TROY, Mich.--(BUSINESS WIRE)--While 83% of U.S. small businesses expect more good than bad things to happen for their companies, more than half (51%) are currently categorized as financially unhealthy.1 Among those who are financially unhealthy, 61% are carrying revolving debt on their business credit cards and 63% are borrowing with those cards to fund operating expenses, according to the J.D. Power 2024 U.S. Small Business Credit Card Satisfaction Study,SM released today. The findings put a spotlight on the tenuous nature of the small business economy and the critical role that business credit cards are playing in keeping merchants afloat.

“The small business economy is highly bifurcated right now, with 46% indicating they are better off financially than they were a year ago and 49% categorized as financially healthy," said John Cabell, managing director of payments intelligence at J.D. Power. "But the other half of small businesses are clearly struggling. Among those that are struggling, business credit cards have been a lifeline but the buildup of revolving debt they are accumulating should raise some concerns. Notably, overall satisfaction scores and perceived value of card benefits and rewards are lower among small businesses seeking credit. This gap among businesses that rely on cards the most is putting brand loyalty and advocacy at risk.”

Following are some key findings of the 2024 study:

- Small business outlook either half full or half empty: Overall, 46% of small business credit card customers describe the financial state of their company as better off than a year ago and 49% describe it as about the same. Just 5% say they are worse off this year than in 2023. When it comes to financial health metrics, however, just 49% of small businesses are financially healthy, while 27% are vulnerable, 15% are capital constrained and 8% are cash constrained.

- Revolving debt mounts: More than one-fourth (26%) of U.S. small businesses are credit-seeking heavy users of credit cards and payment plans. Among businesses that use credit cards, 63% of those with card debt are also financially unhealthy. Within this group, 15% also have used a fixed payment plan on their credit card and 24% have used buy-now-pay-later plans for business expenses—yet only a fraction of these businesses (10%) plan to decrease spending in the next year.

- Customer satisfaction directly correlated with business outlook: Overall satisfaction among small business credit card customers who say their business is better off today than a year ago is 67 points higher (on a 1,000-point scale) than among those who say their business is about the same, and 135 points higher than among those who say their business is worse off this year. Satisfaction drops by 143 points when a business is financially unhealthy vs. if it is financially healthy.

- Advocacy and loyalty at risk: The likelihood of those small business card customers who say they “definitely will not” switch cards in the next year drops to 20% among financially unhealthy card users vs. 37% among financially healthy card users. Credit limits and interest rates are influencing possible defection. Further, the percentage of small business card clients willing to be promoters and refer new business to their issuer falls to 50% from 77% when a business is unhealthy than when a business is healthy.

- Rewards programs and benefits not connecting with all cardholders: Nearly half (49%) of small business card customers say their card offers important benefits including priority boarding, free late checkout, free shipping, expedited security at airport and free companion ticket. Slightly more than one-third (36%) say the rewards they earn help their business, a percentage that peaks at only 40% among those without revolving card debt.

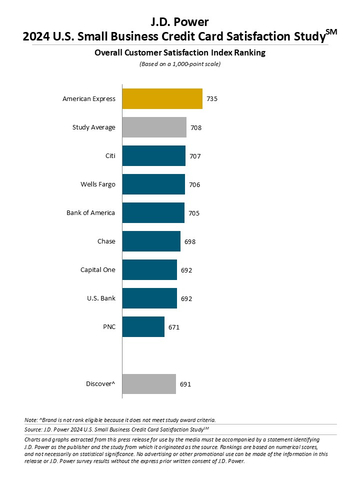

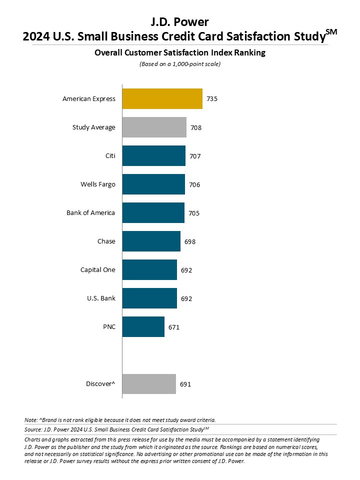

Study Ranking

American Express ranks highest in customer satisfaction for a fourth consecutive year, with a score of 735.

The U.S. Small Business Credit Card Satisfaction Study was redesigned for 2024. Scores are not comparable year-over-year with previous studies. The study measures customer satisfaction with the largest small business credit card issuers in the U.S. across seven core dimensions (in order of importance): account management; meeting my business needs; terms; benefits; rewards redeeming; rewards earning; and customer service. The study is based on responses gathered from 3,303 small business credit card customers whose business has an approximate annual revenue between $10,000 and $10 million. The study was fielded in July-September 2024.

For more information about the U.S. Small Business Credit Card Satisfaction Study, visit

https://www.jdpower.com/business/resource/us-small-business-credit-card-study.

See the online press release at http://www.jdpower.com/pr-id/2024159.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

______________

1 J.D. Power measures the financial health of small businesses as a metric combining their creditworthiness, access to affordable funding and credit and safety net items like insurance coverage. Businesses are placed on a continuum from healthy to vulnerable.