TROY, Mich.--(BUSINESS WIRE)--Mortgage servicers this year have successfully fought back the headwinds of persistently high interest rates and financial uncertainty to drive improvements in overall customer satisfaction, but significant risks loom on the horizon. According to the J.D. Power 2024 U.S. Mortgage Servicer Satisfaction Study,SM released today, mortgage servicer efforts to improve digital experiences and streamline problem resolution have helped drive incremental improvements in customer satisfaction, but the overall financial health1 of borrowers has declined sharply and an increasing number of borrowers are paying their bill after the due date.

“On the surface, mortgage servicers’ efforts to elevate their digital tools and customer service are offsetting challenging market conditions,” said Bruce Gehrke, senior director of lending intelligence at J.D. Power. “But digging a little deeper, the data shows early signs of potentially serious challenges for servicers in the future. A proverbial ‘canary in the coal mine’ is the financial health of borrowers, which has materially declined in the past few years. At the same time, most borrowers are facing rising escrow costs that result in their total monthly mortgage payment increasing. This means the industry has a growing number of at-risk customers facing higher costs, a group that tends to be a lot more expensive to service.”

Following are some key findings of the 2024 study:

- Financial health of borrowers declines sharply: Just 41% of borrowers are currently classified as financially healthy, down from 46% in 2023 and 52% in 2022. Conversely, the percentage of at-risk borrowers is now 19%, up from 17% in 2023. Overall satisfaction scores among financially unhealthy borrowers are, on average, 117 points lower than among financially healthy borrowers.

- Escrow costs rising and borrowers need guidance: Escrow costs—the fees typically rolled into a mortgage to pay annual property tax and homeowners insurance bills—are rising nationwide, with 56% of borrowers experiencing an increase in escrow costs this year. Overall satisfaction is 62 points lower (on a 1,000-point scale), on average, among those who experienced an escrow cost increase than among those who experienced no change. Among those borrowers whose escrow costs increased, overall satisfaction is higher among those who say they had access to tools/information on escrow from their servicer than among those who say they were not aware of such tools.

- Overall satisfaction with mortgage servicers improves: The overall customer satisfaction score for mortgage servicers is 606, up 5 points from 2023. Improvements in problem resolution and satisfaction with digital channels are the primary drivers of this year’s higher scores.

- Controlling costs still a challenge: Self-service is key to keeping costs down. Although satisfaction with the look and feel of mortgage servicer websites and apps improves this year, borrowers say the phone is still the most likely customer service channel to drive a successful outcome and 29% of borrowers still considered this the easiest channel to use. Among those who had a problem, just 49% say their initial contact was calling customer service.

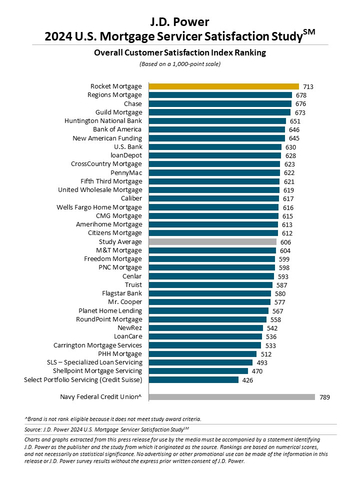

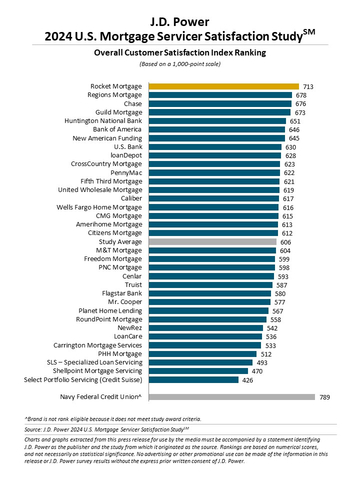

Study Ranking

Rocket Mortgage ranks highest among mortgage servicers with a score of 713. Regions Mortgage (678) ranks second and Chase (676) ranks third.

The U.S. Mortgage Servicer Satisfaction Study measures customer satisfaction with the mortgage servicing experience in six factors (in order of importance): level of trust; makes it easy to do business with; keeps me informed and educated; people; resolving problems or questions; and digital channels. The study is based on responses from 15,020 customers who have been with their current mortgage loan servicer for at least one year. The study was fielded from May 2023 through May 2024.

For more information about the U.S. Mortgage Servicer Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-mortgage-servicer-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024071.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

_________________________

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.