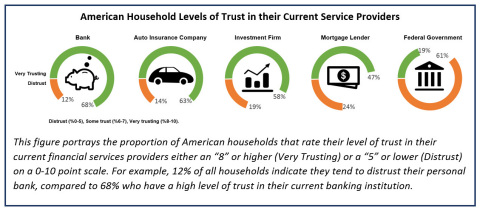

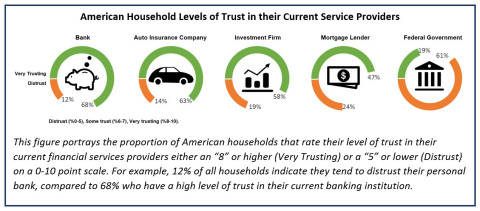

LIVONIA, Mich.--(BUSINESS WIRE)--Based on a recent Market Strategies International study, 31 percent of American households feel obliged to do business with one or more financial services companies they distrust. Market Strategies’ national omnibus study explored trust in a variety of financial services product categories, including banking, credit cards, home mortgage, investment services, auto, home and life insurance. The proportion of customers who distrust their current provider varies by category, with only 12 percent of customers indicating they distrust their bank, compared to 24 percent of all homeowners who distrust their mortgage lender. As a frame of reference, 61 percent of Americans indicate they generally distrust the federal government. Yet while many may feel they have little ability to choose or change the US government’s direction, this is not the case when it comes to choosing or making changes in personal finances and insurance: Most households are presented with more choices today than ever before.

“The fact that so many consumers are working with a financial services institution they don’t trust has significant financial implications,” said Jeremy Bowler, senior vice president of Financial Services at Market Strategies. “It creates greater opportunity for disruptive change, and with financial technology solutions rapidly emerging, this is a pool of consumers who are ripe for the picking.”

For the personal insurance industry, the very product is a promise—to help restore your car or home in the event of an accident or loss. Since the average American household only files an auto insurance claim once every seven years—and a homeowner’s claim once every 10-15 years—many have never had the experience of filing a claim with their current insurer. So while the level of trust consumers feel toward their personal insurance providers may be stronger than that for a mortgage lender, the insurance industry has reason to be concerned at the proportion of policyholders who distrust that their carrier will live up to its promises.

Customers who don’t trust their service providers represent a significant risk to the profitability of those businesses. Survey results reveal the overwhelming majority of distrusters are significantly more likely to dissuade friends and colleagues from doing business with a company they use. This is critical because personal recommendations are one of the most trusted information sources cited by consumers when shopping for a new bank, insurer or investment firm.

When it comes to trust, we see significant variation by age. On average, consumers over age 55 tend to be more trusting of their financial services providers than customers under age 35. For a financial services firm, correctly identifying those customers who lack trust in their brand or service representatives can often be challenging. For instance, it’s not accurate to say all Millennials are distrusting. Indeed, the data show that 69 percent of Millennials say they trust all of their financial services providers.

However, a number of factors can influence a customer’s level of trust; among these are service consistency and quality. Customer-perceived service failures are often likely to seed distrust, such as a mortgage servicer’s year-end escrow statement, which often causes client confusion, or an auto insurance company that never communicates with its clients except to send a bill or renewal notice.

“Among auto insurance customers, those who recall receiving even just one non-bill related communication are, on average, 12 percentage points more likely to be very trusting than those recalling no such interaction with their carrier,” added Bowler. “A similar pattern exists for banking, life insurance, mortgage lending, credit cards and even investment firms. Meeting expectations is just part of the trust equation. Consistency is the true catalyst; few people are going to buy a car, wristwatch or door lock that only meets expectations most of the time.”

In addition to financial service products, Market Strategies also explored trust levels among consumers for numerous services outside of the financial category (healthcare, electric utility, religious institutions, courts, police, federal government, neighbors and strangers) to provide a broad perspective on trust among American households in companies, individuals and institutions they deal with every day. Contact Jeremy Bowler to learn how to better understand customer differences and perceptions so your brand can build long-term, trusting relationships.

About this Study

Market Strategies interviewed a national sample of 1,056 consumers age 18 and older between April 27th and April 30th, 2016. Respondents were recruited from the E-rewards opt-in online panel of US adults and were interviewed online. In order to qualify, each survey respondent had to confirm they have either primary or shared responsibility for making household financial decisions. The data were weighted by age and gender to match the demographics of the US population. Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Market Strategies will supply the exact wording of any survey question upon request.

About Market Strategies International

Market Strategies International is a market research consultancy with deep expertise in financial services with practice areas serving wealth, banking, payments and insurance. We blend primary research with data from our syndicated, benchmarking and self-funded studies as well as Big Data to help our clients grow their businesses and brands. Market Strategies’ research specialties include brand, communications, CX, product development and segmentation. Our syndicated products, known as Cogent Reports, are the wealth sector’s leading source for insight on the attitudes, opinions and behaviors of key investor populations, including advisors, plan sponsors and affluent and institutional investors.

Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China and additional industry expertise in consumer & retail, energy, healthcare, technology and telecommunications. Read Market Strategies’ blog at FreshMR, and follow us on Facebook, Twitter and LinkedIn.