BOSTON--(BUSINESS WIRE)--Pioneer Investments announced today the results of a live webinar poll designed to gauge advisor sentiment on the Fiduciary Regulation issued by the Department of Labor (DOL). The webinar was attended by 861 financial advisors and featured a panel of fiduciary experts from fi360® and Drinker Biddle & Reath, LLP. In April 2015, Pioneer hosted a similar webinar on the DOL proposal. During each webinar, advisors were polled on questions related to the impact of the regulation on their business and for investors, as well as their expectations of their broker-dealers.

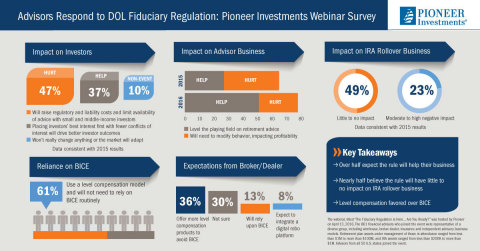

When asked about the impact of the new rule, 51 percent of advisors polled said that the regulation would help their business by leveling the playing field on retirement advice and eliminating competition from those not willing to accept fiduciary responsibility. In 2015, only 27 percent of advisors polled felt that the regulation would help their business while 38 percent felt that it would hurt their business and impact profitability. This year, only 27 percent felt that it would hurt their business and 15 percent indicated that it would be a non-event.

“The key takeaways are the majority of advisors now feel that managing their practice in line with the new regulation will help their business and there is still a significant percentage of advisors who remain concerned that it could hurt their business,” said Mark Spina, Executive Vice President and Head of U.S. Intermediary Distribution at Pioneer Investments. “This reinforces our belief that the importance of providing timely, educational information to financial advisors has never been greater than in today’s regulatory environment.”

Forty-seven percent of advisors polled in the most recent survey believe that the new rule will hurt investors by raising costs and limiting the availability of advice for small and middle-income investors. Thirty-seven percent believe that it will help investors by placing their best interest first with fewer conflicts of interest to drive better outcomes, and 10 percent felt that it will be a non-event for investors. In 2015, 42 percent of respondents thought that the proposed rule would hurt investors, 32 percent thought that it would help and 8 percent thought that it would be a non-event.

“I certainly agree that there is going to be a significant transition period, and that always entails some level of cost,” said Blaine Aikin, Executive Chairman at fi360®, in response to the poll results. “But if you look longer term the benefits definitely are there for the investors, and I expect will ultimately pay off, so it makes sense that the industry is divided on this.”

When asked how the fiduciary proposal will impact their IRA rollover business, 49 percent of advisors indicated that it will have little to no impact and 23 percent expect a moderate to high negative impact. Only 12 percent indicated that there would be a moderate to high positive impact on their IRA rollover business and 16 percent were unsure. These results were also relatively consistent with advisors’ responses to this question in 2015.

“The impact on IRA rollover businesses will vary by type of advisor,” explains Fred Reish, Partner at Drinker Biddle & Reath, LLP. “For advisors working as registered representatives of broker-dealers the impact will be pretty high, whereas smaller firms may be able to adapt to the rule more easily.”

Responses from advisors varied when asked if they will need to rely on the Best Interest Contract Exemption (BICE). Sixty-one percent of advisors polled said that they use a level compensation model and will not need to rely on BICE routinely, while 17 percent use a non-level compensation model and will need to rely on BICE routinely. Twenty percent indicated that they will change from a non-level to a level compensation model to avoid BICE, while only 2 percent indicated that they will change from a level compensation model to a non-level compensation model given BICE.

In terms of what broker-dealers will do in response to the regulation, 36 percent of advisors expect that their broker-dealer will offer more level compensation products to avoid BICE. Thirteen percent expect that they will rely upon BICE to continue providing products with compensation conflicts, and 8 percent expect that they will integrate a digital robo platform to support small or potentially orphaned accounts. Thirty-percent of advisors were not sure.

Note to Editors

The webinar, titled “The Fiduciary Regulation is Here… Are You Ready?” was hosted by Pioneer on April 13, 2016. Panelists included Fred Reish, Partner at Drinker Biddle & Reath, LLP, Bradford Campbell, Counsel at Drinker Biddle & Reath, LLP, and Blaine Aikin, Executive Chairman at fi360®. Mark Spina, Executive Vice President and Head of U.S. Intermediary Distribution at Pioneer Investments, moderated the discussion and provided introductions. Topics covered during the webinar included noteworthy changes from the proposal, how to avoid a Prohibitive Transaction and the key impacts of the regulation on Broker-Dealers and RIAs, among others.

The 861 financial advisors who joined the event were representative of a diverse group, including wirehouse, broker-dealer, insurance and independent advisory business models. Retirement plan assets under management of those in attendance ranged from less than $1M to more than $100M, and IRA assets ranged from less than $200K to more than $1M. Advisors from all 50 U.S. states joined the event.

About Pioneer Investments

Founded in 1928, Pioneer Investments is a leading global asset manager with a history of providing innovative investment products to investors worldwide. The firm offers a diverse range of products and services across traditional and non-traditional asset classes for a wide range of clients, including institutional investors, wealth management firms, financial advisors, and private investors.

Pioneer Investments is the trade name for Pioneer Global Asset Management S.p.A. (PGAM) and its subsidiaries, a global investment firm with offices in 28 countries and approximately $249 billion in assets under management as of March 31, 2016, of which approximately $67 billion was managed in the U.S. Pioneer Investment Management USA Inc. is the North American operating subsidiary of PGAM, a wholly-owned subsidiary of UniCredit S.p.A.

Pioneer Investments is not affiliated with Drinker Biddle & Reath, LLP or fi360

©2016 Pioneer Investment Management USA Inc.

60 State Street,

Boston, MA 02109

Member of the UniCredit Group, Register of Banking

Groups