SUNNYVALE, Calif.--(BUSINESS WIRE)--Juniper Networks (NYSE:JNPR), the industry leader in network innovation, today reported preliminary financial results for the three months ended Sept. 30, 2015 and provided its outlook for the three months ending Dec. 31, 2015.

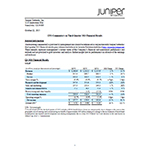

Net revenues for the third quarter of 2015 were $1,248.6 million, an increase of 11% year-over-year and 2% sequentially.

Juniper’s operating margin for the third quarter of 2015 increased to 20.7% on a GAAP basis, a year-over-year increase of 5.4 points and an increase of 0.8 points sequentially. Non-GAAP operating margin for the third quarter of 2015 increased to 25.5%, an increase of 4.0 points year-over-year and 0.3 points sequentially.

In the third quarter of 2015, Juniper posted GAAP net income of $197.7 million, an increase of 91% year-over-year and 25% sequentially. GAAP net income per diluted share was $0.51, inclusive of a $0.06 benefit from a lower tax rate primarily due to changes in the year-to-date geographic mix of earnings and a nonrecurring tax benefit relating to a change in the tax treatment of stock-based compensation and R&D cost sharing arrangements due to a July 2015 Federal Tax Court decision in the case known as Altera Corp. et al. v. Commissioner.

Non-GAAP net income was $221.7 million, an increase of 34% year-over-year and 6% sequentially. Non-GAAP net income for the third quarter of 2015 was $0.57 per diluted share, an increase of $0.21 year-over-year primarily due to the positive impact from higher revenue, reduced share count, and lower operating expenses. The sequential increase of $0.04 was primarily due to higher revenue and an approximate $0.02 impact from the lower tax rate.

The reconciliation between GAAP and non-GAAP results of operations is provided in a table immediately following the Preliminary Net Revenues by Market table below.

“We delivered another solid quarter of growth, demonstrating our continued momentum across the business and ability to execute our clear and deliberate strategy,” said Rami Rahim, chief executive officer of Juniper Networks. “We continue to challenge the status quo and bring new product innovations to market that bolster our position as a leader in network innovation. I'm proud of the results our team has yielded and have confidence in our prospects for the future.”

“We once again delivered good revenue and earnings for the quarter, a testament to our focus on our financial performance across key business metrics,” said Robyn Denholm, chief financial and operations officer of Juniper Networks. “We delivered significant year-over-year earnings expansion, maintained our focus on cost control, meaningfully improved our operating margin and continued to return capital to shareholders. I'm pleased with the significant progress our team has made and continue to see growing, evolving and diversifying demand for the solutions we provide.”

Other Financial Highlights

Total cash, cash equivalents, and investments as of Sept. 30, 2015 were $3,247 million, compared to $3,076 million as of June 30, 2015, and $3,321 million as of Sept. 30, 2014.

Juniper’s net cash flow provided by operations for the third quarter of 2015 was $293 million, compared to net cash provided by operations of $263 million in the second quarter of 2015, and $(70) million in the third quarter of 2014.

Days sales outstanding in accounts receivable, or “DSO,” was 42 in the third quarter of 2015, compared to 39 days in the prior quarter, and 49 days in the third quarter of 2014.

Capital expenditures were $71 million and depreciation and amortization of intangible assets expense was $41 million during the third quarter of 2015. Capital expenditures for the quarter increased as we focus on investments to drive long-term productivity and support continued innovation and development of new products.

Juniper’s Board of Directors has declared a quarterly cash dividend of $0.10 per share to be paid on Dec. 22, 2015 to shareholders of record as of the close of business on Dec. 1, 2015.

During the third quarter of 2015, the Company repurchased $50 million of common stock and paid $39 million in dividends. Since the first quarter of 2014, the Company has returned approximately $3.5 billion of capital to shareholders against its commitment to return a total of $4.1 billion by the end of 2016.

Outlook

The Company expects the demand environment across multiple verticals to remain healthy and anticipates the diversification of its revenue to continue.

Juniper Networks estimates that for the quarter ending Dec. 31, 2015:

- Revenues will be approximately $1,290 million, plus or minus $20 million.

- Non-GAAP gross margin will be approximately 64%, plus or minus 0.5%.

- Non-GAAP operating expenses will be $500 million, plus or minus $5 million. The increase in expenses is primarily due to variable costs given higher revenue and for certain strategic go-to-market investments.

- Non-GAAP operating margin will be roughly 25% at the midpoint of revenue guidance.

- Non-GAAP net income per share will range between $0.57 and $0.60 on a diluted basis. This assumes a flat share count from the third quarter and a non-GAAP tax rate of approximately 25.5% for the fourth quarter, and assumes no renewal of the R&D tax credit for 2015.

All forward-looking non-GAAP measures exclude estimates for amortization of intangible assets, share-based compensation expenses, acquisition-related charges, restructuring and other (benefits) charges, impairment charges, professional services related to non-routine stockholder matters, litigation settlement and resolution charges, professional fees and other income and expenses associated with the sale of Junos Pulse, gain or loss on equity investments, retroactive impact of certain tax settlements, non-recurring income tax adjustments, valuation allowance on deferred tax assets, and income tax effect of non-GAAP exclusions. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis.

Third Quarter Financial Commentary Available Online

A commentary by Robyn Denholm, chief financial and operations officer, reviewing the Company’s third quarter 2015 financial results and fourth quarter 2015 financial outlook will be furnished to the SEC on Form 8-K and published on the Company’s website at http://investor.juniper.net. Analysts and investors are encouraged to review this commentary prior to participating in the conference call webcast.

Conference Call Webcast

Juniper Networks will host a conference call webcast today, Oct. 22, 2015, at 2:00 pm PT, to be broadcast live over the Internet at http://investor.juniper.net. To participate via telephone in the US, the toll free dial-in number is 1-877-407-8033. Outside the US, dial +1-201-689-8033. Please call 10 minutes prior to the scheduled conference call time. The webcast replay will be archived on the Juniper Networks website.

About Juniper Networks

Juniper Networks (NYSE: JNPR) delivers innovation across routing, switching and security. Juniper Networks’ innovations in software, silicon and systems transform the experience and economics of networking. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter and Facebook.

Investors and others should note that the Company announces material financial and operational information to its investors using its Investor Relations website, press releases, SEC filings and public conference calls and webcasts. The Company also intends to use the Twitter accounts @JuniperNetworks and @Juniper_IR and the Company’s blogs as a means of disclosing information about the Company and for complying with its disclosure obligations under Regulation FD. The social media channels that the Company intends to use as a means of disclosing information described above may be updated from time to time as listed on the Company’s Investor Relations website.

Juniper Networks and Junos, are registered trademarks of Juniper Networks, Inc. in the United States and other countries. The Juniper Networks logo and the Junos logo are trademarks of Juniper Networks, Inc. All other trademarks, service marks, registered trademarks, or registered service marks are the property of their respective owners.

Safe Harbor

Statements in this release concerning Juniper Networks’ business outlook, economic and market outlook, future financial and operating results, ability to deliver revenue and earnings growth, ability to execute its strategy, innovation pipeline, capital return program, and overall future prospects are forward-looking statements that involve a number of uncertainties and risks. Actual results or events could differ materially from those anticipated in those forward-looking statements as a result of several factors, including: general economic and political conditions globally or regionally; business and economic conditions in the networking industry; changes in overall technology spending and spending by communication service providers and major customers; the network capacity requirements of communication service providers; contractual terms that may result in the deferral of revenue; increases in and the effect of competition; the timing of orders and their fulfillment; manufacturing and supply chain constraints; availability of key product components; ability to establish and maintain relationships with distributors, resellers and other partners; variations in the expected mix of products sold; changes in customer mix; changes in geography mix; customer and industry analyst perceptions of Juniper Networks and its technology, products and future prospects; delays in scheduled product availability; market acceptance of Juniper Networks products and services; rapid technological and market change; adoption of regulations or standards affecting Juniper Networks products, services or the networking industry; the ability to successfully acquire, integrate and manage businesses and technologies; product defects, returns or vulnerabilities; the ability to recruit and retain key personnel; significant effects of tax legislation and judicial or administrative interpretation of tax regulations; currency fluctuations; litigation settlements and resolutions; the potential impact of activities related to the execution of capital return and product rationalization; and other factors listed in Juniper Networks’ most recent report on Form 10-Q filed with the Securities and Exchange Commission. All statements made in this press release are made only as of the date set forth at the beginning of this release. Juniper Networks undertakes no obligation to update the information in this release in the event facts or circumstances subsequently change after the date of this press release.

Juniper Networks believes that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to the company’s financial condition and results of operations. For further information regarding why Juniper Networks believes that these non-GAAP measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the discussion below. The following tables and reconciliations can also be found on our Investor Relations website at http://investor.juniper.net.

| Juniper Networks, Inc. | |||||||||||||||

| Preliminary Condensed Consolidated Statements of Operations | |||||||||||||||

|

(in millions, except per share amounts) |

|||||||||||||||

|

(unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2015 | 2014 | 2015 | 2014 | ||||||||||||

| Net revenues: | |||||||||||||||

| Product | $ | 925.4 | $ | 809.5 | $ | 2,589.2 | $ | 2,614.7 | |||||||

| Service | 323.2 | 316.4 | 949.0 | 910.8 | |||||||||||

| Total net revenues | 1,248.6 | 1,125.9 | 3,538.2 | 3,525.5 | |||||||||||

| Cost of revenues: | |||||||||||||||

| Product | 322.6 | 290.0 | 923.1 | 975.9 | |||||||||||

| Service | 128.6 | 121.1 | 378.9 | 366.5 | |||||||||||

| Total cost of revenues | 451.2 | 411.1 | 1,302.0 | 1,342.4 | |||||||||||

| Gross margin | 797.4 | 714.8 | 2,236.2 | 2,183.1 | |||||||||||

| Operating expenses: | |||||||||||||||

| Research and development | 247.0 | 253.2 | 747.3 | 772.7 | |||||||||||

| Sales and marketing | 235.3 | 249.2 | 687.9 | 780.6 | |||||||||||

| General and administrative | 57.1 | 55.0 | 168.6 | 190.5 | |||||||||||

| Restructuring and other (benefits) charges | — | (15.0 | ) | (0.5 | ) | 157.2 | |||||||||

| Total operating expenses | 539.4 | 542.4 | 1,603.3 | 1,901.0 | |||||||||||

| Operating income | 258.0 | 172.4 | 632.9 | 282.1 | |||||||||||

| Other (expense) income, net | (8.4 | ) | (6.8 | ) | (41.3 | ) | 326.0 | ||||||||

| Income before income taxes | 249.6 | 165.6 | 591.6 | 608.1 | |||||||||||

| Income tax provision | 51.9 | 62.0 | 155.7 | 172.8 | |||||||||||

| Net income | $ | 197.7 | $ | 103.6 | $ | 435.9 | $ | 435.3 | |||||||

| Net income per share: | |||||||||||||||

| Basic | $ | 0.52 | $ | 0.23 | $ | 1.11 | $ | 0.93 | |||||||

| Diluted | $ | 0.51 | $ | 0.23 | $ | 1.09 | $ | 0.91 | |||||||

| Shares used in computing net income per share: | |||||||||||||||

| Basic | 382.8 | 448.4 | 393.2 | 468.1 | |||||||||||

| Diluted | 389.2 | 454.8 | 401.2 | 477.0 | |||||||||||

| Cash dividends declared per common stock | $ | 0.10 | $ | 0.10 | $ | 0.30 | $ | 0.10 | |||||||

| Juniper Networks, Inc. | |||||||||||||||

| Preliminary Net Revenues by Product and Service | |||||||||||||||

|

(in millions) |

|||||||||||||||

|

(unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2015 | 2014 | 2015 | 2014 | ||||||||||||

| Routing | $ | 604.4 | $ | 533.2 | $ | 1,711.6 | $ | 1,700.8 | |||||||

| Switching | 201.4 | 155.0 | 558.1 | 546.8 | |||||||||||

| Security | 119.6 | 121.3 | 319.5 | 367.1 | |||||||||||

| Total product | 925.4 | 809.5 | 2,589.2 | 2,614.7 | |||||||||||

| Total service | 323.2 | 316.4 | 949.0 | 910.8 | |||||||||||

| Total | $ | 1,248.6 | $ | 1,125.9 | $ | 3,538.2 | $ | 3,525.5 | |||||||

| Juniper Networks, Inc. | |||||||||||||||

| Preliminary Net Revenues by Geographic Region | |||||||||||||||

|

(in millions) |

|||||||||||||||

|

(unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2015 | 2014 | 2015 | 2014 | ||||||||||||

| Americas | $ | 712.8 | $ | 678.3 | $ | 2,037.6 | $ | 2,070.8 | |||||||

| Europe, Middle East, and Africa | 355.0 | 290.5 | 975.1 | 911.0 | |||||||||||

| Asia Pacific | 180.8 | 157.1 | 525.5 | 543.7 | |||||||||||

| Total | $ | 1,248.6 | $ | 1,125.9 | $ | 3,538.2 | $ | 3,525.5 | |||||||

| Juniper Networks, Inc. | |||||||||||||||

| Preliminary Net Revenues by Market | |||||||||||||||

|

(in millions) |

|||||||||||||||

|

(unaudited) |

|||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2015 | 2014 | 2015 | 2014 | ||||||||||||

| Service Provider | $ | 804.3 | $ | 741.5 | $ | 2,356.6 | $ | 2,356.0 | |||||||

| Enterprise | 444.3 | 384.4 | 1,181.6 | 1,169.5 | |||||||||||

| Total | $ | 1,248.6 | $ | 1,125.9 | $ | 3,538.2 | $ | 3,525.5 | |||||||

| Juniper Networks, Inc. | ||||||||||||||

| Reconciliation between GAAP and non-GAAP Financial Measures | ||||||||||||||

|

(in millions, except percentages and per share amounts) |

||||||||||||||

|

(unaudited) |

||||||||||||||

| Three Months Ended | ||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||

| 2015 | 2015 | 2014 | ||||||||||||

| GAAP operating income | $ | 258.0 | $ | 243.1 | $ | 172.4 | ||||||||

| GAAP operating margin | 20.7 | % | 19.9 | % | 15.3 | % | ||||||||

| Share-based compensation expense | C | 56.5 | 58.9 | 65.3 | ||||||||||

| Share-based payroll tax expense | C | 0.7 | 2.0 | 2.3 | ||||||||||

| Amortization of purchased intangible assets | A | 5.6 | 5.6 | 8.5 | ||||||||||

| Restructuring and other benefits | B | (3.5 | ) | (1.9 | ) | (15.0 | ) | |||||||

| Memory-related, supplier component remediation charge | B | — | — | 7.0 | ||||||||||

| Divestiture-related charges | B | — | — | 1.0 | ||||||||||

| Other | B | 0.5 | 0.5 | — | ||||||||||

| Non-GAAP operating income | $ | 317.8 | $ | 308.2 | $ | 241.5 | ||||||||

| Non-GAAP operating margin | 25.5 | % | 25.2 | % | 21.5 | % | ||||||||

| GAAP net income | $ | 197.7 | $ | 158.0 | $ | 103.6 | ||||||||

| Share-based compensation expense | C | 56.5 | 58.9 | 65.3 | ||||||||||

| Share-based payroll tax expense | C | 0.7 | 2.0 | 2.3 | ||||||||||

| Amortization of purchased intangible assets | A | 5.6 | 5.6 | 8.5 | ||||||||||

| Restructuring and other benefits | B | (3.5 | ) | (1.9 | ) | (15.0 | ) | |||||||

| Memory-related, supplier component remediation charge | B | — | — | 7.0 | ||||||||||

| Divestiture-related charges | B | — | — | 1.0 | ||||||||||

| (Gain) loss on equity investments | B | (7.3 | ) | — | 1.6 | |||||||||

| Gain on legal/contract settlement, net | B | (4.0 | ) | — | (10.8 | ) | ||||||||

| Income tax effect of non-GAAP exclusions | B | (22.4 | ) | (10.8 | ) | 0.8 | ||||||||

| Other | B | (1.6 | ) | (3.0 | ) | 1.1 | ||||||||

| Non-GAAP net income | $ | 221.7 | $ | 208.8 | $ | 165.4 | ||||||||

| GAAP diluted net income per share | $ | 0.51 | $ | 0.40 | $ | 0.23 | ||||||||

| Non-GAAP diluted net income per share | D | $ | 0.57 | $ | 0.53 | $ | 0.36 | |||||||

| Shares used in computing diluted net income per share | 389.2 | 397.2 | 454.8 | |||||||||||

Discussion of Non-GAAP Financial Measures

This press release, including the tables above, includes the following non-GAAP financial measures derived from our Preliminary Condensed Consolidated Statements of Operations: operating income; operating margin; net income; and diluted net income per share. These measures are not presented in accordance with, nor are they a substitute for U.S. generally accepted accounting principles, or GAAP. In addition, these measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The non-GAAP financial measures used in the table above should not be considered in isolation from measures of financial performance prepared in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, many of the adjustments to our GAAP financial measures reflect the exclusion of items that are recurring and will be reflected in our financial results for the foreseeable future.

We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of our business, in making operating decisions, forecasting and planning for future periods, and determining payments under compensation programs. We consider the use of the non-GAAP measures presented above to be helpful in assessing the performance of the continuing operation of our business. By continuing operations we mean the ongoing revenue and expenses of the business, excluding certain items that render comparisons with prior periods or analysis of on-going operating trends more difficult, such as expenses not directly related to the actual cash costs of development, sale, delivery or support of our products and services, or expenses that are reflected in periods unrelated to when the actual amounts were incurred or paid. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides such readers with useful supplemental data that, while not a substitute for financial measures prepared in accordance with GAAP, allows for greater transparency in the review of our financial and operational performance. In addition, we have historically reported non-GAAP results to the investment community and believe that continuing to provide non-GAAP measures provides investors with a tool for comparing results over time. In assessing the overall health of our business for the periods covered by the table above and, in particular, in evaluating the financial line items presented in the table above, we have excluded items in the following three general categories, each of which are described below: Acquisition-Related Charges, Other Items, and Share-Based Compensation Related Items. We also provide additional detail below regarding the shares used to calculate our non-GAAP net income per share. Notes identified for line items in the table above correspond to the appropriate note description below. Additionally, with respect to future financial guidance provided on a non-GAAP basis, we have excluded estimates for amortization of intangible assets, share-based compensation expenses, acquisition-related charges, restructuring and other (benefits) charges, impairment charges, professional services related to non-routine stockholder matters, litigation settlement and resolution charges, professional fees and other income and expenses associated with the sale of Junos Pulse, gain or loss on equity investments, retroactive impact of certain tax settlements, non-recurring income tax adjustments, valuation allowance on deferred tax assets, and the income tax effect of non-GAAP exclusions.

Note A: Acquisition-Related Charges. We exclude certain expense items resulting from acquisitions including amortization of purchased intangible assets associated with our acquisitions. The amortization of purchased intangible assets associated with our acquisitions results in our recording expenses in our GAAP financial statements that were already expensed by the acquired company before the acquisition and for which we have not expended cash. Moreover, had we internally developed the products acquired, the amortization of intangible assets, and the expenses of uncompleted research and development would have been expensed in prior periods. Accordingly, we analyze the performance of our operations in each period without regard to such expenses. In addition, acquisitions result in non-continuing operating expenses, which would not otherwise have been incurred by us in the normal course of our business operations. We believe that providing non-GAAP information for acquisition-related expense items in addition to the corresponding GAAP information allows the users of our financial statements to better review and understand the historic and current results of our continuing operations, and also facilitates comparisons to less acquisitive peer companies.

Note B: Other Items. We exclude certain other items that are the result of either unique or unplanned events including the following, when applicable: (i) restructuring and other (benefits) charges; (ii) impairment charges; (iii) professional fees and other income and expenses associated with the sale of Junos Pulse; (iv) gain or loss on equity investments; (v) gain or loss on legal settlement, net of related transaction costs; (vi) gain or loss on contract settlement; (vii) memory-related, supplier component remediation charge; (viii) valuation allowance on deferred tax assets; (ix) significant effects of tax legislation and judicial or administrative interpretation of tax regulations; and (x) the income tax effect on our financial statements of excluding items related to our non-GAAP financial measures. It is difficult to estimate the amount or timing of these items in advance. Restructuring and impairment charges result from events, which arise from unforeseen circumstances, which often occur outside of the ordinary course of continuing operations. Although these events are reflected in our GAAP financials, these unique transactions may limit the comparability of our on-going operations with prior and future periods. In the case of legal and contract settlements, these gains or losses are recorded in the period in which the matter is concluded or resolved even though the subject matter of the underlying dispute may relate to multiple or different periods. As such, we believe that these gains or losses do not accurately reflect the underlying performance of our continuing business operations for the period in which they are incurred. Similarly, the significant effects of tax legislation are unique events that occur in periods that are generally unrelated to the level of business activity to which such legislation applies. These expenses do not accurately reflect the underlying performance of our continuing business operations for the period in which they are incurred. Whether we realize gains or losses on equity investments is based primarily on the performance and market value of those independent companies. Accordingly, we believe that these gains and losses do not reflect the underlying performance of our continuing operations. We also believe providing financial information with and without the income tax effect of excluding items related to our non-GAAP financial measures provide our management and users of the financial statements with better clarity regarding the on-going performance and future liquidity of our business. Because of these factors, we assess our operating performance with these amounts both included and excluded, and by providing this information, we believe the users of our financial statements are better able to understand the financial results of what we consider our continuing operations.

Note C: Share-Based Compensation Related Items. We provide non-GAAP information relative to our expense for share-based compensation and related payroll tax. We began to include share-based compensation expense in our GAAP financial measures in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation - Stock Compensation (“FASB ASC Topic 718”), in January 2006. Because of varying available valuation methodologies, subjective assumptions and the variety of award types, which affect the calculations of share-based compensation, we believe that the exclusion of share-based compensation allows for more accurate comparisons of our operating results to our peer companies. Further, we believe that excluding share-based compensation expense allows for a more accurate comparison of our financial results to previous periods during which our equity-based awards were not required to be reflected in our income statement. Share-based compensation is very different from other forms of compensation. A cash salary or bonus has a fixed and unvarying cash cost. For example, the expense associated with a $10,000 bonus is equal to exactly $10,000 in cash regardless of when it is awarded and who it is awarded by. In contrast, the expense associated with an award of an option for 1,000 shares of stock is unrelated to the amount of compensation ultimately received by the employee; and the cost to the company is based on a share-based compensation valuation methodology and underlying assumptions that may vary over time and that does not reflect any cash expenditure by the company because no cash is expended. Furthermore, the expense associated with granting an employee an option is spread over multiple years unlike other compensation expenses which are more proximate to the time of award or payment. For example, we may be recognizing expense in a year where the stock option is significantly underwater and is not going to be exercised or generate any compensation for the employee. The expense associated with an award of an option for 1,000 shares of stock by us in one quarter may have a very different expense than an award of an identical number of shares in a different quarter. Finally, the expense recognized by us for such an option may be very different than the expense to other companies for awarding a comparable option, which makes it difficult to assess our operating performance relative to our competitors. Similar to share-based compensation, payroll tax on stock option exercises is dependent on our stock price and the timing and exercise by employees of our share-based compensation, over which our management has little control, and as such does not correlate to the operation of our business. Because of these unique characteristics of share-based compensation and the related payroll tax, management excludes these expenses when analyzing the organization’s business performance. We also believe that presentation of such non-GAAP information is important to enable readers of our financial statements to compare current period results with periods prior to the adoption of FASB ASC Topic 718.

Note D: Non-GAAP Net Income Per Share Items. We provide diluted non-GAAP net income per share. The diluted non-GAAP income per share includes additional dilution from potential issuance of common stock, except when such issuances would be anti-dilutive.

| Juniper Networks, Inc. | |||||||

| Preliminary Condensed Consolidated Balance Sheets | |||||||

|

(in millions) |

|||||||

|

(unaudited) |

|||||||

| September 30, | December 31, | ||||||

| 2015 |

2014(*) |

||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 1,453.5 | $ | 1,639.6 | |||

| Short-term investments | 529.9 | 332.2 | |||||

| Accounts receivable, net of allowances | 577.5 | 598.9 | |||||

| Deferred tax assets, net | 198.4 | 147.0 | |||||

| Prepaid expenses and other current assets | 138.8 | 239.9 | |||||

| Total current assets | 2,898.1 | 2,957.6 | |||||

| Property and equipment, net | 959.9 | 904.3 | |||||

| Long-term investments | 1,263.6 | 1,133.1 | |||||

| Restricted cash and investments | 33.9 | 46.0 | |||||

| Purchased intangible assets, net | 39.2 | 62.4 | |||||

| Goodwill | 2,981.3 | 2,981.5 | |||||

| Other long-term assets | 329.9 | 303.9 | |||||

| Total assets | $ | 8,505.9 | $ | 8,388.8 | |||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

| Current liabilities: | |||||||

| Short-term debt | $ | 299.9 | $ | — | |||

| Accounts payable | 209.1 | 234.6 | |||||

| Accrued compensation | 193.7 | 225.0 | |||||

| Deferred revenue | 814.4 | 780.8 | |||||

| Other accrued liabilities | 217.8 | 273.0 | |||||

| Total current liabilities | 1,734.9 | 1,513.4 | |||||

| Long-term debt | 1,648.7 | 1,349.0 | |||||

| Long-term deferred revenue | 310.5 | 294.9 | |||||

| Long-term income taxes payable | 185.0 | 177.5 | |||||

| Other long-term liabilities | 198.7 | 134.9 | |||||

| Total liabilities | 4,077.8 | 3,469.7 | |||||

| Total stockholders' equity | 4,428.1 | 4,919.1 | |||||

| Total liabilities and stockholders' equity | $ | 8,505.9 | $ | 8,388.8 | |||

* Certain amounts in the prior year Condensed Consolidated Financial Statements contained in this press release have been reclassified to conform to the current year presentation.

| Juniper Networks, Inc. | ||||||||

| Preliminary Condensed Consolidated Statements of Cash Flows | ||||||||

|

(in millions) |

||||||||

|

(unaudited) |

||||||||

| Nine Months Ended September 30, | ||||||||

| 2015 |

2014(*) |

|||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 435.9 | $ | 435.3 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Share-based compensation expense | 161.3 | 185.4 | ||||||

| Depreciation, amortization, and accretion | 131.5 | 141.9 | ||||||

| Restructuring and other (benefits) charges | (4.0 | ) | 179.4 | |||||

| Deferred income taxes | 10.0 | (85.4 | ) | |||||

| Gain on investments, net | (6.8 | ) | (165.1 | ) | ||||

| Gain on legal settlement, net | — | (121.1 | ) | |||||

| Excess tax benefits from share-based compensation | (7.4 | ) | (8.8 | ) | ||||

| Loss on disposal of fixed assets | 0.4 | 1.9 | ||||||

|

Changes in operating assets and liabilities, net of effects from acquisitions: |

||||||||

| Accounts receivable, net | (15.7 | ) | (33.2 | ) | ||||

| Prepaid expenses and other assets | 8.8 | (19.9 | ) | |||||

| Accounts payable | (21.8 | ) | 49.9 | |||||

| Accrued compensation | (29.0 | ) | (78.3 | ) | ||||

| Income taxes payable | 108.2 | 86.1 | ||||||

| Other accrued liabilities | (45.0 | ) | (130.5 | ) | ||||

| Deferred revenue | 49.1 | 40.9 | ||||||

| Net cash provided by operating activities | 775.5 | 478.5 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (154.9 | ) | (141.0 | ) | ||||

| Purchases of available-for-sale investments | (1,147.6 | ) | (1,970.5 | ) | ||||

| Proceeds from sales of available-for-sale investments | 625.9 | 1,918.7 | ||||||

| Proceeds from maturities of available-for-sale investments | 197.4 | 339.0 | ||||||

| Purchases of trading investments | (3.8 | ) | (3.5 | ) | ||||

| Proceeds from sales of privately-held investments | 10.3 | 2.5 | ||||||

| Purchases of privately-held investments | (5.4 | ) | (12.3 | ) | ||||

| Payments for business acquisitions, net of cash and cash equivalents acquired | (3.5 | ) | (27.1 | ) | ||||

| Changes in restricted cash | 11.6 | 45.0 | ||||||

| Net cash (used in) provided by investing activities | (470.0 | ) | 150.8 | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of common stock | 97.0 | 157.6 | ||||||

| Purchases and retirement of common stock | (1,057.6 | ) | (1,761.0 | ) | ||||

| Issuance of long-term debt, net | 594.6 | 346.5 | ||||||

| Payment for capital lease obligation | 0.4 | (0.4 | ) | |||||

| Customer financing arrangements | — | 0.8 | ||||||

| Excess tax benefits from share-based compensation | 7.4 | 8.8 | ||||||

| Payment of cash dividends | (118.0 | ) | (43.8 | ) | ||||

| Net cash used in financing activities | (476.2 | ) | (1,291.5 | ) | ||||

| Effect of foreign currency exchange rates on cash and cash equivalents | (15.4 | ) | (5.9 | ) | ||||

| Net decrease in cash and cash equivalents | (186.1 | ) | (668.1 | ) | ||||

| Cash and cash equivalents at beginning of period | 1,639.6 | 2,284.0 | ||||||

| Cash and cash equivalents at end of period | $ | 1,453.5 | $ | 1,615.9 | ||||

* Certain amounts in the prior year Condensed Consolidated Financial Statements contained in this press release have been reclassified to conform to the current year presentation.

| Juniper Networks, Inc. | |||||||

| Cash, Cash Equivalents, and Investments | |||||||

|

(in millions) |

|||||||

|

(unaudited) |

|||||||

| September 30, | December 31, | ||||||

| 2015 | 2014 | ||||||

| Cash and cash equivalents | $ | 1,453.5 | $ | 1,639.6 | |||

| Short-term investments | 529.9 | 332.2 | |||||

| Long-term investments | 1,263.6 | 1,133.1 | |||||

| Total | $ | 3,247.0 | $ | 3,104.9 | |||