NEWARK, Del.--(BUSINESS WIRE)--November: a month devoted to mustaches, the Mayflower, and, for millions of recent college graduates, their first student loan payment. While Sallie Mae, the nation’s saving, planning, and paying for college company, won’t be offering facial grooming advice or hosting trips to Plymouth Rock, the company does have tips, tools, and resources to help students pay like a pro. In addition, the company will award one customer up to $10,000 for making on-time payments through its “It Pays to Repay” sweepstakes.

When it comes to paying back student loans, a great place to start is Managing Your Loans, Sallie Mae’s free, online, one-stop resource for straightforward, comprehensive tips and tools. It features a monthly budget worksheet, loan payment calculators, and information about payment options, including the Graduated Repayment Period. The Graduated Repayment Period allows graduates with eligible Sallie Mae loans in good standing to make 12 months of interest-only payments before they transition into making full principal and interest payments. The company is the only private student lender to offer this option.

“If you’ve borrowed for college, paying back your loans can seem overwhelming. However, the reality is there are repayment options available for both federal and private student loans,” said Reyna Gobel, student loan and paying for college expert and author of the new book, “Parents’ Guide to Paying for College and Repaying Student Loans.” “The advice I give to recent graduates is to create a budget for your lifestyle, talk to all your student loan servicers about your repayment plan options, and put a few extra dollars toward your loan each month to pay down any private student loans faster.”

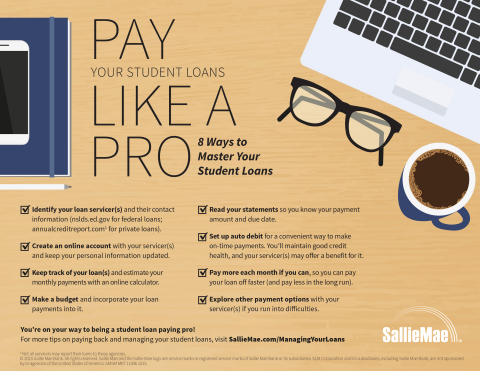

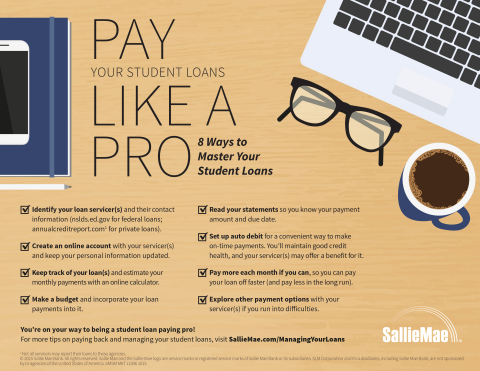

Whether student loans are federal or private, Sallie Mae recommends the following tips to help graduates manage their payments:

- Eliminate Surprises: Use an online calculator to estimate your monthly payments. If your loans are federal—93 percent of today’s loans are made by the federal government— check with the Department of Education to identify your loan servicer. Sallie Mae services its own private education loans, but others may rely on third parties for servicing. If you are unsure, call your lender or check your credit report for loans being reported to the nationwide consumer reporting agencies.

- Create a Budget: Once you know how much you owe, you need to figure out how your loan payment will fit into your monthly expenses. Free resources like Sallie Mae’s monthly budget worksheet can help you do that.

- Set up Automatic Debit: After you set up your account online, sign up for auto-debit. It will ensure your payments are on time, and some lenders will offer a benefit for it. Sallie Mae customers, for example, may be eligible to receive a 0.25 percent interest rate reduction when they pay on-time via auto-debit.

- Read Monthly Billing Statements Carefully: Whether you view it online or receive it by mail, your monthly billing statement not only has payment and balance information, but also important messages for you.

- Sign Up for Free Reward Programs: Programs like Upromise by Sallie Mae allow students and families to earn cash back through everyday purchases and pay down student loan debt. Students with eligible Sallie Mae loans can use Upromise Loan Link to apply Upromise earnings directly toward their loans.

- Pay More Each Month If You Can: Paying even a little bit extra each month can go a long way toward paying off loans faster.

“Whether you are an aspiring commander in chief, a budding doctor, educator, or engineer, student loans can help make your dream of college and career a reality,” said Martha Holler, senior vice president, Sallie Mae. “We pride ourselves on being a trusted partner to our customers along every step of paying for college, including making on-time payments after leaving school to establish good credit. Our goal is to provide the tools and information to help all customers successfully manage their student loans.”

Sallie Mae is investing millions of dollars to enhance the customer experience. Earlier this year the company moved all customer service of its private education loans to the United States. Sallie Mae also upgraded and simplified its online customer service experience. In addition, Sallie Mae recently extended its free FICO® Score benefit to more than 1 million borrowers and cosigners.

For more information, visit www.Salliemae.com/Managingyourloans. For Sweepstakes rules, visit sallie.cc/repay.

Sallie Mae (NASDAQ: SLM) is the nation’s saving, planning, and paying for college company. Whether college is a long way off or just around the corner, Sallie Mae offers products that promote responsible personal finance, including private education loans, Upromise rewards, scholarship search, college financial planning tools, and online retail banking. Learn more at SallieMae.com. Commonly known as Sallie Mae, SLM Corporation and its subsidiaries are not sponsored by or agencies of the United States of America.