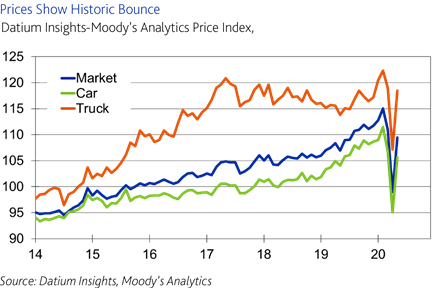

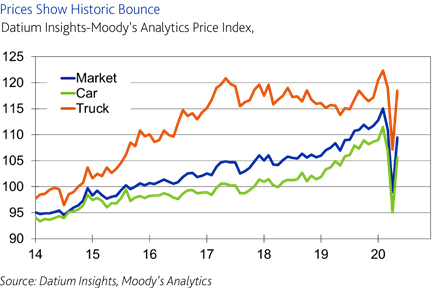

SYDNEY--(BUSINESS WIRE)--A new index launched by Moody’s Analytics in collaboration with Datium Insights reveals that Australian wholesale used-vehicle prices increased by 10.6% from April to May of this year. This follows a price contraction of 14% over March and April, which means prices are almost back to pre-pandemic levels and are on par with May 2019.

“The used-vehicle market benefits from a few distinct factors supporting price stability until economic acceleration can restart. Supply constraints, the substitution effect, low fuel costs, and a decline in use of public transportation have all helped prices bounce back from April lows,” explained Michael Brisson, Auto Economist at Moody’s Analytics.

Moody’s Analytics developed the index by using used-vehicle transaction data from Datium Insights to track the average prices of used vehicles in Australia. The Datium Insights database, sourced from Pickles, covers approximately 60% of the Australian wholesale vehicle market with transaction-level data on more than 1 million transactions from 1999 through today.

Prices rebounded significantly in May for passenger cars as well as light trucks and utes. Car prices increased by 11.2% from April to May while truck/ute prices increased by 10.6%. The larger rebound for car prices is mainly a function of the deeper fall they had experienced— from February through April, car prices fell almost 15%, compared with a 12.4% decrease for trucks and utes. Low petrol prices likely kept demand comparatively higher for less fuel-efficient vehicles such as trucks, utes, and SUVs. Additionally, trucks and utes are used in construction, which was deemed to be an essential business.

Looking forward, Moody’s Analytics projects that the May price rebound will be sustained in the near term after COVID-19 restrictions are lifted. “Used-vehicle prices are supported by limited supply after a slowdown in new-vehicle sales across Australia over the past 24 months. In addition, consumers will continue to prefer driving over public transportation while a vaccine or treatment option for COVID-19 remains elusive,” continued Mr. Brisson. “Longer-term price growth will be difficult as a global economic slowdown restricts demand and puts pressure on the Aussie economy.”

The Datium Insights-Moody’s Analytics Used Vehicle Price Index differs from the motor-vehicle Consumer Price Index produced by the Australian Bureau of Statistics by focusing on sale prices of vehicles rather than the utility derived by consumers from the prices paid. The introduction of this data point will help dealers, lenders, and insurers monitor the value of their vehicle fleets.

“The new index can help both lenders and lessors gauge market conditions, compare performance with other geographies and plan for future movements,” said Tanim Ahmed, Head of Product at Datium Insights. “We are pleased to collaborate with Moody’s Analytics to bring this tool to industry participants during this time of increased uncertainty.”

The new index is part of the Moody’s Analytics suite of tools for the Australian auto market, which also includes the Datium Insights-Moody’s Analytics Retention Value Index and the AutoCycle solution, a proprietary model for forecasting residual value of individual vehicle models under a range of economic scenarios. The Datium Insights-Moody’s Analytics Retention Value Index controls for manufacturers’ suggested retail prices, allowing the used-vehicle market to track movement in wholesale residual values.

Learn more about the Datium Insights-Moody’s Analytics Used Vehicle Price Index methodology, and associated analysis of recent trends.

About Moody’s Analytics

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better, faster decisions. Our deep risk expertise, expansive information resources, and innovative application of technology help our clients confidently navigate an evolving marketplace. We are known for our industry-leading and award-winning solutions, made up of research, data, software, and professional services, assembled to deliver a seamless customer experience. We create confidence in thousands of organizations worldwide, with our commitment to excellence, open mindset approach, and focus on meeting customer needs. For more information about Moody’s Analytics, visit our website or connect with us on Twitter or LinkedIn.

Moody's Analytics, Inc. is a subsidiary of Moody's Corporation (NYSE: MCO). Moody’s Corporation reported revenue of $4.8 billion in 2019, employs approximately 11,300 people worldwide and maintains a presence in 40 countries.

About Datium Insights

Datium Insights is the data arm of Pickles, Australia’s No. 1 Auction and Valuation Specialist. We aggregate massive amounts of vehicle information—partnering with multiple reliable sources across Australia to create an extensive and accurate database. By combining quality data with industry knowledge, innovative tools and proprietary analysis methodologies, we help our customers uncover business intelligence to increase profitability and reduce risk. Our data analytics, valuation and benchmarking products are used by industry leaders and are recognised for their accuracy in Australia’s automotive industry.

For more information, visit our website or connect with us on LinkedIn.