WILMINGTON, Del.--(BUSINESS WIRE)--Americans have a thing or two to say about finances – especially for summer romances now in full swing, according to the Chase Slate 2017 Credit Outlook.

“When it comes to relationships, many Americans are unwilling to compromise on credit health, and for a good reason,” said Mical Jeanlys, General Manager of the Chase Slate credit card. “Credit plays a critical role in everything – from securing a loan to qualifying for competitive interest rates.”

Here’s what Slate uncovered:

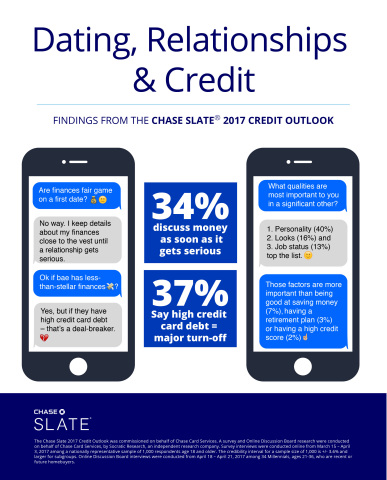

- High credit card debt is a deal-breaker. 37% of Americans say that credit card debt is a reason to think less of a significant other.

- Finances are not fair game. Only 1% of women are willing to discuss finances on a first date, while men are more open to discussing them at 15%.

- Money talk is off-limits, until it’s serious. 34% of Americans say finances should be discussed as soon as things get serious.

- Millennials know their scores. Married Millennials (58%) are more likely to know their partner’s credit score than other generations – married Gen Xers (44%) and married Boomers (38%).

“Credit health and relationships share at least one thing in common – both require commitment,” said Farnoosh Torabi, a personal finance expert and Chase Slate Financial Education Ambassador. “Before taking the next big step with a potential partner, have a conversation about credit. If you discover that one of you has less than stellar credit, but you are both committed to improvement, then you can begin working together to raise your partner's score by paying monthly bills on time or prioritizing debt reduction.”

About Chase Slate

With no annual fee, a low introductory APR on purchases and balance transfers, and tailored insights into your credit behavior, Chase Slate empowers customers to manage their finances wisely now and in the future. Through the Chase Slate Credit Dashboard, customers receive access to their FICO® Score, the top positive and negative factors impacting it and tips for improving their credit health overtime for free every month. The feature is available to customers online at Chase.com.

About the Chase Slate 2017 Credit Outlook Survey

The Chase Slate 2017 Credit Outlook was commissioned on behalf of Chase Card Services. A survey, Online Discussion Board and Video Diary Research were conducted on behalf of Chase Card Services, by Socratic Research, an independent research company. Survey interviews were conducted online from March 15 – April 3, 2017 among a nationally representative sample of 1,000 respondents age, 18 and older. The credibility interval for a sample size of 1,000 is +/- 3.6% and larger for subgroups.

Online Discussion Board interviews were conducted from April 18 – April 21, 2017 among 34 Millennials, ages 21-36, and the Video Diary Research interviews were conducted from April 26 – May 5, 2017 among 20 Millennials, ages 21-36. Both the Online Discussion Board and Video Diary Research were conducted nationally among Millennials who are recent or future homebuyers.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading global financial services firm with assets of $2.6 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: 5,200 branches, 16,000 ATMs, mobile, online and by phone. For more information, go to Chase.com. For more information about Chase Slate, go to ChaseSlate.com. Also, Chase offers consumers the opportunity to monitor their credit score at no cost through Credit JourneySM.