LONDON--(BUSINESS WIRE)--Despite a recent slowdown in defence spending, Indonesia will experience a return to robust growth by 2019, according to new analysis from IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

Indonesia will be the fifth fastest-growing defence budget in the world between 2016 and 2025, the IHS Markit analysis predicts, growing at a compound annual rate of 4.7 percent and spending more than $20 billion on procurement over the period.

“Indonesia currently faces several challenges. It has confrontations around the Natuna Islands in the South China Sea as well as maritime piracy and terrorism issues in its territorial waters,” said Ridzwan Rahmat, senior defence and security analyst for IHS Jane’s. “At the same time, it is trying to enhance autonomy in its defence.”

Driven by escalating strategic concerns, Indonesia’s military requires a wide range of equipment, especially in sea and air domains. Procurement programs the government has approved for the period of 2015 and 2019 include an F-5 multirole fighter, offshore patrol vessels, replacement of mine countermeasure vessels (MCMVs) and artilleries.

Intense competition

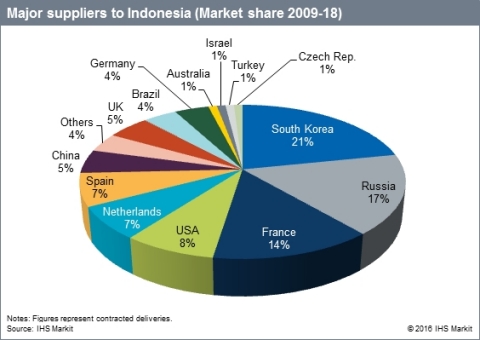

The Indonesian defence market is shifting, with the country’s commitment to diversify suppliers. Between 2009 and 2018, more than 30 countries are expected to export to Indonesia. “This reflects Indonesia’s wariness about dependency of a supplier or a set of suppliers, as well as the intention to ‘shop around’ for the best defence deals, spurring competition,” said Jon Grevatt, APAC defence industry analyst for IHS Jane’s.

During the same period, South Korea, Russia and France will hold a combined 53 percent of market share. The other half of that market will be shared by about 30 countries, many with even less than 1 percent. “South Korea recently assumed the major supplier position, mainly supported by such key deals as the T-50 jet trainer and Type 209 submarines,” Grevatt said. “The U.S. is also quickly gaining market share although the wariness of the U.S. still persists in Indonesia.”

Industrial capability

Indonesia’s indigenous capability is still limited but with the government’s commitment to develop capability as a means to boost the economy, it is slowly developing thanks to collaboration with foreign contractors. A number of co-development and production projects have emerged in the past five years or so, including some industry engagement and obligations. “Some of these can be regarded as over-ambitious, such as the Type 209 submarines, South Korea’s next-generation KFX fighter, and medium tanks with Turkey,” Grevatt said. “Yet, the collaboration strategy is certain to remain the key driver for the advancement at all levels of procurement.”

IHS Jane’s experts Ridzwan Rahmat and Jon Grevatt will attend the Indo Defence 2016 Expo & Forum from November 2 to 5, 2016. For comment and interviews ahead of and during the event, please contact press@ihs.com.

About IHS Jane’s Defence Budgets

IHS Jane’s Defence Budgets online solution platform tracks 99 percent of the global defence expenditure from 104 of the world’s largest defence budgets. It includes five-year forecasts, historical data, budget charting, trend evaluation and in-depth analysis by country. In this study, values are based on constant 2016 U.S. dollars.

For further information about IHS Jane’s Defence Budgets platform and reports, please contact Christopher.Fry@ihsmarkit.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 key business and government customers, including 85 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. All other company and product names may be trademarks of their respective owners © 2016 IHS Markit Ltd. All rights reserved.