CAMBRIDGE, Mass.--(BUSINESS WIRE)--While Millennial and Gen X investors combined represent only 37% of affluent Americans, they comprise a majority (55%) of ETF owners. Nearly four in ten (38%) Millennials and one in five (21%) Gen X investors report owning ETFs, compared to just 14% of 2nd Wave Boomers, 12% of 1st Wave Boomers and 11% of Silent Generation investors. Furthermore, despite being an average of 8 years younger than non-owners (48 years vs. 56 years, respectively), investors who own ETFs have significantly more investable assets ($737,000 for owners vs. $512,000 for non-owners). These and other findings are included in the 2015 Investor Brandscape™ study by Cogent Reports™, the syndicated division of Market Strategies International.

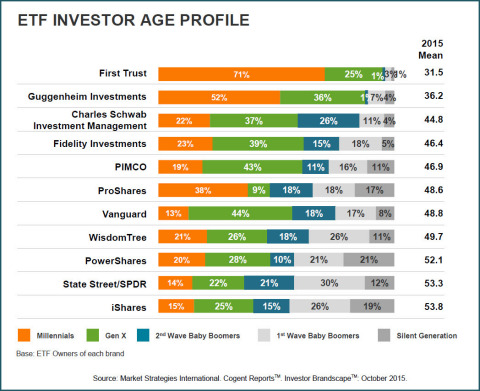

Cogent Reports found that the average age of all ETF owners across nearly a dozen providers is not at all uniform. In fact, the range in average age by provider spans more than 20 years, from 31.5 years for First Trust customers to 53.8 for iShares owners. The average amount of a client’s investable assets also varies considerably across providers, ranging from a low of $576,000 among First Trust users to $1.1 million for iShares customers.

“At present, there is an obvious advantage for established ETF providers that have a greater proportion of customers who are older, and therefore wealthier,” said Julia Johnston-Ketterer, author of the report and senior director at Market Strategies. “But looking to the future, companies who do the best job connecting with younger investors who embrace ETFs are the firms that will likely to see the most growth.”

Among the 11 ETF providers evaluated by Cogent Reports, First Trust is one of only three firms that are perceived by investors to be firms that “offer products that align with my needs.” This perception was even more pronounced among Millennials and Gen Xers. An example of how interest in ETFs and certain providers among younger investors will impact the industry is reflected in the increased use of ETFs inside retirement plans. One-third (34%) of respondents now report using ETFs in an employer-sponsored retirement plan, up from 31% in 2014.

“Millennials and Gen Xers are entering their peak earning years, and more than three-quarters of them are actively contributing to a work-based retirement plan,” said Johnston-Ketterer. “Increased traction for ETFs in this space could be huge, both for the industry and for those individual providers that manage to get a meaningful piece of the action.”

About Investor Brandscape

Cogent Reports interviewed 3,889 affluent investors who were recruited from the Research Now, Survey Sampling International (SSI) and uSamp online panels. Respondents were required to have at least $100,000 in investable assets (excluding real estate). Due to their opt-in nature, the online panels (like most others) do not yield a random probability sample of the target population. Thus, target quotas and weighting are set around key demographic variables using the most recent data available from the Survey of Consumer Finances (SCF) conducted by the Federal Reserve Board. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Market Strategies will supply the exact wording of any survey question upon request.

About Market Strategies International

Market Strategies International is a market research consultancy with deep expertise in consumer/retail, energy, financial services, healthcare, technology and telecommunications. The firm is ISO 20252 certified, reflecting its commitment to providing intelligent research, designed to the highest levels of accuracy, with meaningful results that help companies make confident business decisions.

Market Strategies conducts qualitative and quantitative research in 75 countries, and its specialties include brand, communications, CX, product development, segmentation and syndicated. Its syndicated products, known as Cogent Reports, help clients understand the market environment, explore industry trends and monitor their brand and products within the competitive landscape. Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China. Read Market Strategies’ blog at FreshMR, and follow us on Facebook, Twitter and LinkedIn.