out based on the information and statements that appear in this presentation, or for indirect damage, lost profit or related issues. The Company does not intend to provide to potential shareholders with a revision of the statements or an analysis of the differences between the statements and the actual results. You are urged to carefully review OGX's offering circular, including the risk factors included therein. This presentation does not purport to be all-inclusive or to contain all the information that a prospective investor may desire in evaluating OGX. Each investor must conduct and rely on its own evaluation, including of the associated risks, in making an investment decision.