SAN FRANCISCO--(BUSINESS WIRE)--The Charles Schwab Corporation announced today that its net income for the second quarter of 2016 was $452 million, up 10% from $412 million for the first quarter of 2016, and up 28% from $353 million for the second quarter of 2015. Net income for the six months ended June 30, 2016 was $864 million, up 32% from the year-earlier period. The company’s financial results for the second quarter and first six months of both 2016 and 2015 include certain non-recurring items; a description of these items is included below.

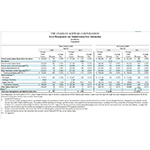

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30, | % | June 30, | % | |||||||||||||||||||||||||

| Financial Highlights | 2016 | 2015 | Change | 2016 | 2015 | Change | ||||||||||||||||||||||

| Net revenues (in millions) | $ | 1,828 | $ | 1,566 | 17 | % | $ | 3,592 | $ | 3,092 | 16 | % | ||||||||||||||||

| Net income (in millions) | $ | 452 | $ | 353 | 28 | % | $ | 864 | $ | 655 | 32 | % | ||||||||||||||||

| Diluted earnings per common share | $ | .30 | $ | .25 | 20 | % | $ | .60 | $ | .47 | 28 | % | ||||||||||||||||

| Pre-tax profit margin | 39.4 | % | 36.2 | % | 38.3 | % | 34.0 | % | ||||||||||||||||||||

|

Return on average common stockholders’ equity (annualized) |

13 | % | 12 | % | 13 | % | 11 | % | ||||||||||||||||||||

| EPS Impact of Certain Non-Recurring Items | ||||||||||||||||||||||||||||

| Net litigation proceeds (1) | $ | - | $ | .01 | $ | - | $ | .01 | ||||||||||||||||||||

|

Note: All per-share results are rounded to the nearest cent, based on weighted-average diluted common shares outstanding. |

||||||||||||||||||||||||||||

| (1) |

Net litigation proceeds include $2 million and $16 million in the second quarters of 2016 and 2015, respectively, relating to the company’s non-agency residential mortgage-backed securities (RMBS) portfolio. |

|

CEO Walt Bettinger said, “Our second quarter results mark yet another period of standout financial performance for Schwab. Our 17% year-over-year revenue growth and 28% increase in earnings reflect the power of our successful ‘through clients’ eyes’ strategy and disciplined financial management, particularly in the face of an unsettled economic environment and interest rates that remain near historic lows. Our second quarter pre-tax profit margin of 39.4% was the highest since our record performance in 2008. During the intervening seven-plus years, we have focused on balancing near-term profitability with reinvestment to drive growth, while working through the economic and interest rate aftermath of the financial crisis. From 2009 through mid-2016, we coped with extraordinary pressure on our revenues while investing approximately $3 billion in our brand and service capabilities, expanding our client base by approximately $1.20 trillion to $2.62 trillion, and building our earnings to today’s record level. Our second quarter pre-tax profit margin represented the 13th consecutive quarter in excess of 30% and a significant improvement from the sub-30% margins that followed the crisis.”

Mr. Bettinger continued, “We are winning in the marketplace, steadily attracting clients and assets with a compelling combination of financial products, service and value. Clients brought us $26.6 billion in core net new assets in the second quarter and $58.6 billion year-to-date, continuing our pattern of solid organic growth on top of a sizeable base. Our first-half performance puts Schwab on pace to gather over $100 billion in core net new assets for the fifth year in a row. Clients opened 271,000 new brokerage accounts in the second quarter – and we ended June with 10.0 million brokerage accounts, 1.1 million bank accounts, and 1.6 million retirement plan participants, up 4%, 6%, and 5%, respectively. Additionally, the number of accounts enrolled in one of our retail advisory solutions continued to grow faster than brokerage accounts overall, reaching 581,000 as of June 30th, up 8% from a year ago. We’ve also seen more investors turn to us for help with setting and tracking long-term goals; our financial consultants held planning conversations with 33,000 clients during the second quarter, up 14% from last year.”

Mr. Bettinger noted, “Client engagement remained strong throughout the second quarter, with activity spiking in late June as the United Kingdom held its referendum on leaving the European Union. Amidst the subsequent volatility, the S&P Global Broad Market Index lost a record $3 trillion in value over just two trading sessions. As our clients have come to expect, we immediately stepped up to provide timely, actionable insights. We sent nearly three million emails to investors, connecting them with representatives and commentary from our senior investment strategists. While web logins, calls to our service centers, and interactions with our financial consultants all rose markedly from prior weeks, we had planned for incremental demand on our staff and systems and were able to accommodate elevated volumes without disruption. Our clients explored implications for their current holdings and future goals, ultimately remaining net buyers of securities through the period.”

Mr. Bettinger concluded, “We continue to develop Schwab’s products and services with investors’ needs in mind, and enhance the multichannel access that makes it easy for them to do business with us. This quarter, we graduated 32 financial consultants from the inaugural classes of our FC University and FC Academy, programs designed to develop a pipeline of talent for our client-facing ranks. We also opened a new branch in downtown Washington D.C. and upgraded several branches throughout the country. These are initial steps in a larger, long-term effort to expand Schwab’s branch network throughout multiple metropolitan areas. In June, we introduced updates to the Schwab Intelligent Portfolios™ retirement income feature, which uses the account’s portfolio allocation, time horizon and initial investment to calculate an estimated monthly income level. Clients now have more flexibility in setting their desired monthly income and receive suggestions on adjustments to meet their goal. Additionally, Schwab Stock Plan Services announced a series of initiatives enabling more convenient monitoring and management of equity compensation awards. Plan participants can now view detailed information about their awards on our mobile app and receive support via live web chat or over the phone. In our Advisor Services business, we launched a national advertising campaign advocating for independent registered investment advisors and raising awareness of this model’s benefits for high net worth investors. In conjunction with the campaign, we introduced our updated Independent Advisor Learning Center, an online content hub where investors can learn more about RIAs and connect with one in their region.”

CFO Joe Martinetto commented, “We delivered record financial results in the second quarter based on sustained success in growing our client base, as well as the effects of the Federal Reserve’s initial rate increase in December and the relative stability of other environmental drivers until late in the period. Asset management and administration fees were a record $757 million, up 13% year-over-year, as higher short-term interest rates lifted net money fund revenue. Net interest revenue was a record $798 million, up 30% from the second quarter of 2015, reflecting both stronger short-term rates and a $30-plus billion increase in average interest-earning assets through a combination of organic asset gathering and bulk transfers of client sweep cash balances from money market funds to Schwab Bank. Finally, apart from a late surge, trading volumes declined from the first quarter to levels more consistent with our expectations. Trading revenue was down 1% year-over-year to $201 million. Together, our diversified revenue streams delivered overall revenue growth of 17% year-over-year, a bit stronger than our baseline scenario expectations. Reinvestment into the business proceeded largely as planned, yielding a gap of 580 basis points between revenue and expense growth and our strongest profitability in years.”

Mr. Martinetto observed, “Our year-to-date results have outperformed the baseline scenario that we laid out in the beginning of 2016. But as the second quarter came to a close, market concerns regarding economic growth, interest rates and equity valuations in the second half of this year escalated significantly. While many of these concerns have abated somewhat, we recognize the importance of remaining flexible in order to make the most of the environment as it evolves. Our management team is experienced in monitoring conditions and adjusting spending plans as necessary to maintain that balance between near-term profitability and investing for long-term growth.”

Mr. Martinetto concluded, “As part of managing Schwab’s capital levels, our Board of Directors declared a one cent, or 17%, increase in the company’s quarterly cash dividend beginning with the second quarter. The current payout of $0.07 per common share is consistent with our target range of 20-30% of earnings. We also continued laying the groundwork for accelerated balance sheet growth via bulk transfers and cash sweep feature changes. We currently expect to transfer up to $8 billion in money fund balances to Schwab Bank during the second half of 2016. In June, the Bank became the default sweep option for all new accounts, and we anticipate approximately $3 billion of related incremental deposit growth by year-end. As of June 30th, the company had a preliminary consolidated Tier 1 Leverage ratio of 7.2%.”

Business highlights for the second quarter (data as of quarter-end unless otherwise noted):

Investor Services

- New retail brokerage accounts for the quarter totaled approximately 170,000, down 3% year-over-year; total accounts were 7.0 million, up 4% year-over-year.

- Held financial planning conversations with approximately 33,000 clients during the quarter, up 14% year-over-year.

- Opened a new Washington D.C. City Center branch. Schwab has over 330 branches across the country that offer clients access to a range of investing and personal finance guidance, services, and products.

- Schwab Trading Services hosted another Online Trading Event for over 4,800 attendees, featuring a conversation with General Colin Powell, former Secretary of State and National Security Advisor, and Schwab’s own Randy Frederick.

- A class of 15 financial consultants graduated from our inaugural FC Academy, a 24-month developmental rotational program preparing recent college graduates for a career in one of our branch offices.

- A class of 17 financial consultants graduated from our inaugural FC University, a 12-week onboarding program that prepares new-hires to be successful at Schwab and support the expansion of our branch network.

Advisor Services

- Debuted a national advertising campaign advocating for independent advisors, raising awareness of the benefits of independence among high net worth investors, and underscoring Schwab’s longstanding commitment to RIAs.

- Updated our Independent Advisor Learning Center, an online content hub central to the campaign, where investors can learn more about independent financial advisors and use a directory to find and connect with advisors in their region. The site is located at www.FindYourIndependentAdvisor.com.

- Held the annual EXPLORE® conference for the company’s top independent advisor clients. Schwab leadership and keynote speakers discussed client initiatives and growth opportunities for RIAs, with a focus on the international landscape, as well as firm talent and leadership.

- Launched our voice ID service for clients of advisors. Biometric technology allows clients to quickly and securely authenticate with their Schwab Alliance service team by simply saying a passphrase.

Products and Infrastructure

-

For Charles Schwab Bank:

- Balance sheet assets = $153.9 billion, up 26% year-over-year.

- Outstanding mortgage and home equity loans = $11.1 billion, comparable to a year ago.

- Pledged Asset Line® balances = $3.5 billion, up 21% year-over-year.

- Delinquency, nonaccrual, and loss reserve ratios for Schwab Bank’s loan portfolio = 0.23%, 0.18% and 0.21%, respectively, at month-end June.

- Schwab Bank High Yield Investor Checking® accounts = 874,000, with $12.7 billion in balances.

- Opened the Charles Schwab Trust Company, and began offering full corporate trustee and successor trustee solutions in Nevada and Utah.

- Client assets managed by Windhaven® totaled $10.6 billion, down 29% from the second quarter of 2015.

- Client assets managed by ThomasPartners® totaled $8.5 billion, up 20% from the second quarter of 2015.

- Client assets managed by Intelligent Portfolios (Schwab Intelligent Portfolios and Institutional Intelligent Portfolios™) totaled $8.2 billion, up $1.6 billion from the first quarter of 2016.

- Enhanced the Schwab Intelligent Portfolios retirement income feature, which uses the account’s portfolio allocation, time horizon and initial investment to calculate an estimated monthly income level. Clients can now further customize their income goal and receive suggestions on how to meet it.

- Announced a series of Schwab Stock Plan Services initiatives to help equity compensation recipients easily monitor and manage their awards via web browser and mobile app, as well as receive support by live chat or phone.

Supporting schedules are either attached or located at: http://www.aboutschwab.com/investor-relations/financial-reports.

Commentary from the CFO

Joe Martinetto, Senior Executive Vice President and Chief Financial Officer, provides insight and commentary regarding Schwab’s financial picture at: http://www.aboutschwab.com/investor-relations/cfo-commentary. The most recent commentary was posted on January 19, 2016.

Forward-Looking Statements

This press release contains forward-looking statements relating to attracting clients and assets; 2016 core net new assets; expansion of the branch network; balancing near-term profitability with reinvestment for growth; balance sheet growth; bulk transfers; changes to cash sweep features; and bank deposit growth.

Important factors that may cause such differences include, but are not limited to, the company’s ability to attract and retain clients and registered investment advisors and grow those relationships and client assets; competitive pressures on rates and fees; the company’s ability to develop and launch new products, services and capabilities in a timely and successful manner; client use of the company’s advisory solutions and other products and services; general market conditions, including the level of interest rates, equity valuations and trading activity; the level of client assets, including cash balances; the company’s ability to manage expenses; capital needs and management; the company’s ability to monetize client assets; the timing, amount and impact of bulk transfers and changes to cash sweep features; the quality of the company’s balance sheet assets; client sensitivity to interest rates; regulatory guidance; the effect of adverse developments in litigation or regulatory matters and the extent of any charges associated with legal matters; any adverse impact of financial reform legislation and related regulations; and other factors set forth in the company’s most recent reports on Form 10-K and Form 10-Q.

About Charles Schwab

The Charles Schwab Corporation (NYSE:SCHW) is a leading provider of financial services, with more than 330 offices and 10.0 million active brokerage accounts, 1.6 million corporate retirement plan participants, 1.1 million banking accounts, and $2.62 trillion in client assets as of June 30, 2016. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, money management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC, http://www.sipc.org), and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at www.schwab.com and www.aboutschwab.com.

|

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||

|

Consolidated Statements of Income |

|||||||||||||||||||||

|

(In millions, except per share amounts) |

|||||||||||||||||||||

|

(Unaudited) |

|||||||||||||||||||||

|

Three Months Ended |

Six Months Ended |

||||||||||||||||||||

| June 30, |

June 30, |

||||||||||||||||||||

| 2016 | 2015 |

2016 |

2015 | ||||||||||||||||||

|

Net Revenues |

|||||||||||||||||||||

| Asset management and administration fees (1) | $ | 757 | $ | 670 | $ | 1,456 | $ | 1,314 | |||||||||||||

| Interest revenue | 840 | 645 | 1,650 | 1,262 | |||||||||||||||||

| Interest expense | (42 | ) | (33 | ) | (80 | ) | (62 | ) | |||||||||||||

| Net interest revenue | 798 | 612 | 1,570 | 1,200 | |||||||||||||||||

| Trading revenue | 201 | 203 | 433 | 430 | |||||||||||||||||

| Other | 70 | 79 | 133 | 142 | |||||||||||||||||

| Provision for loan losses | 2 | 2 | - | 6 | |||||||||||||||||

| Total net revenues | 1,828 | 1,566 | 3,592 | 3,092 | |||||||||||||||||

| Expenses Excluding Interest | |||||||||||||||||||||

| Compensation and benefits | 602 | 540 | 1,228 | 1,121 | |||||||||||||||||

| Professional services | 125 | 112 | 241 | 226 | |||||||||||||||||

| Occupancy and equipment | 101 | 85 | 199 | 168 | |||||||||||||||||

| Advertising and market development | 70 | 62 | 140 | 131 | |||||||||||||||||

| Communications | 62 | 59 | 122 | 117 | |||||||||||||||||

| Depreciation and amortization | 57 | 55 | 113 | 109 | |||||||||||||||||

| Other | 91 | 86 | 174 | 169 | |||||||||||||||||

| Total expenses excluding interest | 1,108 | 999 | 2,217 | 2,041 | |||||||||||||||||

| Income before taxes on income | 720 | 567 | 1,375 | 1,051 | |||||||||||||||||

| Taxes on income | 268 | 214 | 511 | 396 | |||||||||||||||||

| Net Income | 452 | 353 | 864 | 655 | |||||||||||||||||

| Preferred stock dividends and other (2) | 46 | 23 | 66 | 34 | |||||||||||||||||

| Net Income Available to Common Stockholders | $ | 406 | $ | 330 | $ | 798 | $ | 621 | |||||||||||||

| Weighted-Average Common Shares Outstanding: | |||||||||||||||||||||

| Basic | 1,322 | 1,314 | 1,322 | 1,313 | |||||||||||||||||

| Diluted | 1,333 | 1,326 | 1,331 | 1,325 | |||||||||||||||||

| Earnings Per Common Share: | |||||||||||||||||||||

| Basic | $ | .31 | $ | .25 | $ | .60 | $ | .47 | |||||||||||||

| Diluted | $ | .30 | $ | .25 | $ | .60 | $ | .47 | |||||||||||||

| Dividends Declared Per Common Share | $ | .07 | $ | .06 | $ | .13 | $ | .12 | |||||||||||||

| (1) | Includes fee waivers of $55 and $168 during the second quarters of 2016 and 2015, respectively, and $152 and $353 during the first halves of 2016 and 2015, respectively, relating to Schwab-sponsored money market funds. | |

| (2) | Includes preferred stock dividends and undistributed earnings and dividends allocated to non-vested restricted stock units. | |

|

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||||

|

Financial and Operating Highlights |

|||||||||||||||||||||||||||||||||||||

|

(Unaudited) |

|||||||||||||||||||||||||||||||||||||

|

Q2-16 % change |

2016 | 2015 | |||||||||||||||||||||||||||||||||||

| vs. | vs. | Second | First | Fourth | Third | Second | |||||||||||||||||||||||||||||||

| (In millions, except per share amounts and as noted) | Q2-15 | Q1-16 | Quarter | Quarter | Quarter | Quarter | Quarter | ||||||||||||||||||||||||||||||

| Net Revenues | |||||||||||||||||||||||||||||||||||||

| Asset management and administration fees | 13 | % | 8 | % | $ | 757 | $ | 699 | $ | 673 | $ | 663 | $ | 670 | |||||||||||||||||||||||

| Net interest revenue | 30 | % | 3 | % | 798 | 772 | 690 | 635 | 612 | ||||||||||||||||||||||||||||

| Trading revenue | (1 | %) | (13 | %) | 201 | 232 | 208 | 228 | 203 | ||||||||||||||||||||||||||||

| Other | (11 | %) | 11 | % | 70 | 63 | 120 | 66 | 79 | ||||||||||||||||||||||||||||

| Provision for loan losses | - |

N/M |

2 | (2 | ) | - | 5 | 2 | |||||||||||||||||||||||||||||

| Total net revenues | 17 | % | 4 | % | 1,828 | 1,764 | 1,691 | 1,597 | 1,566 | ||||||||||||||||||||||||||||

| Expenses Excluding Interest | |||||||||||||||||||||||||||||||||||||

| Compensation and benefits | 11 | % | (4 | %) | 602 | 626 | 572 | 548 | 540 | ||||||||||||||||||||||||||||

| Professional services | 12 | % | 8 | % | 125 | 116 | 119 | 114 | 112 | ||||||||||||||||||||||||||||

| Occupancy and equipment | 19 | % | 3 | % | 101 | 98 | 93 | 92 | 85 | ||||||||||||||||||||||||||||

| Advertising and market development | 13 | % | - | 70 | 70 | 60 | 58 | 62 | |||||||||||||||||||||||||||||

| Communications | 5 | % | 3 | % | 62 | 60 | 58 | 58 | 59 | ||||||||||||||||||||||||||||

| Depreciation and amortization | 4 | % | 2 | % | 57 | 56 | 58 | 57 | 55 | ||||||||||||||||||||||||||||

| Other | 6 | % | 10 | % | 91 | 83 | 86 | 87 | 86 | ||||||||||||||||||||||||||||

| Total expenses excluding interest | 11 | % | - | 1,108 | 1,109 | 1,046 | 1,014 | 999 | |||||||||||||||||||||||||||||

| Income before taxes on income | 27 | % | 10 | % | 720 | 655 | 645 | 583 | 567 | ||||||||||||||||||||||||||||

| Taxes on income | 25 | % | 10 | % | 268 | 243 | 229 | 207 | 214 | ||||||||||||||||||||||||||||

| Net Income | 28 | % | 10 | % | $ | 452 | $ | 412 | $ | 416 | $ | 376 | $ | 353 | |||||||||||||||||||||||

| Preferred stock dividends and other | 100 | % | 130 | % | 46 | 20 | 38 | 11 | 23 | ||||||||||||||||||||||||||||

| Net Income Available to Common Stockholders | 23 | % | 4 | % | $ | 406 | $ | 392 | $ | 378 | $ | 365 | $ | 330 | |||||||||||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||||||||||||||||

| Basic | 24 | % | 3 | % | $ | .31 | $ | .30 | $ | .29 | $ | .28 | $ | .25 | |||||||||||||||||||||||

| Diluted | 20 | % | 3 | % | $ | .30 | $ | .29 | $ | .28 | $ | .28 | $ | .25 | |||||||||||||||||||||||

| Dividends declared per common share | 17 | % | 17 | % | $ | .07 | $ | .06 | $ | .06 | $ | .06 | $ | .06 | |||||||||||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||||||||||||||||

| Basic | 1 | % | - | 1,322 | 1,321 | 1,319 | 1,316 | 1,314 | |||||||||||||||||||||||||||||

| Diluted | 1 | % | - | 1,333 | 1,330 | 1,330 | 1,328 | 1,326 | |||||||||||||||||||||||||||||

| Performance Measures | |||||||||||||||||||||||||||||||||||||

| Pre-tax profit margin | 39.4 | % | 37.1 | % | 38.1 | % | 36.5 | % | 36.2 | % | |||||||||||||||||||||||||||

| Return on average common stockholders’ equity (annualized) (1) | 13 | % | 13 | % | 13 | % | 13 | % | 12 | % | |||||||||||||||||||||||||||

| Financial Condition (at quarter end, in billions) | |||||||||||||||||||||||||||||||||||||

| Cash and investments segregated | 4 | % | (8 | %) | $ | 18.6 | $ | 20.3 | $ | 19.6 | $ | 17.2 | $ | 17.9 | |||||||||||||||||||||||

| Receivables from brokerage clients - net | 1 | % | 5 | % | 16.8 | 16.0 | 17.3 | 17.1 | 16.6 | ||||||||||||||||||||||||||||

| Bank loans - net | 5 | % | 2 | % | 14.7 | 14.4 | 14.3 | 14.3 | 14.0 | ||||||||||||||||||||||||||||

| Total assets | 21 | % | 4 | % | 198.1 | 191.0 | 183.7 | 170.4 | 163.6 | ||||||||||||||||||||||||||||

| Bank deposits | 22 | % | 1 | % | 137.3 | 135.7 | 129.5 | 119.0 | 112.9 | ||||||||||||||||||||||||||||

| Payables to brokerage clients | 4 | % | 1 | % | 32.7 | 32.3 | 33.2 | 31.0 | 31.5 | ||||||||||||||||||||||||||||

| Short-term borrowings |

N/M |

N/M |

5.0 | .8 | - | - | - | ||||||||||||||||||||||||||||||

| Long-term debt | - | - | 2.9 | 2.9 | 2.9 | 2.9 | 2.9 | ||||||||||||||||||||||||||||||

| Stockholders’ equity | 21 | % | 3 | % | 15.0 | 14.5 | 13.4 | 13.2 | 12.4 | ||||||||||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||||||||||

| Full-time equivalent employees (at quarter end, in thousands) | 8 | % | 3 | % | 16.1 | 15.6 | 15.3 | 15.4 | 14.9 | ||||||||||||||||||||||||||||

|

Capital expenditures - purchases of equipment, office facilities, and property, net (in millions) |

70 | % | 115 | % | $ | 131 | $ | 61 | $ | 67 | $ | 80 | $ | 77 | |||||||||||||||||||||||

|

Expenses excluding interest as a percentage of average client assets (annualized) |

0.17 | % | 0.18 | % | 0.16 | % | 0.16 | % | 0.16 | % | |||||||||||||||||||||||||||

| Clients’ Daily Average Trades (in thousands) | |||||||||||||||||||||||||||||||||||||

| Revenue trades (2) | 4 | % | (15 | %) | 279 | 328 | 285 | 304 | 267 | ||||||||||||||||||||||||||||

| Asset-based trades (3) | 15 | % | (11 | %) | 90 | 101 | 84 | 84 | 78 | ||||||||||||||||||||||||||||

| Other trades (4) | - | (20 | %) | 149 | 187 | 168 | 149 | 149 | |||||||||||||||||||||||||||||

| Total | 5 | % | (16 | %) | 518 | 616 | 537 | 537 | 494 | ||||||||||||||||||||||||||||

|

Average Revenue Per Revenue Trade (2) |

(6 | %) | (1 | %) | $ | 11.27 | $ | 11.44 | $ | 11.73 | $ | 11.67 | $ | 11.97 | |||||||||||||||||||||||

| (1) | Return on average common stockholders’ equity is calculated using net income available to common stockholders divided by average common stockholders’ equity. | |

| (2) | Includes all client trades that generate trading revenue (i.e., commission revenue or principal transaction revenue); also known as DART. | |

| (3) | Includes eligible trades executed by clients who participate in one or more of the Company’s asset-based pricing relationships. | |

| (4) | Includes all commission-free trades, including Schwab Mutual Fund OneSource® funds and ETFs, and other proprietary products. | |

|

N/M Not meaningful. |

||

|

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Interest Revenue Information | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(In millions) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(Unaudited) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||||||||||||||||

| Average | Revenue/ | Yield/ | Average | Revenue/ | Yield/ | Average | Revenue/ | Yield/ | Average | Revenue/ | Yield/ | ||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 10,888 | $ | 14 | 0.52 | % | $ | 8,540 | $ | 6 | 0.28 | % | $ | 10,820 | $ | 27 | 0.50 | % | $ | 8,959 | $ | 11 | 0.25 | % | |||||||||||||||||||||||||||||

| Cash and investments segregated | 19,155 | 22 | 0.46 | % | 18,265 | 7 | 0.15 | % | 19,710 | 41 | 0.42 | % | 18,884 | 13 | 0.14 | % | |||||||||||||||||||||||||||||||||||||

| Broker-related receivables (1) | 685 | - | 0.20 | % | 261 | - | 0.02 | % | 535 | - | 0.15 | % | 271 | - | 0.06 | % | |||||||||||||||||||||||||||||||||||||

| Receivables from brokerage clients | 15,027 | 124 | 3.32 | % | 15,105 | 125 | 3.32 | % | 14,959 | 249 | 3.35 | % | 14,763 | 244 | 3.33 | % | |||||||||||||||||||||||||||||||||||||

| Securities available for sale (2) | 71,431 | 211 | 1.19 | % | 61,194 | 153 | 1.00 | % | 69,797 | 409 | 1.18 | % | 59,315 | 295 | 1.00 | % | |||||||||||||||||||||||||||||||||||||

| Securities held to maturity | 53,404 | 335 | 2.52 | % | 36,458 | 227 | 2.50 | % | 51,830 | 657 | 2.55 | % | 35,673 | 445 | 2.52 | % | |||||||||||||||||||||||||||||||||||||

| Bank loans | 14,569 | 98 | 2.71 | % | 13,866 | 91 | 2.63 | % | 14,487 | 197 | 2.73 | % | 13,701 | 181 | 2.66 | % | |||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 185,159 | 804 | 1.75 | % | 153,689 | 609 | 1.59 | % | 182,138 | 1,580 | 1.74 | % | 151,566 | 1,189 | 1.58 | % | |||||||||||||||||||||||||||||||||||||

| Other interest revenue | 36 | 36 | 70 | 73 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 185,159 | $ | 840 | 1.82 | % | $ | 153,689 | $ | 645 | 1.68 | % | $ | 182,138 | $ | 1,650 | 1.82 | % | $ | 151,566 | $ | 1,262 | 1.68 | % | |||||||||||||||||||||||||||||

|

Funding sources: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank deposits | $ | 136,009 | $ | 8 | 0.02 | % | $ | 110,159 | $ | 6 | 0.02 | % | $ | 133,814 | $ | 16 | 0.02 | % | $ | 108,008 | $ | 14 | 0.03 | % | |||||||||||||||||||||||||||||

| Payables to brokerage clients (1) | 25,302 | 1 | 0.01 | % | 25,138 | - | 0.01 | % | 26,015 | 1 | 0.01 | % | 25,602 | 1 | 0.01 | % | |||||||||||||||||||||||||||||||||||||

| Short-term borrowings (1,4) | 2,038 | 2 | 0.39 | % | 24 | - | 0.15 | % | 1,029 | 2 | 0.39 | % | 16 | - | 0.15 | % | |||||||||||||||||||||||||||||||||||||

| Long-term debt (5) | 2,876 | 26 | 3.64 | % | 2,889 | 24 | 3.33 | % | 2,877 | 52 | 3.63 | % | 2,517 | 43 | 3.45 | % | |||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities (5) | 166,225 | 37 | 0.09 | % | 138,210 | 30 | 0.09 | % | 163,735 | 71 | 0.09 | % | 136,143 | 58 | 0.09 | % | |||||||||||||||||||||||||||||||||||||

| Non-interest-bearing funding sources (4) | 18,934 | 15,479 | 18,403 | 15,423 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other interest expense (3) | 5 | 3 | 9 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding sources | $ | 185,159 | $ | 42 | 0.09 | % | $ | 153,689 | $ | 33 | 0.08 | % | $ | 182,138 | $ | 80 | 0.09 | % | $ | 151,566 | $ | 62 | 0.08 | % | |||||||||||||||||||||||||||||

| Net interest revenue | $ | 798 | 1.73 | % | $ | 612 | 1.60 | % | $ | 1,570 | 1.73 | % | $ | 1,200 | 1.60 | % | |||||||||||||||||||||||||||||||||||||

| (1) | Interest revenue or expense was less than $500,000 in the period or periods presented. | |

| (2) | Amounts have been calculated based on amortized cost. | |

| (3) | Includes the impact of capitalizing interest on building construction and software development. | |

| (4) | Certain prior-period amounts have been reclassified to conform to the 2016 presentation. | |

| (5) |

Adjusted for the retrospective adoption of Accounting Standards Update 2015-03, which decreased long-term debt and total interest-bearing liabilities by an immaterial amount. |

|

|

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Asset Management and Administration Fees Information |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(In millions) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(Unaudited) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Average | Average | Average | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Client | Average | Client | Average | Client | Average | Client | Average | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | Revenue | Fee | Assets | Revenue | Fee | Assets | Revenue | Fee | Assets | Revenue | Fee | ||||||||||||||||||||||||||||||||||||||||||||||

| Schwab money market funds before fee waivers | $ | 163,929 | $ | 239 | 0.59 | % | $ | 157,418 | $ | 230 | 0.59 | % | $ | 166,184 | $ | 485 | 0.59 | % | $ | 161,411 | $ | 469 | 0.59 | % | |||||||||||||||||||||||||||||||||

| Fee waivers | (55 | ) | (168 | ) | (152 | ) | (353 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Schwab money market funds | 163,929 | 184 | 0.45 | % | 157,418 | 62 | 0.16 | % | 166,184 | 333 | 0.40 | % | 161,411 | 116 | 0.14 | % | |||||||||||||||||||||||||||||||||||||||||

| Schwab equity and bond funds and ETFs | 112,814 | 52 | 0.19 | % | 103,986 | 56 | 0.22 | % | 108,103 | 103 | 0.19 | % | 100,556 | 108 | 0.22 | % | |||||||||||||||||||||||||||||||||||||||||

| Mutual Fund OneSource ® | 201,034 | 169 | 0.34 | % | 235,433 | 199 | 0.34 | % | 197,839 | 333 | 0.34 | % | 234,342 | 395 | 0.34 | % | |||||||||||||||||||||||||||||||||||||||||

| Other third-party mutual funds and ETFs (1) | 252,405 | 56 | 0.09 | % | 257,516 | 58 | 0.09 | % | 244,820 | 107 | 0.09 | % | 253,031 | 114 | 0.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Total mutual funds and ETFs (2) | $ | 730,182 | 461 | 0.25 | % | $ | 754,353 | 375 | 0.20 | % | $ | 716,946 | 876 | 0.25 | % | $ | 749,340 | 733 | 0.20 | % | |||||||||||||||||||||||||||||||||||||

| Advice solutions (2) : | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fee-based | $ | 175,973 | 226 | 0.52 | % | $ | 174,657 | 228 | 0.52 | % | $ | 171,146 | 441 | 0.52 | % | $ | 172,405 | 448 | 0.52 | % | |||||||||||||||||||||||||||||||||||||

| Intelligent Portfolios | 6,620 | - | - | 2,159 | - | - | 5,868 | - | - | 1,725 | - | - | |||||||||||||||||||||||||||||||||||||||||||||

| Legacy Non-Fee | 17,015 | N/A | N/A | 16,783 | N/A | N/A | 16,712 | N/A | N/A | 16,815 | N/A | N/A | |||||||||||||||||||||||||||||||||||||||||||||

| Total advice solutions | $ | 199,608 | 226 | 0.46 | % | $ | 193,599 | 228 | 0.47 | % | $ | 193,726 | 441 | 0.46 | % | $ | 190,945 | 448 | 0.47 | % | |||||||||||||||||||||||||||||||||||||

| Other balance-based fees (3) | 338,529 | 58 | 0.07 | % | 327,569 | 57 | 0.07 | % | 328,278 | 114 | 0.07 | % | 320,699 | 112 | 0.07 | % | |||||||||||||||||||||||||||||||||||||||||

| Other (4) | 12 | 10 | 25 | 21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total asset management and administration fees | $ | 757 | $ | 670 | $ | 1,456 | $ | 1,314 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

Note: Beginning in the fourth quarter of 2015, certain changes have been made to the above categorizations of both balances and revenues in order to provide improved insight into asset management and administration fee drivers. Prior period information has been recast to reflect these changes. |

||

| (1) | Includes ETF OneSource. | |

| (2) | Advice solutions include managed portfolios, specialized strategies and customized investment advice. Fee-based advice solutions include Schwab Private Client, Schwab Managed Portfolios, Managed Account Select®, Schwab Advisor Network®, Windhaven® Strategies, ThomasPartners® Dividend Growth Strategy, and Schwab Index Advantage® advised retirement plan balances. Intelligent Portfolios include Schwab Intelligent Portfolios, launched in March 2015, and Institutional Intelligent Portfolios, launched in June 2015. Legacy Non-Fee advice solutions include superseded programs such as Schwab Advisor Source and certain retirement plan balances. Average client assets for advice solutions may also include the asset balances contained in the mutual fund and/or ETF categories listed above. | |

| (3) | Includes various asset-based fees, such as trust fees, 401(k) recordkeeping fees, and mutual fund clearing fees and other service fees. | |

| (4) | Includes miscellaneous service and transaction fees relating to mutual funds and ETFs that are not balance-based. | |

|

N/A Not applicable. |

||

|

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||

| Growth in Client Assets and Accounts | |||||||||||||||||||||||||||||||||||

|

(Unaudited) |

|||||||||||||||||||||||||||||||||||

|

Q2-16 % Change |

2016 | 2015 | |||||||||||||||||||||||||||||||||

| vs. | vs. | Second | First | Fourth | Third | Second | |||||||||||||||||||||||||||||

|

(In billions, at quarter end, except as noted) |

Q2-15 | Q1-16 | Quarter | Quarter | Quarter | Quarter | Quarter | ||||||||||||||||||||||||||||

| Assets in client accounts | |||||||||||||||||||||||||||||||||||

| Schwab One®, certain cash equivalents and bank deposits | 18 | % | 1 | % | $ | 168.4 | $ | 166.4 | $ | 161.1 | $ | 148.7 | $ | 143.0 | |||||||||||||||||||||

|

Proprietary mutual funds (Schwab Funds® and Laudus Funds®): |

|||||||||||||||||||||||||||||||||||

| Money market funds | 3 | % | (4 | %) | 161.0 | 167.4 | 166.1 | 161.8 | 155.6 | ||||||||||||||||||||||||||

| Equity and bond funds | (2 | %) | 1 | % | 62.8 | 62.1 | 62.4 | 59.3 | 64.1 | ||||||||||||||||||||||||||

| Total proprietary mutual funds | 2 | % | (2 | %) | 223.8 | 229.5 | 228.5 | 221.1 | 219.7 | ||||||||||||||||||||||||||

| Mutual Fund Marketplace® (1) | |||||||||||||||||||||||||||||||||||

| Mutual Fund OneSource® (2) | (12 | %) | - | 203.4 | 203.8 | 207.7 | 210.7 | 231.2 | |||||||||||||||||||||||||||

| Mutual fund clearing services | 2 | % | 3 | % | 192.0 | 186.3 | 186.5 | 177.8 | 188.9 | ||||||||||||||||||||||||||

| Other third-party mutual funds (2) | 2 | % | 4 | % | 529.7 | 510.7 | 496.4 | 490.4 | 519.4 | ||||||||||||||||||||||||||

| Total Mutual Fund Marketplace | (2 | %) | 3 | % | 925.1 | 900.8 | 890.6 | 878.9 | 939.5 | ||||||||||||||||||||||||||

|

Total mutual fund assets |

(1 | %) | 2 | % | 1,148.9 | 1,130.3 | 1,119.1 | 1,100.0 | 1,159.2 | ||||||||||||||||||||||||||

| Exchange-traded funds (ETFs) | |||||||||||||||||||||||||||||||||||

| Proprietary ETFs (3) | 40 | % | 12 | % | 47.9 | 42.9 | 39.7 | 34.2 | 34.3 | ||||||||||||||||||||||||||

| ETF OneSource™ (1) | 15 | % | 9 | % | 19.0 | 17.5 | 16.1 | 15.4 | 16.5 | ||||||||||||||||||||||||||

| Other third-party ETFs | 6 | % | 4 | % | 220.5 | 211.5 | 207.4 | 194.6 | 207.4 | ||||||||||||||||||||||||||

| Total ETF assets | 11 | % | 6 | % | 287.4 | 271.9 | 263.2 | 244.2 | 258.2 | ||||||||||||||||||||||||||

| Equity and other securities (2) | 2 | % | 3 | % | 830.7 | 808.5 | 799.0 | 755.3 | 817.1 | ||||||||||||||||||||||||||

| Fixed income securities | 12 | % | 4 | % | 202.0 | 194.1 | 187.2 | 183.6 | 181.1 | ||||||||||||||||||||||||||

| Margin loans outstanding | 1 | % | 6 | % | (15.4 | ) | (14.5 | ) | (15.8 | ) | (15.9 | ) | (15.3 | ) | |||||||||||||||||||||

| Total client assets | 3 | % | 3 | % | $ | 2,622.0 | $ | 2,556.7 | $ | 2,513.8 | $ | 2,415.9 | $ | 2,543.3 | |||||||||||||||||||||

| Client assets by business (4) | |||||||||||||||||||||||||||||||||||

| Investor Services | 3 | % | 3 | % | $ | 1,415.5 | $ | 1,377.3 | $ | 1,358.6 | $ | 1,306.2 | $ | 1,380.8 | |||||||||||||||||||||

| Advisor Services | 4 | % | 2 | % | 1,206.5 | 1,179.4 | 1,155.2 | 1,109.7 | 1,162.5 | ||||||||||||||||||||||||||

| Total client assets | 3 | % | 3 | % | $ | 2,622.0 | $ | 2,556.7 | $ | 2,513.8 | $ | 2,415.9 | $ | 2,543.3 | |||||||||||||||||||||

| Net growth (decline) in assets in client accounts (for the quarter ended) | |||||||||||||||||||||||||||||||||||

| Net new assets by business (4) | |||||||||||||||||||||||||||||||||||

| Investor Services (5) | (44 | %) | (6 | %) | $ | 14.8 | $ | 15.7 | $ | 21.6 | $ | 13.3 | $ | 26.5 | |||||||||||||||||||||

| Advisor Services | 12 | % | (28 | %) | 11.8 | 16.3 | 21.3 | 17.5 | 10.5 | ||||||||||||||||||||||||||

| Total net new assets | (28 | %) | (17 | %) | $ | 26.6 | $ | 32.0 | $ | 42.9 | $ | 30.8 | $ | 37.0 | |||||||||||||||||||||

| Net market gains (losses) |

N/M |

N/M |

38.7 | 10.9 | 55.0 | (158.2 | ) | (18.1 | ) | ||||||||||||||||||||||||||

| Net growth (decline) |

N/M |

52 | % | $ | 65.3 | $ | 42.9 | $ | 97.9 | $ | (127.4 | ) | $ | 18.9 | |||||||||||||||||||||

| New brokerage accounts (in thousands, for the quarter ended) | (3 | %) | 2 | % | 271 | 265 | 262 | 254 | 280 | ||||||||||||||||||||||||||

| Clients (in thousands) | |||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts | 4 | % | 1 | % | 9,977 | 9,869 | 9,769 | 9,691 | 9,605 | ||||||||||||||||||||||||||

| Banking Accounts | 6 | % | 2 | % | 1,065 | 1,047 | 1,033 | 1,027 | 1,004 | ||||||||||||||||||||||||||

| Corporate Retirement Plan Participants | 5 | % | 1 | % | 1,553 | 1,532 | 1,519 | 1,492 | 1,474 | ||||||||||||||||||||||||||

| (1) | Excludes all proprietary mutual funds and ETFs. | |

| (2) | In 2015, certain Mutual Fund OneSource balances were reclassified to Other third-party mutual funds and Equity and other securities. Prior period information has been recast to reflect these changes. | |

| (3) | Includes proprietary ETFs held on and off the Schwab platform. | |

| (4) |

In the fourth quarter of 2015, the Company realigned its reportable segments as a result of organizational changes. The Corporate Brokerage Retirement Services business was transferred from the Investor Services segment to the Advisor Services segment. Prior period segment information has been recast to reflect this change. |

|

| (5) | Second quarter of 2016 includes an inflow of $2.7 billion from a mutual fund clearing services client. Fourth quarter, third quarter and second quarter of 2015 include inflows of $10.2 billion, $4.9 billion and $17.4 billion, respectively, from certain mutual fund clearing services clients. | |

|

N/M Not meaningful. |

||

|

The Charles Schwab Corporation Monthly Activity Report For June 2016 |

|||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 2016 |

Change |

|||||||||||||||||||||||||||||||||||||||||||||

|

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Mo. |

Yr. |

|||||||||||||||||||||||||||||||||

|

Market Indices |

|||||||||||||||||||||||||||||||||||||||||||||||

| (at month end) | |||||||||||||||||||||||||||||||||||||||||||||||

| Dow Jones Industrial Average | 17,620 | 17,690 | 16,528 | 16,285 | 17,664 | 17,720 | 17,425 | 16,466 | 16,517 | 17,685 | 17,774 | 17,787 | 17,930 | 1% | 2% | ||||||||||||||||||||||||||||||||

| Nasdaq Composite | 4,987 | 5,128 | 4,777 | 4,620 | 5,054 | 5,109 | 5,007 | 4,614 | 4,558 | 4,870 | 4,775 | 4,948 | 4,843 | (2%) | (3%) | ||||||||||||||||||||||||||||||||

| Standard & Poor’s 500 | 2,063 | 2,104 | 1,972 | 1,920 | 2,079 | 2,080 | 2,044 | 1,940 | 1,932 | 2,060 | 2,065 | 2,097 | 2,099 | - | 2% | ||||||||||||||||||||||||||||||||

| Client Assets | |||||||||||||||||||||||||||||||||||||||||||||||

| (in billions of dollars) | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning Client Assets | 2,568.8 | 2,543.3 | 2,562.5 | 2,462.4 | 2,415.9 | 2,539.9 | 2,553.3 | 2,513.8 | 2,428.3 | 2,433.6 | 2,556.7 | 2,576.2 | 2,607.2 | ||||||||||||||||||||||||||||||||||

| Net New Assets (1) | 17.8 | 9.8 | 9.2 | 11.8 | 10.5 | 17.2 | 15.2 | 8.1 | 10.9 | 13.0 | 1.3 | 16.0 | 9.3 | (42%) | (48%) | ||||||||||||||||||||||||||||||||

| Net Market (Losses) Gains | (43.3) | 9.4 | (109.3) | (58.3) | 113.5 | (3.8) | (54.7) | (93.6) | (5.6) | 110.1 | 18.2 | 15.0 | 5.5 | ||||||||||||||||||||||||||||||||||

| Total Client Assets (at month end) | 2,543.3 | 2,562.5 | 2,462.4 | 2,415.9 | 2,539.9 | 2,553.3 | 2,513.8 | 2,428.3 | 2,433.6 | 2,556.7 | 2,576.2 | 2,607.2 | 2,622.0 | 1% | 3% | ||||||||||||||||||||||||||||||||

| Receiving Ongoing Advisory Services | |||||||||||||||||||||||||||||||||||||||||||||||

| (at month end) | |||||||||||||||||||||||||||||||||||||||||||||||

| Investor Services | 191.4 | 193.3 | 187.2 | 184.9 | 193.3 | 194.5 | 192.6 | 187.3 | 187.9 | 197.9 | 200.3 | 202.7 | 205.0 | 1% | 7% | ||||||||||||||||||||||||||||||||

| Advisor Services (2) | 1,066.7 | 1,079.0 | 1,039.5 | 1,019.9 | 1,072.4 | 1,075.6 | 1,061.1 | 1,029.9 | 1,032.3 | 1,084.0 | 1,093.2 | 1,103.7 | 1,110.5 | 1% | 4% | ||||||||||||||||||||||||||||||||

| Client Accounts | |||||||||||||||||||||||||||||||||||||||||||||||

| (at month end, in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

| Active Brokerage Accounts | 9,605 | 9,631 | 9,671 | 9,691 | 9,712 | 9,731 | 9,769 | 9,792 | 9,826 | 9,869 | 9,916 | 9,948 | 9,977 | - | 4% | ||||||||||||||||||||||||||||||||

| Banking Accounts | 1,004 | 1,011 | 1,021 | 1,027 | 1,029 | 1,033 | 1,033 | 1,039 | 1,045 | 1,047 | 1,053 | 1,060 | 1,065 | - | 6% | ||||||||||||||||||||||||||||||||

| Corporate Retirement Plan Participants | 1,474 | 1,483 | 1,488 | 1,492 | 1,502 | 1,514 | 1,519 | 1,518 | 1,523 | 1,532 | 1,532 | 1,555 | 1,553 | - | 5% | ||||||||||||||||||||||||||||||||

| Client Activity | |||||||||||||||||||||||||||||||||||||||||||||||

| New Brokerage Accounts (in thousands) | 89 | 87 | 87 | 80 | 88 | 76 | 98 | 83 | 84 | 98 | 103 | 81 | 87 | 7% | (2%) | ||||||||||||||||||||||||||||||||

| Inbound Calls (in thousands) | 1,763 | 1,788 | 1,807 | 1,631 | 1,716 | 1,554 | 1,844 | 1,736 | 1,737 | 1,902 | 1,867 | 1,554 | 1,665 | 7% | (6%) | ||||||||||||||||||||||||||||||||

| Web Logins (in thousands) | 31,644 | 33,498 | 34,167 | 29,550 | 33,574 | 30,488 | 32,156 | 33,268 | 33,283 | 38,078 | 37,854 | 38,000 | 43,220 | 14% | 37% | ||||||||||||||||||||||||||||||||

| Client Cash as a Percentage of Client Assets (3) | 11.7% | 11.8% | 12.6% | 12.9% | 12.3% | 12.3% | 13.0% | 13.7% | 13.7% | 13.1% | 12.8% | 12.7% | 12.6% |

(10) bp |

90 bp | ||||||||||||||||||||||||||||||||

| Mutual Fund and Exchange-Traded Fund | |||||||||||||||||||||||||||||||||||||||||||||||

| Net Buys (Sells) (4, 5) | |||||||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||||||

| Large Capitalization Stock | (804) | (702) | (664) | (608) | (214) | 637 | 451 | (162) | (212) | (462) | (857) | (799) | 185 | ||||||||||||||||||||||||||||||||||

| Small / Mid Capitalization Stock | 78 | 149 | (540) | (108) | 17 | (2) | (572) | (952) | 58 | 685 | (86) | (272) | (113) | ||||||||||||||||||||||||||||||||||

| International | 2,255 | 947 | (266) | (560) | 72 | 427 | (918) | 469 | (28) | 833 | 324 | (207) | (1,208) | ||||||||||||||||||||||||||||||||||

| Specialized | 8 | 410 | (390) | (643) | 667 | 744 | (495) | (668) | 260 | 191 | 815 | 265 | 470 | ||||||||||||||||||||||||||||||||||

| Hybrid | (133) | (152) | (1,144) | (726) | (110) | (410) | (1,361) | (377) | 38 | 281 | 14 | 1,133 | (403) | ||||||||||||||||||||||||||||||||||

| Taxable Bond | 421 | (111) | (634) | (91) | 628 | (1,250) | (4,020) | 99 | 546 | 1,628 | 1,098 | 1,526 | 1,421 | ||||||||||||||||||||||||||||||||||

| Tax-Free Bond | (132) | 156 | 111 | 35 | 494 | 260 | 731 | 379 | 641 | 949 | 479 | 940 | 700 | ||||||||||||||||||||||||||||||||||

| Net Buy (Sell) Activity | |||||||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | |||||||||||||||||||||||||||||||||||||||||||||||

| Mutual Funds (4) | (725) | (1,101) | (4,712) | (4,336) | (910) | (3,602) | (10,988) | (1,215) | 197 | 1,769 | (207) | 620 | (2,049) | ||||||||||||||||||||||||||||||||||

| Exchange-Traded Funds (5) | 2,418 | 1,798 | 1,185 | 1,635 | 2,464 | 4,008 | 4,804 | 3 | 1,106 | 2,336 | 1,994 | 1,966 | 3,101 | ||||||||||||||||||||||||||||||||||

| Money Market Funds | (358) | 2,208 | 4,730 | (717) | (451) | 251 | 4,538 | 1,994 | 1,359 | (2,101) | (3,959) | (738) | (1,799) | ||||||||||||||||||||||||||||||||||

| Average Interest-Earning Assets (6) | |||||||||||||||||||||||||||||||||||||||||||||||

| (in millions of dollars) | 155,369 | 158,238 | 160,638 | 162,639 | 165,351 | 167,388 | 172,334 | 177,332 | 178,610 | 181,529 | 183,341 | 184,432 | 187,933 | 2% | 21% | ||||||||||||||||||||||||||||||||

| (1) | May 2016 includes an inflow of $2.7 billion from a mutual fund clearing services client. November, September and June 2015 include inflows of $10.2 billion, $4.9 billion and $8.1 billion, respectively, from certain mutual fund clearing services clients. | |

| (2) | Excludes Retirement Business Services Trust and Corporate Brokerage Retirement Services. | |

| (3) | Schwab One®, certain cash equivalents, bank deposits and money market fund balances as a percentage of total client assets. | |

| (4) | Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. | |

| (5) | Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. | |

| (6) | Represents total interest-earning assets on the Company’s balance sheet. |