LONDON--(BUSINESS WIRE)--The global industrial chocolate market is expected to grow at a CAGR of over 3% during the forecast period, according to Technavio’s latest report.

In this report, Technavio covers the market outlook and growth prospects of the global industrial chocolate market for 2017-2021. Based on application, this market is segmented into confectionery, biscuits and bakery products, dairy and desserts, ice creams and frozen items, cereals, and others.

In recent times, there has been an increasing demand for organic and sugar-free chocolates due to increasing awareness about the negative effects of synthetic products on one’s health. Aligning to this preference of end-users, food and beverage manufacturers have started increasing the demand for organic and sugar-free industrial chocolate instead of the conventional types of chocolate, which is a major driver for this market. Other important drivers are the growth and expansion opportunities available in emerging economies and inclination of the industry towards Fairtrade practices.

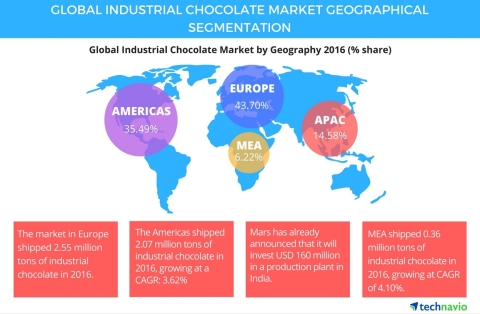

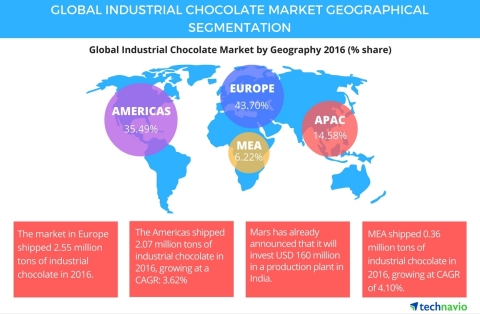

Technavio’s research study segments the global industrial chocolate market into the following regions:

- Europe

- Americas

- APAC

- MEA

Europe: largest industrial chocolate market segment

“In 2016, Europe was responsible for shipping 2.55 million tons of chocolate, of which Western Europe registered the highest per capita consumption of chocolate in the region. Additionally, many of the chocolate manufacturers with an international presence, alongside many private label companies operate from this region. These two factors are responsible for the dominance of this market segment,” says Manjunath Reddy, one of the lead analysts at Technavio for food research.

Germany, Italy, France, Spain, and the UK register the highest consumption of chocolate in the EU. This region shows a preference towards premium ingredients and unique flavors in the industrial chocolate markets. Manufacturers operating in this space are required to adhere to the constantly evolving tastes and preferences of consumers while catering to specific end-user segments. Additionally, organic and Fairtrade products are gaining prominence on the retail front, and the industry is also focusing on new techniques such as roasting of whole beans to enhance flavor.

Request a sample report: http://www.technavio.com/request-a-sample?report=55484

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Americas: market driven by increased exports from Latin American countries

In this region, Latin America is showing strong growth, whereas the market in North America is relatively mature, with most new demand arising from dark chocolates. Additionally, consumers are demanding for single-origin chocolates and value-added, premium products at a lower price range, which results in the region seeing the maximum number of new product launches.

Countries like Ecuador in Latin America are capitalizing on the rising demand for chocolate in the global market to increase their exports quickly. Cocoa producers are quickly adopting better farming practices and resource management to increase their output to enable the increased exports. Also, with the rise in disposable income among individuals in Latin American countries, there is an increasing internal demand which is also bringing in additional revenue.

APAC: fastest growing industrial chocolate market

“APAC will be the fastest growing market segment during the forecast period, growing at a CAGR of 4.33%. China and India are the key revenue generating countries in the region, where a large consumer base balances the low per capita consumption. Also, this region has chocolate manufacturers who are focusing exclusively on the raw materials used in chocolate production, which is resulting in countries focusing mainly on the cultivation of quality cocoa,” says Manjunath.

Despite the low per capita consumption of chocolates in China, the country generates significant revenue for the market. This is due to foreign players promoting Chinese chocolates as gift items, which accounts for nearly half of China’s chocolate sales. Super-premium chocolate confectionery items are popularly given as gifts, particularly during occasions such as Valentine's Day and Chinese New Year. Meanwhile, the Indian market is dominated by changing consumer patterns and growing popularity of indulgent chocolates, which has encouraged many vendors to set up their manufacturing plants in the region.

MEA: improving economic situation in Africa to drive market growth

This region has Africa, which is the world’s largest producer of cocoa. Currently, even though the per capita consumption of chocolates is very low in the region, it is expected to change during the forecast period due to changing economic situation. This region is also witnessing private and public sector companies operating from the region across the chocolate supply chain, which is leading to increased investments towards the improvement of sustainability of cocoa production. These factors are expected to lead to a steady growth of the market during the forecast period.

The top vendors in the global industrial chocolate market highlighted in the report are:

- Barry Callebaut

- Blommer Chocolate

- Cargill

- CÉMOI Group

Browse Related Reports:

- Global Chocolate Market 2016-2020

- Global Cocoa Market 2016-2020

- Confectionery Market in the US 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like alcoholic beverages, food service, and non-alcoholic beverages. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.