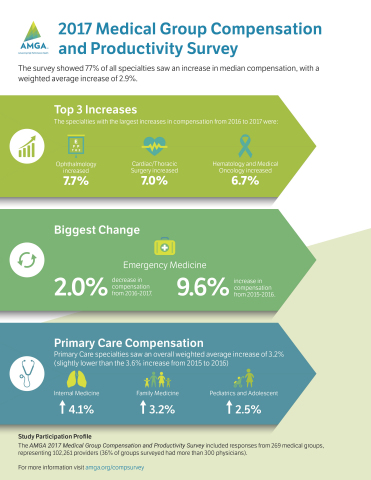

ALEXANDRIA, Va.--(BUSINESS WIRE)--AMGA today announced findings from its 2017 Medical Group Compensation and Productivity Survey, conducted by its consulting arm, AMGA Consulting. This year’s survey marks the 30th year of publication of the findings. The report shows that 77% of physician specialties experienced increases in compensation. The overall weighted average increase in 2016 compensation was 2.9%, similar to 3.1% in 2015.

- Primary Care specialists saw an increase of 3.2%, similar to the increase of 3.6% in 2015 data (weighted average).

- Other medical specialties saw an average increase of 2.8%, comparable to 3.0% in 2015.

- Surgical specialties saw an average increase of 2.0%, down from a 3.6% increase in 2015.

Specialties experiencing the largest increases in compensation in 2016 were Ophthalmology Surgery (7.7%), Cardiac/Thoracic Surgery (7.0%), Hematology and Medical Oncology (6.7%), Allergy/Immunology (5.9%) and Pulmonary Disease (5.6%).

Data represent responses from 269 medical groups representing more than 102,000 providers (an 11% increase over last year’s report). The data is representative of large multispecialty medical groups and integrated health systems, with 380 the average number of providers per participant group.

“We’re proud of the fact that this year’s survey marks AMGA’s 30th year of publication of compensation data,” said Ryan A. O’Connor, M.B.A., CAE, interim AMGA president and chief executive officer. “Market salary data has become a driving determinant in physician base salary, and its importance has steadily increased over other factors. The topic of compensation arises in nearly every conversation I have with our members and on most event agendas we organize. The findings in this survey are critical to medical group leaders as they make decisions impacting their organization’s financial performance.”

The survey also reports on work RVUs (relative value units), which are the primary measure of a physician’s productivity for the majority of participating medical groups. This year, the weighted average change in median work RVUs was +1.54%.

“We are seeing signs of a perfect storm gathering as costs continue to rise, productivity is flat, and collections are flat, with 51% of specialties this year reporting a decrease in median net collections,” said Tom Dobosenski, CPA, president, AMGA Consulting. “These trends are driving enhanced efficiency and consolidation, but the cost curve will only bend so much. With 61% of groups responding that some of their physicians’ compensation was based on the achievement of value-based measures, the move to value-based incentives is happening, albeit at a slower pace than anticipated. However, value-based incentives do not lessen the economic pressures on medical groups, as they do not necessarily mean reductions in compensation.”

The AMGA 2017 Medical Group Compensation and Productivity Survey presents data for 140 physician specialties and 28 other provider specialties, with breakdowns by region and group size (group size assigned by physician FTE). The survey provides data on compensation, net collections, work RVUs, and compensation-to-productivity ratios. Other data include panel sizes, gross productivity, fringe benefits and benefits expense-to-compensation ratios, patient visits, compensation for experienced new hires and new residents or fellows, compensation and productivity for academic facilities, and compensation and productivity for nurse practitioner and physician assistant subspecialties.

About AMGA

AMGA is a trade association leading the transformation of healthcare in America. Representing multispecialty medical groups and integrated systems of care, we advocate, educate, innovate, and empower our members to deliver the next level of high performance health. AMGA is the national voice promoting awareness of medical groups’ recognized excellence in the delivery of coordinated, high-quality, cost-effective care. More than 175,000 physicians practice in our member organizations, delivering care to one in three Americans. For more information, visit amga.org.

Limited copies of the survey are available for working press. For press copies, contact Angela Sidlauskas at asidlauskas@amga.org. Surveys are also available for purchase for $500 to AMGA members and $1000 to non-members. To order, visit amga.org/compsurvey or contact AMGA at 703.838.0033 ext. 362 or cgibbs@amga.org. Survey data is also available in a subscription-based, interactive, online database. For details, visit amga.org/compsurvey.