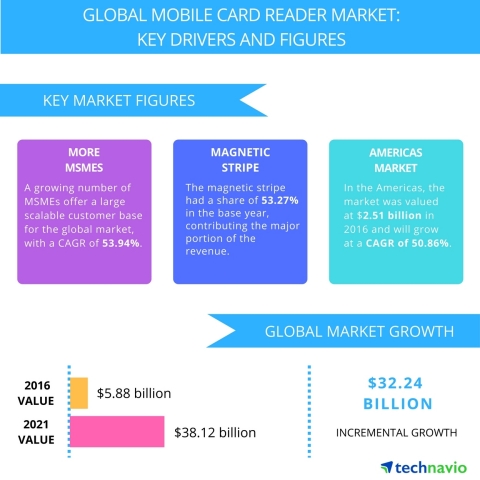

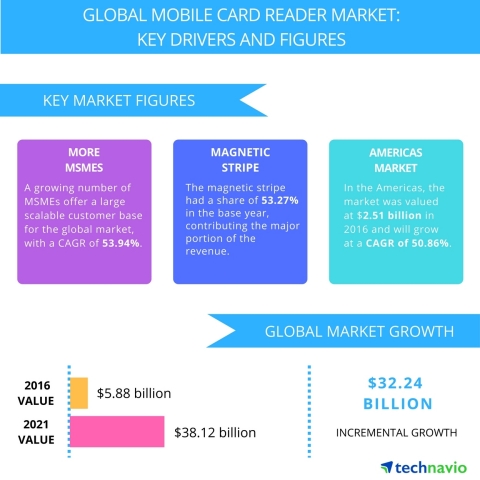

LONDON--(BUSINESS WIRE)--Technavio research analysts forecast the global mobile card reader market to grow at a CAGR of close to 54% during the forecast period, according to their latest report.

The study covers the present scenario and growth prospects of the global mobile card reader market for 2017-2021. The report also lists magnetic stripe, chip and PIN, and near-field communication (NFC) as the three major technology segments for the mobile card reader market, with the magnetic stripe technology being the most commonly used technology in 2016. It had a share of over 53% and was followed by the chip and PIN technology with a share of approximately 41% in 2016.

“With governments across the globe looking to improve infrastructure in terms of the Internet and mobile devices, the demand for contactless payment systems is also likely to improve. This will aid vendors to penetrate markets in India, China, Brazil, and other developing economies, which are considered difficult to penetrate,” says Chetan Mohan, a lead analyst at Technavio for computing devices research.

Request a sample report: http://www.technavio.com/request-a-sample?report=55294

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio hardware and semiconductor analysts highlight the following three market drivers that are contributing to the growth of the global mobile card reader market:

- Growing number of MSMEs offer a large scalable customer base

- Lower transaction costs

- Growing dependence on plastic for transactions

Growing number of MSMEs offer a large scalable customer base

The complex banking procedures and the high transaction fees have been the biggest letdown for micro, small, and medium enterprises (MSMEs) looking to adopt card-based transactions. The advent of mobile card readers has simplified the process altogether, with the role of banks being reduced significantly. Strategies implemented by market vendors ensure that they charge only around 2%-3% of the transactional value, from which a share is given to the banks. In addition, these devices are a cheaper alternative to traditional point-of-sale (POS) terminals, leading to greater acceptance among end-users.

The market being in the nascent stage is the main reason behind the current low adoption in MSMEs, but with MSMEs driving economic growth and development at regional, national, and global levels integrating card readers will be an important aspect to propel their growth.

“In developing and upcoming regions such as India and China, the MSME sector is pivotal in driving the growth engine,” says Chetan.

Lower transaction costs

Reduced transactional costs, apart from the simplicity of use, is a major selling point for vendors offering mobile card readers. Vendors charge a fixed fee for every transaction, which varies on the technology being used (swipe or chip and PIN). The fee per transaction in 2016 ranged between USD2-3 only. This is an improvement over the traditional method followed by banks, who used to charge a monthly service fee in addition to the fee for every transaction. In addition, market vendors are not charging additional cost such as annual, monthly, and processing fees or binding them to any contracts. The reduction in complexities of payment transactions will boost the market for mobile card readers, as customers find it much more convenient.

Growing dependence on plastic for transactions

On a global scale, the number of debit and credit cards are increasing at a rapid pace. The increase in the number of cards has also increased the number of transactions taking place in the market. For instance, the number of transactions using Visa, UnionPay, MasterCard, JCB, Diners Club/Discover, and American Express was 230 billion in 2016, while the number of cards in circulation was 12.04 billion globally. The rise in plastic payment modes is forcing enterprises to start accepting card-based payments. This is a positive development for the global mobile card reader market as Technavio believes that the adoption rate of mobile card readers will be much greater than the traditional mPOS terminals.

Browse Related Reports:

- POS Terminal Market in Europe 2016-2020

- Global NFC Transaction Market 2016-2020

- Global Mobile EMV POS Terminals Market 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like displays, sensors and embedded systems. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.