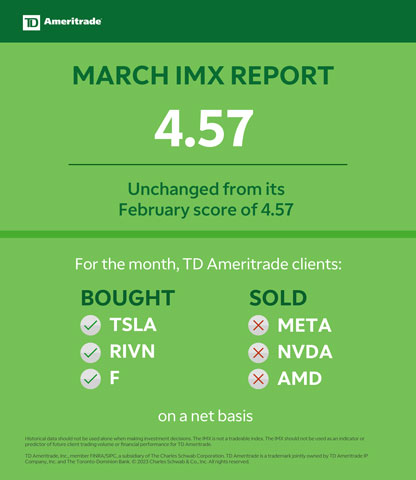

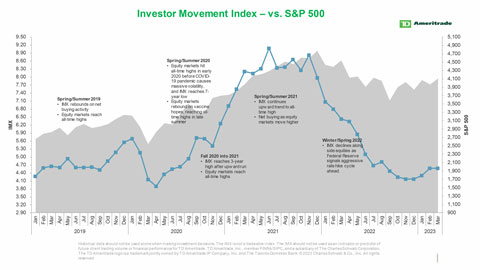

OMAHA, Neb.--(BUSINESS WIRE)--The Investor Movement Index® (IMX℠) remained at 4.57 in March, unchanged from its score in February. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

The reading for the five-week period ending March 31, 2023 ranks “moderate low” compared to historic averages.

“March was full of surprises, but the overall impact among TD Ameritrade retail clients when it came to exposure to the markets was neutral,” said Lorraine Gavican-Kerr, Managing Director, Investor Education at TD Ameritrade. “For the second month in a row, our clients were net buyers of equities, seemingly eyeing an opportunity to buy into the Financial sector’s lows and to sell off the highs in Information Technology.”

The March IMX period saw the S&P 500 (SPX) finish higher despite many surprises and macroeconomic catalysts. The period began with hotter-than-expected inflation data, and Federal Reserve Chairman Jerome Powell addressed Congress early in the month with a stern testimony that sent the two-year Treasury yield above 5% for the first time since 2007. The U.S. Bureau of Labor Statistics’ Employment Situation report showed that the labor market remained stubbornly strong, although the unemployment rate did uptick from 3.4% to 3.6% as labor market participation picked up slightly. This, however, was largely overshadowed by concerns surrounding the health of the financial system stemming from the failure of two influential regional banks. As these concerns grew, the impact was felt in global markets, which rapidly re-priced the trajectory of interest rates. Global leaders and regulators made significant efforts to shore up confidence in the financial system and ease concerns.

Despite this uncertainty, the Federal Reserve’s Federal Open Market Committee (FOMC) did ultimately raise the Fed Funds rate by 25 basis points, as expected, during its March meeting. As the month rolled on, concerns surrounding the health of the banking system eased and U.S. equities rallied sharply. The SPX closed the period at 4109.31, up 3.51%, and the CBOE Market Volatility Index ended near its lows for the year at 18.70. U.S. Treasury markets were volatile during the March period, with 10-year yields trading as high as almost 4.1% and as low as 3.3% before finishing near 3.5%. The U.S. Dollar Index lost ground, closing down near 102.6. Crude oil was volatile once again, briefly falling under $65 a barrel, but it ultimately recovered to settle near $80 a barrel, up around 4%.

TD Ameritrade clients were net buyers during the period. Popular names bought included:

- Tesla Inc. (TSLA)

- Rivian Autmotive Inc. (RIVN)

- Ford Motor Co. (F)

- First Republic Bank (FRC)

- Amazon.com Inc. (AMZN)

Names net sold during the period included:

- Meta Platforms Inc. (META)

- NVIDIA Corp. (NVDA)

- Advanced Micro Devices Inc. (AMD)

- Intel Corp. (INTC)

- Apple Inc. (AAPL)

Millennial Buys & Sells

TD Ameritrade millennial clients increased exposure during the March period, and like the overall TD Ameritrade client population, they were net buyers of equities.

Both TD Ameritrade millennial clients and the overall TD Ameritrade client population were net buyers of First Republic Bank (FRC). As the company’s shares plummeted by more than 88% over worries regarding uninsured deposits, TD Ameritrade clients saw this as an opportunity to increase exposure in the regional bank. TD Ameritrade millennial clients, like the overall TD Ameritrade client population, showed continued buying interest in Rivian (RIVN) as the electric vehicle maker stated it was on track to meet 2023 production targets. Walt Disney (DIS) was also net bought by TD Ameritrade millennial clients as CEO Bob Iger continued to expand on his turnaround plans for the entertainment and streaming giant.

Both populations sold Apple (AAPL) into strength as the shares continued to show signs of resilience despite increasing macroeconomic uncertainty. Nvidia (NVDA) shares continued their climb during the March period, hitting a 52-week high of $280 per share, as both the TD Ameritrade millennial and overall TD Ameritrade client population sold this strength and reduced exposure in the semiconductor giant. Boeing (BA) was net sold by TD Ameritrade millennial clients as the aircraft maker built on its strong start to 2023 after confirming a large order for 78 of its Dreamliner jets.

TD Ameritrade millennial clients bought most heavily in the S&P Financials sector, while selling interest was highest in the Communication Services and Information Technology sectors.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010, to view the full report from March 2023, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade. IMX data includes that from accounts of TD Ameritrade clients which recently transferred to our affiliate, Charles Schwab & Co., Inc., as part of our planned integration.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting-edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.tdameritrade.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co. Inc. All rights reserved.