SCOTTSDALE, Ariz.--(BUSINESS WIRE)--Westphalia Dev. Corp. (the “Corporation”) announced today its results for the third quarter ending September 30, 2023. The Corporation was formed in March 2012, for the development of a 310-acre Westphalia property located in Prince George’s County, Maryland, United States. The Corporation is managed by Walton Global (the “Manager”).

Development and Sales Activities

The key development and sales activities of the Corporation in the third quarter ending September 30, 2023, were:

- The Westphalia Interchange TIF project located at the intersection of Pennsylvania Avenue (Route 4) and Woodyard Route (Route 223) is undergoing a final pave, with the expectation that this will be complete by year end.

- The Presidential Parkway East TIF project is substantially complete. We are in discussions with the local County for final acceptance.

- The Presidential Parkway West TIF project has work remaining, which will likely be completed in Q1, 2024.

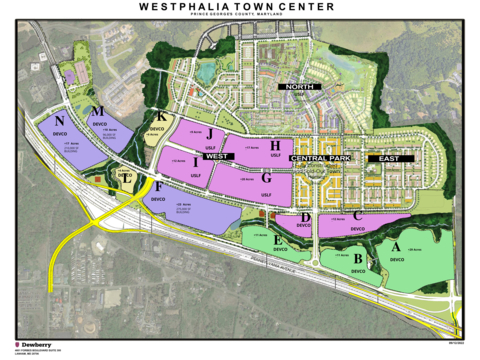

- The Manager is engaged with a number of builders interested in developing and building out the retail and/or residential pods shown above. Offers to purchase are expected on these parcels imminently.

- The Manager continues to work proactively with Prince George’s County to attain approvals for our retail commercial, mixed use commercial and residential pods shown as Parcel “A” & “B”, above, which is expected in late Q4, 2023, or early Q1, 2024.

Financial Results

- Management has determined the substantial completion date of Phase 1 to be June 30, 2023, at which point carrying costs, including interest, financing costs and property taxes, will no longer be capitalized and are now expensed. Otherwise, other operating expenses for this quarter remained consistent with Q2 2023.

The Corporation’s unaudited consolidated interim financial statements and management’s discussion and analysis for the third quarter ending September 30, 2023, are available under the Corporation’s SEDAR profile at www.sedar.com.

About Walton Global

Walton Global is a privately-owned, leading land asset management and global real estate investment company that concentrates on the research, acquisition, administration, planning, and development of land. With more than 44 years of experience, Walton has a proven track record of administering land investment projects within the fastest growing metropolitan areas in North America. The company manages and administers US$3.3 billion in assets on behalf of its global investors, builders and developer clients and industry business partners. Walton has more than 93,000 acres of land under ownership, management and administration in the United States and Canada with business lines ranging from exit-focused pre-development land investments, builder land financing and build-to-rent. For more information visit walton.com.

# # #

This news release, required by Canadian laws, does not constitute an offer of securities, and is not for distribution or dissemination outside Canada. This news release contains forward looking information, and actual future results may differ from what is disclosed in this news release. Forward-looking information is based on the current expectations, estimates and projections of the Corporation at the time the statements are made. They involve a number of known and unknown risks and uncertainties which would cause actual results or events to differ materially from those presently anticipated. The risks, uncertainties and other factors that could cause the Corporation's actual results and performance in future periods to differ materially from the forward looking information contained in this news release include, among other things, the development of Westphalia Town Center, general economic and market factors, including interest rates, a decline in the real estate market, changes in government policies and regulations or in tax laws, changes in municipal planning strategies and whether certain development approvals are obtained and changes in the Canadian/U.S. dollar exchange rate, in addition to those factors discussed or referenced in documents filed with Canadian securities regulatory authorities and available online at www.sedar.com.

Except as otherwise noted, all amounts are in Canadian dollars, and are based on interim financial statements for the quarter ended September 30, 2023, and related notes, prepared in accordance with International Financial Reporting Standards.