RUEIL-MALMAISON, France--(BUSINESS WIRE)--Regulatory News:

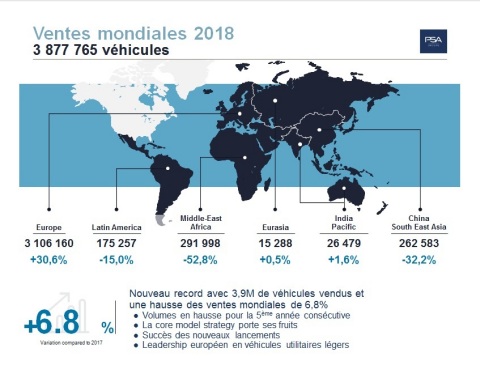

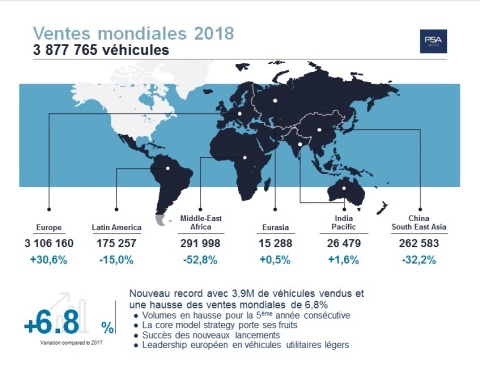

This profitable growth, reaching circa 3.878.000 units, has been leveraged by Groupe PSA (Paris:UG) product offensive in motion with more than 70 regional launches in 2 years, customer driven Core Model Strategy deployment and commercial network commitment.

- Groupe PSA products have been on all short final lists of prestigious automotive contests every year since 2014 and have been awarded this year “Van of the Year IVOTY 2019” (Peugeot Partner, Citroën Berlingo Van, Opel/Vauxhall Combo) and ‘Best Buy Car of Europe 2019’ AUTOBEST (Citroën Berlingo Van, Opel/Vauxhall Combo Life and Peugeot Rifter), following Citroën C3 Aircross last year.

- Groupe PSA Core technology has also been awarded with the International Engine of the Year prize for the 4th year in a row for its Turbo three-cylinder petrol engine (110 and 130 hp).

- Groupe PSA SUV models are particularly successful, driven by the Peugeot 2008, 30081, 5008 (leader in Europe), Citroën C3 Aircross2, C3-XR, C5 Aircross, DS 7 Crossback, Opel/Vauxhall Crossland X, Mokka X, and Grandland X. The momentum will continue in 2019 with major launches for all brands.

- The Group announced its electrification offensive for all brands, with first PHEV3 and EV4 models available for customers in 2019, starting with the DS brand.

Groupe PSA achieves new record LCV sales: 564 147 vehicles sold, + 18.3%.

- Groupe PSA renewed its range of compact vans in 2016 and of B-LCV in 2018 and has consolidated its leading position in Europe in every sub-segments, grasping almost 1 out of 4 LCV customers.

- The Group’s LCV offensive has set the basis for overseas growth with the successful launch of production of Peugeot Expert and Citroën Jumpy in Eurasia and the very promising start of our comprehensive range of LCV products and services for Latin American clients.

Europe5: Change of scale with 17.1% market share.

Groupe PSA took full advantage of its perfectly managed new WLTP standard implementation phase to gain a competitive edge in the last four months of the year. Group market share reaches 17.1% by end 2018, up +3.8 pt, underpinned by Peugeot and Citroën brands that are the best progressing brands in 2018, with almost +5% sales increase for both brands among the top 10 brands in Europe.

Peugeot stands out for its success: SUV European leader, number 1 in Spain, number 1 in France on B2C and B2B passenger cars. Citroën reaches its best level of sales in 7 years.

DS Automobiles marks a breakthrough with 6.7% of sales increase, supported by

DS7 Crossback launch. Opel/Vauxhall is continuing its product offensive driven by the X family.

Groupe PSA exceeds market performance and is improving in all main markets: France (+2.6 pt), Spain (+4.2 pt), Italy (+3.9 pt), Great Britain (+4.8 pt), Germany (+3.7 pt).

Middle East – Africa: the Group remains offensive in a chaotic regional context.

Despite strong headwinds mainly due to wind down in Iran6 and Turkish market downturn, Groupe PSA market share increased in Morocco (+1.7pt), Tunisia (+1pt) and Egypt (+3.1pt) and the Group remains market leader in French Overseas Departments.

The regional industrial footprint is under deployment to become operational in 2019 with the start of production of Kenitra plant in Morocco, as a key milestone.

China & South East Asia: Groupe PSA works to overcome China situation and prepares its commercial offensive in South East Asia.

In a declining Chinese passenger vehicle market (-2%), sales are down 34.2%. The Group is working on action plans with its partners to tackle current issues. The Group is implementing its electrification strategy with the Fukang brand, followed by PCD7 electrified models from 2019 onwards. Moreover, the core model strategy is under execution to propose a product offering designed for Chinese clients.

Sales in South East Asia doubled versus 2017, amounting to 10,882 vehicles. The joint venture with Naza Corporation Holdings (Malaysia) will start delivering its first productions in 2019 with the Peugeot 3008 and 5008.

Latin America: the drop in sales is largely linked to the strong decline of the Argentinian market (-32% in H2) related to the country’s economic context, with a significant exchange rate impact and a difficult Brazilian market, while sales remain well oriented in the Pan-American zone (54,887 units, +13,3%) – composed mainly by Chile, Mexico, Colombia, Peru, Uruguay and Ecuador.

The launch of the new C4 Cactus SUV industrialized in the region, is encouraging. The local manufacturing of the LCV range is in process (launch of the Jumpy MiniBus version, Berlingo, Boxer and Jumper in Brazil, Jumpy and Expert Crewcab in Argentina and the electric Partner in Chile and Uruguay).

India-Pacific: sales growth is notably driven by the Group successful business in Japan (+9.6%). The manufacturing project in India, developed in partnership with the CK Birla Group, is on track.

Eurasia: stable sales. Sales increase notably in Ukraine (+7%). The good dynamic of Peugeot 3008, C4 Sedan and the newly produced LCVs in Kaluga since April (Peugeot Expert and Citroën Jumpy) are encouraging.

“In an increasingly unstable environment, we thrived with the rigorous execution of our efficient core model strategy. The product appeal to our B2B or B2C customers supports our pricing power policy for all of our brands, while we are currently implementing our electrified offensive. Agility and Darwinian spirit are more than ever important to tackle forthcoming challenges and enhance our customer satisfaction” comments Carlos Tavares, Chairman of the Managing Board of Groupe PSA

Consolidated world sales by regions

| 12 months 17 | 12 months 18 | |||||||||

| PSA REGION | BRANDS | Sales | Sales | % | %Var | |||||

| China & SE Asia | Peugeot | 249 223 | 143 628 | 3.70% | -42.37% | |||||

| Citroën | 131 821 | 114 419 | 2.95% | -13.20% | ||||||

| DS | 5 963 | 3 955 | 0.10% | -33.67% | ||||||

| PCD | 387 007 | 262 002 | 6.76% | -32.30% | ||||||

| OV | 295 | 581 | 0.01% | 96.95% | ||||||

| PCD+OV | 387 302 | 262 583 | 6.77% | -32.20% | ||||||

| Eurasia | Peugeot | 8 479 | 8 660 | 0.22% | 2.13% | |||||

| Citroën | 6 345 | 6 391 | 0.16% | 0.72% | ||||||

| DS | 84 | 57 | 0.00% | -32.14% | ||||||

| PCD | 14 908 | 15 108 | 0.39% | 1.34% | ||||||

| OV | 307 | 180 | 0.00% | -41.37% | ||||||

| PCD+OV | 15 215 | 15 288 | 0.39% | 0.48% | ||||||

| Europe | Peugeot | 1 173 465 | 1 231 327 | 31.75% | 4.93% | |||||

| Citroën | 785 662 | 824 623 | 21.27% | 4.96% | ||||||

| DS | 43 135 | 46 013 | 1.19% | 6.67% | ||||||

| PCD | 2 002 262 | 2 101 963 | 54.21% | 4.98% | ||||||

| OV | 376 380 | 1 004 197 | 25.9% | ++ | ||||||

| PCD+OV | 2 378 642 | 3 106 160 | 80.1% | 30.59% | ||||||

| India & Pacific | Peugeot | 19 205 | 19 987 | 0.52% | 4.07% | |||||

| Citroën | 6 049 | 5 661 | 0.15% | -6.41% | ||||||

| DS | 799 | 831 | 0.02% | 4.01% | ||||||

| PCD | 26 053 | 26 479 | 0.68% | 1.64% | ||||||

| PCD+OV | 26 053 | 26 479 | 0.68% | 1.64% | ||||||

| Latam | Peugeot | 136 303 | 112 774 | 2.91% | -17.26% | |||||

| Citroën | 68 526 | 60 404 | 1.56% | -11.85% | ||||||

| DS | 1 304 | 969 | 0.02% | -25.69% | ||||||

| PCD | 206 133 | 174 147 | 4.49% | -15.52% | ||||||

| OV | 142 | 1 110 | 0.03% | ++ | ||||||

| PCD+OV | 206 275 | 175 257 | 4.52% | -15.04% | ||||||

| MEAF | Peugeot | 533 170 | 223 838 | 5.77% | -58.01% | |||||

| Citroën | 57 273 | 34 731 | 0.90% | -39.36% | ||||||

| DS | 1 575 | 1 440 | 0.04% | -8.57% | ||||||

| PCD | 592 018 | 260 009 | 6,71% | -56.08% | ||||||

| OV | 26 809 | 31 989 | 0.82% | 19.32% | ||||||

| PCD+OV | 618 827 | 291 998 | 7.53% | -52.81% | ||||||

| Total | Peugeot | 2 119 845 | 1 740 214 | 44.88% | -17.91% | |||||

| Citroën | 1 055 676 | 1 046 229 | 26.98% | -0.89% | ||||||

| DS | 52 860 | 53 265 | 1.37% | 0.77% | ||||||

| PCD | 3 228 381 | 2 839 708 | 73.23% | -12.04% | ||||||

| OV | 403 933 | 1 038 057 | 26.77% | ++ | ||||||

| PCD+OV | 3 632 314 | 3 877 765 | 100.00% | 6.76% | ||||||

PCD : Peugeot/Citroën/DS

OV : Opel/Vauxhall

About Groupe PSA

Groupe PSA designs unique automotive experiences and delivers mobility solutions to meet all customer expectations. The Group has five car brands, Peugeot, Citroën, DS, Opel and Vauxhall and provides a wide array of mobility and smart services under the Free2Move brand. Its ‘Push to Pass’ strategic plan represents a first step towards the achievement of the Group’s vision to be “a global carmaker with cutting-edge efficiency and a leading mobility provider sustaining lifetime customer relationships”. An early innovator in the field of autonomous and connected cars, Groupe PSA is also involved in financing activities through Banque PSA Finance and in automotive equipment via Faurecia..

Media library: medialibrary.groupe-psa.com / @GroupePSA_EN

Communications Division - www.groupe-psa.com/en - +33 6 61 93 29 36– @GroupePSA_EN

1 Peugeot 4008 in China

2 C4 Aircross in China

3

PHEV: Plug-in Hybrid Electric Vehicle

4 EV : Electric

Vehicle

5 PCDOV figures

6 Iran: Volumes

industrialized in Iran are not more recorded in consolidated sales since

May 1st 2018

7 PCD: Peugeot Citroën DS