TORONTO--(BUSINESS WIRE)--GoldMoney Inc. (TSX-V:XAU), a full-reserve and gold-based financial service and technology group, is pleased to announce Key Performance Indicators (KPI’s) for its two operating platforms for the period ending November 30, 2015. KPI’s are published on a monthly basis to increase network transparency for customers, the investment community and other stakeholders.

BitGold Key Performance Indicators:

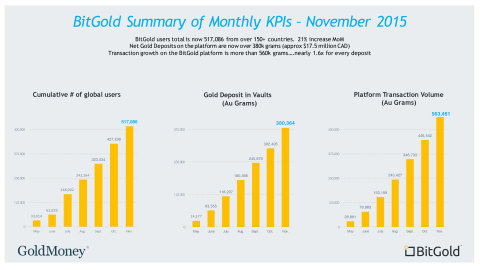

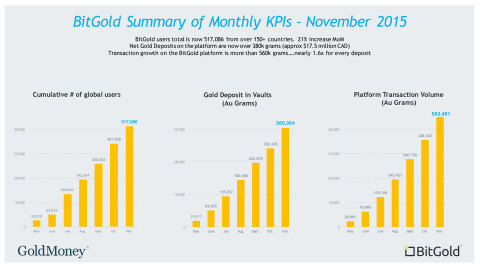

|

User Sign Ups |

||||

| Period |

Total User Signups –

End of Period |

Net Increase/Decrease | ||

| November 2015 | 517,086 | +89,848 | ||

| October 2015 | 427,238 | +104,204 | ||

| September 2015 | 323,034 | +80,770 | ||

| August 2015 | 242,264 | +74,262 | ||

| July 2015 | 168,002 | +105,373 | ||

| June 5th to June 30th 2015 | 62,629 | +29,615 | ||

| Launch to June 4th 2015 | 33,014 | +33,014 | ||

|

Transaction Volume (Gold Grams) 1 |

||||||

| Period |

Transaction Volume – |

Net |

Value in CAD for |

|||

| November 2015 | 563,431 | +116,889 | C$25,934,729 | |||

| October 2015 | 446,542 | +99,809 | C$21,349,173 | |||

| September 2015 | 346,733 | +103,306 | C$16,691,726 | |||

| August 2015 | 243,427 | +90,318 | C$ 11,798,926 | |||

| July 2015 | 153,109 | +74,226 | C$ 7,069,042 | |||

| June 5th to June 30th 2015 | 78,883 | +45,002 | C$ 3,479,889 | |||

| Launch to June 4th 2015 | 28,881 | +28,881 | C$ 1,359,428 | |||

|

Customer Gold in Vaults (Gold Grams) 2 |

||||||

| Period |

Gold in Vaults – End of (grams) |

Net |

Value in CAD for |

|||

| November 2015 | 380,364 | +77,938 | C$17,508,155 | |||

| October 2015 | 302,426 | +56,547 | C$ 14,458,997 | |||

| September 2015 | 245,879 | +65,513 | C$ 11,836,615 | |||

| August 2015 | 180,366 | +62,159 | C$ 8,745,947 | |||

| July 2015 | 118,207 | +54,652 | C$ 5,457,617 | |||

| June 5th to June 30th 2015 | 63,555 | +39,178 | C$ 2,993,400 | |||

| Launch to June 4th 2015 | 24,377 | +24,377 | C$ 1,147,681 | |||

1. Defined as deposits, redemptions and payments on the network.

2.

Defined as total segregated and allocated customer gold under

safekeeping.

GoldMoney Key Performance Indicators:

|

GoldMoney Holdings |

||||

| Period | Total Funded Accounts | Net Increase/Decrease | ||

| November 2015 | 21,350 | -61 | ||

| October 2015 | 21,411 | -51 | ||

| September 2015 | 21,462 | -23 | ||

| August 2015 | 21,485 | -58 | ||

| July 2015 | 21,543 | -47 | ||

|

Transaction Volume (Canadian Dollars) 3 |

||||

| Period |

Transaction Volume – for |

Net Increase/Decrease | ||

| November 2015 | C$ 35,615,402 | C$ +4,373,379 | ||

| October 2015 | C$ 31,242,023 | C$- 940,141 | ||

| September 2015 | C$ 32,182,164 | C$ -15,208,676 | ||

| August 2015 | C$ 47,390,840 |

C$ -1,244,000 |

||

| July 2015 | C$ 48,634,497 | N/A | ||

|

Customer Assets under Administration 4 |

||||

| Period | Customer Assets | Net Increase/Decrease | ||

| November 2015 | C$ 1,470,517,776 | C$ -76,973,551 | ||

| October 2015 | C$ 1,547,491,327 | C$ +4,818,248 | ||

| September 2015 | C$ 1,542,673,079 | C$ +14,525,631 | ||

| August 2015 | C$ 1,528,147,448 | C$ +43,077,113 | ||

| July 2015 | C$ 1,485,070,335 | N/A | ||

3. Defined as all dealing (buy/sell), deposits, and redemption activity

by GoldMoney clients.

4. Defined as total segregated and allocated

customer precious metals and full reserved currency balances under

safekeeping.

About GoldMoney

GoldMoney Inc. is a global, full-reserve and gold-based financial services group. GoldMoney provides financial services as a trusted, limited third-party, combining the unique attributes of gold with technology-driven innovation. Through GoldMoney® the company offers precious metals custody and wealth services, trading and execution, and independent research to individual investors and institutions. Through BitGold™ the company operates a self-directed savings platform and a payments network allowing individuals and businesses to make or receive online, in-store or mobile payments. GoldMoney Inc. has over 540,000 clients from over 200 countries and $1.5 billion in client assets under administration. GoldMoney is regulated by the Jersey Financial Services Commission (JFSC) as a Money Services Business. The JFSC is the main supervisory body that oversees and regulates Jersey's large financial services industry. For more information on BitGold, visit bitgold.com. For more information on GoldMoney, visit ir.goldmoney.com.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy of this release.

Forward-Looking Statements

This news release contains certain “forward-looking information” within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others: the Company’s limited operating history; future capital needs and uncertainty of additional financing; the competitive nature of the industry; unproven markets for the Company’s product offering; volatility of gold prices & public interest in gold investment; lack of regulation and customer protection; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; foreign currency and gold trading risks; use and storage of personal information and compliance with privacy laws; use of the Company’s services for improper or illegal purposes; global economic and financial market conditions; uninsurable risks; and those risks set out in the Company’s public documents filed on www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.