SAN FRANCISCO--(BUSINESS WIRE)--The Charles Schwab Corporation announced today that its net income for the second quarter of 2017 was a record $575 million, up 2% from $564 million for the prior quarter, and up 27% from $452 million for the second quarter of 2016. Net income for the six months ended June 30, 2017 was $1.1 billion, up 32% from the year-earlier period.

|

Three Months Ended |

% |

Six Months Ended |

% | |||||||||||||||||

| Financial Highlights | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||

| Net revenues (in millions) | $ | 2,130 | $ | 1,828 | 17% | $ | 4,211 | $ | 3,592 | 17% | ||||||||||

| Net income (in millions) | $ | 575 | $ | 452 | 27% | $ | 1,139 | $ | 864 | 32% | ||||||||||

| Diluted earnings per common share | $ | .39 | $ | .30 | 30% | $ | .78 | $ | .60 | 30% | ||||||||||

| Pre-tax profit margin | 42.7 | % | 39.4 | % | 41.6 | % | 38.3 | % | ||||||||||||

|

Return on average common stockholders’ equity (annualized) |

15 | % | 13 | % | 15 | % | 13 | % | ||||||||||||

| Note: All per-share results are rounded to the nearest cent, based on weighted-average diluted common shares outstanding. Effective January 1, 2017, a new accounting standard prospectively changes the treatment of a portion of the tax deductions relating to equity compensation. These deductions were previously reflected in additional paid-in capital, a component of stockholders’ equity, and are now included in taxes on income, a component of net income. The company’s tax expense for the second quarter and first half of 2017 decreased by approximately $5 million and $36 million, respectively, as a result of this change. Future effects will depend on the company’s share price, restricted stock vesting, and the volume of equity incentive options exercised. | ||||||||||||||||||||

CEO Walt Bettinger said, “Strong client engagement and demand for our contemporary approach to wealth management have led to business momentum that ranks among the most powerful in Schwab’s history. Equity markets touched all-time highs during the second quarter, volatility remained largely contained, short-term interest rates rose further, and clients benefited from the full extent of the strategic pricing moves we announced in February. Against this backdrop, clients opened more than 350,000 new brokerage accounts during the second quarter, bringing year-to-date new accounts to 719,000 – up 34% from a year ago and our strongest first half total in seventeen years. In addition, households new to Schwab as part of our Retail business rose by 50% versus the first half of 2016. We gathered $46.2 billion of core net new assets during the second quarter, a record for the period and the second-highest quarter ever. Our year-to-date core net new assets of $85.1 billion represent the strongest first half in the company’s history and a 6% organic growth rate. Retail gathered record levels of core net new assets in the first six months of 2017, posting a 69% increase over the year-earlier period. Concurrently, Advisor Services attracted near-record core inflows and achieved a 77% year-over-year increase. Our impressive results were helped by an 86% year-over-year lift in net transfers of client assets from our competitors for the first half of 2017, demonstrating our ability to win in the marketplace. Total client assets reached a record $3.04 trillion at month-end June, up 16% year-over-year. We ended June serving 10.5 million active brokerage accounts, 1.1 million banking accounts, and 1.5 million retirement plan participants.”

Mr. Bettinger continued, “We believe that following our ‘Through Clients’ Eyes’ strategy means bringing investors the capabilities they expect to help build their financial futures, and we’ve continued to see more clients turn to us for help in setting and tracking long-term goals. Our financial consultants held planning conversations with approximately 73,000 clients in the first six months of 2017, up 9% year-over-year. Client balances receiving ongoing advisory services rose 17% year-over-year, faster than overall client asset growth. These advised balances totaled a record $1.54 trillion at quarter-end, with $1.30 trillion under the guidance of a registered investment advisor and $242 billion enrolled in one of our retail or other advisory solutions.”

Mr. Bettinger added, “We recently placed in the top 20 for Barron’s 2017 rankings of The Most Respected American Companies. This is certainly important recognition, yet the ultimate measure of our success is whether clients and prospects entrust us with their business. Our second quarter performance gives us great optimism for the future, as we continue to execute against our goal of helping clients invest through a ‘no trade-offs’ combination of value, service, transparency, and trust.”

CFO Peter Crawford commented, “Our financial model, with multiple revenue streams, operating leverage, and an all-weather balance sheet, produced outstanding second quarter results, with records for revenue and pre-tax profit margin. Net interest revenue rose to a record $1.1 billion, up 32% from last year’s second quarter, driven by higher short-term rates reflecting the Federal Reserve’s March and June 2017 hikes. We achieved these results even as the longer end of the yield curve softened and growth in interest-earning assets slowed due to clients engaging further with the markets and investing more of their cash. Asset management and administration fees grew 12% year-over-year to a record $845 million, reflecting further improvement in net money fund revenue from rising rates and growing balances in advised solutions, equity and bond funds, and ETFs. By quarter-end, the yields on all proprietary money market fund portfolios were at or above their respective operating expense ratios, fully eliminating money fund fee waivers for the first time since the financial crisis. Trading revenue declined 22% to $157 million as the full effect of our February commission reductions took hold, partially offset by stronger client activity. Overall, our growing success with clients, the Fed’s rate actions, and improving equity market valuations helped us end the second quarter a bit ahead of our 2017 baseline scenario, with total revenue up 17% year-over-year to $2.1 billion.”

“On the expense front, our 10% year-over-year increase for the second quarter was consistent with serving an expanding client base, higher incentive accruals relating to strong client metrics, and our planned pace of investment in growth initiatives,” Mr. Crawford said. “The resulting 630 basis point gap between revenue and expense growth yielded a 42.7% pre-tax profit margin and once again demonstrated our ability to successfully balance near-term profitability with reinvestment to drive long-term growth.”

Mr. Crawford concluded, “We remain focused on managing the company’s balance sheet to support investment initiatives and further our strategy of optimizing the spread earned on client cash sweep balances. With sweep balances impacted by minimal year-to-date bulk transfers and reduced client cash levels, our consolidated assets totaled $221 billion as of June 30th. This contributed to a preliminary 7.4% Tier 1 Leverage ratio at quarter-end, somewhat above our long-term operating objective of 6.75-7%. We delivered a 15% return on equity for the second quarter, capping our strongest first half ROE in 8 years.”

Business highlights for the second quarter (data as of quarter-end unless otherwise noted):

Investor Services

- New retail brokerage accounts for the quarter totaled approximately 232,000, up 36% year-over-year; total accounts were 7.3 million, up 4% year-over-year.

- Opened three new company branches and one independent branch; completed two relocations. Schwab has over 340 branches across the country that offer clients access to a range of investing and personal finance services.

- Launched a new account summary page on Schwab.com, making it easier for clients to track their portfolios and manage investments across all of their Schwab accounts.

Advisor Services

- Held the annual EXPLORE® conference for the company’s top independent advisor clients. Schwab leadership and keynote speakers discussed the state of the industry and global economies.

- Initiated the transition for advisor firms to Schwab Advisor StreetSmart Edge™, providing streaming real-time quotes, advanced charting, and additional trading capabilities; full conversion will be completed throughout 2017.

- The 2017 RIA Benchmarking Study was released to RIA clients; a record 1,321 firms participated, representing $848 billion in AUM. Topics included client acquisition, marketing, technology, and financial performance.

Products and Infrastructure

-

For Charles Schwab Bank:

- Balance sheet assets = $175.7 billion, up 14% year-over-year.

- Outstanding mortgage and home equity loans = $11.7 billion, up 5% year-over-year.

- Pledged Asset Line® balances = $4.0 billion, up 14% year-over-year.

- Schwab Bank High Yield Investor Checking® accounts = 950,000, with $13.5 billion in balances.

-

For Charles Schwab Investment Management:

- Net new assets into proprietary equity and bond funds and ETFs held off the Schwab platform rose 57% year-over-year.

- Excluding money funds, net flows for proprietary mutual funds, ETFs, and collective trust funds reached a record $8.2 billion for the quarter; net flows for first half of 2017 were also a record at $15.7 billion.

- Client assets managed by Windhaven® totaled $8.0 billion, down 25% year-over-year.

- Client assets managed by ThomasPartners® totaled $12.6 billion, up 48% year-over-year.

- Client assets managed by Intelligent Portfolios (Schwab Intelligent Portfolios® and Institutional Intelligent Portfolios®) totaled $19.4 billion, up 137% year-over-year.

Supporting schedules are either attached or located at: http://www.aboutschwab.com/investor-relations/financial-reports.

Commentary from the CFO

Periodically, our Chief Financial Officer provides insight and commentary regarding Schwab’s financial picture at: http://www.aboutschwab.com/investor-relations/cfo-commentary. The most recent commentary was posted on February 28, 2017.

Forward-Looking Statements

This press release contains forward-looking statements relating to the company’s business momentum; strategy; balancing near-term profitability with reinvestment for growth; balance sheet management; investment in growth initiatives; and optimization of the spread earned on client cash sweep balances. Achievement of these expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but are not limited to, client use of the company’s investment advisory services and other products and services; the company’s ability to attract and retain clients and registered investment advisors and grow those relationships and client assets; general market conditions, including the level of interest rates, equity valuations and trading activity; competitive pressures on pricing; the company’s ability to develop and launch new products, services and capabilities in a timely and successful manner; the level of client assets, including cash balances; the company’s ability to manage expenses; capital and liquidity needs and management; the company’s ability to monetize client assets; the timing, amount and impact of bulk transfers; the quality of the company’s balance sheet assets; client sensitivity to interest rates; regulatory guidance; the effect of adverse developments in litigation or regulatory matters and the extent of any charges associated with legal matters; any adverse impact of financial reform legislation and related regulations; and other factors set forth in the company’s most recent reports on Form 10-K and Form 10-Q.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with more than 340 offices and 10.5 million active brokerage accounts, 1.5 million corporate retirement plan participants, 1.1 million banking accounts, and $3.04 trillion in client assets as of June 30, 2017. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, money management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC, http://www.sipc.org), and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at www.schwab.com and www.aboutschwab.com.

|

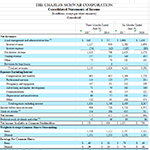

THE CHARLES SCHWAB CORPORATION Consolidated Statements of Income (In millions, except per share amounts) (Unaudited) |

||||||||||||||||

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net Revenues | ||||||||||||||||

| Asset management and administration fees (1) | $ | 845 | $ | 757 | $ | 1,668 | $ | 1,456 | ||||||||

| Interest revenue | 1,127 | 840 | 2,182 | 1,650 | ||||||||||||

| Interest expense | (74 | ) | (42 | ) | (129 | ) | (80 | ) | ||||||||

| Net interest revenue | 1,053 | 798 | 2,053 | 1,570 | ||||||||||||

| Trading revenue | 157 | 201 | 349 | 433 | ||||||||||||

| Other | 75 | 70 | 141 | 133 | ||||||||||||

| Provision for loan losses | — | 2 | — | — | ||||||||||||

| Total net revenues | 2,130 | 1,828 | 4,211 | 3,592 | ||||||||||||

| Expenses Excluding Interest | ||||||||||||||||

| Compensation and benefits | 663 | 602 | 1,364 | 1,228 | ||||||||||||

| Professional services | 144 | 125 | 277 | 241 | ||||||||||||

| Occupancy and equipment | 107 | 101 | 212 | 199 | ||||||||||||

| Advertising and market development | 71 | 70 | 142 | 140 | ||||||||||||

| Communications | 58 | 62 | 115 | 122 | ||||||||||||

| Depreciation and amortization | 66 | 57 | 131 | 113 | ||||||||||||

| Other | 112 | 91 | 218 | 174 | ||||||||||||

| Total expenses excluding interest | 1,221 | 1,108 | 2,459 | 2,217 | ||||||||||||

| Income before taxes on income | 909 | 720 | 1,752 | 1,375 | ||||||||||||

| Taxes on income (2) | 334 | 268 | 613 | 511 | ||||||||||||

| Net Income | 575 | 452 | 1,139 | 864 | ||||||||||||

| Preferred stock dividends and other (3) | 45 | 46 | 84 | 66 | ||||||||||||

| Net Income Available to Common Stockholders | $ | 530 | $ | 406 | $ | 1,055 | $ | 798 | ||||||||

| Weighted-Average Common Shares Outstanding: | ||||||||||||||||

| Basic | 1,338 | 1,322 | 1,337 | 1,322 | ||||||||||||

| Diluted | 1,351 | 1,333 | 1,351 | 1,331 | ||||||||||||

| Earnings Per Common Share: | ||||||||||||||||

| Basic | $ | .40 | $ | .31 | $ | .79 | $ | .60 | ||||||||

| Diluted | $ | .39 | $ | .30 | $ | .78 | $ | .60 | ||||||||

| Dividends Declared Per Common Share | $ | .08 | $ | .07 | $ | .16 | $ | .13 | ||||||||

| (1) | Includes fee waivers of $1 million and $55 million during the second quarters of 2017 and 2016, respectively, and $9 million and $152 million during the first halves of 2017 and 2016, respectively, relating to Schwab-sponsored money market funds. |

| (2) | Taxes on income were reduced by approximately $5 million and $36 million for the three and six months ended June 30, 2017 to reflect the required adoption of Accounting Standards Update 2016-09, which changes the accounting treatment of a portion of the tax deductions relating to equity compensation. |

| (3) | Includes preferred stock dividends and undistributed earnings and dividends allocated to non-vested restricted stock units. |

|

THE CHARLES SCHWAB CORPORATION Financial and Operating Highlights (Unaudited) |

||||||||||||||||||||||||||

|

Q2-17 % change |

2017 | 2016 | ||||||||||||||||||||||||

| (In millions, except per share amounts and as noted) |

vs. |

vs. Q1-17 |

Second Quarter |

First Quarter |

Fourth Quarter |

Third Quarter |

Second Quarter |

|||||||||||||||||||

| Net Revenues | ||||||||||||||||||||||||||

| Asset management and administration fees | 12 | % | 3 | % | $ | 845 | $ | 823 | $ | 801 | $ | 798 | $ | 757 | ||||||||||||

| Net interest revenue | 32 | % | 5 | % | 1,053 | 1,000 | 907 | 845 | 798 | |||||||||||||||||

| Trading revenue | (22 | )% | (18 | )% | 157 | 192 | 202 | 190 | 201 | |||||||||||||||||

| Other | 7 | % | 14 | % | 75 | 66 | 62 | 76 | 70 | |||||||||||||||||

| Provision for loan losses | (100 | )% | — | — | — | — | 5 | 2 | ||||||||||||||||||

| Total net revenues | 17 | % | 2 | % | 2,130 | 2,081 | 1,972 | 1,914 | 1,828 | |||||||||||||||||

| Expenses Excluding Interest | ||||||||||||||||||||||||||

| Compensation and benefits | 10 | % | (5 | )% | 663 | 701 | 629 | 609 | 602 | |||||||||||||||||

| Professional services | 15 | % | 8 | % | 144 | 133 | 134 | 131 | 125 | |||||||||||||||||

| Occupancy and equipment | 6 | % | 2 | % | 107 | 105 | 99 | 100 | 101 | |||||||||||||||||

| Advertising and market development | 1 | % | — | 71 | 71 | 61 | 64 | 70 | ||||||||||||||||||

| Communications | (6 | )% | 2 | % | 58 | 57 | 58 | 57 | 62 | |||||||||||||||||

| Depreciation and amortization | 16 | % | 2 | % | 66 | 65 | 61 | 60 | 57 | |||||||||||||||||

| Other | 23 | % | 6 | % | 112 | 106 | 106 | 99 | 91 | |||||||||||||||||

| Total expenses excluding interest | 10 | % | (1 | )% | 1,221 | 1,238 | 1,148 | 1,120 | 1,108 | |||||||||||||||||

| Income before taxes on income | 26 | % | 8 | % | 909 | 843 | 824 | 794 | 720 | |||||||||||||||||

| Taxes on income | 25 | % | 20 | % | 334 | 279 | 302 | 291 | 268 | |||||||||||||||||

| Net Income | 27 | % | 2 | % | $ | 575 | $ | 564 | $ | 522 | $ | 503 | $ | 452 | ||||||||||||

| Preferred stock dividends and other | (2 | )% | 15 | % | 45 | 39 | 44 | 33 | 46 | |||||||||||||||||

| Net Income Available to Common Stockholders | 31 | % | 1 | % | $ | 530 | $ | 525 | $ | 478 | $ | 470 | $ | 406 | ||||||||||||

| Earnings per common share: | ||||||||||||||||||||||||||

| Basic | 29 | % | 3 | % | $ | .40 | $ | .39 | $ | .36 | $ | .36 | $ | .31 | ||||||||||||

| Diluted | 30 | % | — | $ | .39 | $ | .39 | $ | .36 | $ | .35 | $ | .30 | |||||||||||||

| Dividends declared per common share | 14 | % | — | $ | .08 | $ | .08 | $ | .07 | $ | .07 | $ | .07 | |||||||||||||

| Weighted-average common shares outstanding: | ||||||||||||||||||||||||||

| Basic | 1 | % | — | 1,338 | 1,336 | 1,329 | 1,324 | 1,322 | ||||||||||||||||||

| Diluted | 1 | % | — | 1,351 | 1,351 | 1,341 | 1,334 | 1,333 | ||||||||||||||||||

| Performance Measures | ||||||||||||||||||||||||||

| Pre-tax profit margin | 42.7 | % | 40.5 | % | 41.8 | % | 41.5 | % | 39.4 | % | ||||||||||||||||

| Return on average common stockholders’ equity (annualized) (1) | 15 | % | 15 | % | 14 | % | 14 | % | 13 | % | ||||||||||||||||

| Financial Condition (at quarter end, in billions) | ||||||||||||||||||||||||||

| Cash and investments segregated | (1 | )% | (13 | )% | $ | 18.5 | $ | 21.2 | $ | 22.2 | $ | 20.1 | $ | 18.6 | ||||||||||||

| Receivables from brokerage clients - net | 7 | % | 8 | % | 18.0 | 16.7 | 17.2 | 16.4 | 16.8 | |||||||||||||||||

| Bank loans - net | 7 |

% |

2 | % | 15.8 | 15.5 | 15.4 | 14.9 | 14.7 | |||||||||||||||||

| Total assets |

11 |

% |

(3 | )% | 220.6 | 227.1 | 223.4 | 209.3 | 198.1 | |||||||||||||||||

| Bank deposits | 18 | % | (3 | )% | 162.3 | 166.9 | 163.5 | 149.6 | 137.3 | |||||||||||||||||

| Payables to brokerage clients | 1 | % | (4 | )% | 33.0 | 34.3 | 35.9 | 33.0 | 32.7 | |||||||||||||||||

| Short-term borrowings | (94 | )% | (50 | )% | .3 | .6 | — | 3.0 | 5.0 | |||||||||||||||||

| Long-term debt | 21 | % | — | 3.5 | 3.5 | 2.9 | 2.9 | 2.9 | ||||||||||||||||||

| Stockholders’ equity | 17 | % | 3 | % | 17.5 | 17.0 | 16.4 | 15.5 | 15.0 | |||||||||||||||||

| Other | ||||||||||||||||||||||||||

| Full-time equivalent employees (at quarter end, in thousands) | 5 | % | 2 | % | 16.9 | 16.5 | 16.2 | 16.1 | 16.1 | |||||||||||||||||

|

Capital expenditures - purchases of equipment, office facilities, and property, net (in millions) |

(34 | )% | 28 | % | $ | 86 | $ | 67 | $ | 86 | $ | 75 | $ | 131 | ||||||||||||

|

Expenses excluding interest as a percentage of average client assets (annualized) |

0.16 | % | 0.18 | % | 0.17 | % | 0.17 | % | 0.17 | % | ||||||||||||||||

| Clients’ Daily Average Trades (in thousands) | ||||||||||||||||||||||||||

| Revenue trades (2) | 11 | % | (2 | )% | 311 | 317 | 293 | 268 | 279 | |||||||||||||||||

| Asset-based trades (3) | 14 | % | — | 103 | 103 | 106 | 80 | 90 | ||||||||||||||||||

| Other trades (4) | 17 | % | 6 | % | 175 | 165 | 174 | 195 | 149 | |||||||||||||||||

| Total | 14 | % | 1 | % | 589 | 585 | 573 | 543 | 518 | |||||||||||||||||

| Average Revenue Per Revenue Trade (2) | (29 | )% | (19 | )% | $ | 7.96 | $ | 9.84 | $ | 11.03 | $ | 11.17 | $ | 11.27 | ||||||||||||

| (1) |

Return on average common stockholders’ equity is calculated using net income available to common stockholders divided by average common stockholders’ equity. |

| (2) | Includes all client trades that generate trading revenue (i.e., commission revenue or principal transaction revenue); also known as DART. |

| (3) | Includes eligible trades executed by clients who participate in one or more of the Company’s asset-based pricing relationships. |

| (4) | Includes all commission-free trades, including Schwab Mutual Fund OneSource® funds and ETFs, and other proprietary products. |

|

THE CHARLES SCHWAB CORPORATION Net Interest Revenue Information (In millions) (Unaudited) |

||||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||||||||||||||||||||||||

|

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

Average Balance |

Interest Revenue/ Expense |

Average Yield/ Rate |

|||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 8,562 | $ | 22 | 1.03 | % | $ | 10,888 | $ | 14 | 0.52 | % | $ | 8,803 | $ | 39 | 0.89 | % | $ | 10,820 | $ | 27 | 0.50 | % | ||||||||||||||||||||

| Cash and investments segregated | 19,703 | 41 | 0.83 | % | 19,155 | 22 | 0.46 | % | 20,755 | 76 | 0.74 | % | 19,710 | 41 | 0.42 | % | ||||||||||||||||||||||||||||

| Broker-related receivables (1) | 435 | 1 | 0.68 | % | 685 | — | 0.20 | % | 412 | 1 | 0.62 | % | 535 | — | 0.15 | % | ||||||||||||||||||||||||||||

| Receivables from brokerage clients | 15,827 | 138 | 3.50 | % | 15,027 | 124 | 3.32 | % | 15,537 | 264 | 3.43 | % | 14,959 | 249 | 3.35 | % | ||||||||||||||||||||||||||||

| Available for sale securities (2) | 48,154 | 177 | 1.47 | % | 71,431 | 211 | 1.19 | % | 59,728 | 428 | 1.45 | % | 69,797 | 409 | 1.18 | % | ||||||||||||||||||||||||||||

| Held to maturity securities | 107,378 | 600 | 2.24 | % | 53,404 | 335 | 2.52 | % | 95,439 | 1,085 | 2.29 | % | 51,830 | 657 | 2.55 | % | ||||||||||||||||||||||||||||

| Bank loans | 15,701 | 115 | 2.94 | % | 14,569 | 98 | 2.71 | % | 15,615 | 225 | 2.91 | % | 14,487 | 197 | 2.73 | % | ||||||||||||||||||||||||||||

| Total interest-earning assets | 215,760 | 1,094 | 2.03 | % | 185,159 | 804 | 1.75 | % | 216,289 | 2,118 | 1.97 | % | 182,138 | 1,580 | 1.74 | % | ||||||||||||||||||||||||||||

| Other interest revenue | 33 | 36 | 64 | 70 | ||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 215,760 | $ | 1,127 | 2.10 | % | $ | 185,159 | $ | 840 | 1.82 | % | $ | 216,289 | $ | 2,182 | 2.03 | % | $ | 182,138 | $ | 1,650 | 1.82 | % | ||||||||||||||||||||

| Funding sources: | ||||||||||||||||||||||||||||||||||||||||||||

| Bank deposits | $ | 163,711 | $ | 30 | 0.07 | % | $ | 136,009 | $ | 8 | 0.02 | % | $ | 163,696 | $ | 49 | 0.06 | % | $ | 133,814 | $ | 16 | 0.02 | % | ||||||||||||||||||||

| Payables to brokerage clients | 26,125 | 3 | 0.05 | % | 25,302 | 1 | 0.01 | % | 26,892 | 5 | 0.04 | % | 26,015 | 1 | 0.01 | % | ||||||||||||||||||||||||||||

| Short-term borrowings | 1,393 | 3 | 0.86 | % | 2,038 | 2 | 0.39 | % | 1,363 | 5 | 0.74 | % | 1,029 | 2 | 0.39 | % | ||||||||||||||||||||||||||||

| Long-term debt | 3,518 | 31 | 3.53 | % | 2,876 | 26 | 3.64 | % | 3,305 | 59 | 3.60 | % | 2,877 | 52 | 3.63 | % | ||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 194,747 | 67 | 0.14 | % | 166,225 | 37 | 0.09 | % | 195,256 | 118 | 0.12 | % | 163,735 | 71 | 0.09 | % | ||||||||||||||||||||||||||||

| Non-interest-bearing funding sources | 21,013 | 18,934 | 21,033 | 18,403 | ||||||||||||||||||||||||||||||||||||||||

| Other interest expense | 7 | 5 | 11 | 9 | ||||||||||||||||||||||||||||||||||||||||

| Total funding sources | $ | 215,760 | $ | 74 | 0.14 | % | $ | 185,159 | $ | 42 | 0.09 | % | $ | 216,289 | $ | 129 | 0.12 | % | $ | 182,138 | $ | 80 | 0.09 | % | ||||||||||||||||||||

| Net interest revenue | $ | 1,053 | 1.96 | % | $ | 798 | 1.73 | % | $ | 2,053 | 1.91 | % | $ | 1,570 | 1.73 | % | ||||||||||||||||||||||||||||

| (1) | Interest revenue was less than $500,000 in the period or periods presented. |

| (2) | Amounts have been calculated based on amortized cost. |

|

THE CHARLES SCHWAB CORPORATION Asset Management and Administration Fees Information (In millions) (Unaudited) |

||||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||||||||||||||||||||||||

|

Average Client Assets |

Revenue |

Average Fee |

Average Client Assets |

Revenue |

Average Fee |

Average Client Assets |

Revenue |

Average Fee |

Average Client Assets |

Revenue |

Average Fee |

|||||||||||||||||||||||||||||||||

| Schwab money market funds before fee waivers | $ | 158,974 | $ | 224 | 0.57 | % | $ | 163,929 | $ | 239 | 0.59 | % | $ | 160,881 | $ | 455 | 0.57 | % | $ | 166,184 | $ | 485 | 0.59 | % | ||||||||||||||||||||

| Fee waivers | (1 | ) | (55 | ) | (9 | ) | (152 | ) | ||||||||||||||||||||||||||||||||||||

| Schwab money market funds | 158,974 | 223 | 0.56 | % | 163,929 | 184 | 0.45 | % | 160,881 | 446 | 0.56 | % | 166,184 | 333 | 0.40 | % | ||||||||||||||||||||||||||||

| Schwab equity and bond funds and ETFs | 151,825 | 52 | 0.14 | % | 112,814 | 52 | 0.19 | % | 145,363 | 107 | 0.15 | % | 108,103 | 103 | 0.19 | % | ||||||||||||||||||||||||||||

| Mutual Fund OneSource ® | 220,680 | 179 | 0.33 | % | 201,034 | 169 | 0.34 | % | 211,548 | 349 | 0.33 | % | 197,839 | 333 | 0.34 | % | ||||||||||||||||||||||||||||

| Other third-party mutual funds and ETFs (1) | 271,503 | 59 | 0.09 | % | 252,405 | 56 | 0.09 | % | 272,065 | 117 | 0.09 | % | 244,820 | 107 | 0.09 | % | ||||||||||||||||||||||||||||

| Total mutual funds and ETFs (2) | $ | 802,982 | 513 | 0.26 | % | $ | 730,182 | 461 | 0.25 | % | $ | 789,857 | 1,019 | 0.26 | % | $ | 716,946 | 876 | 0.25 | % | ||||||||||||||||||||||||

| Advice solutions (2) : | ||||||||||||||||||||||||||||||||||||||||||||

| Fee-based | $ | 199,823 | 256 | 0.51 | % | $ | 175,973 | 226 | 0.52 | % | $ | 195,791 | 500 | 0.51 | % | $ | 171,146 | 441 | 0.52 | % | ||||||||||||||||||||||||

| Intelligent Portfolios | 17,796 | — | — | 6,620 | — | — | 16,020 | — | — | 5,868 | — | — | ||||||||||||||||||||||||||||||||

| Legacy Non-Fee | 18,340 | — | — | 17,015 | — | — | 17,890 | — | — | 16,712 | — | — | ||||||||||||||||||||||||||||||||

| Total advice solutions (3) | $ | 235,959 | 256 | 0.44 | % | $ | 199,608 | 226 | 0.46 | % | $ | 229,701 | 500 | 0.44 | % | $ | 193,726 | 441 | 0.46 | % | ||||||||||||||||||||||||

| Other balance-based fees (4) | 406,307 | 64 | 0.06 | % | 338,529 | 58 | 0.07 | % | 397,523 | 125 | 0.06 | % | 328,278 | 114 | 0.07 | % | ||||||||||||||||||||||||||||

| Other (5) | 12 | 12 | 24 | 25 | ||||||||||||||||||||||||||||||||||||||||

| Total asset management and administration fees | $ | 845 | $ | 757 | $ | 1,668 | $ | 1,456 | ||||||||||||||||||||||||||||||||||||

| (1) | Includes Schwab ETF OneSource™. |

| (2) | Advice solutions include managed portfolios, specialized strategies, and customized investment advice. Fee-based advice solutions include Schwab Private Client, Schwab Managed Portfolios, Managed Account Select®, Schwab Advisor Network®, Windhaven® Strategies, ThomasPartners® Dividend Growth Strategy, Schwab Index Advantage® advised retirement plan balances, and Schwab Intelligent AdvisoryTM, launched in March 2017; average client assets are shown exclusive of enrolled balances that do not generate advice fees. Intelligent Portfolios include Schwab Intelligent Portfolios® and Institutional Intelligent Portfolios®. Legacy Non-Fee advice solutions include superseded programs such as Schwab Advisor Source and certain retirement plan balances. Average client assets for advice solutions may also include the asset balances contained in the mutual fund and/or ETF categories listed above. |

| (3) | For total end of period client assets receiving ongoing advisory services, including those not generating advice fees, please see the Monthly Activity Report. |

| (4) | Includes various asset-related fees, such as trust fees, 401(k) recordkeeping fees, and mutual fund clearing fees and other service fees. Beginning in the first quarter of 2017, a prospective methodology change was made to average client assets relating to 401(k) recordkeeping fees to provide improved insight into the associated fee driver, which resulted in an increase of approximately $25 billion. There was no impact to revenue or the average fee. |

| (5) | Includes miscellaneous service and transaction fees relating to mutual funds and ETFs that are not balance-based. |

|

THE CHARLES SCHWAB CORPORATION Growth in Client Assets and Accounts (Unaudited) |

|||||||||||||||||||||||||||

|

Q2-17 % Change |

2017 | 2016 | |||||||||||||||||||||||||

| (In billions, at quarter end, except as noted) |

vs. Q2-16 |

vs. Q1-17 |

Second Quarter |

First Quarter |

Fourth Quarter |

Third Quarter |

Second Quarter |

||||||||||||||||||||

| Assets in client accounts | |||||||||||||||||||||||||||

| Schwab One®, certain cash equivalents and bank deposits | 15 | % | (3 | )% | $ | 193.7 | $ | 199.6 | $ | 197.4 | $ | 181.1 | $ | 168.4 | |||||||||||||

| Proprietary mutual funds (Schwab Funds® and Laudus Funds®): | |||||||||||||||||||||||||||

| Money market funds | (3 | )% | (4 | )% | 156.2 | 162.9 | 163.5 | 160.3 | 161.0 | ||||||||||||||||||

| Equity and bond funds (1) | 17 | % | 5 | % | 73.3 | 70.1 | 66.1 | 64.6 | 62.8 | ||||||||||||||||||

| Total proprietary mutual funds | 3 | % | (2 | )% | 229.5 | 233.0 | 229.6 | 224.9 | 223.8 | ||||||||||||||||||

| Mutual Fund Marketplace® (2) | |||||||||||||||||||||||||||

| Mutual Fund OneSource® | 10 | % | 10 | % | 224.7 | 204.9 | 198.9 | 206.1 | 203.4 | ||||||||||||||||||

| Mutual fund clearing services | 18 | % | 15 | % | 226.4 | 197.5 | 196.6 | 198.8 | 192.0 | ||||||||||||||||||

| Other third-party mutual funds | 15 | % | 2 | % | 609.0 | 596.2 | 558.2 | 556.1 | 529.7 | ||||||||||||||||||

| Total Mutual Fund Marketplace | 15 | % | 6 | % | 1,060.1 | 998.6 | 953.7 | 961.0 | 925.1 | ||||||||||||||||||

| Total mutual fund assets | 12 | % | 5 | % | 1,289.6 | 1,231.6 | 1,183.3 | 1,185.9 | 1,148.9 | ||||||||||||||||||

| Exchange-traded funds (ETFs) | |||||||||||||||||||||||||||

| Proprietary ETFs (1) | 63 | % | 13 | % | 78.0 | 69.3 | 59.8 | 53.9 | 47.9 | ||||||||||||||||||

| ETF OneSource™ (2) | 31 | % | 8 | % | 24.9 | 23.1 | 21.2 | 20.2 | 19.0 | ||||||||||||||||||

| Other third-party ETFs | 23 | % | 5 | % | 270.2 | 257.0 | 238.3 | 230.8 | 220.5 | ||||||||||||||||||

| Total ETF assets | 30 | % | 7 | % | 373.1 | 349.4 | 319.3 | 304.9 | 287.4 | ||||||||||||||||||

| Equity and other securities | 17 | % | 3 | % | 971.4 | 939.7 | 886.5 | 860.3 | 830.7 | ||||||||||||||||||

| Fixed income securities | 14 | % | 5 | % | 229.3 | 217.5 | 208.3 | 208.0 | 202.0 | ||||||||||||||||||

| Margin loans outstanding | 7 | % | 8 | % | (16.5 | ) | (15.3 | ) | (15.3 | ) | (14.9 | ) | (15.4 | ) | |||||||||||||

| Total client assets | 16 | % | 4 | % | $ | 3,040.6 | $ | 2,922.5 | $ | 2,779.5 | $ | 2,725.3 | $ | 2,622.0 | |||||||||||||

| Client assets by business | |||||||||||||||||||||||||||

| Investor Services | 15 | % | 4 | % | $ | 1,634.1 | $ | 1,565.9 | $ | 1,495.4 | $ | 1,470.8 | $ | 1,415.5 | |||||||||||||

| Advisor Services | 17 | % | 4 | % | 1,406.5 | 1,356.6 | 1,284.1 | 1,254.5 | 1,206.5 | ||||||||||||||||||

| Total client assets | 16 | % | 4 | % | $ | 3,040.6 | $ | 2,922.5 | $ | 2,779.5 | $ | 2,725.3 | $ | 2,622.0 | |||||||||||||

| Net growth in assets in client accounts (for the quarter ended) | |||||||||||||||||||||||||||

| Net new assets by business | |||||||||||||||||||||||||||

| Investor Services (3) | 170 | % | 185 | % | $ | 39.9 | $ | 14.0 | $ | 13.7 | $ | 14.2 | $ | 14.8 | |||||||||||||

| Advisor Services | 108 | % | (1 | )% | 24.6 | 24.9 | 23.2 | 15.8 | 11.8 | ||||||||||||||||||

| Total net new assets | 142 | % | 66 | % | $ | 64.5 | $ | 38.9 | $ | 36.9 | $ | 30.0 | $ | 26.6 | |||||||||||||

| Net market gains | 39 | % | (49 | )% | 53.6 | 104.1 | 17.3 | 73.3 | 38.7 | ||||||||||||||||||

| Net growth | 81 | % | (17 | )% | $ | 118.1 | $ | 143.0 | $ | 54.2 | $ | 103.3 | $ | 65.3 | |||||||||||||

| New brokerage accounts (in thousands, for the quarter ended) | 32 | % | (1 | )% | 357 | 362 | 293 | 264 | 271 | ||||||||||||||||||

| Clients (in thousands) | |||||||||||||||||||||||||||

| Active Brokerage Accounts | 5 | % | 2 | % | 10,487 | 10,320 | 10,155 | 10,046 | 9,977 | ||||||||||||||||||

| Banking Accounts | 7 | % | 2 | % | 1,143 | 1,120 | 1,106 | 1,088 | 1,065 | ||||||||||||||||||

| Corporate Retirement Plan Participants | (1 | )% | — | 1,540 | 1,545 | 1,543 | 1,561 | 1,553 | |||||||||||||||||||

| (1) | Includes proprietary equity and bond funds and ETFs held on and off the Schwab platform. As of June 30, 2017, off-platform equity and bond funds and ETFs were $8.7 billion and $17.2 billion, respectively. |

| (2) | Excludes all proprietary mutual funds and ETFs. |

| (3) | Second quarter of 2017 includes inflows of $18.3 billion from a mutual fund clearing services client. First quarter of 2017 includes an outflow of $9.0 billion from a mutual fund clearing services client. Second quarter of 2016 includes an inflow of $2.7 billion from a mutual fund clearing services client. |

|

The Charles Schwab Corporation Monthly Activity Report For June 2017 |

|||||||||||||||||||||||||||||||||||||||||||

| 2016 | 2017 |

Change |

|||||||||||||||||||||||||||||||||||||||||

|

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Mo. |

Yr. |

|||||||||||||||||||||||||||||

| Market Indices | |||||||||||||||||||||||||||||||||||||||||||

| (at month end) | |||||||||||||||||||||||||||||||||||||||||||

| Dow Jones Industrial Average | 17,930 | 18,432 | 18,401 | 18,308 | 18,142 | 19,124 | 19,763 | 19,864 | 20,812 | 20,663 | 20,941 | 21,009 | 21,350 | 2% | 19% | ||||||||||||||||||||||||||||

| Nasdaq Composite | 4,843 | 5,162 | 5,213 | 5,312 | 5,189 | 5,324 | 5,383 | 5,615 | 5,825 | 5,912 | 6,048 | 6,199 | 6,140 | (1)% | 27% | ||||||||||||||||||||||||||||

| Standard & Poor’s 500 | 2,099 | 2,174 | 2,171 | 2,168 | 2,126 | 2,199 | 2,239 | 2,279 | 2,364 | 2,363 | 2,384 | 2,412 | 2,423 | — | 15% | ||||||||||||||||||||||||||||

| Client Assets | |||||||||||||||||||||||||||||||||||||||||||

| (in billions of dollars) | |||||||||||||||||||||||||||||||||||||||||||

| Beginning Client Assets | 2,607.2 | 2,622.0 | 2,698.2 | 2,710.4 | 2,725.3 | 2,686.7 | 2,734.6 | 2,779.5 | 2,831.3 | 2,895.2 | 2,922.5 | 2,948.8 | 2,995.8 | ||||||||||||||||||||||||||||||

| Net New Assets (1) | 9.3 | 9.0 | 10.4 | 10.6 | 6.1 | 11.9 | 18.9 | 11.1 | 6.6 | 21.2 | 2.8 | 24.0 | 37.7 | 57% | N/M | ||||||||||||||||||||||||||||

| Net Market Gains (Losses) | 5.5 | 67.2 | 1.8 | 4.3 | (44.7 | ) | 36.0 | 26.0 | 40.7 | 57.3 | 6.1 | 23.5 | 23.0 | 7.1 | |||||||||||||||||||||||||||||

| Total Client Assets (at month end) | 2,622.0 | 2,698.2 | 2,710.4 | 2,725.3 | 2,686.7 | 2,734.6 | 2,779.5 | 2,831.3 | 2,895.2 | 2,922.5 | 2,948.8 | 2,995.8 | 3,040.6 | 1% | 16% | ||||||||||||||||||||||||||||

| Receiving Ongoing Advisory Services | |||||||||||||||||||||||||||||||||||||||||||

| (at month end) | |||||||||||||||||||||||||||||||||||||||||||

| Investor Services | 205.0 | 210.2 | 211.7 | 213.4 | 211.3 | 213.2 | 217.1 | 220.8 | 227.9 | 230.9 | 234.4 | 239.1 | 242.2 | 1% | 18% | ||||||||||||||||||||||||||||

| Advisor Services (2) | 1,110.5 | 1,142.3 | 1,149.4 | 1,155.4 | 1,140.5 | 1,161.8 | 1,184.3 | 1,208.4 | 1,239.0 | 1,250.9 | 1,262.7 | 1,283.4 | 1,297.6 | 1% | 17% | ||||||||||||||||||||||||||||

| Client Accounts | |||||||||||||||||||||||||||||||||||||||||||

| (at month end, in thousands) | |||||||||||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts | 9,977 | 9,989 | 10,021 | 10,046 | 10,068 | 10,102 | 10,155 | 10,198 | 10,254 | 10,320 | 10,386 | 10,439 | 10,487 | — | 5% | ||||||||||||||||||||||||||||

| Banking Accounts | 1,065 | 1,074 | 1,083 | 1,088 | 1,092 | 1,099 | 1,106 | 1,109 | 1,117 | 1,120 | 1,128 | 1,138 | 1,143 | — | 7% | ||||||||||||||||||||||||||||

| Corporate Retirement Plan Participants | 1,553 | 1,559 | 1,565 | 1,561 | 1,547 | 1,550 | 1,543 | 1,543 | 1,534 | 1,545 | 1,543 | 1,541 | 1,540 | — | (1)% | ||||||||||||||||||||||||||||

| Client Activity | |||||||||||||||||||||||||||||||||||||||||||

| New Brokerage Accounts (in thousands) | 87 | 84 | 96 | 84 | 84 | 93 | 116 | 111 | 113 | 138 | 125 | 115 | 117 | 2% | 34% | ||||||||||||||||||||||||||||

| Inbound Calls (in thousands) | 1,665 | 1,605 | 1,755 | 1,633 | 1,565 | 1,642 | 1,931 | 1,817 | 1,787 | 2,111 | 1,788 | 1,727 | 1,736 | 1% | 4% | ||||||||||||||||||||||||||||

| Web Logins (in thousands) | 43,220 | 46,217 | 42,627 | 38,237 | 35,429 | 37,687 | 40,720 | 40,047 | 40,717 | 45,441 | 39,750 | 44,024 | 43,790 | (1)% | 1% | ||||||||||||||||||||||||||||

| Client Cash as a Percentage of Client Assets (3) | 12.6 | % | 12.5 | % | 12.5 | % | 12.5 | % | 12.8 | % | 12.8 | % | 13.0 | % | 12.7 | % | 12.4 | % | 12.4 | % | 12.1 | % | 11.8 | % | 11.5 | % | (30) bp | (110) bp | |||||||||||||||

| Mutual Fund and Exchange-Traded Fund | |||||||||||||||||||||||||||||||||||||||||||

| Net Buys (Sells) (4, 5) | |||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||

| Large Capitalization Stock | 185 | (1,173 | ) | (755 | ) | (1,209 | ) | (652 | ) | 200 | 565 | 265 | 580 | (125 | ) | 346 | 134 | (63 | ) | ||||||||||||||||||||||||

| Small / Mid Capitalization Stock | (113 | ) | (320 | ) | (214 | ) | 460 | (190 | ) | 877 | 1,103 | 1,364 | 673 | (409 | ) | (797 | ) | (285 | ) | (322 | ) | ||||||||||||||||||||||

| International | (1,208 | ) | (347 | ) | 386 | (26 | ) | (1 | ) | 348 | (683 | ) | 1,296 | 1,633 | 1,703 | 2,410 | 3,610 | 3,631 | |||||||||||||||||||||||||

| Specialized | 470 | 357 | 189 | (274 | ) | (159 | ) | (1,019 | ) | 20 | 411 | 1,007 | 273 | 570 | 529 | 647 | |||||||||||||||||||||||||||

| Hybrid | (403 | ) | (463 | ) | (219 | ) | 58 | (432 | ) | (687 | ) | (456 | ) | (53 | ) | 258 | 563 | 92 | 65 | (340 | ) | ||||||||||||||||||||||

| Taxable Bond | 1,421 | 1,420 | 1,888 | 1,585 | 1,475 | (1,110 | ) | 1,045 | 3,144 | 3,535 | 3,876 | 2,060 | 3,618 | 3,499 | |||||||||||||||||||||||||||||

| Tax-Free Bond | 700 | 766 | 920 | 539 | 20 | (1,090 | ) | (1,692 | ) | 864 | 472 | 300 | 155 | 290 | 507 | ||||||||||||||||||||||||||||

| Net Buy (Sell) Activity | |||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||

| Mutual Funds (4) | (2,049 | ) | (1,683 | ) | (297 | ) | (656 | ) | (1,979 | ) | (5,864 | ) | (5,825 | ) | 2,522 | 4,005 | 2,368 | 1,116 | 3,837 | 2,980 | |||||||||||||||||||||||

| Exchange-Traded Funds (5) | 3,101 | 1,923 | 2,492 | 1,789 | 2,040 | 3,383 | 5,727 | 4,769 | 4,153 | 3,813 | 3,720 | 4,124 | 4,579 | ||||||||||||||||||||||||||||||

| Money Market Funds | (1,799 | ) | 701 | (768 | ) | (658 | ) | 211 | 1,851 | 1,141 | (1,761 | ) | (181 | ) | 1,218 | (4,434 | ) | (1,167 | ) | (1,260 | ) | ||||||||||||||||||||||

| Average Interest-Earning Assets (6) | |||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | 187,933 | 191,850 | 194,268 | 199,107 | 201,894 | 206,970 | 212,052 | 216,001 | 216,112 | 218,554 | 217,407 | 215,252 | 214,709 | — | 14% | ||||||||||||||||||||||||||||

| (1) | June 2017 includes an inflow of $15.6 billion from a mutual fund clearing services client. February 2017 includes an outflow of $9.0 billion from a mutual fund clearing services client. |

| (2) | Excludes Retirement Business Services. |

| (3) | Schwab One®, certain cash equivalents, bank deposits, and money market fund balances as a percentage of total client assets. |

| (4) | Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. |

| (5) | Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. |

| (6) | Represents average total interest-earning assets on the Company’s balance sheet. |

| N/M | Not meaningful. |