CASA GRANDE, Ariz. & TORONTO--(BUSINESS WIRE)--Arizona Sonoran Copper Company Inc. (TSX:ASCU | OTCQX:ASCUF) (“ASCU” or the “Company”) is pleased to announce a maiden Mineral Resource Estimate (“MRE”) for the Parks/Salyer (“P/S”) porphyry copper deposit, located immediately southwest of the Cactus Project on contiguous private land in Arizona, USA. The P/S Project is located 1.3 mi (2 km) SW from the Cactus open pit along the mine trend, and demonstrates the same geological characteristics (see FIGURES 1-4).

The ASCU global mineral resources are as noted below; Oxide, Enriched and Stockpile material are all considered amenable to a heap leaching operation:

Table 1: Parks/Salyer Inferred Underground Mineral Resource Estimate as at 26th September, 2022

Inferred Resource |

Tons (kt) |

CuT (%) |

Cu TSol (%) |

Contained Cu (k lbs) |

Contained Cu (k Tons) |

Oxide |

14,100 |

|

0.827 |

233,700 |

117 |

Enriched |

101,200 |

|

1.100 |

2,227,200 |

1,113 |

Leachable |

115,400 |

- |

1.066 |

2,460,900 |

1,230 |

Primary |

28,300 |

0.804 |

- |

454,400 |

228 |

Total Inferred |

143,600 |

1.015 |

|

2,915,400 |

1,458 |

Comprehensive notes for Table 1, with Table 2 below. |

Table 2: Global Cactus and Parks/Salyer Project Open Pit and Underground Mineral Resource Estimate

Material Type |

Tons

|

CuT

|

TSol % |

Contained Cu (k lbs) |

Contained Cu (k Tons) |

INDICATED |

|||||

Cactus |

|||||

Oxide |

31,400 |

|

0.559 |

349,700 |

176 |

Enriched |

42,500 |

|

0.844 |

715,500 |

359 |

Total Leachable |

73,900 |

|

0.723 |

1,065,200 |

534 |

Primary |

77,900 |

0.35 |

|

545,500 |

273 |

Total Indicated |

151,800 |

0.531 |

1,610,700 |

806 |

|

INFERRED |

|||||

Cactus |

|||||

Oxide |

62,500 |

|

0.346 |

430,500 |

216 |

Enriched |

55,100 |

|

0.498 |

548,800 |

274 |

Total Leachable |

117,600 |

|

0.417 |

979,300 |

490 |

Primary |

111,300 |

0.349 |

|

776,000 |

388 |

Total Inferred |

228,900 |

0.384 |

1,755,300 |

879 |

|

Stockpile |

|||||

Oxide |

77,400 |

|

0.144 |

223,500 |

111 |

Parks/Salyer |

|||||

Oxide |

14,100 |

|

0.827 |

233,700 |

117 |

Enriched |

101,200 |

|

1.1 |

2,227,200 |

1,113 |

Total Leachable |

115,400 |

|

1.066 |

2,460,900 |

1,230 |

Primary |

28,300 |

0.804 |

|

454,400 |

228 |

Total Inferred |

143,600 |

1.015 |

2,915,400 |

1,458 |

|

|

|

|

|

|

|

Total Resources |

|||||

INDICATED |

|||||

Total Leachable |

73,900 |

|

0.723 |

1,065,200 |

534 |

Total Indicated |

151,800 |

0.531 |

1,610,700 |

806 |

|

INFERRED |

|||||

Total Leachable |

310,400 |

|

0.59 |

3,663,700 |

1,832 |

Total Inferred |

449,900 |

0.544 |

4,894,200 |

2,447 |

|

Notes for Tables 1 and 2: |

1. CuT means total copper and Tsol means total soluble copper as the addition of sequential acid soluble and sequential cyanide soluble copper assays. Tons are reported as short tons. |

2. Cactus and Stockpile Resource estimates have an effective date of 31st August, 2021 and use a copper price of US$3.15/lb. The assumptions in respect of the Cactus and Stockpile Resource estimates are as stated in the Preliminary Economic Assessment (“PEA”) titled "Arizona Sonoran Copper Company, Inc. Cactus Project, Arizona, USA Preliminary Economic Assessment" with an effective date of August 31, 2021; Parks/Salyer Resource estimate has an effective date of 26th September, 2022 and uses a copper price of US$3.75/lb. |

3. Technical and economic parameters defining resource pit shell: mining cost US$2.45/t; G&A US$0.55/t, and 44°-46° pit slope angle. |

4. Technical and economic parameters defining underground resource: mining cost US$28.93/t, and G&A representing 7% of direct costs. |

5. Technical and economic parameters defining processing: Heap leach (HL) processing cost including selling US$1.77/t; HL recovery 83% of CuT; mill processing cost US$8.50/t. |

6. For Cactus: Variable cutoff grades were reported depending on material type, potential mining method, and potential processing method. Oxide material within resource pit shell = 0.096% TSol; enriched material within resource pit shell = 0.098% TSol; primary material within resource pit shell = 0.205% CuT; oxide underground material outside resource pit shell = 0.56% TSol; enriched underground material outside resource pit shell = 0.70% TSol; primary underground material outside resource pit shell = 0.70% CuT. |

7. For Parks/Salyer: Variable cut-off grades were reported depending on material type associated potential processing method. Oxide underground material = 0.495% TSol; enriched underground material = 0.60% TSol; primary underground material = 0.586% CuT. |

8. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors. |

9. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification. |

10. Total may not add up due to rounding. |

Due to the significant increase in the Company-wide Mineral Resources, the oxide and enriched material at Parks/Salyer will be considered for inclusion in a future technical study incorporating both the Cactus and Parks/Salyer deposits. Future studies will be based on the expanded leachable inventory, heap leaching and SX/EW process methodology. An integrated technical study is expected to be completed in the next 12-18 months. The primary sulphides are currently being tested for leachability (based on the NutonTM technology) and may form the basis of further project upside.

George Ogilvie, Arizona Sonoran President and CEO commented, “The significant increase to our global resource base is a key inflection point in the low-risk development of our existing Cactus Project. We have increased our global leachable inventory base by over 100%, and as a result, the Company has determined that a full revised study will be considered to produce an integrated business case for Cactus and Parks/Salyer. It is clear that the high-grade nature of Parks/Salyer’s mineral resource inventory offers significant potential to increase scale within an integrated operation at conservative copper price estimates. We will continue advancing our work study programs, specifically, metallurgical and geotechnical test work, hydrology, permitting, infill drilling and associated projects to advance the combined Cactus and P/S Project through the technical study phases. Through updating the global MRE, our team has delineated a significant copper project, with the potential to become a key supplier to the USA critical metals chain in the coming years.”

The MRE was prepared by Stantec in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards and National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Due to the proximity of P/S to the Cactus Mine, and associated future shared infrastructure, the P/S MRE will be stated as an inferred mineral resource in a new technical report in conjunction with the Cactus MRE effective August 31, 2021. The Cactus Mine Project economics are as of the date as contained in the technical report titled "Arizona Sonoran Copper Company, Inc. Cactus Project, Arizona, USA Preliminary Economic Assessment" with an effective date of August 31, 2021 (the "2021 Technical Report"). The new technical report covering the Cactus Mine Project and Parks/Salyer, will be filed within 45 days.

Focused Drill Program Results in Large Maiden Resource Estimate

In 2020, ASCU drilled two exploration holes to the north of two historic ASARCO drill holes. These holes successfully intersected well mineralized porphyry copper mineralization over significant widths. In 2021, the Company began exploring the P/S property with 500 ft (152 m) spaced drilling to test its defined Exploration Target. The Exploration Target presented the potential of a second underground operation on the Cactus Mine Project private property. In total, 31 drill holes over 66,507 ft (20,271 m) were used to define the P/S target for this maiden inferred MRE.

The maiden inferred MRE for the Parks/Salyer Deposit is summarized in Table 1 above. The table illustrates the inferred mineral resource in the oxide, enriched and primary mineralized zones and leachable and primary zones, respectively.

Park/Salyer: High grade deposit with significant leverage to Copper Price

The sensitivity and upside exposure to a larger tonnage at higher copper prices is demonstrated in the table below. The reader is cautioned that figures in the following chart should not be misconstrued as Mineral Resources or confused with the Mineral Resource Statement reported above. These figures are only presented to show the sensitivity vis a vis copper prices based on the methodology and assumptions stated:

Table 3: Parks/Salyer Resource: Leverage to Copper Price

Price |

Total Leachable |

Total Material |

||||

Cu TSol (%) |

Tonnage (M short ton) |

Metal (Cu Blbs) |

Cu (%) |

Tonnage (M short ton) |

Metal (Cu Blbs) |

|

$3.35 |

1.13 |

100.5 |

2.30 |

1.08 |

123.5 |

2.65 |

$3.55 |

1.10 |

108.0 |

2.40 |

1.05 |

134.0 |

2.80 |

$3.75 |

1.07 |

115.5 |

2.45 |

1.01 |

143.5 |

2.90 |

$3.95 |

1.04 |

122.5 |

2.55 |

0.99 |

153.5 |

3.05 |

$4.15 |

1.01 |

128.5 |

2.60 |

0.96 |

163.0 |

3.15 |

$4.35 |

0.99 |

135.0 |

2.65 |

0.93 |

172.5 |

3.25 |

$4.55 |

0.97 |

141.5 |

2.75 |

0.91 |

182.5 |

3.30 |

Notes: |

1. Price sensitivity tons and grades were calculated using a consistent methodology to the reporting of the Parks/Salyer inferred resource. New cut-off grades were calculated for each material type (oxide, enriched, and primary) based on the variation in copper price. Tons and grades were rereported for each material type with the appropriate cut-off grade. |

2. Cu grade reported for Total Material represents a blend of Cu TSol for oxide and enriched material, and CuT for primary material. |

Potential shared infrastructure between Parks/Salyer and Cactus

Like Cactus, the P/S Project extends over a portion of the larger Santa Cruz porphyry copper system that has been dismembered and displaced by tertiary extensional faulting. Major host rocks at Cactus are precambrian oracle granite and laramide monzonite porphyry and quartz monzonite porphyry. The porphyries intruded the older rocks to form mixed breccias; monolithic breccias and occur as large masses, poorly defined dike-like masses; and thin well-defined but discontinuous dikes. The mineralization is structurally complex with intense fracturing, faulting, and both pre-mineral and post-mineral brecciation. As such, it is expected the metallurgy of both Cactus and P/S will be similar however testing is ongoing.

The two deposits are located within the same 4,846 acre private land parcel. Water, power, roads, the metallurgical testing building and core shacks are all easily accessible within the confines of the total project area. Future processing plants, ponds, auxiliary buildings and mine access would be considered in a location accessible by both deposits should a positive production decision be made in the future.

Next Steps

Resource Declaration in Technical Report

Due to the proximity of P/S to the Cactus Mine, and associated future shared infrastructure, the P/S MRE will be stated as an inferred mineral resource in a new technical report in conjunction with the Cactus MRE effective August 31, 2021. The Cactus Mine Project economics are as of the date as contained in the 2021 Technical Report. The new technical report covering the Cactus Mine Project and Parks/Salyer will be filed within 45 days.

Continued Exploration Success and 2022 Plans for Further Drilling

ASCU has 3 drills currently running a 105,000 ft (32,000 m) program at the P/S deposit to reduce the spacing between holes to 250 ft (76 m). This infill drilling program is planned to improve the resource category to an indicated status, with a goal to defining future probable reserves. Results will support mine planning in connection with an integrated technical study. The drill program is expected to be complete by year-end, with assays returned by Q1 2023.

Drilling is expected to resume at Cactus later this year to continue to infill drill to 125 ft (38 m) spacing at both Cactus East and West. Drill spacing is being infilled with the goal to produce measured resources in the upcoming integrated technical report.

Metallurgical Studies

Cactus Column Leaching: Over a dozen leaching columns ranging in height between 20 and 30 ft are currently underway to complete a feasibility-level metallurgical program on Cactus material. Testing is taking place in the onsite Trustone Building. Heights were determined to simulate an entire bench on a heap leach pad. Jim Sorensen (Samuel Engineering), Randy Scheffel (Independent Metallurgical Consultant), Amado Guzman (HydroGeoSense Inc.) and Dan Johnson (ASCU’s Project Director) are collaborating and supervising the program to complete the testing program for technical study. Results are expected before the end of 2023 and will update the current recoveries as shown in Table 4 below.

Table 4: Average Cactus Metallurgical Performance, updated Feb 22, 2022

Resource Component |

Net Copper Recovery (% CuAS) |

Net Copper Recovery (% CuCN) |

Gross Acid Consumption (lb/ton) |

Net Acid Consumption (lb/ton) |

STOCKPILE |

||||

Oxide |

90% |

40% |

22 |

16 |

OPEN PIT AND UNDERGROUND |

||||

Oxide |

92% |

73% |

22 |

16 |

Enriched |

92% |

73% |

22 |

0 |

A Parks/Salyer bottle roll testing program is now underway using material from the current drilling program. It will be followed by a column leach test using material from larger exploration bore holes, expected to begin in October.

Sulphide leaching optionality: Oxide, enriched and primary material samples from both Cactus and Parks/Salyer have testing underway. ASCU material was sent to test the leachability using the Nuton Technology. Initial testing of the primary sulphide material using Nuton technology indicates copper recovery in excess of 72% and provides optionality to unlock the primary resource at depth, below the Cactus and Parks/Salyer leachable resources. Results from the column testing program are expected in 2023.

Private Land Operation Permitting Underway

ASCU holds approximately 4,846 acres of private land to support an operation entirely on private land. The company has received its water permits, including the right to draw water, the aquifer protection permit and air quality permit, all key state-level permits required for a private land operations, along with other minor permits. Additionally, the company has received confirmation from the US Army Corps of Engineers that no Waters of the United States flow through the ASCU properties, thus confirming State-led permitting processes.

The Company is advancing its production and construction permitting process. The Mined Land Reclamation Permit, for closure and monitoring, and Industrial Air Permitting Applications, for air quality during production, are being prepared and are expected to be submitted to the State and County Permitting offices by year-end.

Bronco Creek Lands

A total of 725.5 M pounds of inferred mineral resources at 1.084% Cu, contained within the maiden Parks/Salyer Inferred MRE, was reported from the Bronco Creek lands (“BCE”). BCE was leased from Bronco Creek Exploration, a wholly-owned subsidiary of EMX Royalties (EMX: TSXV, NYSE American) in February 2022 and consists of 158 acres; together with P/S, totaling 318 acres of the Parks/Salyer project. Under the terms of the agreement, having had declared at least 200 M pounds of Copper on the land, ASCU will pay US$3 M to BCE.

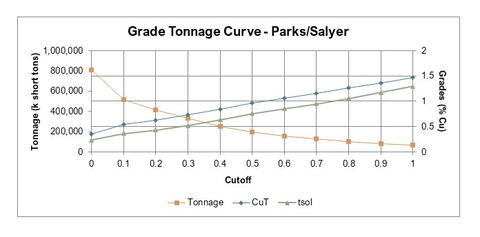

Sensitivity Analysis

The results of grade sensitivity analysis are presented below to illustrate the continuity of the grade estimates at various cut-off increments and the sensitivity of the mineralization to changes in cut-off grade. The reader is cautioned that figures in the following chart should not be misconstrued as Mineral Resources or confused with the Mineral Resource Statement reported above. These figures are only presented to show the sensitivity of the block model estimated grades and tonnages to the selection of cut-off grade. Cut-off at Parks/Salyer was set at $3.75/lb copper, translating to a 0.6% Cu grade.

Resource Estimation Methodology

A total of 31 holes, drilled at 500 ft (250 m) drill spacing, by ASCU including four by previous owners were used to inform the Parks/Salyer resource model. The methodology followed to estimate mineral resources at P/S is consistent to the approach used at ASCU’s Cactus Mine Project, including using the Inverse Distance Cubed (ID3) estimation method. Please refer to the NI 43-101 Technical Report for Cactus, with an effective date of August 31, 2021 for more details; an restated report will be posted to the Company’s website and to SEDAR within 45 days detailing the Parks/Salyer resource estimation methodology.

Quality Assurance / Quality Control

Drilling completed on the project between 2020 and 2022 was supervised by on-site ASCU personnel who prepared core samples for assay and implemented a full QA/QC program using blanks, standards, and duplicates to monitor analytical accuracy and precision. The samples were sealed on site and shipped to Skyline Laboratories in Tucson AZ for analysis. Skyline’s quality control system complies with global certifications for Quality ISO9001:2008.

Technical aspects of this news release have been reviewed and approved by Dr. Martin Kuhn, who is a qualified person as defined by National Instrument 43-101– Standards of Disclosure for Mineral Projects.

Technical aspects of this news release have been reviewed and verified by Allan Schappert – CPG #11758, who is a qualified person as defined by National Instrument 43-101– Standards of Disclosure for Mineral Projects.

Links from the Press Release

FIGURES 1-4: https://arizonasonoran.com/projects/exploration/maps-and-figures/

Neither the TSX nor the regulating authority has approved or disproved the information contained in this press release.

About Arizona Sonoran Copper Company (www.arizonasonoran.com | www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with low operating costs, develop the Cactus and Parks/Salyer Project that could generate robust returns for investors, and provide a long term sustainable and responsible operation for the community and all stakeholders. The Company's principal asset is a 100% interest in the Cactus Project (former ASARCO, Sacaton mine) and Parks/Salyer deposit which is situated on private land in an infrastructure-rich area of Arizona. The Company is led by an executive management team and Board which have a long-standing track record of successful project delivery in North America complemented by global capital markets expertise.

Forward-Looking Statements

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of ASCU to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals.

Although ASCU has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and ASCU disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.